The extreme volatility of the crypto market on October 11, 2025 (referred to as the "10.11 Incident") is considered the largest liquidation event in crypto history, with liquidations totaling $19.1-19.37 billion across the network, affecting approximately 1.64 million traders.

This crisis put Binance at the forefront of public opinion, with accusations that internal system issues triggered a chain reaction, leading to losses across the industry. The community speculated that BiAn's own margin calls could reach $10-30 billion, and that it was unable to admit its mistakes to avoid massive compensation, leading to a series of controversial actions. Background: Internal Man-Made Disaster and Market Purge The incident originated from a macro-panic sparked by US President Trump's tweets, but quickly evolved into a flash crash in the crypto market. (Trump restarts tariff war! Crypto market plummets...)

Bitcoin, Ethereum and other currencies plummeted, and altcoins were once close to zero. The total amount of liquidations across the entire network hit a record high, with Hyperliquid Exchange liquidating $10.3 billion. Binance's reported liquidation data was accused of being underestimated. Community analysis shows that the decoupling of Binance's wealth management products (USDE, BNSOL, and WBETH) was the key trigger, leading to a liquidity vacuum and a chain reaction of liquidations. Community analysis shows that the decoupling of Binance's wealth management products (USDE, BNSOL, and WBETH) was the key trigger, leading to a liquidity vacuum and a chain reaction of margin calls. Accusations of insider manipulation Various sources speculate that Binance's system experienced a freeze after 5:18 AM (ET8), causing a loss of market maker liquidity and leading to price spikes and long position liquidations. Some believe this was a targeted attack on Binance's unified margin mechanism, leveraging revolving loans to amplify risk. Binance holds the highest weighting, and its index influences other exchanges (such as OKX and Hyperliquiquit), leading to a "scam" across the entire industry. The scale of the liquidation is estimated to be in the tens of billions of dollars, with Binance's own losses potentially exceeding 10 billion, or even approaching 30 billion. Binance's controversial actions and cover-up questions

Compensation and PR

Binance paid approximately $283 million in compensation, primarily to users affected by decoupling products, but was accused of covering only a fraction and excluding losses from market volatility.

The community criticized this as "compensating its own users/users who caused a stir" in exchange for PR support.

At the same time, pumping up BNB, distributing BSC ecosystem, and launching Alpha incentives are seen as using "small money" to cover up the truth and win over some user opinions.

Blame-shifting and data disputes

Although Binance officials emphasized that the incident was mainly driven by macroeconomics (such as the risk aversion caused by Trump's tariff news), the community and project owners accused it of systemic problems as the core fuse.

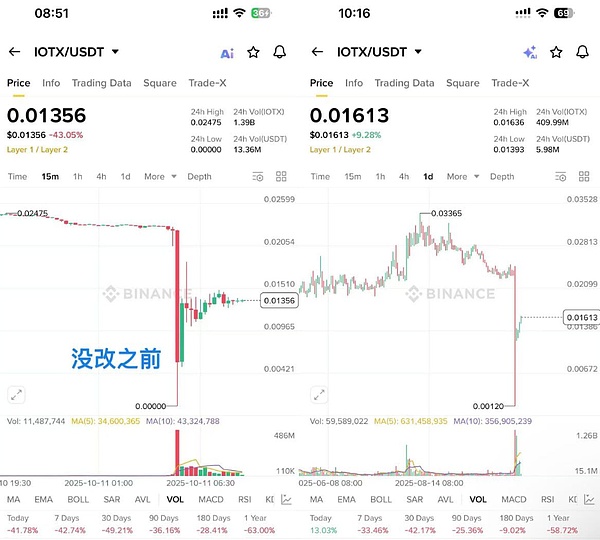

The K-line modification (the lowest price was adjusted from 0.01 US dollars to 1.54 US dollars, and then recovered but the 3-day line was omitted) sparked doubts and was accused of tampering with historical data and violating the transparency principle of blockchain. Binance is forced to defend. After a recent frenzied conquest and scramble to capture the on-chain market, last year's on-chain landscape was dominated by Solana, the most active, OKX wallet the most commonly used, and Hyperliquid, the leading contract trading platform. These three giants dominated. However, Binance has been planning for over a year, first declaring war on Hyperliquid through Aster this year, and now Aster's trading volume is overwhelming its rival. Subsequently, the Binance meme craze crushed Solana. If nothing unexpected happens, now is the time to start a war with the OKX wallet. If the other giants in the cryptocurrency circle don't unite and seize this opportunity to suppress Binance, they may not be able to do so in the future. Finally, let's talk about BNB. This is a super-powerful coin with absolute control by the market makers. Its future trend depends entirely on the needs of Binance. It is definitely not appropriate to force a pull before the crisis is over. As long as there is an opportunity to continue to attack in the future, it can easily continue to pull to a new high!

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance decrypt

decrypt Cryptoknowmics

Cryptoknowmics Coindesk

Coindesk Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist