From ancient times to the present, shells, chips, cash, deposits, electronic wallets, etc. are all carriers or forms of expression of currency. These carriers and forms of expression are constantly changing in line with the times, just like the digital currency form derived from blockchain technology in the digital economy era today, and the Web3 payment ecosystem built on it.

As the latest currency carrier or form of expression, stablecoins have spread to all aspects of the financial life of ordinary users since they were initially used as collateral or exchange mediums for crypto assets. With the rise of stablecoins in the past five years and their continuous penetration into the global economy, the endowment of blockchain as a financial infrastructure will inevitably be explored and fully utilized by the traditional financial world outside the crypto market.

VISA's stablecoin report provides us with the following data: The total supply of stablecoins is about $170 billion. They settle trillions of dollars worth of assets each year. About 20 million addresses on the chain conduct stablecoin transactions every month. More than 120 million addresses on-chain hold non-zero stablecoin balances. These numbers all show that stablecoins are a currency that runs parallel to traditional financial infrastructure - it just started from close to zero five years ago.

Therefore, we can no longer limit our vision to the use cases of stablecoins in the native crypto market, but should look at the use cases of stablecoins in non-crypto native scenarios from a new perspective. Who uses stablecoins? What are they used for? How has it penetrated our global economy and is used for remittances, cross-border payments, international trade settlements, and is seen as a savings tool for ordinary people?

VISA's stablecoin report is of great significance.To date, research on cryptocurrency adoption has mainly focused on general cryptocurrency penetration, and no survey has been conducted specifically on stablecoin adoption and use cases.In particular, research on use cases in non-native crypto markets will have a profound impact on the traditional financial payment system and indicate the future development path of Web3 payments.

In the report, VISA starts with on-chain data on the widespread use of stablecoins and conducts in-depth surveys of recognized crypto users in five major emerging market economies (Brazil, India, Indonesia, Nigeria and Turkey). In addition to on-chain data and survey results, VISA also provides in-depth insights into companies that actually operate in these markets. Together, these on-chain data, survey data, and qualitative local insights provide us with a panoramic view of global stablecoin usage to fully understand the use of stablecoins around the world, with a particular focus on the use of stablecoins for non-crypto purposes, such as remittances, cross-border payments, payroll, trade settlements, and B2B transfers.

VISA report full text: Stablecoins: The Emerging Market Story

https://castleisland.vc/writing/stablecoins-the-emerging-market-story/

1. Why VISA

"Money is not coins, cash or credit cards. These are just forms, not functions. The function of money is usually a tool for measuring equal value and a medium of exchange. Money will become a digital representation of letters, and it will move around the world at the speed of light through infinitely different paths at minimal cost." - Dee Hock, founder of VISA.

When Dee Hock founded VISA more than fifty years ago, the original vision was not just a card organization network. He hoped that VISA could become the world's most important electronic value exchange system (Exchange of Electronic Value), regardless of the form of value or the underlying technology.

Although Dee Hock passed away in 2022, many of his thoughts and expressions are so profound and have traveled through history. Every change in the carrier or form of currency will be accompanied by huge changes, just like the digital currency form derived from blockchain technology in today's digital economy era, and the Web3 payment ecosystem built on it. This also guides VISA, a global financial infrastructure company, to explore new value circulation paths.

VISA believes that stablecoins are a payment innovation that has the potential to provide safe, reliable and convenient payments to more people in more places. Thinking about how to incorporate digital currency forms/payment forms derived from blockchain technology into VISA's territory is more about how VISA enters the game and finds its own ecological positioning.

VISA currently provides technical services that enable consumers, merchants, financial institutions, fintech companies and governments to safely transfer value around the world. VISA has more than 4.5 billion credit cards worldwide, and its products cover more than 130 million merchants, approximately 14,500 financial institutions and more than 200 countries and regions. In the past year alone, VISA has facilitated more than 296.8 billion transactions and a transaction volume of US$15.5 trillion.

Today, VISA has supported more than 50 wallet partners, enabling users to use VISA cards to pay quickly and securely at more than 130 million merchants worldwide. VISA is also piloting the use of stablecoins such as USDC to expand the settlement capabilities of global issuers and acquirers, providing greater flexibility for fund management.

Recommended derivative reading: LilinSun, from the origin of "mixed order" to the "VISA" of the Web3.0 generation

2. Overview of the stablecoin market

Stablecoins, as tokenized representations of legal tender circulating on blockchains, are undoubtedly the "killer application" of the crypto market to date. Currently, there are more than $160 billion in stablecoins in circulation, far higher than the billions of dollars in 2020. More than 20 million addresses trade stablecoins on public blockchains every month. In the first half of 2024, the value of stablecoin settlements exceeded $2.6 trillion.

Compared with existing payment systems, stablecoins have significant advantages, including open and transparent ledgers, settlement of transactions, self-custody of funds, on-chain programmability, and interoperability. While stablecoins were initially used by traders and cryptocurrency exchanges as collateral or a medium of exchange for assets, they have now transcended their niche and are now widely adopted in the global economy.

