Article author: Andrew SingerArticle compilation: Block unicorn

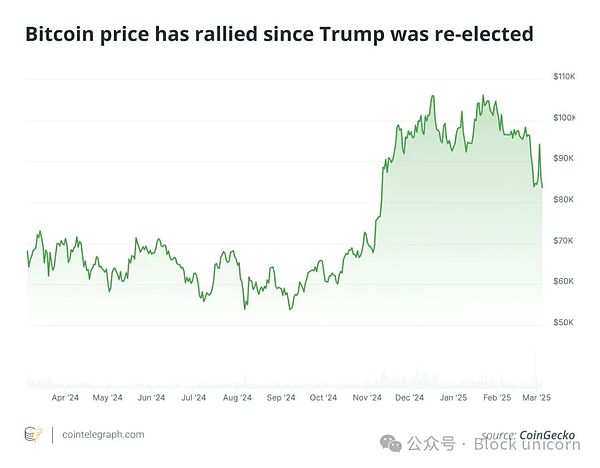

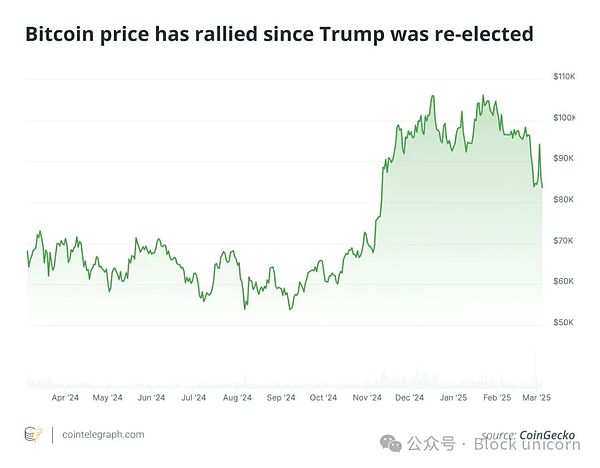

Many in the cryptocurrency community believed that the re-election of US President Donald Trump would drive a surge in the price of Bitcoin, and indeed it did - the price of Bitcoin went from $69,374 on Election Day (November 5) to an all-time high of $108,786 when the new government took office on January 20.

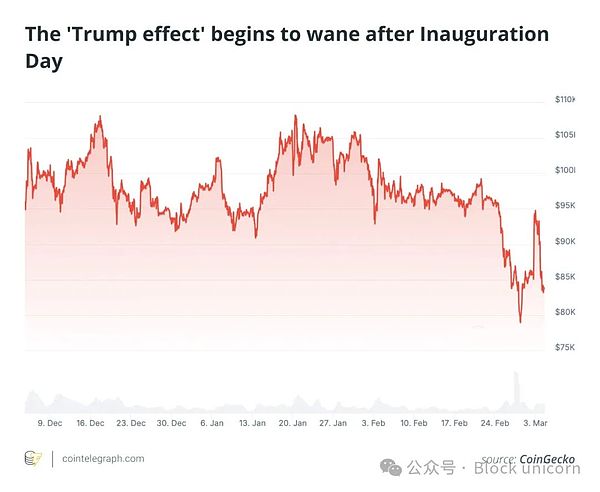

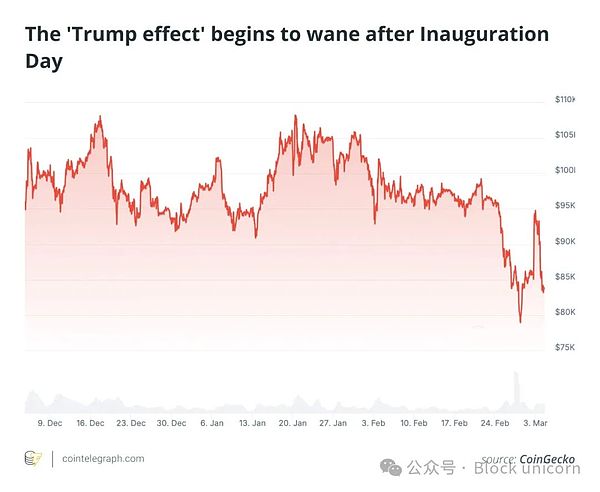

But BTC’s price has mostly fallen since then, even briefly falling below $80,000 on Feb. 28 — a 26% drop.

The new administration came to power promising changes such as building a strategic cryptocurrency reserve, appointing pro-crypto cabinet members, and pushing for legislation to reform market structures. So far, it has largely delivered on its promises.

Still, it’s too early to ask: Is the

Trump effect — the expected rise in Bitcoin prices following the election of the first pro-crypto U.S. president — overhyped?

Perhaps macroeconomic factors, such as the looming tariff war and a weakening global economy, are to blame for the market’s price decline. Also, the hack of Bybit in late February cost the world’s second-largest cryptocurrency exchange by volume $1.4 billion. Or perhaps the Trump administration itself is to blame for the chaos and insecurity it has created in its first six weeks in office?

