Author: Lisa Editor: Sherry

In April 2025, the Federal Bureau of Investigation (FBI) released the 2024 Cryptocurrency Fraud Report. The report is based on data collected by the FBI Internet Crime Complaint Center (IC3) in 2024, analyzing the number of cryptocurrency-related complaints, loss scale, victim portraits, crime types, and asset recovery progress. This article will interpret the core content of the report to help readers quickly grasp trend changes and enhance their awareness and prevention capabilities of complex cybersecurity threats.

Key Point 1: Complaint data in 2024

1. Overall Situation

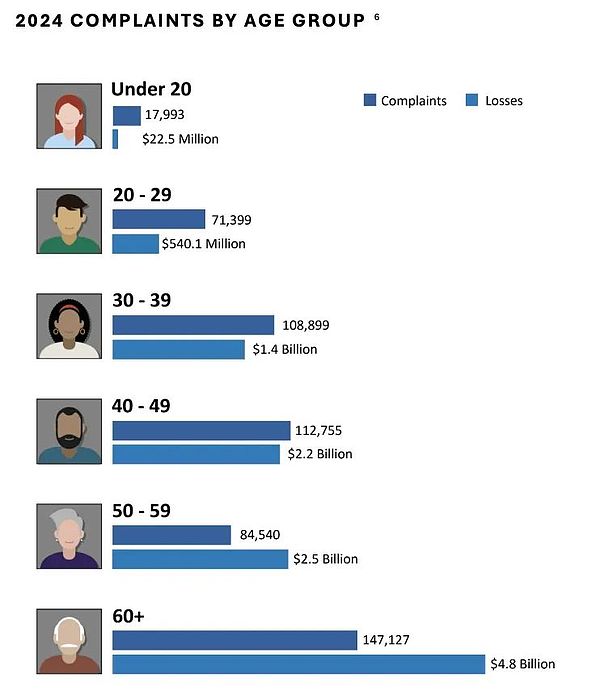

In 2024, IC3 received a total of 859,532 complaints, resulting in actual losses of US$16.6 billion, an increase of 33% over 2023. 256,256 of the complaints involved actual financial losses, with an average loss of about $19,372 per incident. About 83% of the losses were caused by online fraud.

