Source: IOSG Ventures

On June 3, Solana founder Anatoly and Ethereum Foundation researcher Justin mentioned the issue of economic security in a debate organized by Bankless. Toly believed that economic security was a meme, which triggered subsequent discussions among many bilateral KOLs.

The overall discussion content was relatively fragmented. We will briefly organize and analyze it from Toly's point of view.

1. Toly’s logic

Due to the existence of centralized staking services, the cost of acquiring 33% of the nodes for attack is much less than the actual staking value

The POS chain with a very small staking economy has never been attacked, which means that the security of the POS network is guaranteed by the operating mechanism of the distributed network

Even if an attack occurs, it can be quickly recovered through the network’s social layer, preventing the attacker from gaining value higher than the cost

The recovery of the social layer may cause the network to temporarily lose activity, but this impact is insignificant

Therefore, his conclusion is that economic security is a meme for the POS network, and the security of Ethereum comes from excellent engineering design, node distribution and client diversity.

Subsequently, around economic security, the KOLs of both communities expressed their opinions, but it was difficult to reach a conclusion. Let us try to clarify the proposition, analyze the arguments and give evidence.

2. Is economic security a meme?

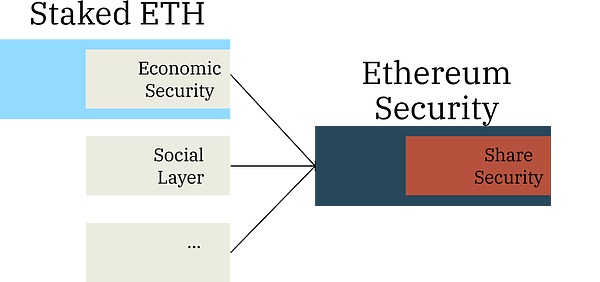

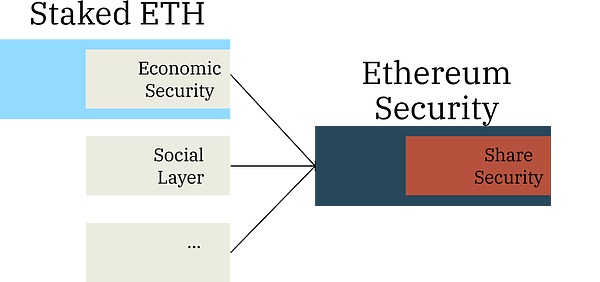

Before discussing this point, we need to clarify the definitions and transmission relationships of pledge, economic security, Ethereum security, and shared security. These four terms are often used interchangeably in many discussions.

The figure below attempts to describe the relationship between them. The pledged ETH partially becomes economic security. Economic security and other security factors together constitute Ethereum security, and Ethereum security is partially used by AVS as a shared security service.

Source: IOSG

Toly's first argument is that the security effect of staking in preventing attacks on the POS chain is far less than the value of the stake. To verify this, we need to know how much of the staked ETH has been converted into Ethereum security.

The relationship between staking -> economic security -> Ethereum security

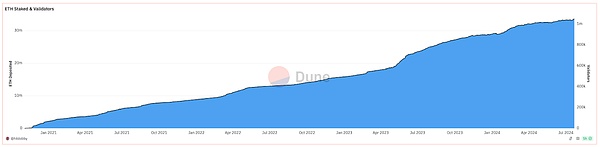

Currently, 33m ETH has been staked, with a market value of nearly $120b. Has such a large amount of staked amount become economic security equally and effectively?

Before that, let's review the "attack" that is relative to security. There are two types of attacks that we mainly consider

>=33% of the nodes, in theory, you can launch a double-signature attack or bring the network to a standstill.

>50% of the nodes, you can review the transaction; you can initiate a short-range reorganization.

Theoretically, there are ways to get 33%/51% of the nodes:

Run new nodes

Control existing nodes

In the first case, given that new nodes need to queue up to enter the network, adding more than 33% of validators takes hundreds of days, which is almost impossible to achieve.

In the second case, Toly believes that due to the existence of the LST protocol and centralized staking services, the cost of obtaining 33% of the nodes for attack is much less than the staking amount. In essence, the cost here is the cost of attacking/bribing the liquidity staking protocol or centralized staking service provider rather than the cost of funds.

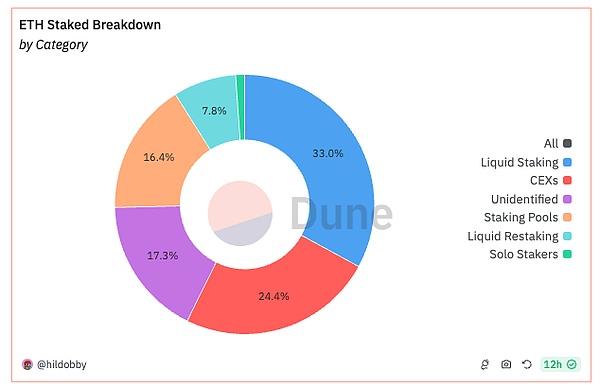

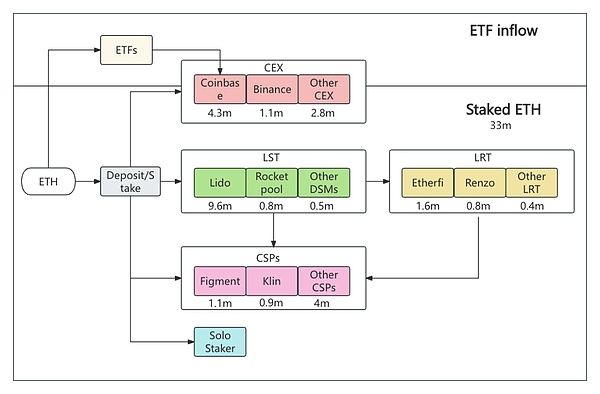

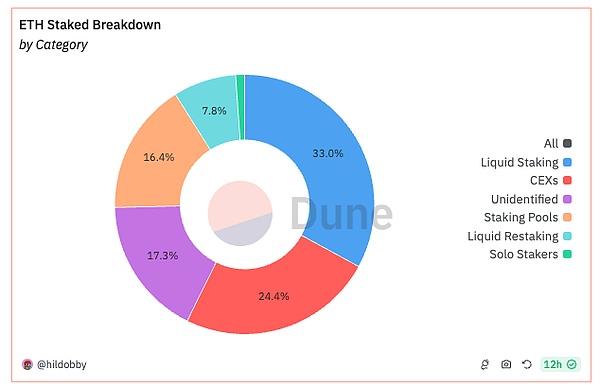

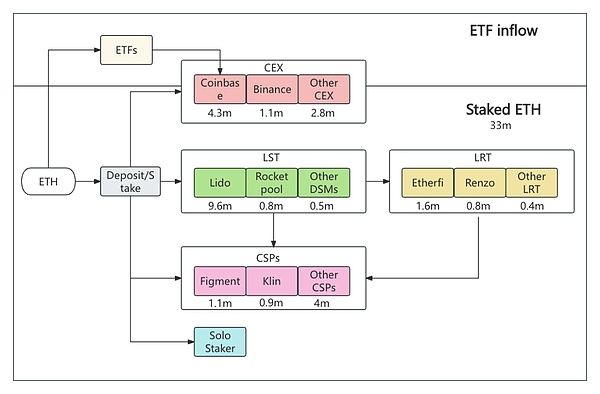

Then let's take a look at the current status of staking by the liquidity staking protocol and centralized staking service providers. Currently, Liquid Staking accounts for nearly 33% of the staking ratio, and centralized service providers such as CEX account for 24.4%, which is quite close to the threshold of 33%.

Source: hildobby - Dune Analytic

Source: hildobby - Dune Analytic

For CEX, with the passage of Ethereum ETF, the proportion may increase further - Bitcoin ETFs often use Coinbase as a fund custodian.

Source: Maximum Viable Security: A New Framing for Ethereum Issuance

Source: Maximum Viable Security: A New Framing for Ethereum Issuance

The centralization of CEX staking is very high. Coinbase even created a sequence of eight consecutive blocks from its own validators. This will only intensify with the passage of ETFs in the future. Such a degree of centralization makes this part not only uncontributory to economic security, but even has side effects.

Source: IOSG Ventures

Source: IOSG Ventures

Liquidity Staking

Overall, as the leading protocol, Lido controls nearly 1/3 of the staked ETH, which means that from the perspective of the protocol, the Nakamoto coefficient has dropped to 1 (only one protocol is needed to attack the entire network).