Today, global users value the ability to hold fiat currencies (primarily USD stablecoins) directly themselves, rather than relying on unreliable or inaccessible bank accounts. Stablecoins are also being used for cross-border payments, wages, trade settlements, and remittances. There is also a growing number of stablecoin-based yield products, either as interest-bearing stablecoins themselves or through decentralized DeFi protocols. In emerging markets, the pace of adoption of stablecoins for payments, currency substitution, and as a form of high-quality yield is accelerating.

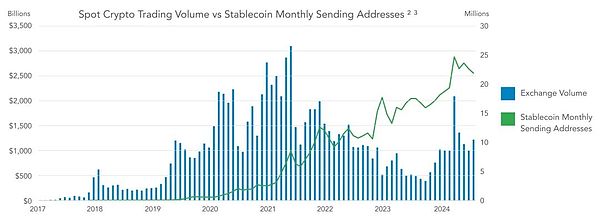

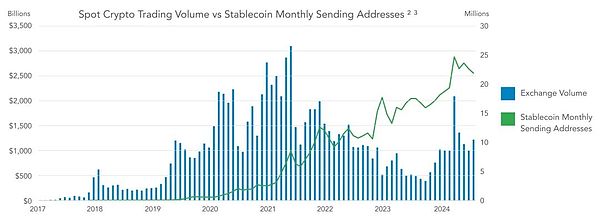

Based on the differences between stablecoin activity and crypto market cycles, it is clear that stablecoin adoption has expanded beyond serving cryptocurrency users and asset trading use cases.

If stablecoins were used simply as a form of settlement between traders and crypto exchanges, then stablecoin settlement volume, transaction counts, and monthly active addresses should be largely correlated with crypto market cycles. However, the lackluster performance of crypto exchange trading volumes in 2022-2023 suggests that stablecoins have real-world uses beyond pure speculative use.

Stablecoins have indeed grown in non-crypto transactional uses, especially in emerging markets. They are used for currency substitution (to escape volatile or depreciating local currencies), as alternatives to dollar-based bank accounts, for B2B and consumer payments, for access to various forms of yield products, and for trade settlement.

Stablecoins are particularly attractive when dollar banking is non-existent or difficult to obtain, in countries with high inflation, and in countries where the fiat financial system is lacking.

3. On-chain stablecoin data

The following is a data panel provided by VISA, which you can study if you are interested:

https://visaonchainanalytics.com/transactions

3.1 The stablecoin market is growing year by year

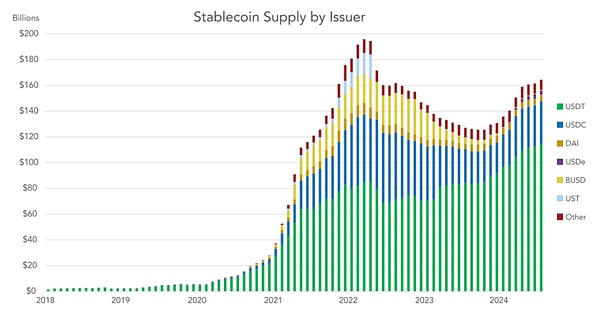

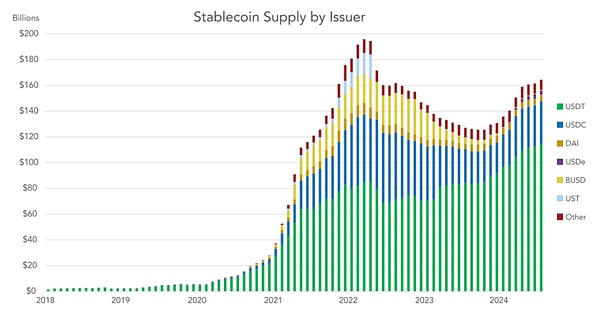

The total supply of stablecoins has grown rapidly since 2017, when the total circulation of stablecoins was still less than $1 billion. The total supply of stablecoins peaked at approximately $192 billion in March 2022, before Terra's UST collapsed and the credit crunch suppressed cryptocurrency native interest rates, depressed cryptocurrency trading volumes, and hurt the balance sheets of cryptocurrency native companies. After the credit crisis largely subsided, stablecoin supply began to recover in December 2023 as major crypto assets began to rise ahead of the approval of a Bitcoin ETF in the United States.

In recent months, various new forms of stablecoins have emerged as various regulators have passed clear stablecoin legislation in the hope of attracting issuers. Some of the most active jurisdictions in developing stablecoin regulatory frameworks include the European Union, Singapore, Dubai, Hong Kong, and Bermuda.

As crypto-native and sovereign interest rates rise, certain stablecoin issuers have begun to experiment with models that pass returns to holders, either through on-chain programmatic or through third-party revenue sharing arrangements. The presence of programmable (and in some cases permissionless) returns in stablecoins - whether crypto-native or based on US Treasury bonds - adds a new value proposition for end users who do not have easy access to US dollar money market funds.

3.2 Data needs to be corrected and adjusted

The on-chain stablecoin data clearly shows the trend of continued growth of stablecoins. However, on-chain data is often overestimated and needs to be de-noised and carefully interpreted.

VISA has extended existing methods to estimate the total settlement volume of stablecoins. Nominal (total) figures are not a reliable estimate of settlement volume because the nature of blockchains and how certain agents (exchanges, mixers, and various robots) use them can cause significant overestimation, resulting in settlement volumes being exaggerated by an order of magnitude. Therefore, a lot of de-noising work must be done.

The adjusted settlement volume is still a difficult number to estimate, and there is no exact "ground truth" - only estimates and best guesses. VISA does not regard its estimates as authoritative.

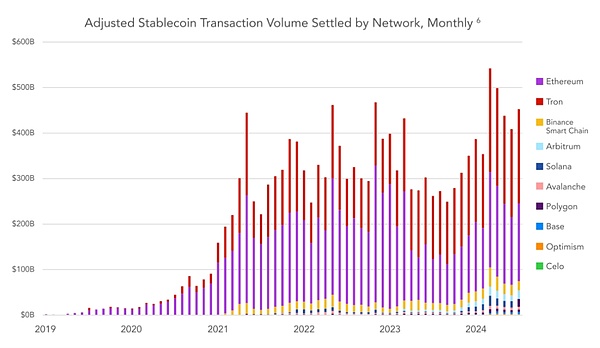

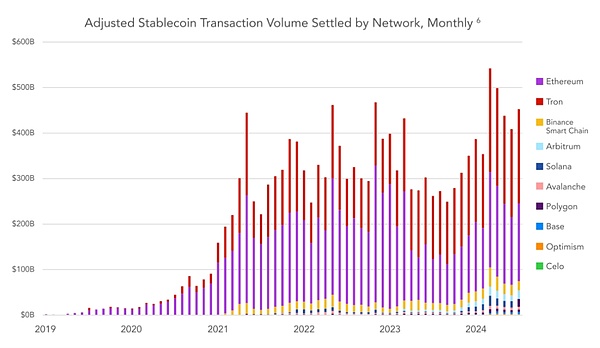

Based on the adjustments, VISA expects a conservative estimate of $3.7 trillion in total stablecoin settlements in 2023, $2.62 trillion in the first half of 2024, and an estimated $5.28 trillion for the full year of 2024.

It is worth noting that despite the sell-off of crypto assets and the decline in exchange trading volumes in 2022 and 2023, the settlement volume of stablecoins has been growing steadily throughout the market cycle.

This once again shows that stablecoins have attracted a new group of users who are not only interested in using them for exchange settlements. As of June 2024, the most popular blockchains by settled value are Ethereum, Tron, Arbitrum, Base, BSC, and Solana.