2. Cryptocurrency-related situations

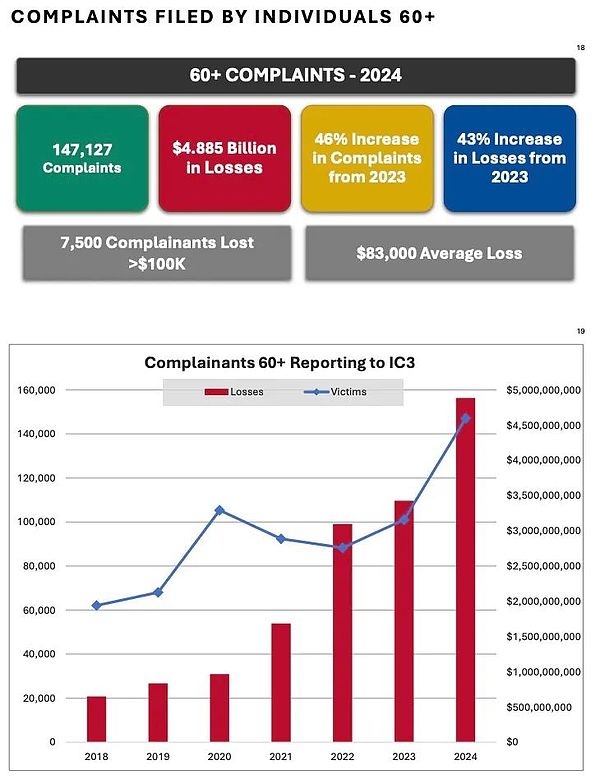

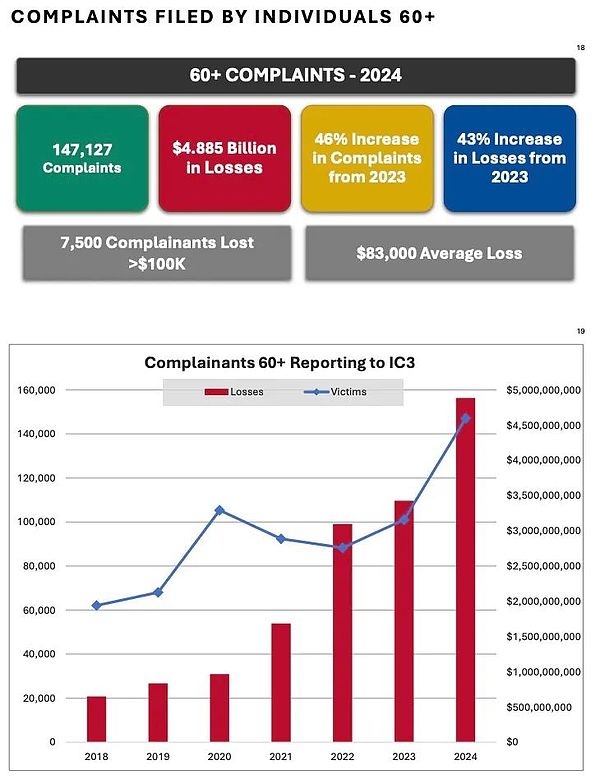

There were 149,686 complaints related to cryptocurrency, resulting in a loss of $9.3 billion, a year-on-year increase of 66%. Among the victims, those aged 60 and above accounted for the highest proportion. 3. People aged 60 and above

This group submitted 147,127 complaints and reported losses of $4.885 billion. The number of complaints increased by 46% year-on-year, and the amount of losses increased by 43% year-on-year. Among them, 7,500 people reported losses of more than $100,000, with an average loss of up to $83,000.

Key Point 2: Analysis of victim groups

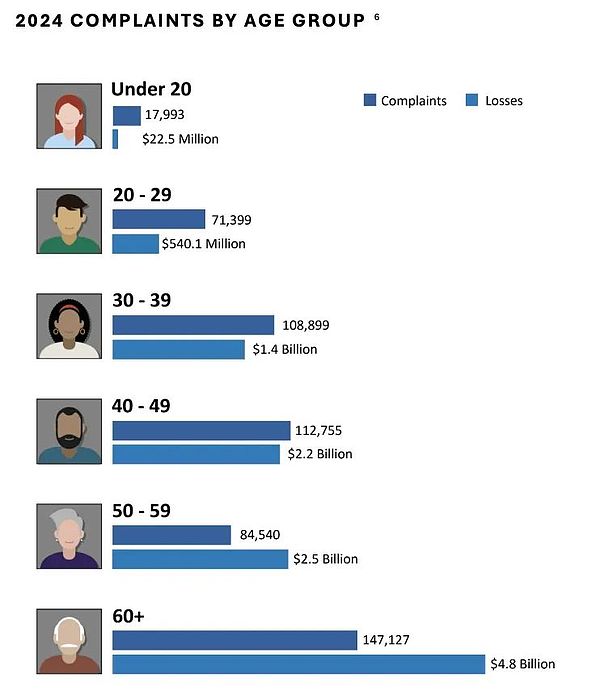

1. Overall age distribution

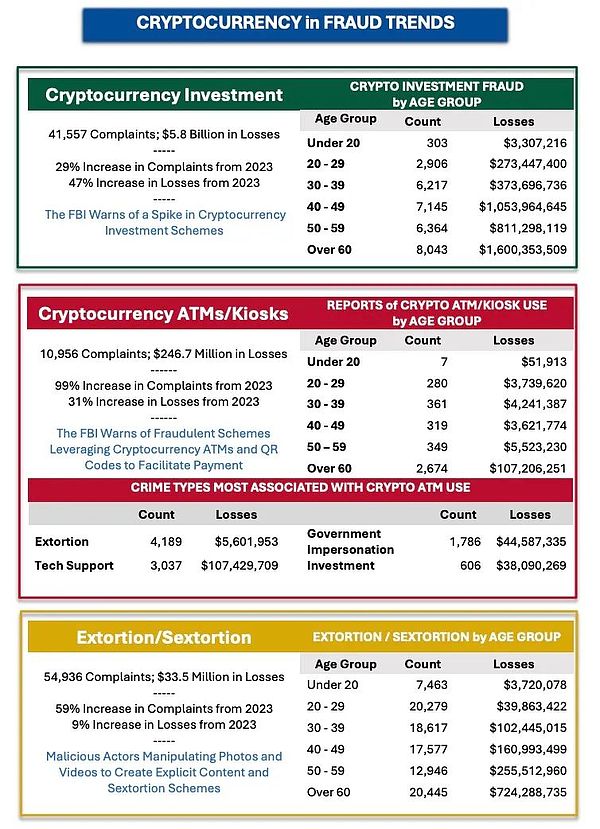

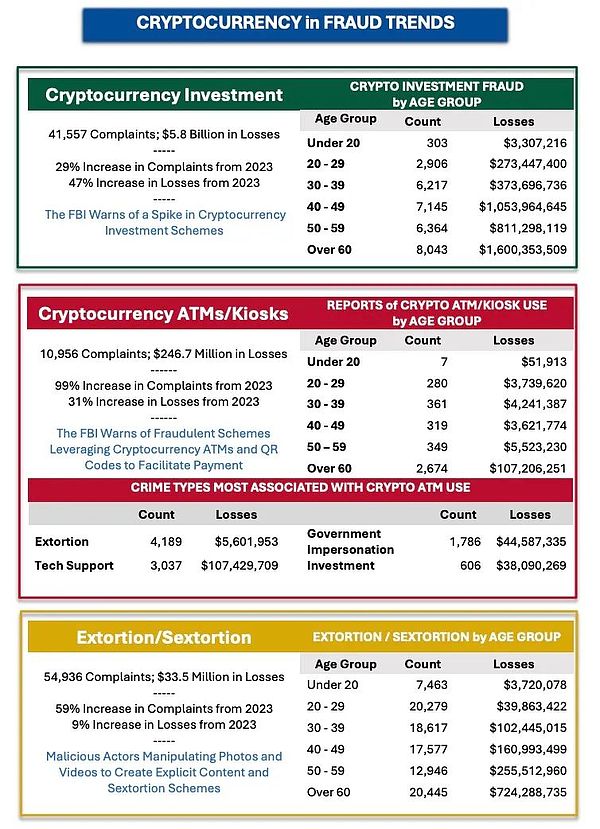

2. Cryptocurrency victim groups

In cryptocurrency investment fraud, people over 60 years old received the most complaints (8,043 cases), with losses reaching US$1.6 billion, far exceeding other age groups. People aged 60 and above are the main targets of fraudsters (2,674 cases with a loss of US$107,206,251) due to their lack of awareness of fraud prevention and unfamiliarity with new payment methods such as cryptocurrency ATMs. They are also the group with the most complaints about extortion/sexual extortion (20,445 cases with a loss of US$724,288,735).