Bloomberg noted on February 25:“Macro factors and the cryptocurrency crash have combined to undermine confidence.”Meanwhile, the Financial Times observed that while some investors hope that Trump’s election will herald agolden agefor cryptocurrencies, other investors, such as the well-known American hedge fund Elliott Management, have warned that Trump’s embrace of cryptocurrencies may lead to an “inevitable collapse” that “could cause serious damage in ways we can’t yet predict.”

“Healthy pullback”?

Independent cryptocurrency analyst Garrick Hileman told us:

While the recent Bybit event was significant, the shift in Bitcoin price momentum began long before the record-breaking $1.4 billion hack.

Hileman said the pullback did follow traditional market cycles - a "classic"

case of "buy the rumor, sell the news," further noting:

"The biggest cryptocurrency gains came around the Trump election, so a market cooling was expected and could even be a healthy pullback."

text="">In addition, cryptocurrencies are now more closely tied to traditional markets, making crypto prices more sensitive to macroeconomic issues such as inflation, interest rates and trade tensions. “These broader economic pressures are suppressing risk appetite across the board,” Hileman noted.

Justin d’Anethan, head of sales at token issuance consultancy Liquifi, agreed that the market was simply experiencing a traditional “buy the rumor, sell the news” situation.

Enthusiasm over possible pro-crypto policies from the new administration drove prices to record highs, but enthusiasm turned to pessimism as uncertainty about the timeline for policy implementation loomed. “With no immediate regulatory changes, the market has pulled back,” d’Anethan told us.

Coupled with the Bybit hack (which the FBI blamed on North Korea), “investor confidence was severely dampened,” he continued. Moreover, the subsequent laundering/liquidation of stolen assets across various platforms “created very real downward pressure on the market,” despite Strategy (formerly MicroStrategy) acquiring a large amount of Bitcoin, d’Anethan added.

Trend Remains Positive

Nevertheless, James McKay, founder and principal of digital asset advisory firm McKayResearch, told us: “The long-term outlook remains positive. We’ve never had a bull market cycle that didn’t have multiple 30%, 40% or even 50% pullbacks.”

“We’ve had more positive regulatory developments in the past year than in the past four years combined,” McKay said, including the SEC’s January 23 repeal of SAB 121.

(Its main purpose is to regulate how financial institutions that hold crypto assets for their customers reflect these assets and their corresponding protection obligations on their financial statements.) "This will allow mainstream financial institutions to custody cryptocurrencies." However, Hileman noted that while optimism remains high, some uncertainty about Trump's policies may still be creeping in: "There are still questions about whether key initiatives - such as a formal 'cryptocurrency committee' or a national Bitcoin reserve - will actually come to fruition." For example, it was reported on March 2 that the cryptocurrency reserve plan still requires a vote in Congress.

Hileman believes: “Sentiment will weaken further if Trump’s promises stall or fail to meet expectations.”

“The impact is still being felt”

Perhaps the cryptocurrency industry was too optimistic after the US election in November?

Hileman doesn’t think so. He added: “The positive impact of Trump’s election on the cryptocurrency market is real, but its effects are still unfolding.”

Pro-crypto cabinet and agency appointments, such as Paul Atkins at the SEC, Howard Lutnick at the Commerce Department, and crypto czar David Sacks, are concrete and meaningful events. In addition, Coinbase and Uniswap no longer have to worry about regulatory pushback, as regulatory investigations into these cryptocurrency exchange platforms have been dropped.

But Hileman believes that the long-term impact of the Trump administration remains unclear. “Recent events, such as the President of Argentina’s unexpected endorsement of a pump-and-dump meme coin, highlight the risks of politicians getting involved in cryptocurrencies.” Meanwhile, the Trump family, with its “personal” cryptocurrency plans, “could make a similar mistake and spark a backlash in the crypto space,” Hileman added. How to Restore Market Price Growth So, what can governments do to restore market price growth for Bitcoin and other cryptocurrencies in the coming months?

“Continued progress on regulatory guidance, particularly in lowering barriers to participation in TradFi, is perhaps the most bullish development at this point,” McKay said. He believes the market has yet to fully appreciate the repeal of SAB 121 — another reason prices could soon rise.

McKay added that there are other long-term drivers that haven’t been discussed as much in the recent news cycle but are critical to future adoption and market price growth, including continued strong demand for cryptocurrency exchange-traded funds (ETFs), increased corporate and sovereign adoption, and “the gradual emergence of a post-halving supply shock.”

Additionally, temporary dips in the prices of BTC, ETH, and other cryptocurrencies aren’t necessarily a bad thing. They could represent buying opportunities. “It would be shocking if cryptocurrencies were 20%-25% cheaper now and big institutions and even retail investors weren’t salivating over it,” said trader d’Anethan.

Hileman expects the new administration to follow through on its promise to establish a cryptocurrency reserve within the U.S. government, which would undoubtedly provide a boost to the industry even as it strays further from cryptocurrency’s decentralized cypherpunk origins.

Brian

Brian