Author: Mario Chow Source: IOSG Ventures Translation: Shan Ouba, Golden Finance

0. Background

A prediction market is a speculative market that aims to aggregate decentralized information by trading contracts tied to the outcomes of future events. The core idea is that the market prices of these contracts can be used as predictions: under certain conditions, the prices of contracts will effectively reflect the probability of an event. Since the 1980s, a large number of studies have shown that such market-based predictions are often very accurate, even better than traditional prediction methods such as polls or expert opinions. This predictive ability stems from the market's use of the "wisdom of the crowd" - anyone can participate, and those who have more information will have an economic incentive to trade based on the information, thereby driving prices close to the true probability. In essence, a well-designed prediction market can efficiently aggregate many individual beliefs into a consensus judgment on future outcomes.

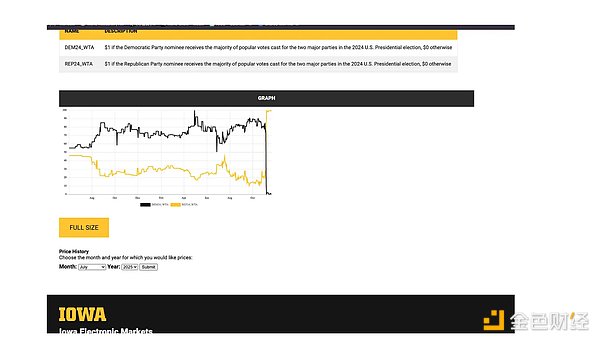

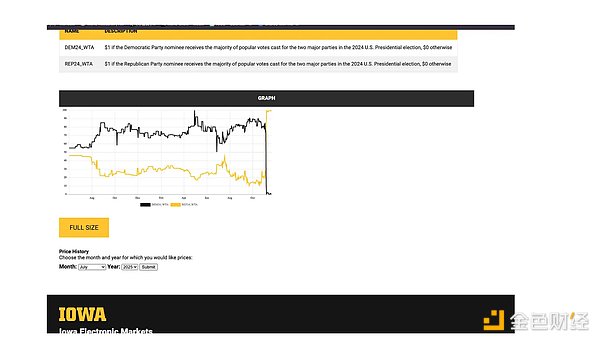

Modern prediction markets can be traced back to pioneering experiments in the late 1980s. The first academic prediction market, the famous Iowa Electronic Markets (IEM), was established by the University of Iowa in 1988.

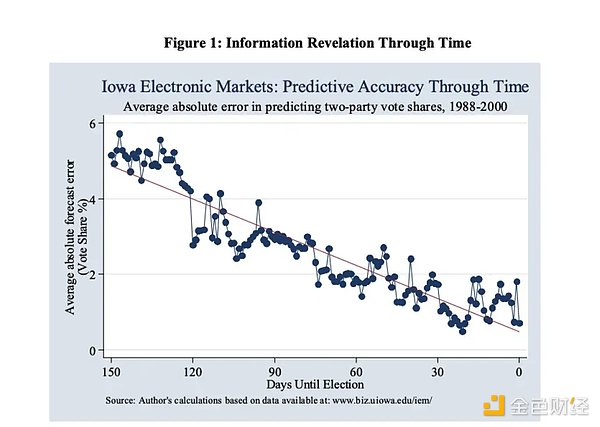

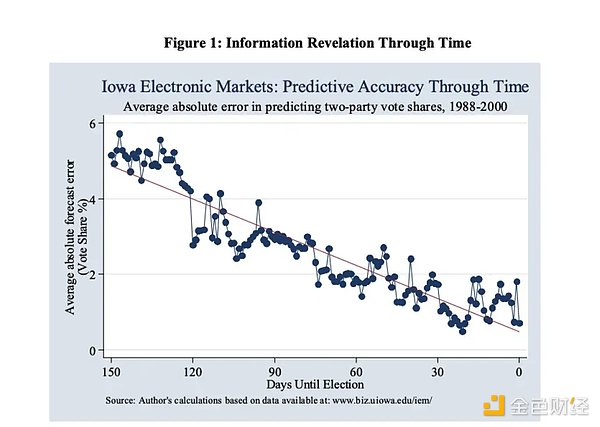

IEM started as a small-scale real money market (limited by regulation to about $500 per person) that focused on predicting the results of the US election. Even at a small scale, IEM's prediction accuracy was impressive. In the week before the election, the market’s average absolute error for the Democratic and Republican candidates’ votes was only about 1.5 percentage points. By comparison, in the same four elections, Gallup’s last poll prediction had an average error of 2.1 percentage points. The relevant chart also shows that the accuracy of the prediction market improves as information is revealed and absorbed by the market.

At the same time, the forward-looking idea of using the market to predict various uncertain events began to take shape. In 1990, economist Robin Hanson proposed the concept of “Idea Futures” – a new system for people to bet on scientific or social issues. Hanson believed that this could create “expert consensus with clear incentives” by rewarding accurate predictions and exposing incorrect predictions. In effect, he envisioned the market as a tool to combat bias and promote truth-telling in areas ranging from science to public policy. This idea of what was essentially a “futures market for ideas” was far ahead of its time and laid the theoretical foundation for the wider application of prediction markets.

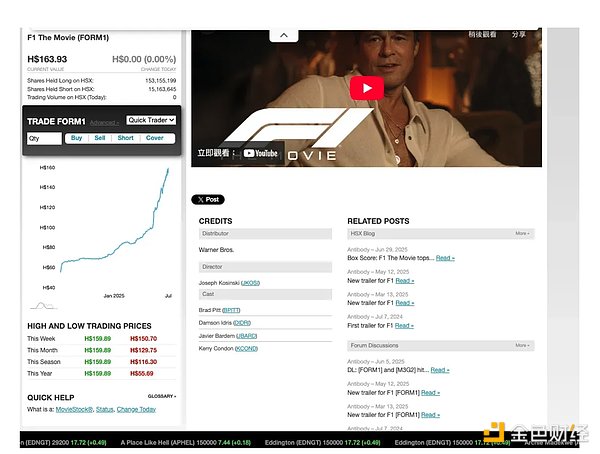

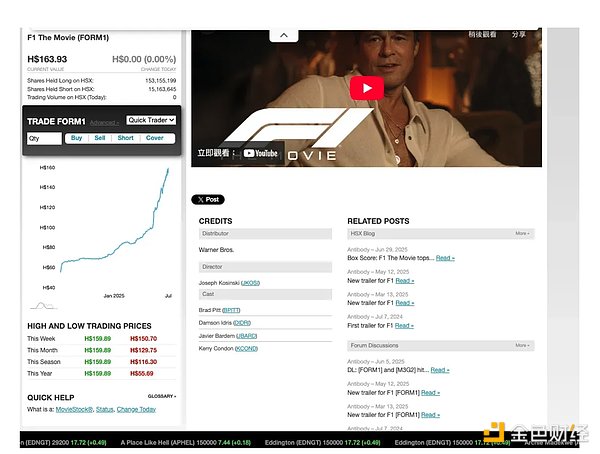

In the 1990s, a number of online prediction markets emerged, both for real money transactions and for “play money” transactions. Iowa Electronic Markets has been active in academia, and “play money” markets for the general public are also becoming popular. For example, the Hollywood Stock Exchange (HSX), founded in 1996, is an entertainment prediction market that trades in virtual currency, allowing users to buy and sell “stocks” in movies and actors.

HSX has performed well in predicting first weekend box office revenues and even Oscar winners, sometimes even better than professional film critics. In 2007, users of the Hollywood Stock Exchange successfully predicted 32 nominations in 39 major award categories and 7 winners in 8 top award categories. HSX is considered an excellent example of a prediction market.

Theoretical Foundations and Market Design

Fundamentally, prediction markets achieve efficient aggregation of information by creating an incentive mechanism for “telling the truth.” Traders need to "vote with real money" and invest real (or sometimes virtual) money on an outcome, so they have an incentive to trade based on their true beliefs and private information.

From an economic perspective, a well-designed market will form an incentive-compatible mechanism: traders will choose prices that match their subjective probability judgments when quoting, thereby maximizing expected profits. Robin Hanson formalized this idea by inventing the market scoring rule. This is an automatic market-making mechanism based on the correct scoring rule that ensures that honest reporting is the optimal strategy for traders.

In addition, research generally finds that prediction markets are surprisingly resilient to manipulation. Attempting to pull prices away from fundamentals creates arbitrage opportunities for other truth-seeking traders who choose to bet in the opposite direction. Existing cases show that such manipulative transactions are usually corrected quickly and sometimes even improve market liquidity. In other words, manipulators are often "subsidizing" smarter traders, and prices will quickly return to the information-driven equilibrium level.

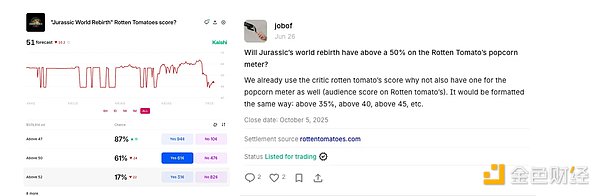

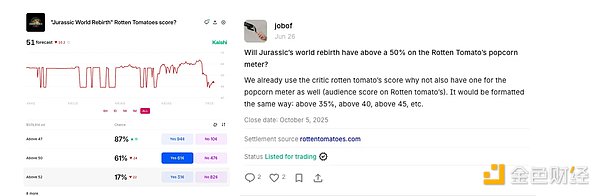

1. Kalshi

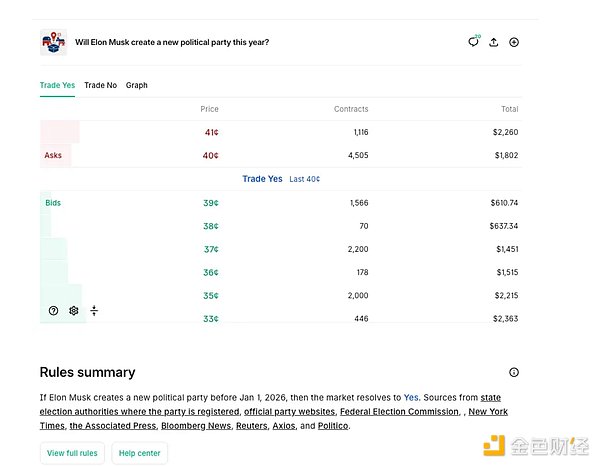

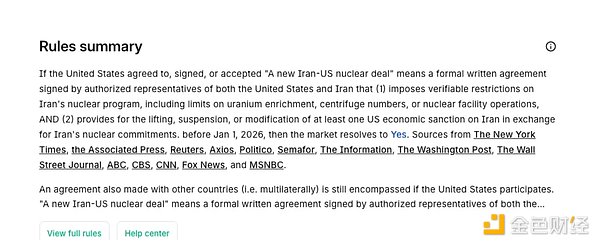

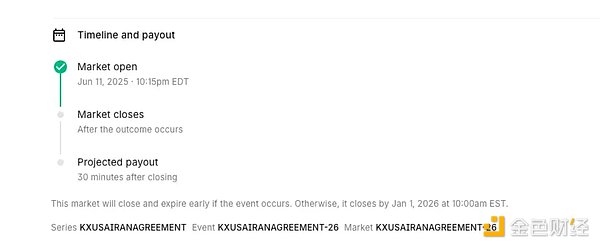

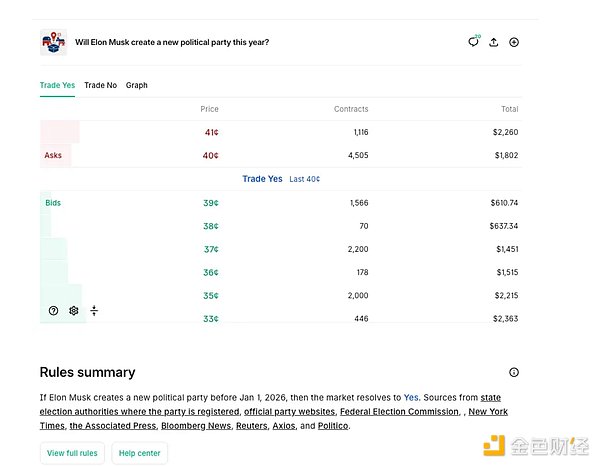

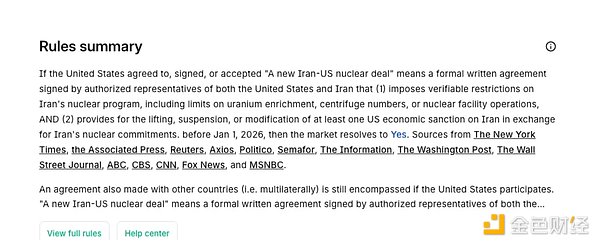

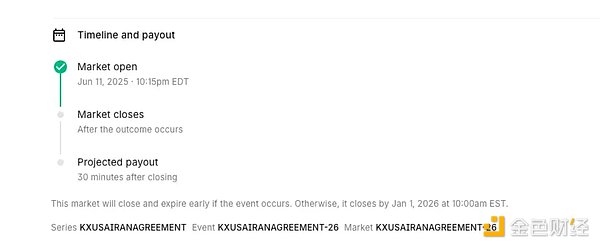

Kalshi operates a federally regulated prediction market exchange where users can trade the outcomes of real-world events. It is the first exchange in the U.S. to be approved by the Commodity Futures Trading Commission (CFTC) to offer event contracts. These are binary (yes/no) futures contracts that pay $1 if the event occurs (or $0 if it does not). Users can buy and sell “Yes” or “No” contracts between $0.01–$0.99, with the price reflecting the market’s implicit expectation of the probability of the event occurring.

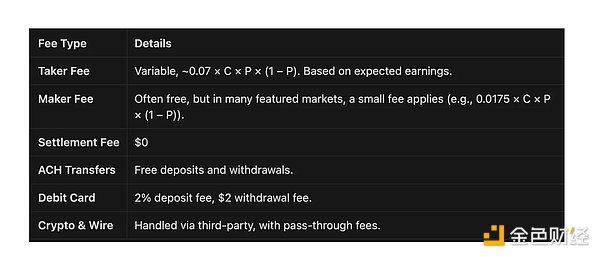

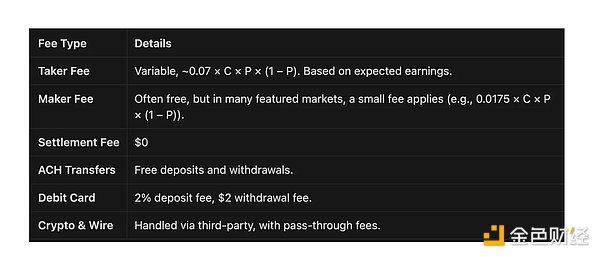

If the prediction is correct, the contract pays $1 at settlement, allowing traders to profit from accurate predictions. Unlike bookmakers, Kalshi does not take positions itself, but rather matches trades between two parties, acting as a pure exchange and only charging a fee for transactions.

a. Market Creation

Proposal & Approval

New event markets (binary yes/no contracts) can be proposed by the Kalshi team or suggested by users through its "Kalshi Ideas" portal. Each proposal is subject to internal review and is required to meet CFTC regulatory standards, including clear definition language, objective settlement trigger conditions, and permitted event categories.

Certification

Once approved, the event will be certified according to Kalshi's Designated Contract Market (DCM) rules, and the supporting formal documentation will detail the contract specifications, trading rules and settlement standards.

Live

The market will be live on the Kalshi platform, and US users can access trading through the Kalshi App, website, or integration with brokers such as Robinhood and Webull.

b. Initial Liquidity and Pricing

Market-making incentives:Traders who add liquidity (i.e., place orders waiting to be filled) are usually exempt from market-making fees, and only very low fees are charged in some specialty markets.

Price discovery:Prices are dynamic and reflect market consensus probabilities. For example, when a "Yes" buyer bids $0.60 and a "No" seller bids $0.40, a contract is created, with both parties investing a total of $1.

c. Market Settlement

d. Fee structure

2. Polymarket

Polymarket Overview:Polymarket is a decentralized prediction market platform based on the Polygon blockchain, where users can trade binary outcome tokens (Yes/No shares) representing the outcome of an event. It uses the Conditional Token Framework (CTF) to ensure that all outcome pairs are fully collateralized by a stablecoin (USDC), and adopts a hybrid decentralized central limit order book (CLOB) for efficient matching. Market settlement is done through UMA's optimistic oracle, a decentralized adjudication system with dispute resolution.

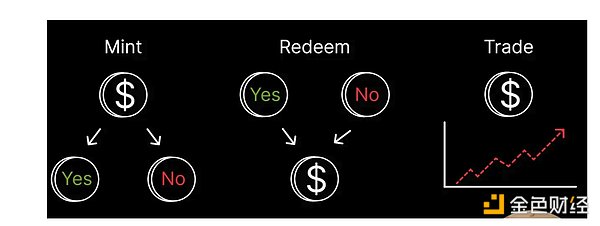

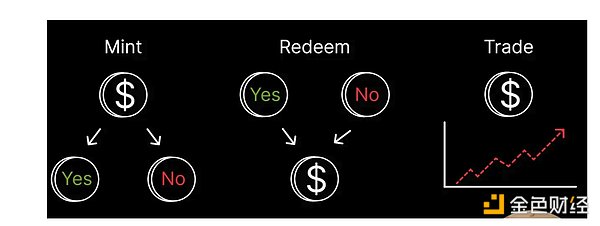

Conditional Token Framework (CTF) and Outcome Tokens

Polymarket is implemented on Polygon using Gnosis's Conditional Token Framework (CTF), and each market outcome is represented as a conditional token. For a binary market, two ERC-1155 tokens are created (e.g., a "Yes" token and a "No" token), both of which are backed by the same underlying collateral (USDC).

This ensures that each share is fully collateralized: at any time, a "Yes" and a "No" token can be combined to redeem back to $1, and at final settlement, only the correct result token will be worth $1.

In practice, when a user buys a share, they either get a newly minted token (if it is the other side of a newly opened position) or take over existing tokens from other users. When selling a share, the token is either transferred to the buyer or redeemed through a smart contract (when an opposing sell order is matched). After the outcome of the event is determined by the oracle, the winning tokens can be exchanged on the chain at a price of $1 each, while the losing tokens become worthless.

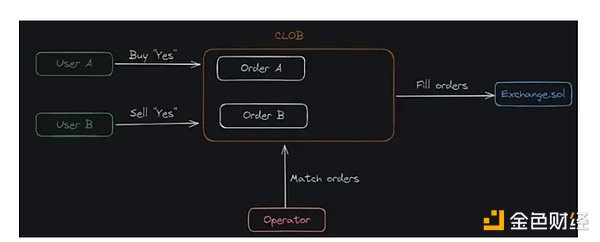

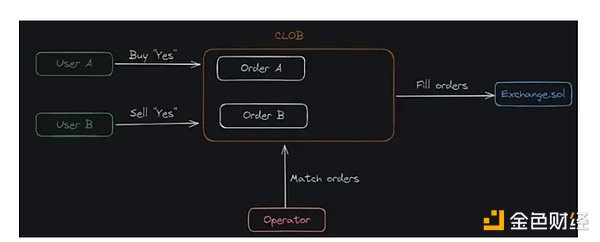

Hybrid Order Book Architecture (CLOB / BLOB Design)

Technical Details Behind Polymarket – Pavel Naydanov

Polymarket’s exchange uses a hybrid CLOB architecture, nicknamed the “Binary Limit Order Book (BLOB)”, which combines off-chain order management with on-chain settlement. As shown below, users submit orders off-chain and are matched by designated operational services, but the final transaction settlement (token transfer) is performed on-chain through smart contract calls:

Order life cycle in Polymarket

Users sign orders off-chain

A user (e.g. User A) uses his wallet to sign an EIP-712 order (e.g. "Buy YES at $0.62").