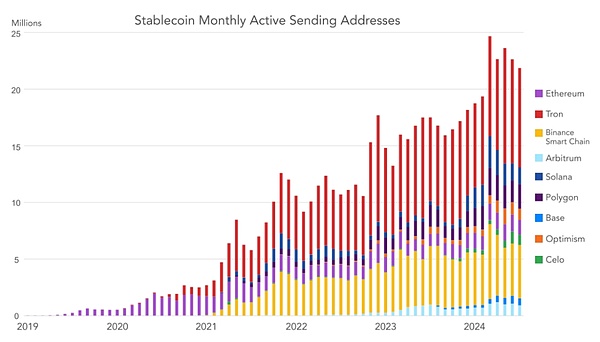

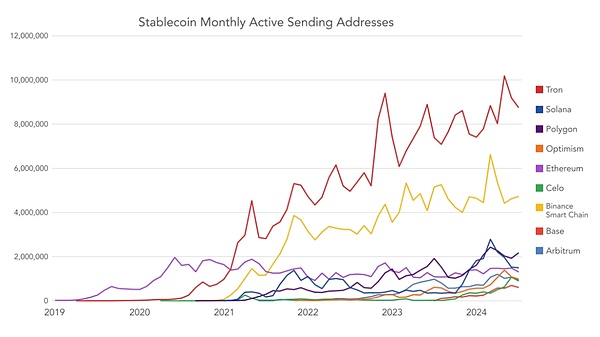

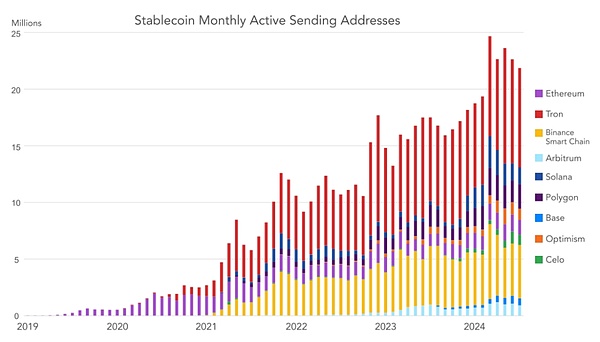

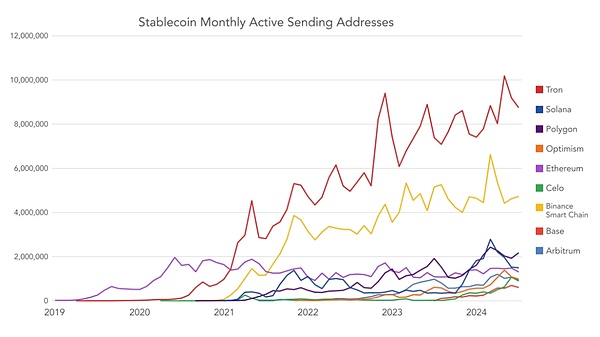

Monthly transfer addresses have similar or even more stable growth. VISA prefers this metric to transaction counts because it is generally more resistant to manipulation (but not completely impervious to manipulation).

The most popular stablecoin transfer blockchains are Tron, BSC, Polygon, Solana, and Ethereum. Ethereum's fee burden is generally higher, meaning that there are often fewer addresses and transaction volumes than Tron or BSC, but Ethereum still leads in terms of value settled.

3.3 Dollarization of Stablecoins

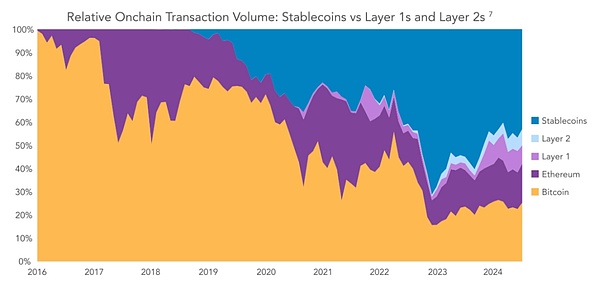

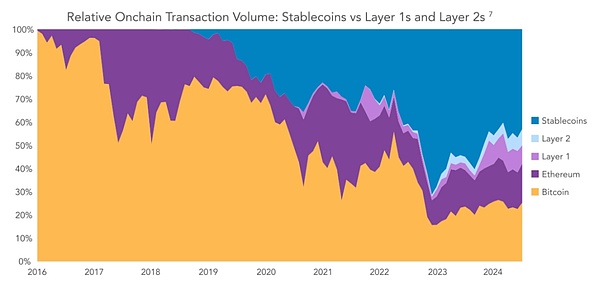

The story of blockchain “dollarization” emerges when stablecoin settlement volumes are compared to native crypto assets. While Bitcoin and Ethereum have historically been the dominant medium of exchange on public blockchains, stablecoins—and those that are almost entirely pegged to the U.S. dollar—have steadily gained market share. Today, stablecoins account for approximately 50% of all value settled on public blockchains, having reached 70% in the past.

Stablecoins remain closely tied to the U.S. dollar. The second most popular currency used in stablecoins is the Euro, which has a supply of $617 million as of June 2024, or 0.38% of the total stablecoin market. While there are stablecoins using the Lira, Singapore Dollar, Japanese Yen, and several other fiat currencies, no stablecoin in any currency other than the USD or EUR has more than $100 million pegged to it.

In practice, this means that when individuals in emerging markets use a USD-pegged stablecoin, they are indirectly purchasing a U.S. debt instrument, such as a short-term Treasury bill. Regulators in certain countries with high cryptocurrency penetration, including Nigeria, which was implicated in the VISA survey, are concerned that their local currencies could be at risk if cryptocurrency dollarization continues unabated.

Why stablecoins are so overwhelmingly dollarized remains an interesting question. The USD is the global reserve currency, but it is not as dominant in any other usage category as it is in stablecoins. Stablecoins referencing alternative currencies have been around for years but have yet to gain traction. The overwhelming dominance of the U.S. dollar in the stablecoin space likely reflects the fact that most states do not impose any local barriers to the use of U.S. dollar stablecoins, and users simply prefer the most liquid tokens, such as USDT and USDC. In addition, the strength of the U.S. dollar against most other sovereign currencies remains a motivation for cryptocurrency users to favor dollar-pegged stablecoins, even outside the United States. Whether regulation will hinder U.S. dollar stablecoins and encourage the growth of local currency-backed stablecoins remains to be seen.

IV. Emerging Market Survey Report

However, despite these observations, the prevalence of non-crypto use cases among emerging market stablecoin users has not been quantified to date. Therefore, VISA conducted a study of crypto users in five major emerging market countries (Brazil, India, Indonesia, Nigeria and Turkey) to better understand the frequency of stablecoin use and how emerging market users use these tools.

VISA surveyed approximately 500 people in Nigeria, Indonesia, Turkey, Brazil and India, with a total sample of 2,541 adults. The general picture shown by the survey data is the increasing adoption of stablecoins, more frequent transactions, significantly higher portfolio penetration, and the use of heterogeneous stablecoins beyond the pure cryptocurrency trading use case.

