The recent crypto market has experienced a major correction. The mainstream coins in the market have continued to fall, and the liquidity of the altcoins has dried up. Only Memecoin on the Solana chain is still full of vitality and has become the only vibrant place in the market. Data shows that the number of new SPL coins per day has reached a new high, and the one-click coin issuance platform Pump.fun has broken a new high in revenue. Even the Solana chain transaction volume has overturned the Ethereum mainnet to become the blockchain with the highest on-chain DEX transaction volume.

In addition to paying attention to community topics, the most important thing for trading Memecoin is actually the analysis of on-chain data. Therefore, the demand for Solana chain data tools is growing. This week, Dr.DODO will introduce three tools that help you manage on-chain assets or track on-chain addresses, as well as multiple TG Bot gadgets. Let us become Solana chain masters together.

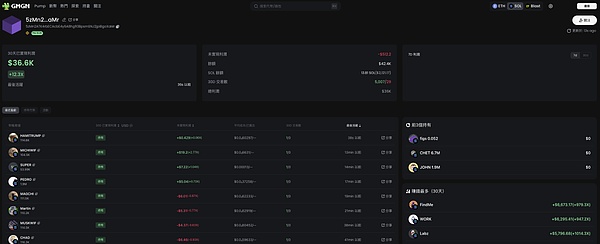

GMGN.ai

GMGN is a tool website that integrates two major functions: a line-watching website and an on-chain asset dashboard. Although old-fashioned line-watching websites such as Dextools, Dexscreener and GeckoTerminal have already supported Solana, GMGN provides faster and more real-time data, and supports Pump.fun line chart services. In addition, it also has address tracking, position management, and SmartMoney/KOL wallet exploration and other functions. It basically meets the various basic functions required by on-chain players and is also the Solana on-chain tool website that is currently the most popular among mainstream Degen users.

Source: GMGN.ai

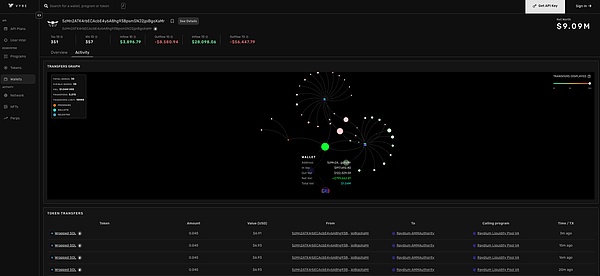

AlphaVybe

AlphaVybe is a tool website that combines an asset management dashboard with a visual on-chain browser. In addition to tracking address token asset holdings, it also has the function of analyzing token data. The biggest difference is the visual address interaction data. When tracking on-chain addresses, AlphaVybe can display all interactive addresses in one picture, which is more readable than crawling solscan data.

Although the asset dashboard function is not as real-time as GMGN.ai data, and AlphaVybe can only read the value of mainstream eco-coins, AlphaVybe's visualization function is basically irreplaceable in terms of address tracking.

Source: https://alpha.vybenetwork.com/

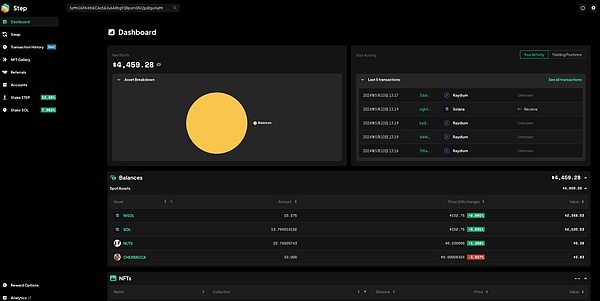

Step Finance

Step is one of the earliest projects to start the Solana on-chain data dashboard. It was successfully launched on FTX in the last bull market and once benchmarked Debank. However, after the collapse of FTX, the project was on the verge of death and has not been updated for a long time. However, it has also made a lot of updates after the Solana market rebounded.

Currently, it provides functions such as asset dashboards and historical transaction records. In addition, there are also sub-products for on-chain token analysis, which can more visually analyze token chip liquidity and other information.

Source: https://app.step.finance/

TG Bot

TG Tranding Bot has been fully introduced in previous issues of CryptoSnap, so I will not repeat it here. Here are some practical tracking channels.

Chain address tracking notification:

After setting the tracking address, you can get the first information when the address has transaction dynamics. The following TG BOT services are similar, and you can choose the one you like.

Cielo

EtherDrop

Solana Ray

GMGN.ai

Notifications for popular trending coins:

SOL TRENDING: You can check what coins are the hottest and most people are playing on the chain, but there are also a lot of spam messages.

Solana Early Birds: A new coin notification channel produced by the Pepeboost team. Different from ordinary new coin channels, the Early Birds channel has added a judgment mechanism for smart wallets to reduce the bombardment of spam messages, but at the same time, since the newly opened tokens themselves are high-risk, it is suitable as a reference for small-scale participation.

Pump Alert: Produced by the GMGN team, it is a notification channel for new coins on Pump.fun. It can be used to screen out the most popular coins on Pump. It is also a very useful channel for participating in small-scale big-money bets.

Author's opinion

Having basic on-chain analysis capabilities is a very important factor for being an on-chain player, especially for Memecoin players. Memecoin has no fundamentals to study, so the only thing to look at is the structure of the chip distribution, whether there is smart money entering the market, whether there is a project party's rat warehouse, etc. Blindly participating in the on-chain currency is very risky, and after learning basic on-chain analysis, you can increase a lot of winning rates. After using the above tools, I hope everyone can become a master player on the Solana chain and make big money together.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance WenJun

WenJun JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph