Author: Zhou Ziyi; Source: Metaverse NEWS

Famous hedge funds Manager Bill Ackman seems to have made a U-turn on Bitcoin in recent days. He said he might invest in Bitcoin because the price of Bitcoin is likely to rise sharply.

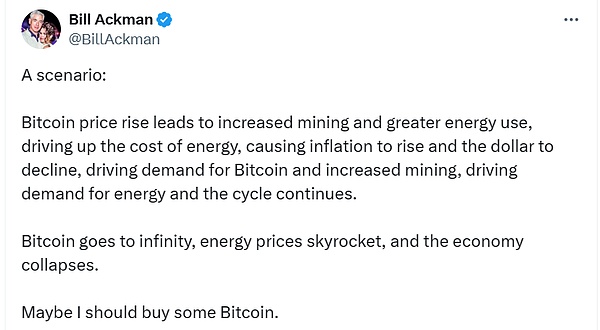

His latest statement on social media platform X on Sunday (March 10), "The price of Bitcoin has no upper limit... Maybe I Will buy some Bitcoin”.

Ackman is known for his aggressive investing. His usual style is to hold large shares in certain listed companies to influence the management and operations of the company. .

1 Ackman’s evolving stance

This is completely opposite to his previous attitude. Ackman has expressed doubts about cryptocurrency. He said at an event in 2021 that "the biggest shortcoming of cryptocurrency is that it has no real value."

Later, he gradually began to change his views on crypto assets. He invested in a blockchain project, Helium. At that time, he said, "I used to think that tokens had no tangible value at all, so I regarded the industry as a modern version of tulip mania. . But I've seen a change over time... With Helium, I've seen that tokens can create tangible value."

But dramatic However, subsequent investigations revealed that Helium had exaggerated its business model and had financial flaws, and Ackman received considerable criticism. Ackman later clarified that his intention was to discuss the broader uses of cryptocurrencies and tokenization in business, rather than promote specific coins.

2 Energy-related debates

In his latest post, Ackman painted a scenario in whicha rise in Bitcoin prices could lead to an increase in mining activity, pushing High energy costs, which leads to higher inflation and weakens the U.S. dollar, which in turn drives increased demand for Bitcoin and mining, which drives demand for energy, and the cycle continues.

As of now, the price of Bitcoin is US$68,600. It once exceeded US$70,000 last Friday (March 8), setting a record high.

Having said that, Ackman also warned that the opposite may be true.

Ackman's "vision" of Bitcoin immediately prompted a variety of responses, particularly regarding energy, ranging from defensive rebuttals to calls for greater understanding of Bitcoin's energy use.

Critics argue that Bitcoin’s energy use is an undeniable problem with significant environmental impacts; while supporters argue that skeptics need to look deeper Engage with the crypto community to understand the intricacies of mining and its potential benefits to the energy industry.

Michael Saylor, the founder of Microstrategy, the company with the largest Bitcoin holdings in the world, and an expert in the field of cryptocurrency, also joined the debate. , who believes thatBitcoin mining could actually lead to more efficient energy solutions and drive the adoption of renewable energy by creating demand for cheaper, more sustainable energy.

Alexander Leishman, founder and CEO of Bitcoin financial institution River Financial, also emphasized the competitive nature of Bitcoin mining, and his response was ,The industry’s drive for profitability naturally leads to the use of cheaper, often renewable, energy sources.

This view challenges the idea that Bitcoin mining increases demand for traditional energy, and instead improves energy efficiency and sustainability potential role.

Alex Gladstein, chief strategy officer of the American Human Rights Foundation, who is known for his environmental advocacy, supports Bitcoin mining mainly using excess energy. Or a renewable energy perspective. His position is consistent with some views in the market that the Bitcoin mining industry is contributing to the optimization of the global energy structure, rather than being a drag.

Joy

Joy