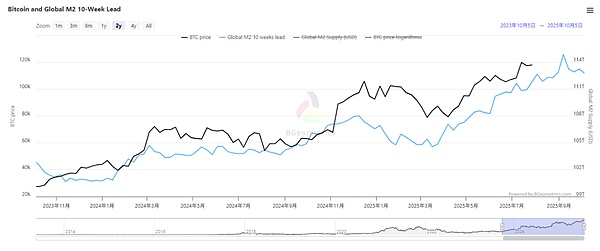

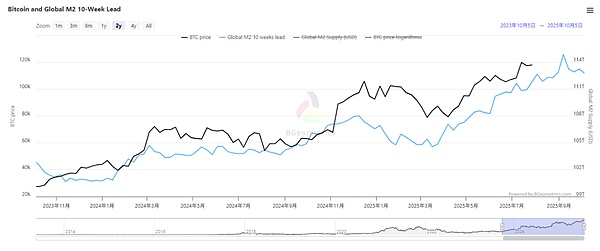

This week, the crypto market presented an "extreme interpretation of the bull-bear game." The market experienced panic selling triggered by whale sell-offs, a brief, unexpected rebound, and then an accelerated decline after a technical breakdown. Each milestone was accompanied by a resonant reaction between the liquidity and the macro environment. Crypto Market Summary 1. Macro Situation: This week, the crypto market presented an "extreme interpretation of the bull-bear game." The market experienced panic selling triggered by whale sell-offs, a brief, unexpected rebound, and then an accelerated decline after a technical breakdown. Each milestone was accompanied by a resonant reaction between the liquidity and the macro environment. Ultimately, Bitcoin (BTC) failed to hold key support levels, and altcoins fell across the board. Market sentiment quickly shifted from cautious optimism at the beginning of the month to a significant cooling. 2. If the US CPI falls below 2.3% (2.5% in July), expectations of a rate cut may rise. 3. The current interest rate swap market indicates a 58.8% probability of no rate cut in September and a 41% probability of a rate cut. The non-farm payroll data could tip this balance.

Macroeconomic Summary

U.S. non-farm payroll data becomes the focus

The U.S. non-farm payroll data for July released on the evening of August 1 is crucial:

It is expected that 110,000 new jobs will be created and the unemployment rate will be 4.2%;

The actual data last month exceeded expectations (147,000 jobs and an unemployment rate of 4.1%). If it continues to improve this time, it will further weaken expectations that the Federal Reserve will cut interest rates in September.

In addition, the US July ISM Manufacturing PMI (expected to be 49.5) and the University of Michigan Consumer Confidence Index (expected to be 62) also need to be paid close attention to. Data divergence may cause sharp market fluctuations.

The policy struggle between the Federal Reserve and Trump

The Federal Reserve: It has continued to reduce its holdings of U.S. debt and tighten liquidity in the past month, but market liquidity has increased instead. The reason behind this is the U.S. Treasury’s “shadow QE” operation;

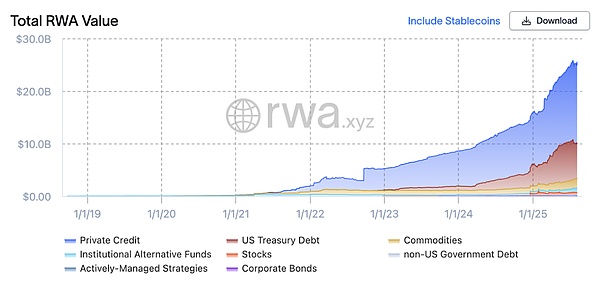

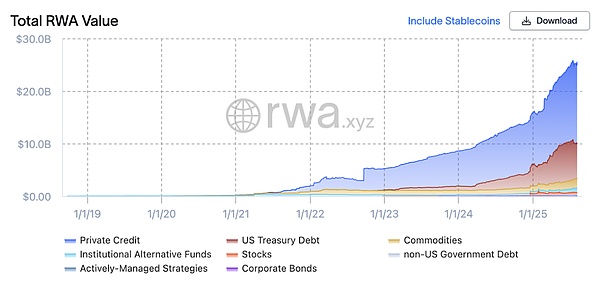

The Trump administration: It has achieved quantitative easing in disguise by expanding the issuance of short-term bonds and repurchasing long-term bonds to lower financing costs. At the same time, it has used tariff games as a bargaining chip to force the Federal Reserve to cut interest rates and expand its balance sheet. The current interest rate swap market indicates a 58.8% probability of no rate cut in September and a 41% probability of a rate cut. The non-farm payroll data may upset this balance. I. Market Overview In the second half of June 2025, among the many indices monitored by FMG, the RWA Index continued to decline, with monthly returns dropping by approximately 1.33%. Web 3 investment opportunities are limited and overly concentrated in Bitcoin and stablecoins. OTC funds are shifting their focus back to DeFi, asset management, and strategic sectors. However, DeFi in a single Web 3 market also carries high risks. Therefore, products anchored to real-world assets and exhibiting DeFi attributes are currently gaining favor.

1.2 Crypto Market Data

As of July 31, 2025, the total market capitalization of cryptocurrencies is $3.87 trillion, which continues to rise compared to $3.12 trillion in the second half of May.

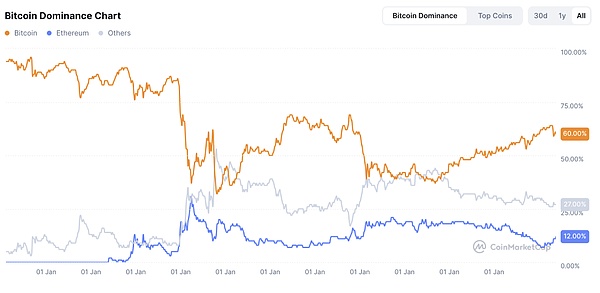

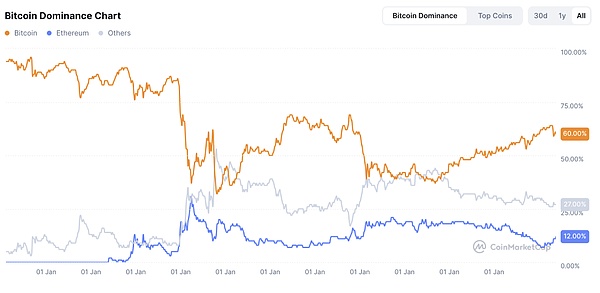

BTC Dominance Index: As of July 31, the current BTC dominance index is 60.2%, gradually declining.

Altcoin Season Arrival Index: As of July 31, the current Altcoin Season Arrival Index is 24, which continues to rise compared to 37 in early May, which means that the current altcoin opportunities are gradually increasing. ETF and Contract Indices ETF and Contract Indices 1.3 CPI and Other Data and Market Reactions: Market Judgment ... Manufacturing contraction spreads. China: The manufacturing PMI fell to 49.3 (14.2% percentile) in July, and the new orders index fell to 49.4 (17.1%), with both domestic and foreign demand weakening. Japan and South Korea: Manufacturing continued to shrink, with Japan's exports to the US falling for three consecutive months. South Korea's semiconductor exports fell 12.4% year-on-year (tariff-sensitive industries were the hardest hit). North America: Canada's Q2 GDP is expected to shrink by 1.5%, while the US trade deficit narrowed to US$60.2 billion in June (exports fell 0.5% month-on-month, imports fell 3.7%), reflecting weak domestic demand. Escalating trade frictions impact financial markets. Foreign exchange markets: The euro fell 1.2% against the dollar, primarily due to the interpretation of the €50 billion purchase agreement between the US and Europe as a "unilateral concession by Europe." This, coupled with the expected delay in the ECB's rate cut, triggered capital flows back into the dollar. A strong dollar: The US dollar index formed a weekly golden cross, with a short-term target of 106.5 (currently 100.05). The Federal Reserve's hawkish stance (only two rate cuts this year) and safe-haven demand provided dual support. II. Hot Market News 2.1 Will $12.5 trillion in pension funds enter the market? Trump supports the inclusion of cryptocurrencies in 401(k) plans? Bloomberg reported on August 7th that US President Trump will sign an executive order on Thursday aimed at allowing private equity, real estate, cryptocurrencies, and other alternative assets into the approximately $12.5 trillion 401(k) plan portfolio. Bloomberg, citing a person familiar with the matter who requested anonymity before the order's formal issuance, revealed that the order will direct the Department of Labor to review guidelines for alternative asset investments in retirement plans governed by the Employee Retirement Income Security Act of 1974. The department will also be responsible for clarifying the government's fiduciary responsibility regarding asset allocation funds that include alternative assets. Of particular note is the establishment of a cross-departmental collaboration mechanism. Trump directed the Secretary of Labor to work with the Treasury Department, the Securities and Exchange Commission (SEC), and other agencies to determine whether rule changes are necessary to facilitate this effort. He specifically requested the SEC to facilitate access to alternative assets for participants in self-managed retirement plans. 2.2 Fundamental Global Plans to Issue Up to $5 Billion in Securities to Acquire Additional Ethereum According to Coincentral, Nasdaq-listed Fundamental Global Inc. (FGF) has filed an S-3 registration statement with the SEC, proposing an offering of up to $5 billion in securities. The majority of the proceeds will be used to acquire Ethereum, with the remainder to support the company's operations. FGF plans to issue the securities in phases, with the flexibility to adjust the size, pricing, and terms based on future developments. The prospectus filed this time consists of a base prospectus and an at-the-market (ATM) prospectus for the proposed offering of up to $4 billion in common stock. These offerings will be made pursuant to a new agreement with ThinkEquity, LLC. The company may sell shares in installments or tranches based on market dynamics. If no shares are sold under the ATM agreement, the full $5 billion offering may be made through other channels. All sales will be subject to SEC guidelines and the latest market capitalization thresholds. 2.3 SEC and Ripple conclude legal dispute: Both parties have dropped their appeals, and the XRP-related ruling remains unchanged. According to The Block, a significant legal battle in the crypto industry appears to be nearing its conclusion. The U.S. Securities and Exchange Commission (SEC) and Ripple Labs' attorneys have jointly agreed to withdraw their appeals to the Second Circuit Court of Appeals. The joint motion for dismissal, filed Thursday, states that each party will bear its own costs. Previously, Ripple Labs CEO Brad Garlinghouse announced in June that the company intended to withdraw its cross-appeal, stating that it would "turn the page and focus on building the Internet of Value." Now that both parties have abandoned their appeals, Judge Analisa Torres's mixed ruling in 2023 will be final. The ruling determined that Ripple Labs' sales of hundreds of millions of dollars in XRP to institutional investors constituted illegal securities sales, but sided with Ripple Labs on the issue of "dark bid" sales to retail investors.

III. Regulatory Environment

Trump Signs Executive Order to Halt Unfair Banking Disconnections for the Crypto Industry

According to The Block, US President Trump signed an executive order on Thursday aimed at preventing federal regulators from targeting financial institutions doing business with the cryptocurrency industry. A White House fact sheet stated that the digital asset industry has been unfairly targeted by "disbanking," a practice that undermines public trust in banks and regulators, impacts livelihoods, freezes wages, and places a heavy economic burden on law-abiding Americans. The order removes "reputational risk" as a justification for increased regulation. While not specific to cryptocurrencies, it has previously been cited as targeting the industry. Previously, cryptocurrency businesses and individuals complained about unfair bank account closures, and Trump pledged to end "Operation Choke Point 2.0." Trump's signing of the order received support from Republican lawmakers. House Financial Services Committee Chairman French Hill called it an important step, and Senator Cynthia Lummis also praised the order for bringing transparency and accountability to the industry.

Anais

Anais