Source: Beosin

In recent years, Turkey has become one of the important players in the global cryptocurrency market with its huge cryptocurrency trading volume. According to statistics, Turkey has become the world's fourth largest cryptocurrency trading market, following the United States, India and the United Kingdom.

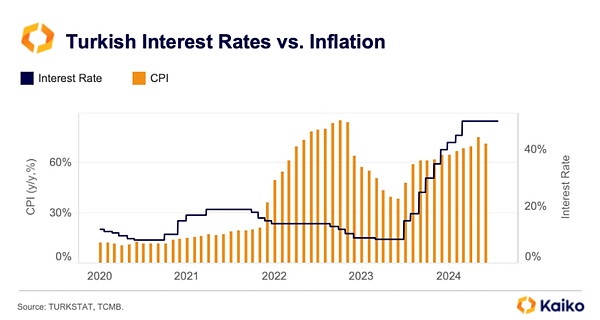

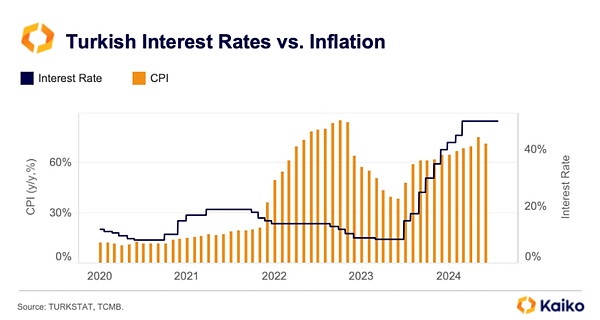

Turks' enthusiasm for cryptocurrency stems from the country's economic instability and currency depreciation. Faced with high inflation and the continued weakening of the lira, more and more Turks regard cryptocurrency as an important tool for hedging economic risks and preserving value.

*Between the end of 2020 and the end of 2023, the Turkish lira depreciated by more than 300% (Photo source: Kaiko)

On August 23, affected by factors such as high domestic inflation, the Turkish lira fell below 34 to 1 against the US dollar on the 23rd, hitting a record low. On the same day, the lira-to-dollar exchange rate in the Turkish foreign exchange market once fell to 34.049 to 1, and then rebounded slightly. According to local media reports, the Turkish lira has fallen by about 15.2% against the US dollar this year.

Although Turkey's cryptocurrency market is huge, it has lacked a clear regulatory framework for many years, which has kept the country's cryptocurrency industry in a legal gray area.

Although the Central Bank of the Republic of Turkey has issued a ban in 2021 on the use of cryptocurrencies such as Bitcoin for payment, this measure has not been able to thoroughly regulate the entire market. With the increasing attention paid to cryptocurrency regulation around the world, Turkey has also begun to gradually strengthen its management of this field.

Turkey's crypto regulation is clarified

The Capital Markets Law Amendment, which was passed by the Turkish Parliament in June this year and took effect in July, has attracted widespread attention from the crypto industry. The country's Capital Markets Board (CMB) emphasized that the content has established a preliminary regulatory framework for crypto asset service providers in Turkey.Specifically:

1. CMB is designated as the regulatory unit for the crypto industry, with the power to authorize operations, supervision, sanctions and take measures.

2. Establish criminal liability for unauthorized operation of crypto businesses, misappropriation of user assets and fraud.

3. Trading platforms need to establish a monitoring system to identify, prevent, restrict and report market manipulation and security incidents.

Currently, even in the absence of a comprehensive cryptocurrency regulatory system, Turkey's current regulations still have a certain regulatory power over the market, including the country's central bank's ban on the use of cryptocurrency payments and the Financial Crimes Investigation Committee (MASAK)'s requirements for exchanges to collect KYC data to maintain anti-money laundering measures.

However, Turkish Finance Minister Mehmet Simsek also revealed earlier this year that a more comprehensive crypto regulatory bill has reached the final evaluation stage, which is said to provide clear legal sources for "crypto wallets, crypto asset service providers, crypto asset custodians" and other operators.

Policy Interpretation: Newly Revised "Capital Market Law Amendment"

On July 2, 2024, the Turkish government officially passed the "Capital Market Law Amendment" No. 7518, which established a clear legal framework for the operation of crypto asset service providers (CASPs). This amendment marks the entry of Turkey's cryptocurrency market into a new era of compliance.