This signed order is not broadcast to the blockchain, but is sent to Polymarket's off-chain order relay infrastructure.

2. Off-chain matching engine (Operator) handles order book logic

Polymarket’s off-chain CLOB maintains all active bids and asks.

When another user (e.g., User B) submits a matching order (e.g., “sell YES at $0.62”), the Operator detects a match.

3. Only matched orders are submitted on-chain

The Operator constructs a trade containing the matched trading pairs.

This is submitted to the Exchange.sol smart contract which verifies: order signatures, price/time terms and token balances

4. Atomic Swap Executed On-Chain

If valid, the swap contract automatically swaps USDC ↔ conditional tokens (YES/NO tokens from Gnosis CTF)

This ensures trustless final settlement and only occurs after off-chain agreement.

Atomic Swap Example

On-chain trade settlement is handled by Polymarket’s Exchange contract (generally referred to as “CTFExchange.sol trade” in the code”). This contract acts as a bridge between the off-chain order book and the conditional token framework to enable atomic swaps. An atomic swap is a single on-chain transaction between two parties that either fully executes the trade (transferring the token (binary token) and collateral (USDC) between the two parties) or not at all (if any of the checks fail), eliminating counterparty risk. The Exchange contract has built-in logic to handle different matching scenarios:

Buy vs Sell (Outcome-Collateral Trade): This is the common case where one user buys the outcome token and the other sells. For example, if Alice wants to buy 100 shares of "Yes" stock at $0.40 and Bob wants to sell 100 shares of "Yes" stock at $0.40, the operator will call the contract to swap these assets. The contract verifies the signatures of both parties' orders and ensures that Alice and Bob have enough USDC and "Yes" tokens (via quotas), then transfers USDC from Alice to Bob and 100 "Yes" tokens from Bob to Alice.

Buy-to-Buy (Two Complementary Buys): Polymarket’s system can match two traders who want to buy opposite outcomes, effectively creating new outcome pairs on the fly. For example, if one user places an order to buy a “yes” stock and another user places an order to buy a “no” stock (for the same market and quantity), the operator can match these orders even if both users are buyers. In this case, the exchange contract performs a “mint” operation: it extracts the required USDC from both users (each user pays their bid price per share, which should total $1) and uses a CTF to split that collateral into one “yes” and one “no” token. Each user receives the outcome they want (yes or no), and collateral is locked to back those tokens. This is essentially two traders on opposite sides of a bet, and creating a new stock between them in one atomic transaction, with one user’s USDC becoming collateral for the yes/no pair, providing them with the yes token and the other user providing the no token. The smart contract ensures that the prices are aligned (the sum paid by both parties equals $1 per share). USDC) in order to mint fully collateralized tokens with no net deficit.

Sell & Take (two complementary sells): Same as Buy & Take, but combined.

Partial Fills and Multiple Order Matching: The exchange also supports one-to-many matching. A large taker order can be matched with multiple maker orders and partially filled as needed. For example, if Alice wants to buy 1,000 shares of Yes stock, and there are multiple sell orders (from different users) at the target price, the operator can aggregate these sell orders and match them based on Alice's The orders are executed in batches (using the function fillOrders()). The contract will be transferred from each seller to the buyer accordingly. All partial fills bundled in a transaction will still be executed atomically. If an order is only partially filled, the remaining portion will remain as an outstanding order in the off-chain order book (if the user cancels the order, the remaining portion will be cancelled). Price concessions will be automatically provided to takers: if the price offered by the matching order is better than the taker's limit price, the taker will receive the preferential difference. The contract will never fill an order at a price lower than the price specified by its signatories.

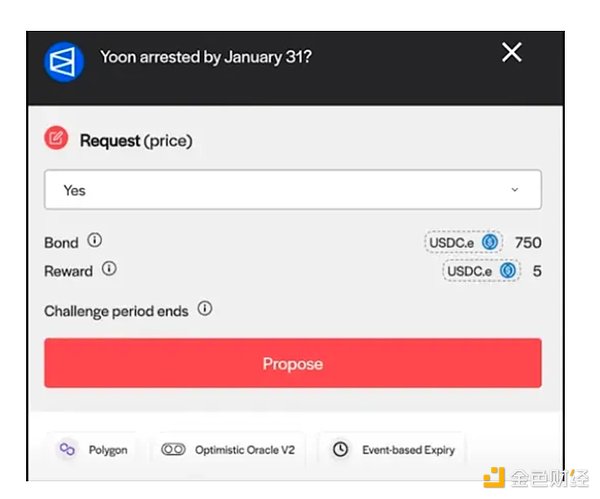

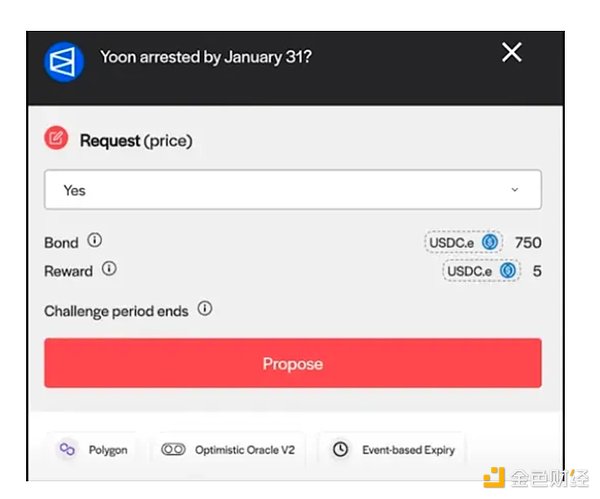

UMA Optimistic Oracle: Settlement and Dispute Mechanism

Unlike traditional exchanges that rely on internal referees or centralized data sources, Polymarket uses UMA's Optimistic Oracle, OO) to settle markets. This is a decentralized oracle system that determines the outcomes of various events through a community-driven process. Because the results come from an external decentralized protocol (UMA) rather than Polymarket itself, this allows Polymarket to achieve "trust neutrality" when determining market outcomes.

After the end date of the event, anyone can propose an outcome value to the UMA oracle through an adapter. This "proposal" is a transaction that declares what the outcome should be (for example, 1 if it occurs, 0 if it does not occur), and requires locking up a certain number of UMA tokens or designated reward tokens as a proposal deposit.

In a Polymarket setup, it is usually the market creator or the Polymarket team who proposes the outcome as soon as it is known, to speed up settlement (they offer a small reward for doing so).

Initialize(CTFAdaptor)-> Propose(OO)-> Resolve(CTFAdaptor)

Initialize(CTFAdaptor)-> Propose(OO)-> Challenge(OO)-> Propose(OO)-> Resolve(CTFAdaptor)

Initialize(CTFAdaptor)-> Proposal (OO) -> Challenge (OO) -> Proposal (OO) -> Challenge (CtfAdapter) -> Solution (CTFAdaptor)

No party (including Polymarket) can unilaterally determine the outcome, but rather it is governed by the community and secured by crypto-economic mechanisms. This makes the system more trustless, although disputes are delayed.

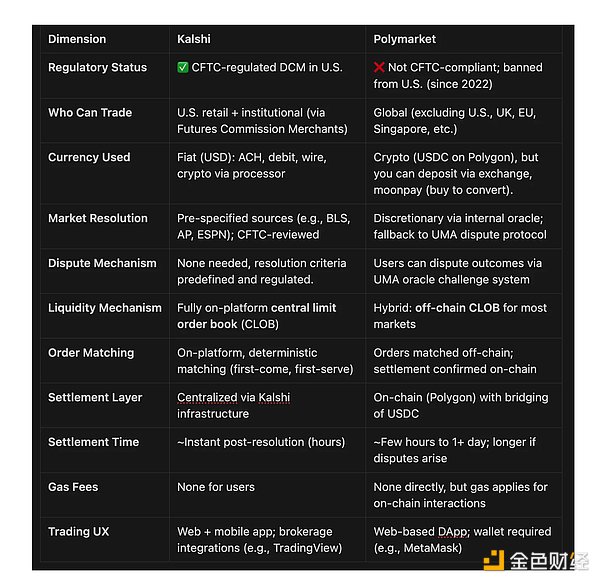

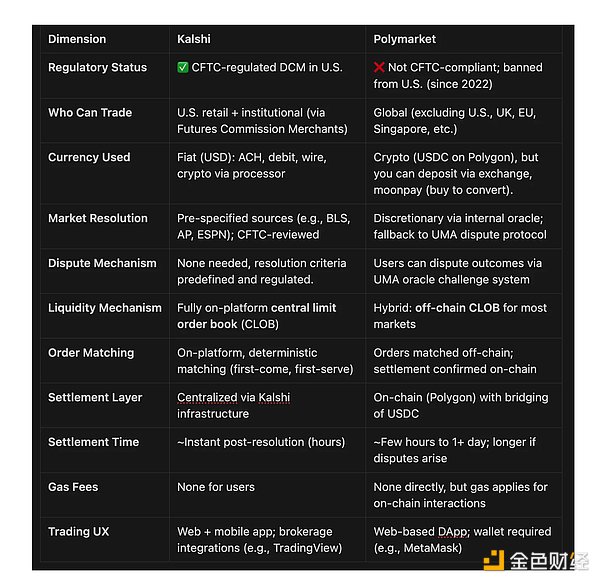

Kalshi vs. Polymarket: Structural and Technical Comparison

3. Marketing Strategy / Growth Performance

Academic Insight: "Gambling on Crypto Tokens"

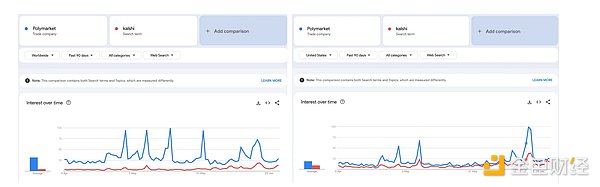

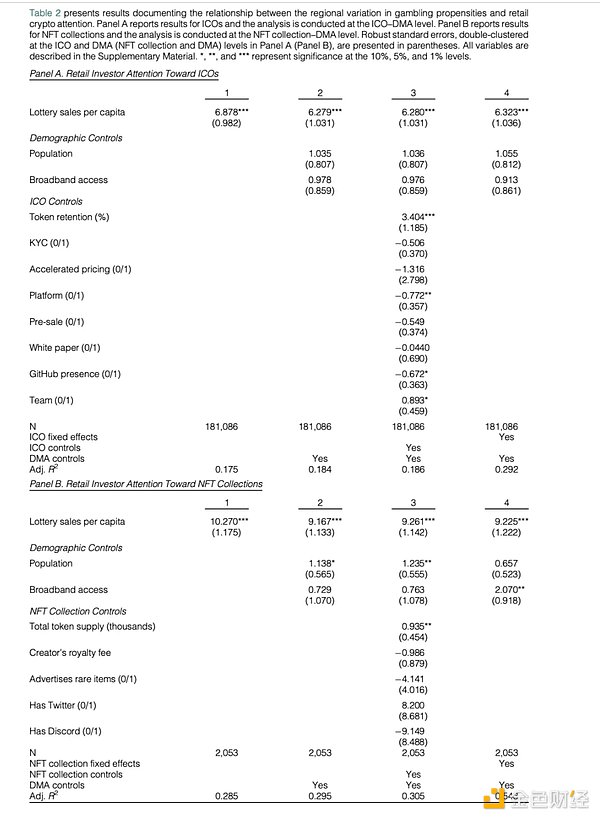

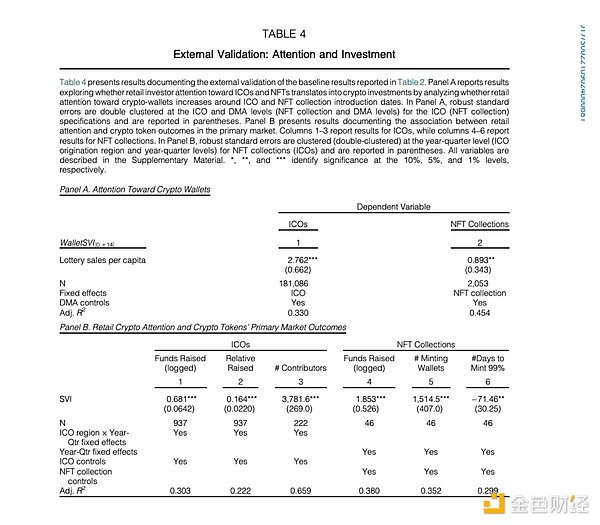

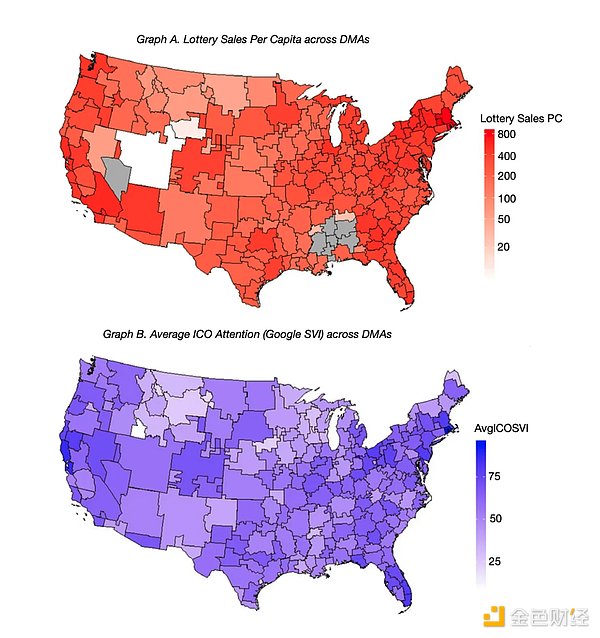

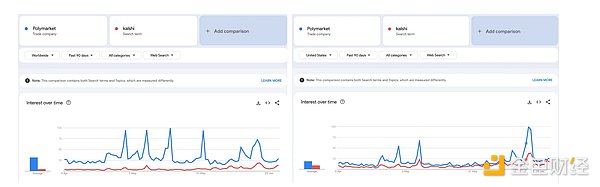

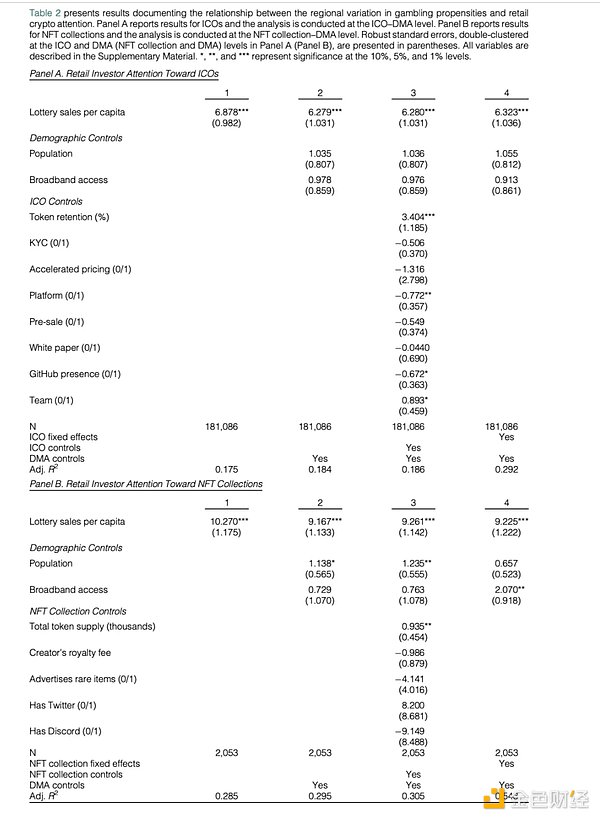

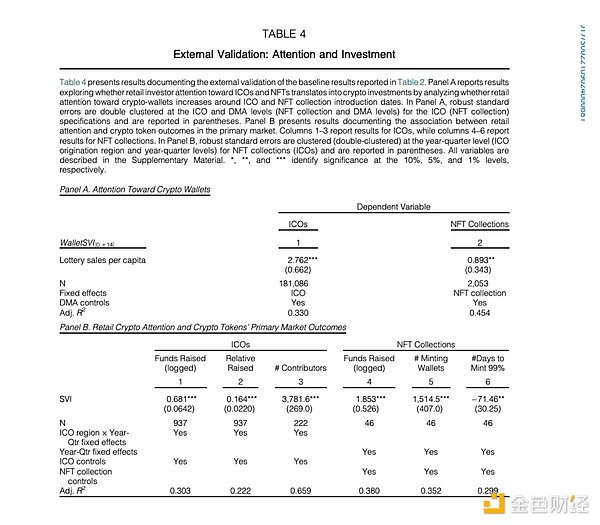

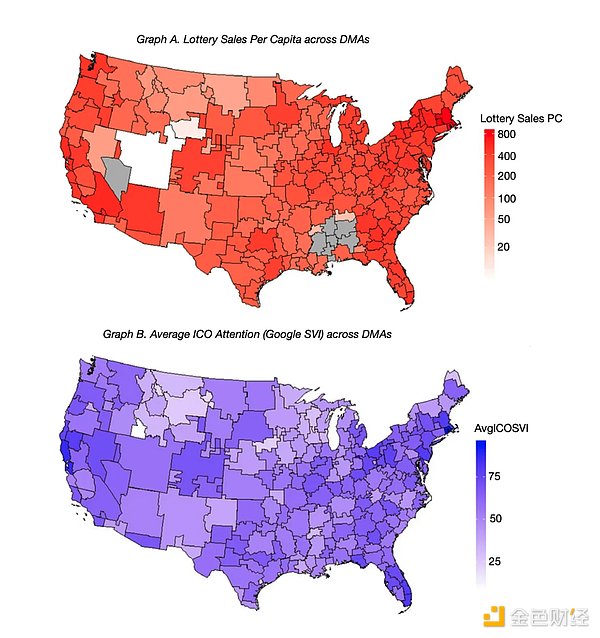

A recent peer-reviewed study "Gambling on Crypto Tokens?" provides empirical evidence of the link between crypto trading and gambling. Using Google Trends as a proxy for retail investor attention, the researchers found several notable patterns:

1. Lottery sales per capita can predict attention to crypto

The core explanatory variables of X_d are: Lottery sales per capita, and include interaction terms with token characteristics.

Initial Coin Offerings (ICOs): regression coefficients range from 6.28–6.88, p < 0.01

This suggests a strong behavioral overlap between gamblers and retail crypto investors.

2. Wallet Attention and Investment Results

In regions with high per capita lottery sales, wallet attention will surge immediately after the ICO or NFT launch.

The surge in wallet SVI (attention to MetaMask, Coinbase Wallet, etc.) at the launch of ICO/NFT is greater in these high lottery sales regions.

These regions also show more fundraising amounts, more investors, and faster NFT Minting speed.