Key Point 3: Analysis of crime types

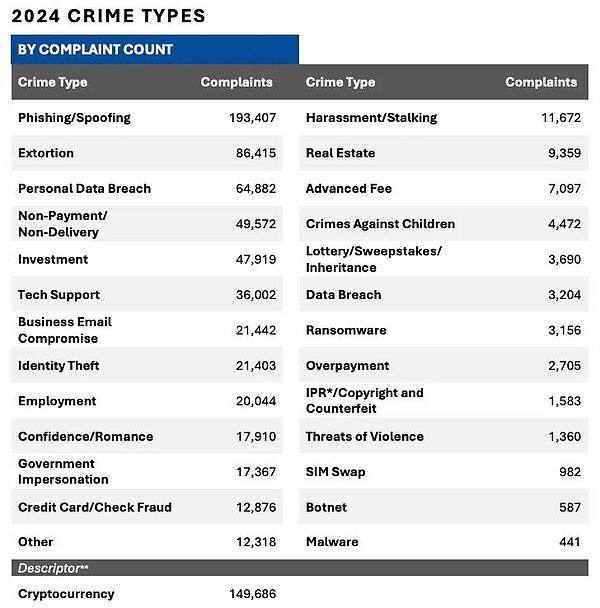

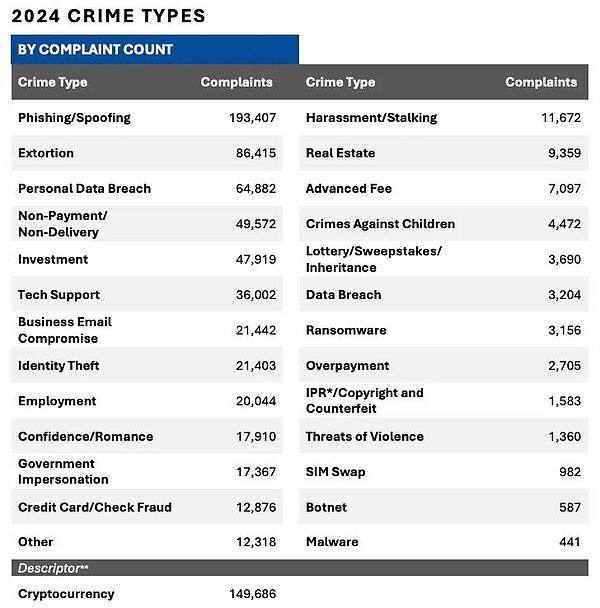

1. From the number of complaints

Personal data breach: 64,882.

Chargeback/failed transaction fraud: 49,572.

2. In terms of the amount of loss

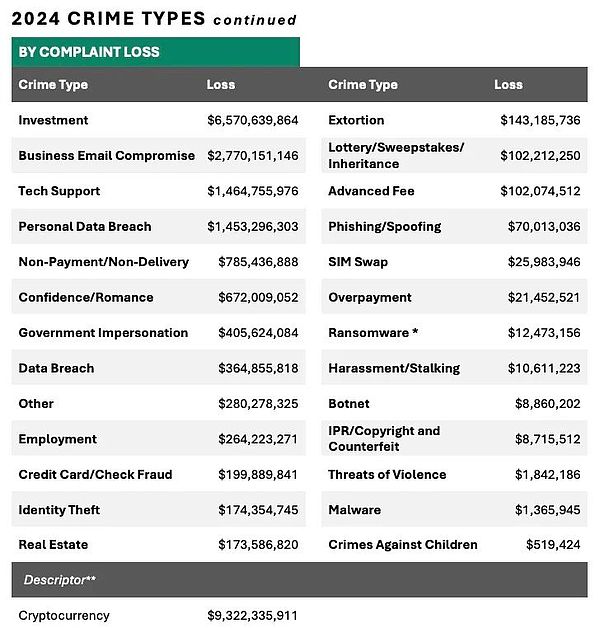

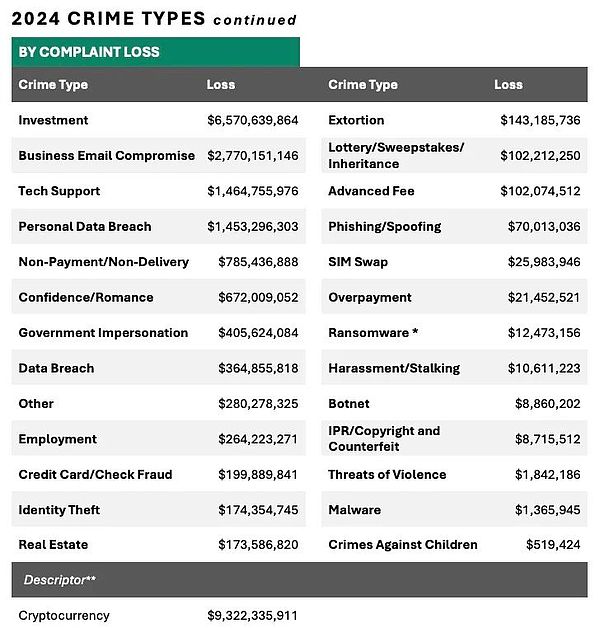

3. Cryptocurrency-related crimes

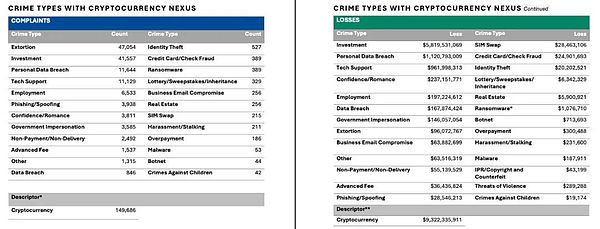

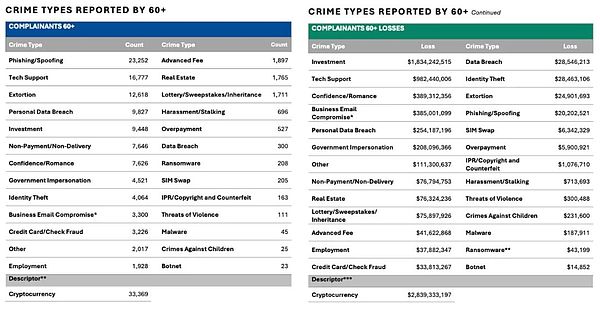

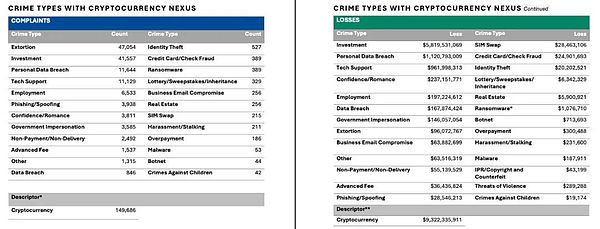

4. The main types of fraud encountered by people over 60 years old

The types of fraud with the most complaints: phishing, technical support, extortion, personal data leakage, and investment fraud.

The types of fraud with the highest losses: investment fraud, technical support, emotional fraud, business email compromise (BEC), and personal data leakage.

Key Point 4: Internet Fraud and Asset Recovery

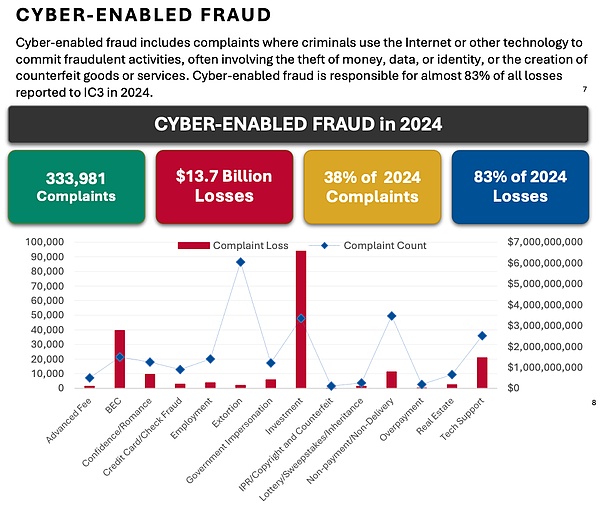

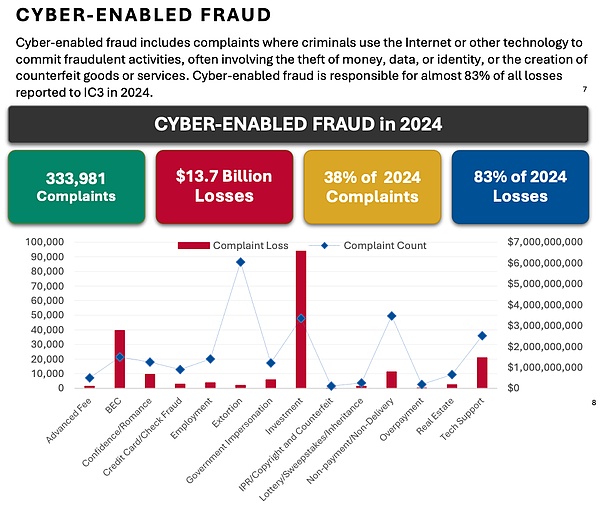

1. Overall situation of Internet fraud

In 2024, IC3 received 333,981 complaints of Internet fraud, resulting in losses of US$13.7 billion, accounting for 83% of the total losses for the year. The main transaction methods include cryptocurrency, wire transfer, credit card payment, etc.

