Written by: Tia, Techub News

On October 10, Uniswap launched the application chain Unichain. Unichain has two major functions: Verifiable Block Building and Unichain Verification Network (UVN). There are many documents describing the introduction of these two functions, so I will not repeat them here.

But if you look closely at the Verifiable Block Building, you can find that Unichain uses priority ordering in this block building mechanism, and the application determines the allocation of MEV. Priority ordering, a mechanism in which applications control the ordering of transactions, is collectively referred to as ASS (Application-Specific Sequencing).

Although Unichain did not mention ASS or disclose detailed sorting rules in the white paper, it can be basically determined that it belongs to the category of ASS from its priority ordering and the MEV redistribution mentioned.

As a leader in the application layer, the roadmap and technical direction chosen by Uniswap are highly forward-looking and excavatable. Therefore, this article will focus on the ASS sorting rule concept used behind Unichain and some solutions currently on the market.

What is ASS & Why use ASS?

ASS stands for Application-Specific Sequencing, which means application-oriented sorting. DApp can formulate its own sorting rules and MEV allocation rules according to the needs of the application, such as giving priority to transactions that reduce slippage, and allocating part of the MEV income to LP and users, etc. In this way, MEV is internalized by application. It may be unfamiliar to everyone, but the idea of ASS is very simple, which is to allow applications to participate in the formulation of sorting rules and seize part of the sorting rights from builders and proposers.

Why should applications formulate sorting rules? MEV allows the profits that should belong to LP to be seized by arbitrageurs, and when the profits of LP, the important role in DEX applications, are severely squeezed, it will affect the development of DEX. Under the PBS mechanism, the validator becomes the profit-making party and obtains part of the MEV profit distribution. However, the ASS mechanism re-examines the issue of MEV value attribution, and advocates that applications formulate transaction sorting rules to return the value of MEV to the losing party.

Perhaps you will wonder how the transaction order determined by the sorter or consensus can allow applications to participate in it. Since Unichain has not yet announced the specific ASS mechanism, let's take a look at several more representative specific mechanism designs on the market:

Current ASS solutions

Usually, sorting is determined by the consensus level, but the cost of changing through the consensus layer is very high. Therefore, the current ASS solutions basically bypass the consensus, mainly using the smart contract framework or embedded applications to make changes in an off-chain manner, so that transactions sent from the application interface to the blockchain can be prioritized according to the sorting rules formulated by the application.

Atlas

Atlas is a modular smart contract framework developed by FastLane, which provides an ASS solution framework for applications. Applications can customize their own sorting logic by writing DAppControl contracts in the framework.

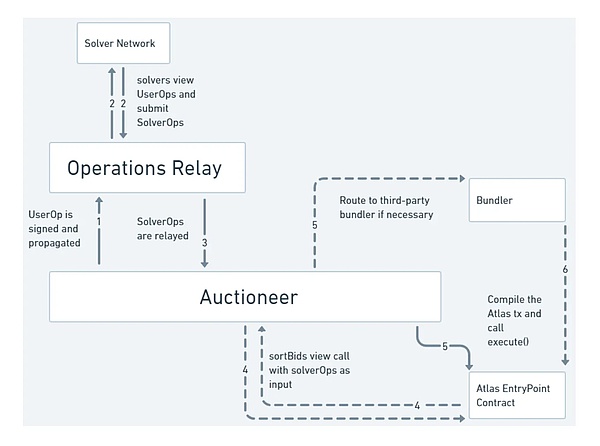

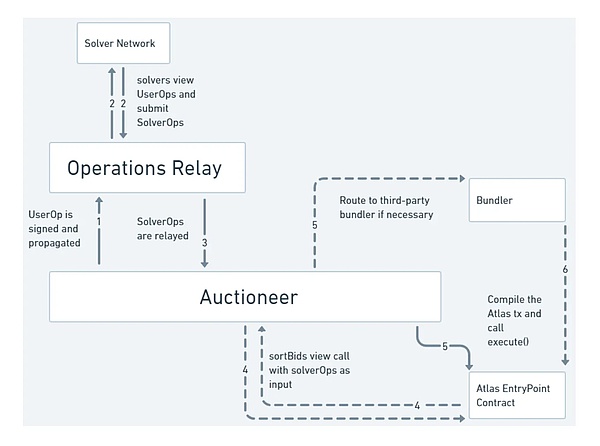

In the Atlas framework, the specific steps of a transaction from user signing to external submission are as follows:

Three additional roles are required in the entire process: Solver, Operations Relay and Auctioneer. The role of Atlas Solvers is limited to Atlas. They have priority access to any value created by user operations and can extract MEV under the rules set by the DAppControl contract. Solvers have priority access over wallets, RPCs, relayers, builders, validators, and sorters.

Operations Relay is responsible for relaying user operations userOps generated by users on the front end to Atlas solvers, and relaying solver operations to Auctioneers after the solver has browsed the user transactions. Auctioneers are tasked with sorting them using the bid valuation function defined in the DAppControl module and ensuring the correct execution order. After determining the execution order, they sign the DAppOperation containing the CallChainHash to ensure that the Bundler cannot tamper with the transaction order after the transaction is sent to the Bundler. Subsequently, the Bundler packages the complete Atlas transaction and submits it to the network for inclusion in the block.

Since the final determination of transaction ordering must be completed by the Auctioneer, there may be a situation where the Auctioneer does not sign transactions that are unfavorable to it. Therefore, it is usually recommended to choose the auction beneficiary (for example, when the rule is to return MEV income to the user, the user is the beneficiary) as the Auctioneer, because the beneficiary can always trust himself.

Angstrom

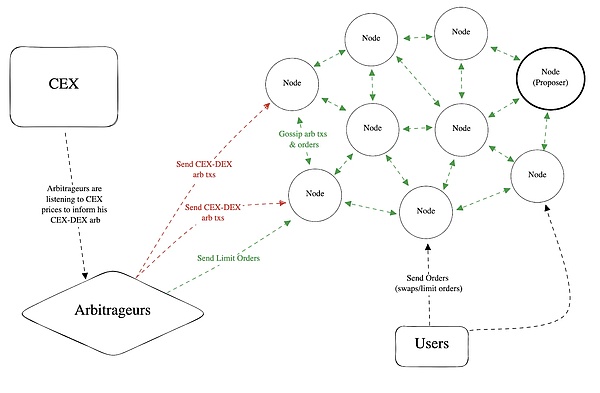

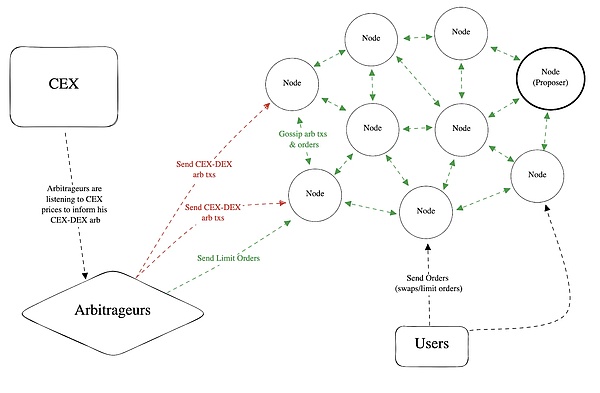

Angstrom is a product developed by Sorella Labs. Unlike the Atlas framework, Angstrom ensures the implementation of application ordering rules through a verifiable consensus network. The verifiable consensus network acts as a guard, and the network can be operated by providing a pledge. The transactions of applications and transactions with arbitrage opportunities between DEX and CEX will be submitted to the network. Nodes need to propagate, verify, and build the best transaction bundle, and return the value to LP according to the LVR auction mechanism.

Currently, Angstrom plans to be launched as a hook for Uniswap V4. Hook is a customizable smart contract bound to a liquidity pool, allowing developers to execute custom code at specific points in the life cycle of the liquidity pool, thereby implementing complex logic and functions.

Vertex

Vertex is a decentralized exchange that uses off-chain sorters to develop application-specific sorting rules. By using off-chain sorters to process orders off-chain, Vertex reduces the risk of MEV (such as front-running and sandwich attacks) because transactions are not publicly broadcast before execution. At the same time, the mechanism allows users to verify that off-chain operations are consistent with on-chain records to prevent misbehavior of the sorter.

Summary

By granting control over transaction sorting and execution, ASS enables DApps to reduce MEV risks, optimize operations, and innovate. But behind this innovation, there are potential trade-offs to consider.

The ASS mechanism sorts by built-in sorting rules within a single application, which will destroy the inherent composability between blockchain applications. Composability is DeFi's biggest weapon against CeFi. When composability is lost, non-arbitrage transactions may be greatly reduced, thereby reducing LP's income. ASS will increase LP's MEV income, but if the reduction in non-arbitrage transaction volume is greater than LP's MEV income, it will be a loss. Therefore, how to design the ASS mechanism to maintain DeFi's natural composability is an urgent issue for ASS.

Weatherly

Weatherly