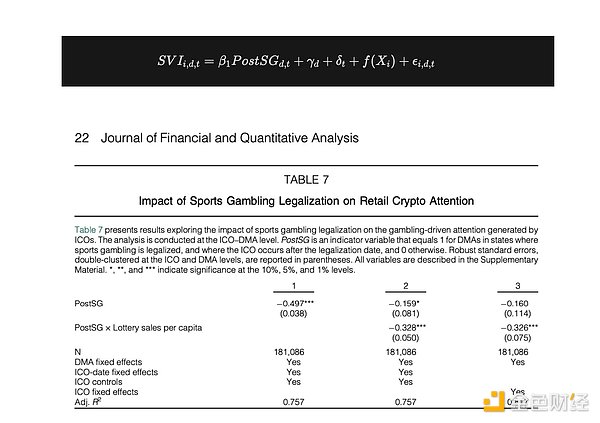

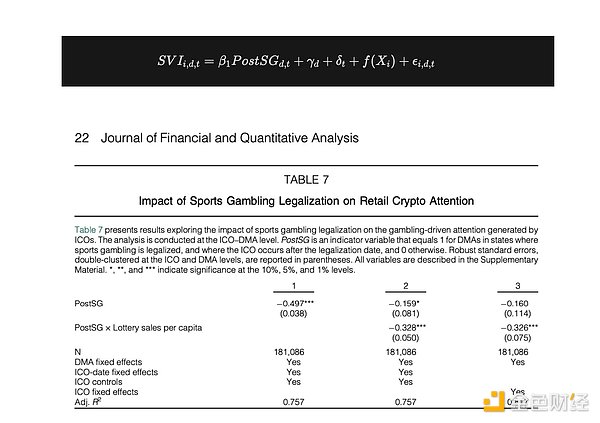

3. Gambling legalization as a natural experiment

Table 7 of the same paper uses the time difference of the phased legalization of sports betting in various states in the United States and finds that: After gambling is legalized in these areas, the attention to cryptocurrencies in areas with high lottery sales will drop significantly.

The interaction term in the regression (PostSG × Lottery Sales) is significantly negative and highly significant. This suggests that cryptocurrency and gambling are substitutes: if there is a legal way to gamble, people will pay less attention to speculative cryptocurrencies.

The conclusion of the entire paper is very clear: "Gambling preference strongly predicts retail investors' interest in crypto markets." In other words, crypto trading is not only "like" gambling, but for a large part of users, it is gambling. These findings validate the comparison between the two and highlight a group of users: they have a very high risk appetite and seek speculative excitement, whether in a casino or on Coinbase.

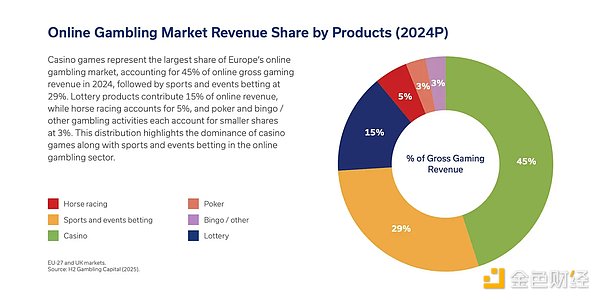

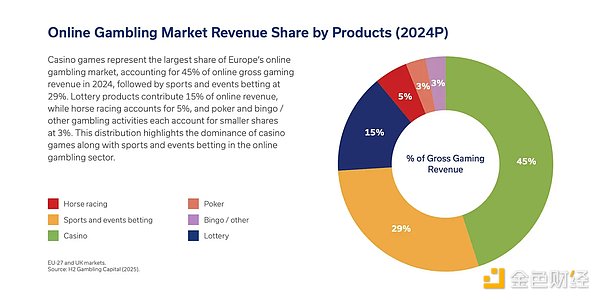

Crypto Gambling Market: Stake.com as a Reference

To measure the size of the market, you can look at the rise of Stake.com, a crypto-native gambling platform (only cryptocurrency top-ups are allowed).

In just a few years, Stake It captures the need for high-risk, high-reward entertainment on a massive scale:

Massive revenue: With gross gaming revenue of approximately $2.6 billion in 2022 (up from just $105 million in 2020), Stake has become one of the world’s largest gambling companies. Growth is extremely rapid—revenue of approximately $4.7 billion in 2024, up approximately 80% from 2022. In comparison, traditional giants Entain will have revenue of approximately $5 billion in 2024, and Flutter will have revenue of approximately $14 billion, putting Stake in the same league.

User base and reach: As of 2023, the platform has 60 10,000+ regular users, despite not being officially accessible in markets like the US and UK. Its users are mainly concentrated in jurisdictions with lax online gambling regulations (Southeast Asia, Japan, Brazil, etc.). Even with geo-blocking, hundreds of thousands of people around the world flock to this crypto gambling site, proving the huge potential demand.

Top Global Contenders: Stake’s explosive growth has made it the 7th largest gambling group in the world by revenue, surpassing many well-known traditional sportsbooks. Notably, major US bookmaker DraftKings’ revenue lags behind Stake, highlighting how crypto-driven gambling has opened up a new market space (TAM) that traditional bookmakers cannot touch.

I think prediction markets have advantages over bookmakers:

Active hedging in times of uncertainty

Dynamic portfolio rebalancing

Risk management speculation

Sports betting (Stake, Bet365, etc.):

While many modern sportsbooks offer cash-out features, these are:

Discretionary and limited, usually at the discretion of the bookmaker

May involve significant price slippage or penalties

style="text-align: left;">Not usually available for multi-round betting or special bets (such as total three-point shots in a basketball game)

Size of Industry: Stake is just one large player in the crypto gambling space. Industry reports suggest that despite regulatory crackdowns in many countries, crypto casinos could gross more than $81 billion in 2024. This figure – total gaming revenue from crypto betting – highlights just how large the crypto-gambling intersection is. It represents a massive pool of users and capital that has, to date, largely gone to offshore or unregulated platforms.

Stake.com’s success shows that there is a large community of users in the market who are happy to speculate in crypto and are eager to seek betting opportunities outside of traditional venues. These users are effectively participating in prediction markets (betting on events), but doing so on unregulated platforms.

Regulated exchanges like Kalshi, with proper market structure and regulation, are well positioned to attract a portion of this audience by offering compliant solutions that provide a similarly stimulating experience. The size of Stake suggests that the potential market for “cryptocurrency” gambling in the U.S. could be worth billions of dollars per year if these users turn to legal alternatives.

Overlapping demographics and behaviors

This is not just a theoretical overlap – numerous studies and surveys confirm that cryptocurrency traders and gamblers are highly similar in key demographics and behavioral patterns.

In many cases, they are the same people, or at least a very similar group of people. Here are some notable overlapping characteristics:

Young, male, risk-seeking: Both retail cryptocurrency trading and sports/casino gambling are highly concentrated in the young adult male group, who generally have a higher risk tolerance. They tend to pursue high-volatility assets and high-odds bets.