Key findings:

While the top motivation for using stablecoins is to acquire cryptocurrencies (50%), motivations for acquiring USD (47%), yield generation (39%), and non-crypto uses are also popular;

Stablecoins are preferred over USD banks due to yield, efficiency, and lower likelihood of government intervention;

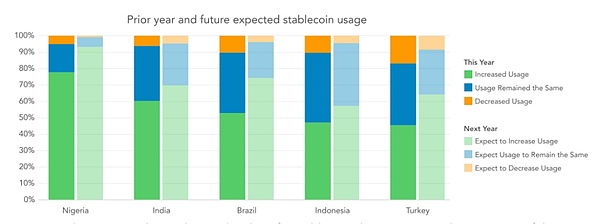

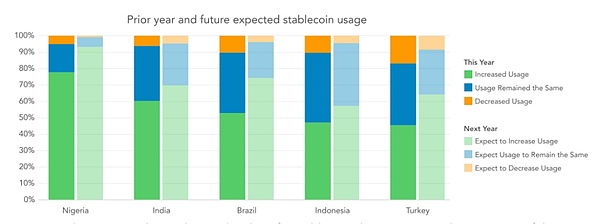

57% of users reported an increase in stablecoin usage over the past year, and 72% believe they will increase their stablecoin usage in the future;

In the case of Tether, the main reason reported was its network effect, followed by user trust, liquidity, and track record relative to other stablecoins;

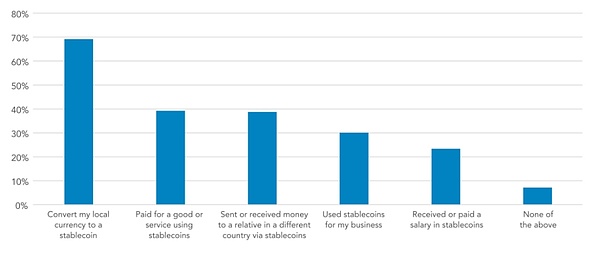

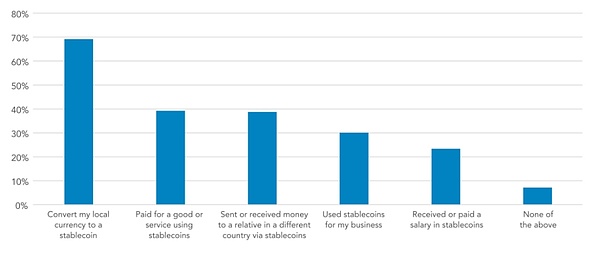

Among non-transaction use cases, currency exchange (converting to USD) was the most reported activity, followed by paying for goods, cross-border payments, and paying or receiving salaries;

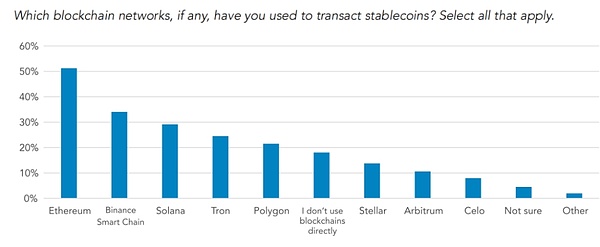

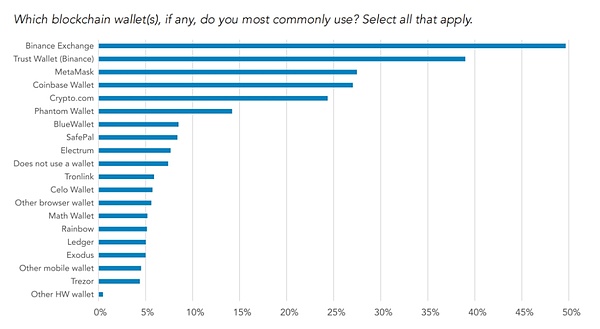

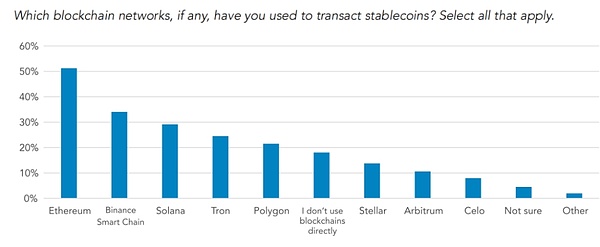

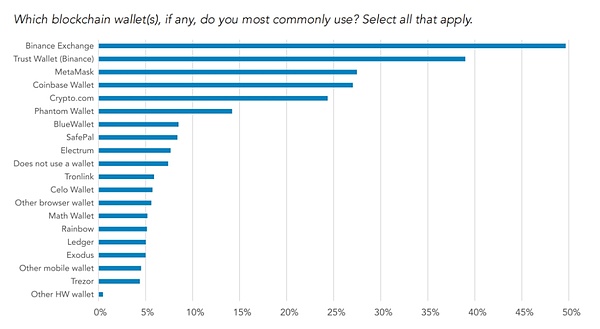

Ethereum is the most popular blockchain among sampled users, followed by BSC, Solana, and Tron; The most popular wallet among respondents is Binance, followed by Trust Wallet, Metamask, Coinbase Wallet, Crypto.com, and Phantom Wallet. 4.1 Types of Stablecoin Activities VISA is most interested in determining the goals of users using stablecoins. Although stablecoins were initially seen as collateral for exchanges and a means of transaction settlement, usage patterns and use cases have expanded. The most popular goal of stablecoin users in the sample is to trade cryptocurrencies or NFTs, but other non-cryptocurrency uses are not far behind. Overall, 47% of respondents said one of their main goals was to save dollars, 43% mentioned better currency exchange rates, and 39% said to earn a yield.

The findings are clear: non-cryptocurrency uses account for a large portion of stablecoin usage patterns in the countries surveyed.

By far, the most popular use was currency exchange, followed by shopping and cross-border transactions. Notably, the majority of respondents in all countries in the sample said they had used stablecoins for non-cryptocurrency transaction use cases. Stablecoin usage is growing in all countries surveyed. The majority of respondents said their usage has increased over the past year, with an even larger percentage saying they will increase their usage further in the year ahead.

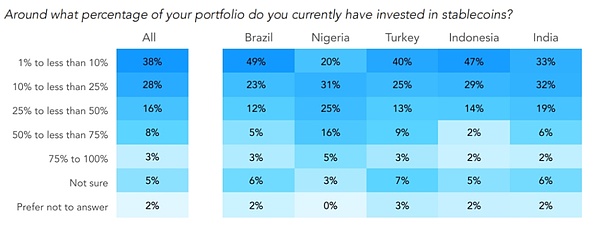

4.2 Penetration of Stablecoins

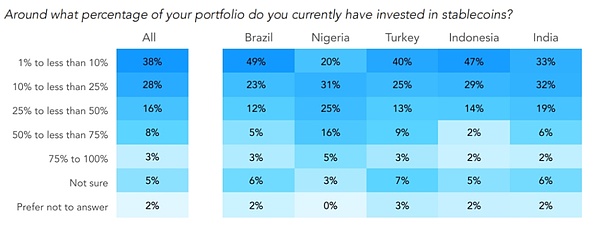

For the penetration of stablecoins in users' portfolios. At the national level, the proportion of Nigerians is much higher than other groups in the sample, followed by Turkey and India. In the Indian user sample, respondents in the richest group also said that they have a larger proportion of stablecoins in their financial portfolios.

Survey results by country:

VISA found that Nigerian users have the highest affinity for stablecoins among all the countries surveyed - far higher than other countries. Nigerians trade most frequently, have the largest share of stablecoins in their portfolios, report the highest share of non-cryptocurrency transactions for stablecoins, and have the highest level of self-reported knowledge of stablecoins.

Interestingly, the primary goals of stablecoin users vary by country. Cryptocurrency trading is the most common goal for stablecoin users across the sample, but there are differences by country. In Turkey, the most common goal is to earn a yield, followed by cryptocurrency trading. For Indonesians, better currency exchange rates, followed by cryptocurrency trading and dollar savings. For Nigerians, dollar savings are the top goal, followed by cryptocurrency trading and getting better currency exchange rates.

The countries with the most active stablecoin use in the sample are Nigeria, India, Indonesia, Turkey, and Brazil. In terms of stablecoin portfolio share, Nigeria once again stands out (by a significant margin), followed by India, Turkey, Brazil, and Indonesia.

VISA also divided respondents into different income brackets to understand the role affluence plays in stablecoin adoption. However, given the uneven sampling of income classes in most countries in the sample, VISA can only produce useful results for India. The results for India by income are quite clear: wealthier respondents have greater stablecoin penetration in their portfolios, they are more likely to use stablecoins for a wider range of use cases, including non-crypto use cases, and they are more likely to trust stablecoins over bank accounts.

Findings by age:

Overall, the results by age are consistent with expectations: younger people have a higher rate of stablecoin use. Young people are more likely to have tried multiple different stablecoins and hold a higher share of stablecoins in their overall financial portfolio.

While there are no clear age differences in most usage categories, younger people are more likely to use stablecoins to save in USD, convert local currency to USD, and enter the crypto economy than older respondents. Younger age groups have a higher rate of stablecoin use in all non-crypto use cases: paying for goods/services in stablecoins, sending remittances, and receiving wages in stablecoins.

Among respondents who said they exchanged their national currency for stablecoins, 34% of younger people (18-24) did so weekly and 38% monthly, compared to only 15% of the oldest respondents (55+) weekly and 46% monthly. Younger respondents also expressed greater trust in stablecoins compared to their USD-denominated bank accounts.

4.3 Tether Preference for USDTTether is widely considered the most popular stablecoin among users in emerging markets. VISA wanted to understand its enduring strengths. Users most commonly reported that they preferred Tether due to network effects, followed by greater trust in it, and that Tether maintained the best liquidity.

For which blockchain networks users prefer (if any), and which wallets they use. VISA surprisingly found that Ethereum was the most popular blockchain network in all regions, followed by BSC, Solana, and Tron. This was unexpected because Ethereum's fees have always been too high for smaller retail payments.

VISA also lets users choose whether to trade only on exchanges (some exchanges allow users to make peer-to-peer transfers, and transactions are settled on their internal ledgers). 18% of the sample admitted to making stablecoin transfers in this way. This trend towards using exchanges directly rather than blockchains is also evident in VISA's questions about wallets.

The most popular non-custodial wallets are Trust Wallet, MetaMask, and Coinbase Wallet. Half of all respondents said they use Binance as their wallet, more than any other non-custodial wallet. Notably, 39% of Nigerians surveyed admitted to using Phantom wallets (primarily Solana clients).

V. In-depth insights from market practitioners

These practitioners who have penetrated into emerging markets have made the data no longer cold, presenting us with real and vivid use cases of stablecoins. Although we may find it difficult to understand in developed countries, this is the reality.

5.1 Mountain Protocol — Interest-Bearing Stablecoins

Mountain Protocol is the first issuer of a state-regulated (Bermuda) and permissionless interest-bearing stablecoin. Due to its yield-bearing nature, USDM is more suitable for use in locations where there is working capital.

This can include being used as collateral for reinsurance policies, such as those issued by Nayms, where real-world risks are covered by crypto collateral.

Another use case is as collateral for loans. In most emerging markets, banks are reluctant to issue unsecured loans to businesses and want collateral. However, borrowers do not want to have USD in the local banking system due to trust risks in some jurisdictions. Companies like Aconcagua solve this problem by depositing USDM in a multi-signature contract, acting as an escrow agent and allowing banks to issue such loans in the form of collateral, thereby expanding credit capacity.

Finally, remittance companies are converting their working capital into USDM.

This transition is still in its early stages as accepting USDT is still king. With interest-bearing stablecoins, these companies can increase profitability by holding yielding assets.

5.2Bits – Crypto Exchange

Bitso is a cryptocurrency exchange with official offices in Argentina, Brazil, Colombia, and Mexico. According to Bitso’s Crypto Trends Report, Bitcoin and stablecoins dominate purchases in Latin America, showing that Bitcoin remains the preferred cryptocurrency among users. However, digital dollars also have a strong presence in the portfolios of ordinary users, and stablecoins were the fastest growing cryptocurrency last year.

Why stablecoins appeal to users in emerging markets:

Latin American users prefer the sense of stability that comes with assets pegged to strong fiat currencies, with inflation and exchange rate volatility high in Argentina and Colombia.

While in Mexico, the platform’s retail users still buy Bitcoin more frequently than stablecoins, the importance and appeal of using stablecoins for remittances is growing among remittance companies. These companies are turning to stablecoins for cost-effective and fast cross-border payments, leveraging regulated providers such as Bitso.

Using stablecoins offers the following benefits:

Stablecoins offer a variety of benefits for cross-border payments. They eliminate intermediaries, making transactions more transparent, efficient, and cheaper.

Stablecoins offer advantages over traditional cross-border payment systems, which can take days, are costly, opaque, and have limited accessibility. One of the reasons for these inefficiencies is that multiple intermediaries and currencies are involved in the process, which adds fees and delays. Stablecoins allow cross-border payments to be completed in a more cost-effective manner, in just minutes, any day of the week.

For digital companies that use the U.S. dollar as their settlement currency, stablecoins provide a valuable hedge. Businesses operating in multiple countries benefit from stablecoins to manage cash flows in different currencies and pay international employees, customers or suppliers.

Investors are also attracted by the opportunity to earn yield, with Bitso offering up to 4% in stablecoins. In addition, cryptocurrencies are increasingly used in everyday transactions and as a means of payment. As the advantages of stablecoins become more widely recognized across different industries, their use in cross-border payments is expected to increase significantly.

5.3 Pintu — Crypto Trading Platform

Pintu is one of the largest cryptocurrency platforms in Indonesia, offering a variety of fiat-backed stablecoins pegged to USD, EUR, and IDR.

Why users prefer stablecoins:

Most retail users primarily use stablecoins for cryptocurrency and trading use cases, including but not limited to accessing Web3 platforms and global exchanges and finding arbitrage opportunities.

Other use cases used by a subset of users, typically OTC clients (high net worth individuals and businesses), include B2B payments and arbitrage.

Efficiencies gained from using stablecoins compared to other financial instruments:

For many Indonesian users, stablecoins are more accessible than USD banks. Registration requirements for local cryptocurrency exchanges are simpler than those for creating a USD bank account, so the barrier to entry for users is lower.

Users can exchange IDR for stablecoins and vice versa 24/7, while some local banks' platforms only allow users to exchange IDR for other foreign currencies during banking hours.

Many local banks and money changers have minimum and maximum amount restrictions for foreign exchange transfers, while Indonesian users can trade from/to stablecoins through cryptocurrency exchanges at prices starting at $1 and with almost no maximum amount restrictions.

Most common usage model:

Pintu users can use stablecoins to earn income through the Pintu Earn feature. Pintu Earn's yields range from 2.5% to 6%, while local banks typically offer less than 2% annual interest on USD deposits.