1. Turkey: Background of the "Capital Market Law Amendment"

Since 2021, Turkey has been included in the FATF's gray list due to money laundering risks. In order to get rid of this unfavorable situation and clarify the taxation policy of cryptocurrencies, Turkey began to increase its supervision of the field. Now that Turkey has been successfully removed from the gray list, a new regulatory framework has been introduced, laying the foundation for the standardized development of the cryptocurrency market.

2. New regulations issued by the Capital Markets Board (CMB)

On July 2, 2024, the Capital Markets Board (CMB) of Turkey officially announced the Capital Markets Law Amendment No. 7518, which included the provisions of crypto asset service providers (CASPs) in the scope of legislation. This marks a new stage in Turkey's cryptocurrency regulation. All crypto asset service providers must obtain a license from the CMB and comply with the standards set by TUBITAK. In addition, bank-related activities must also be approved by the Banking Supervision and Supervisory Authority (BDDK). These regulations not only strengthen supervision, but also provide guarantees for the healthy development of the crypto asset industry.

3. Conditions for the establishment of a crypto asset platform

According to the new regulations, the establishment of a crypto asset platform must meet the following conditions:

1. The platform should be established as a joint-stock company with a minimum paid-in capital of 50 million Turkish liras.

2. All shares should be issued in cash and registered.

3. Founders and managers must comply with the provisions of the Capital Markets Law and other relevant laws and have sufficient economic strength, honesty and trustworthiness.

4. The business scope of the crypto asset platform should be clear, covering activities such as purchase, sale, initial issuance, distribution, liquidation, transfer and custody.

IV. Transition and liquidation of platform operations

The new regulations require that crypto asset service providers currently operating in Turkey must submit the required documents to the CMB within one month, and companies that fail to submit applications must make a liquidation decision within one month. Temporary operating platforms must submit an application for a platform operating license before November 8, 2024, otherwise they will face liquidation.

During the transition period, a total of 76 exchanges have obtained temporary licenses to continue operating and must comply with the requirements of the new regulations. At the same time, 8 exchanges that failed to meet the conditions have been required to be liquidated.

V. Strict Supervision and Penalties

The new regulations establish severe penalties for individuals and institutions that engage in unauthorized crypto asset services. Individuals and legal persons who violate the regulations will face 3 to 5 years in prison and a fine of 5,000 to 10,000 days. The misappropriation of entrusted funds or assets will result in more severe penalties, up to 14 years in prison and a huge fine.

Criminals who engage in fraud to cover up misappropriation will face 14 to 20 years in prison and a fine of up to 20,000 days. In addition, individuals who illegally use the resources of crypto asset service providers whose licenses have been revoked will also face up to 22 years in prison and a fine of 20,000 days.

Impact and Prospects of the Regulatory Framework

The Capital Markets Law Amendment marks a key step forward in Turkey's cryptocurrency regulation. This amendment establishes a clear legal framework for crypto asset service providers (CASPs), making the operation of the cryptocurrency market more standardized and transparent.

Enhancing market trust and stability:By setting strict regulatory standards, the amendments introduce greater transparency and accountability to the cryptocurrency market. This will not only help improve investor trust in the market, but also prevent improper behavior, thereby laying the foundation for the long-term stability of the market.

Promoting compliance and standardized development:The amendments require crypto asset service providers to obtain a license from the CMB and comply with strict operating standards. This requirement will promote the standardized development of the industry, eliminate non-compliant market participants, and encourage more compliant companies to participate in market competition.

Entry and competition of international companies:After the amendments were introduced, a number of internationally renowned exchanges have applied for licenses, showing the attractiveness of the Turkish market to international companies. This trend is likely to intensify market competition, while bringing more advanced technologies and services, further promoting the development of the Turkish crypto market.

Increased supervision and market integration:The amendments not only set stricter regulatory standards, but also set severe penalties for violations. This will help clean up illegal activities in the market, make the market healthier and more transparent, and attract more formal companies to participate.

Potential for market growth: Turkey is the world's fourth largest cryptocurrency trading country, and with the implementation of this amendment, the cryptocurrency market may usher in new growth opportunities. Benefiting from a clearer legal framework, participants in the Turkish market will have the opportunity to develop and expand their business in a more stable environment.

The Capital Markets Law Amendment not only brings new order and norms to Turkey's cryptocurrency market,but also lays a solid foundation for its future development. With the participation of more companies and the gradual maturity of the market, the Turkish cryptocurrency market is expected to usher in a new round of prosperity.

JinseFinance

JinseFinance