Always online, 24/7: Crypto markets never close, trading is available 24/7 around the world, and online gambling is always available, providing a constant dopamine rush.

The retail user group Kalshi wants to target is those who love speculation, including both the crypto trading community and the sports betting/gambling community. They are doing similar things themselves — the key is to provide a product that “can meet this demand in a safer and more regulated way.”

This overlap in behavior also inspired the marketing strategy: to emphasize the excitement of the prediction market (to attract gamblers) while highlighting the professionalism and market-driven characteristics of event trading (to satisfy the crypto trader’s self-identification as an “investor”).

Crypto Narrative Shift: From the "Wild West" to "Regulated Markets"

The crypto industry narrative has shifted significantly over the past few years, from a "Wild West" style of unregulated innovation to an emphasis on institutional adoption and compliance. This change has created a more favorable environment for regulated platforms like Kalshi and also highlighted Kalshi's "moat" (CFTC approval) as a key competitive advantage.

Embracing the "Mainstream": Recently, the crypto narrative has changed significantly. Large traditional financial institutions and governments have begun to enter the crypto field, bringing credibility and regulatory frameworks.

For example, in 2023, BlackRock, the world's largest asset manager, applied to launch a Bitcoin spot ETF, igniting market optimism that the SEC will finally approve a spot Bitcoin ETF (after being rejected for ten consecutive years).

On the legislative side, June 2025 In February, the U.S. Senate passed a landmark bill to regulate stablecoins (the GENIUS Act), establishing federal rules for this type of crypto token for the first time.

Even at the geopolitical level, crypto is moving toward institutionalization: Trump's team has proposed pro-crypto policies such as establishing a national Bitcoin reserve, which is in stark contrast to the outright bans or hostility of some countries.

All of these developments show that crypto is no longer a lawless frontier, but is being incorporated into formal regulatory and institutional systems.

Regulation as a moat: In this transformed environment, "compliance" has become a competitive advantage.

The industry's focus has shifted from "fast trial and error, breaking the rules" to "building within the rules for the long term."

Platforms that have obtained regulatory approval, such as Kalshi, have a huge barrier to entry. It took Kalshi 6 years to obtain the CFTC's approval.

Kalshi’s designated contract market (DCM) qualification means it can legally offer event contract trading in all 50 states in the United States (including states such as California and Texas that prohibit traditional sports betting).

This qualification is very difficult to replicate. For example, Kalshi’s crypto-native competitor Polymarket still operates in a regulatory gray area and is not licensed in the United States, which is a serious risk in the context of the United States’ crackdown on unlicensed platforms.

In the new narrative of “institutional adoption”, Kalshi’s federal regulatory status is a huge selling point: it provides trust, legal clarity, and nationwide accessibility, which is completely in line with the future development direction of the crypto/gambling industry.

In short, Kalshi has already taken a big lead in the compliance track, and other players are only now rushing to catch up.

Kalshi’s strategy: positioning as trading (not gambling) + Robinhood integration

“We are not a gambling site” – Language and model: Kalshi’s founders and executives repeatedly emphasize that their platform operates as a financial exchange, not a casino.

Unlike traditional bookmakers that bet against punters, Kalshi simply matches buyers and sellers and charges a commission on each transaction (like a stock exchange’s commission).

As a Kalshi representative explained: “We are just an exchange… We don’t profit from people losing money, we are just in the middle of the transaction.”

With no so-called “bookmaker” or built-in advantage, this model is attractive to high-level speculators who are skeptical of traditional gambling mechanisms.

CEO Tarek Mansour even asked: Why would Kalshi’s product be considered gambling? “If we are gambling, then you are basically saying that the entire financial market is gambling.”

This sentence summarizes Kalshi’s brand positioning well: they compare event contracts to other financial derivatives, suggesting that betting on contracts such as “whether July will set a record for the hottest month” is not much different from buying and selling oil futures or corporate profit options.

By using trading terms such as “contracts,” “markets,” and “exchanges,” and avoiding words such as “betting” and “betting” in user-facing materials, Kalshi is shaping itself to be more like CME or Nasdaq than DraftKings. This is not only good for regulators, but also attracts a wider user base who are not willing to use a "gambling app" but are willing to "invest in results."

Integration with Robinhood - Mainstream Distribution Channel: An important strategic move for Kalshi is the partnership with Robinhood, which was announced in early 2025. With more than 15 million active users, Robinhood is synonymous with the retail trading boom (stocks and crypto), and its users are young and curious about financial investments.

Through this partnership, Robinhood integrated Kalshi's event contracts into its own platform and created a "Prediction Markets" section. Robinhood users can now seamlessly trade Kalshi's markets (such as economic indicators and even sports results) directly within the Robinhood App.

This greatly expands Kalshi's user reach - no longer relying solely on attracting new users, but can access Robinhood has a large retail trading user base in the United States.

Early results show strong interest: Robinhood's stock price even rose by about 8% when the Kalshi cooperation was announced, showing that investors believe that "adding event trading" is a value enhancement for the platform.

By embedding into the Robinhood ecosystem, Kalshi essentially bypasses the high customer acquisition costs and appears directly in front of millions of potential users who are already accustomed to trading.

This positions event contracts as "another asset class" in addition to stocks, options, and cryptocurrencies, achieving the "normalization" of the product.

Avoiding the "G-word" (Gambling): In its marketing and public relations strategy, Kalshi pays special attention to avoiding positioning itself as a "gambling platform."

For example, Kalshi Kalshi’s markets are described as “yes/no contracts” for future events, and its blog and educational content emphasize how prediction markets can provide event prediction and insight, rather than simply emphasizing the thrill of gambling.

Even its integration with Robinhood uses the phrase “bringing event trading to the masses,” avoiding any casino jargon.

This careful branding is not only intended to prove to regulators that Kalshi is different from sports betting, but also to attract users who may have negative feelings about the word “gambling.”

By making users feel like they are “trading,” Kalshi can attract a wider range of users, including those who actually like to gamble but prefer to tell themselves that they are “investing.” This is a very smart positioning that is both in line with human psychology and adapted to the current regulatory environment. The line between “gambling” and “trading” has always been blurred.

Whether it is a "smart trader" who excels at cross-platform arbitrage, or a "degen" player who bets on sports results, Kalshi can allow both behaviors to coexist within a regulated financial market framework.

By abstracting away the stigma of "gambling" and embracing the language of "markets", Kalshi builds a bridge between the two major user groups - satisfying those who want to "play" and those who want to "trade". And in the process, it does not dilute the needs of either party, but empowers both parties.

JinseFinance

JinseFinance