Many Pintu users use stablecoins for trading purposes. A large portion of the total transaction value on Pintu consists of USD stablecoin transactions.

The number of on-chain transfers of USD stablecoins accounts for almost half of the on-chain transfers on Pintu, while IDRT accounts for about 10% of the total on-chain transfers.

Ethereum remains the most relied-on network for on-chain transfers of USD-based stablecoins by Pintu users (~50%), followed by Binance Chain (~25%), Tron (~8%), and Solana (~4%).

In terms of the number of on-chain transfers by users, USDT is more popular than USDC, accounting for more than 90% of the total.

5.4 DolarApp - Financial Application

DolarApp is using stablecoins to build a global financial application for Latin America. The most common ways users use DolarApp include receiving payments from the U.S. at the best exchange rate, paying with international cards at the best exchange rate, and dollarizing savings.

The main reason DolarApp exists is that there is a huge demand for dollar-denominated financial services in Latin America, but limited access to dollar banking. Stablecoins are attractive to the Latin American user base for the following reasons:

First, because users do not have easy access to dollars. In Mexico, banks cannot provide dollar accounts to anyone who does not live within 20 kilometers of the U.S. border. In Colombia and Brazil, dollar banking is not allowed at all. In Argentina, dollar banking exists, but is limited by transaction volume thresholds and uses an "official" foreign exchange rate that differs from the market rate. In countries with high inflation levels, such as Argentina or Venezuela, stablecoins allow people to save in a stable currency.

When it comes to cross-border transactions, you can’t hold a USD balance with a remitter, which means that whenever you receive a USD transfer, it is automatically converted to your local currency — making it easy for existing banks and remittance players to hide fees in large spreads. Once you have people holding USD stablecoins, they can convert them at will with full knowledge of the FX rate they are getting. The same logic applies to credit card payments.

In countries like Brazil that impose high taxes on cross-border money flows, stablecoins offer a more favorable tax regime than fiat dollars.

Finally, because the restrictions on fiat dollars do not apply to stablecoins, efficiencies are gained — both in terms of the velocity of money (e.g., staying on a blue chip bond in Argentina for remittances) and in terms of taxation (e.g., Brazil’s IOF tax).

5.5 Felix Pago - Financial Payments Company

Felix Pago's mission is to provide a seamless and accessible service to Latinos in the United States, making sending money to loved ones back home as easy as sending a text message. Felix Pago uses artificial intelligence to provide a conversational platform for users to interact with the Felix bot to send money. Felix Pago deposits fiat currency with end users, but uses stablecoins to power Felix Pago's cross-border infrastructure.

The current cross-border infrastructure for these users is still outdated, dominated by banks or old-school remittance companies, and services are cumbersome, slow, and expensive. Felix Pago leverages cryptocurrency for three reasons: first, to access an open money platform through an API; second, to be able to transfer funds instantly; and third, to keep costs as low as possible. But Felix Pago cannot expose the volatility risk of cryptocurrencies to users, so Felix Pago chooses to use stablecoins. In general, users want reliability and credibility. That's why Felix Pago chose USDC, because it is backed by US assets held by regulated US financial institutions and is regularly audited.

Felix Pago solves the problem that users currently want, which is to get local currency to pay for daily expenses. This makes exit in the region one of the biggest challenges for stablecoin adoption. That being said, Felix is taking major steps towards introducing more and more stablecoins to Latin America.

VI. Conclusion

In the report, VISA first proved that the use of stablecoins is growing from the perspective of on-chain stablecoin data, whether calculated by monthly active addresses, total supply or settlement value. In particular, VISA’s new transaction value is expected to establish stablecoins as a meaningful settlement medium, comparable to existing transfer networks, while avoiding the overestimation that has plagued on-chain data in the past.

VISA’s survey results provide us with a cognitive shift that stablecoins are no longer limited to tools for crypto asset investment and trading, but also have a trend of integration with the global economy.47% of the crypto users surveyed listed US dollar savings as their stablecoin goal, 43% mentioned efficient currency exchange, and 39% said it was income generation. Although gaining access to cryptocurrency exchanges remains the top use case for respondents, long-tail or general (non-crypto) economic activities are also evident.

When asked about non-crypto stablecoin activities, the most popular use of stablecoins is currency substitution (69%), followed by payment for goods and services (39%) and cross-border payments (39%). It is clear that stablecoins have evolved from a simple transaction collateral to a general digital dollar tool in the countries surveyed. Furthermore, the vast majority (~99%) of stablecoins are referenced to the U.S. dollar.

Discussions about U.S. stablecoin regulation cannot ignore the fact that a large number of individuals and companies in emerging markets rely on these networks for savings, cross-border payments, remittances, and corporate cash management. In nearly all of the countries surveyed, these stablecoins increasingly serve as a substitute for scarce U.S. dollar banking. The potential benefits of efficient access to alternative hard currencies for billions of users in emerging markets must have a seat at the table when discussing the merits of stablecoins.

Bernice

Bernice