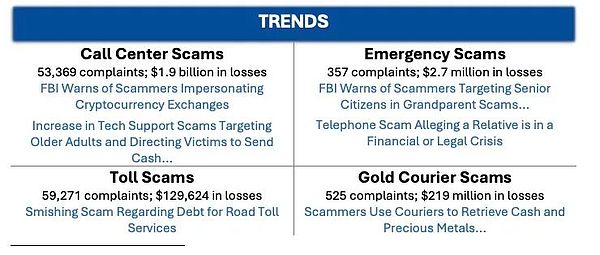

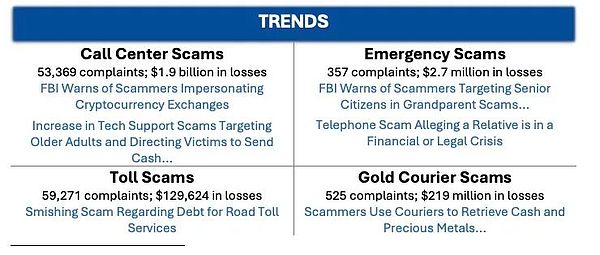

2. Typical fraud methods

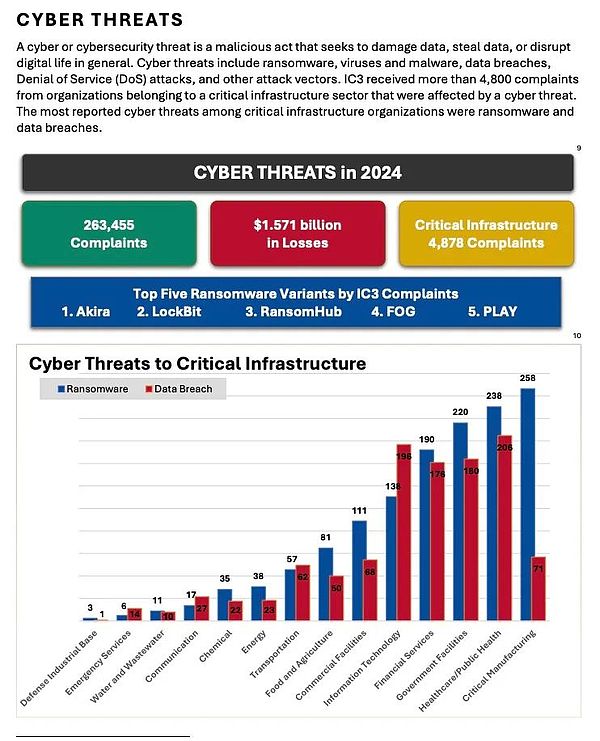

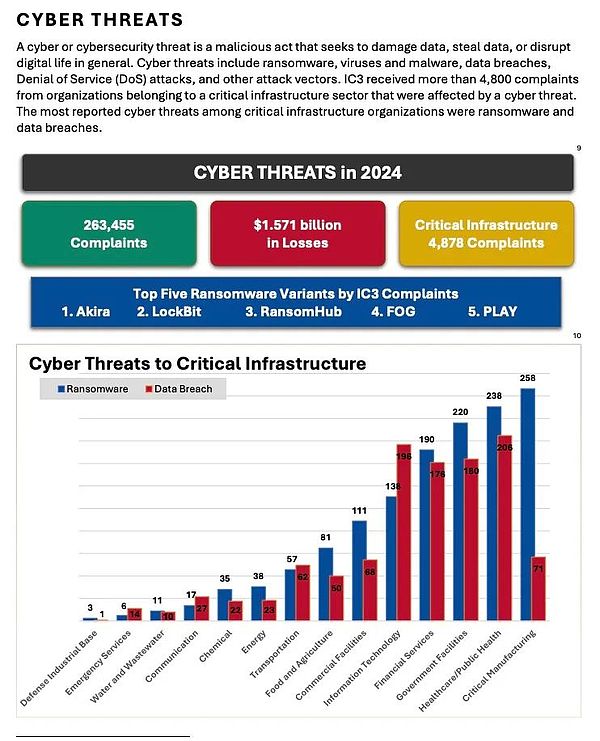

3. Cyber Threats

263,455 cyber threat-related complaints resulted in $1.571 billion in losses. Major ransomware variants include Akira, LockBit, RansomHub, FOG, and PLAY.

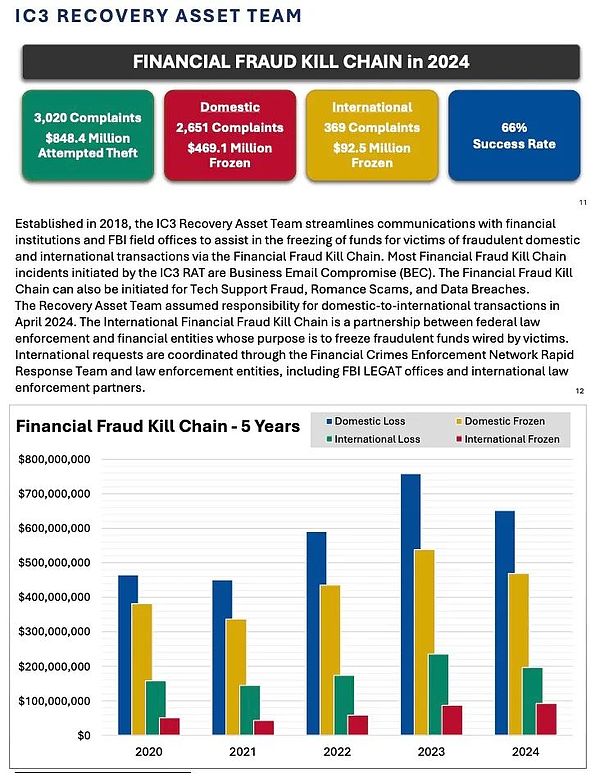

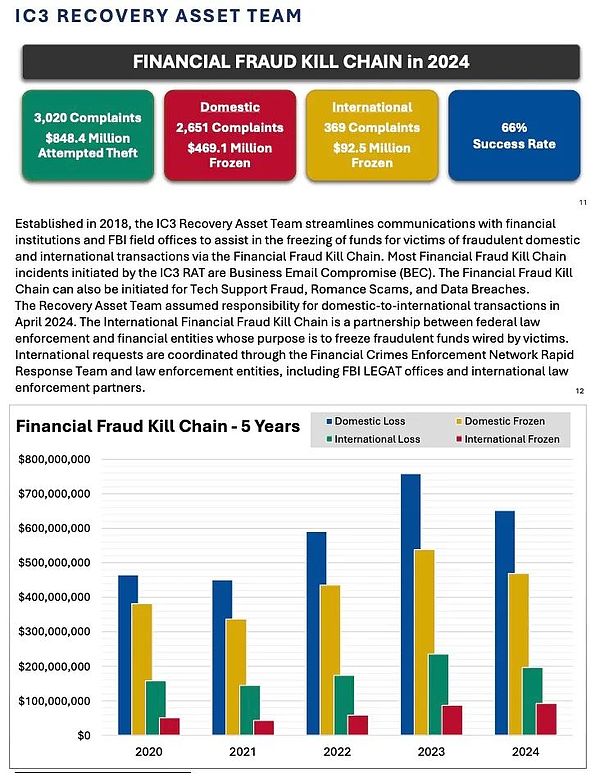

4. Asset Recovery Achievements

The FFKC team handled a total of 3,020 freezing requests, froze USD 560 million, and achieved a recovery

success rate of 66%. Operation Level Up successfully notified 4,323 crypto fraud victims and helped recover approximately $285 million in potential losses.

Worked with Indian law enforcement to combat call center fraud and arrested 215 people, a 700% increase year-over-year.

Successfully froze and recovered multiple large sums of money in financial fraud projects.

Key Point 5: Prevent cryptocurrency fraud

In response to the current high incidence of encryption fraud, the FBI has put forward the following prevention suggestions:

Be vigilant and avoid the temptation of high returns: high-yield, zero-risk investments are often scams.

Verify the legitimacy of the trading platform: Use formal, regulated exchanges, and avoid clicking on unknown links in social media ads.

Avoid transferring money to strangers: Do not trust "investment mentors" or "friends" you met online.

Beware of cryptocurrency ATM transactions: Scammers often ask victims to pay through ATMs, so be sure to be vigilant.

Use two-factor authentication (2FA): enhance account security and prevent hacker intrusion.

Summary

The "2024 Cryptocurrency Fraud Report" released by the FBI reveals new trends in cybercrime in the current crypto asset environment: cryptocurrency-related cases have increased significantly, and the elderly group over 60 years old has become the main victims; fraud methods are highly professional and international. At the same time, cryptocurrency has become the preferred tool for criminals to launder money and transfer funds.

Although asset recovery and cross-border law enforcement cooperation have made some progress, judging from the overall scale of losses and growth trends, ordinary users still need to remain highly vigilant, effectively enhance security awareness, and avoid falling into various fraud traps. For governments and financial institutions, continued strengthening of international cooperation, regulatory enforcement, and tracking of capital flows will be key measures to curb cybercrime and improve combat efficiency.

Weiliang

Weiliang