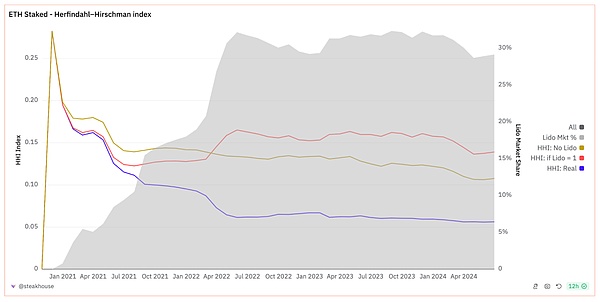

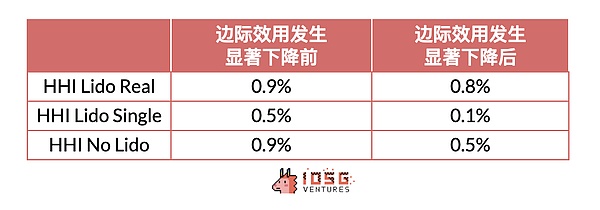

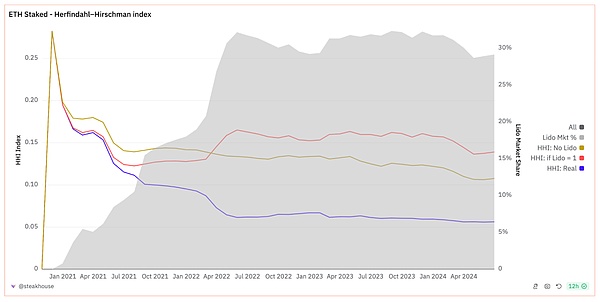

Compared to CEX, liquidity staking is good in that it alleviates centralization through different means, including DAO governance for service provider selection, dual token governance, Lido's DVT and Rocket pool's Mini pool. The HHI index drawn by Steakhouse is used to measure the degree of centralization of Ethereum staking (in a sense, it represents the efficiency of converting the staking amount into economic security), where HHI Lido Real means that Lido has decentralized governance, HHI Lido Single means that Lido has not decentralized governance, and HHI No Lido means that Lido does not exist. We can see that when Lido is actively governing (blue line), it promotes the degree of centralization of staking.

Source: steakhouse - Dune Analytic

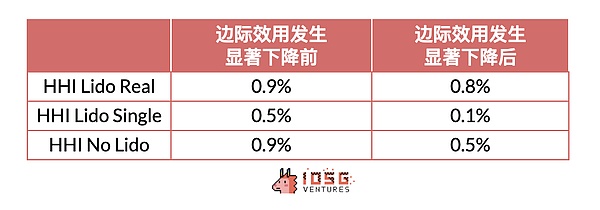

We further analyze the changes in the HHI index. When ETH reaches 11% of the total supply, which is around August 2022, the supply is 120m, and the marginal utility of decentralized growth calculated by HHI begins to weaken significantly. We believe that "staking saturation" has occurred at this time - that is, the decentralization improvement brought by the newly added stake has weakened significantly. We found that in either case, the increase in the number of pledges will have a positive effect on the degree of decentralization of the pledge, but the marginal utility (0.9%) brought by the liquidity pledge protocol that actively conducts decentralized governance is more obvious, and it still plays a relatively outstanding marginal utility after the pledge is relatively saturated (0.8%).

Source: IOSG Ventures

Source: IOSG Ventures

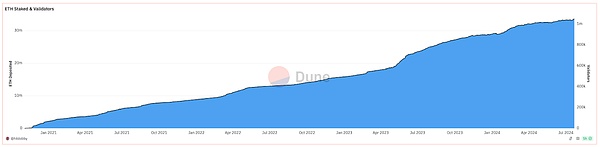

Since the total amount of Ethereum staked is constantly increasing, this means that economic security may still be in a slow but continuous growth.

Source: hildobby - Dune Analytic

Source: hildobby - Dune Analytic

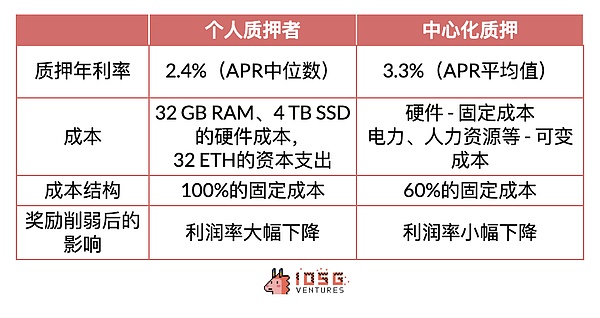

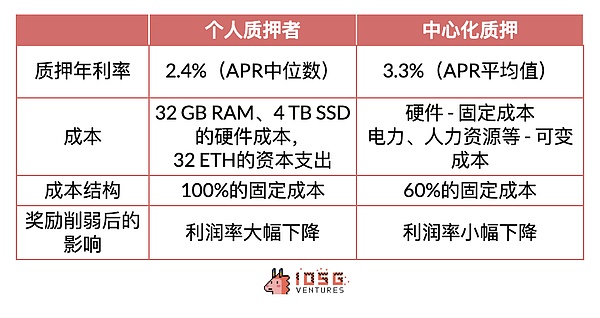

Next, let's look at Solo Stakers. This group contributes the most to decentralization because each person adds a more independent validator at the geographical/social level. However, individual staking currently faces disadvantages compared to centralized staking, mainly due to the cost structure of individual stakers.

Source: IOSG Ventures

Source: IOSG Ventures

Due to the high proportion of fixed costs, independent stakers (and small node operators) are more sensitive to changes in staking rewards than large node operators. Currently, the Ethereum Foundation hopes to reduce the future issuance rate, which means that independent validators will face more severe competition.

Source: IOSG Ventures

Source: IOSG Ventures

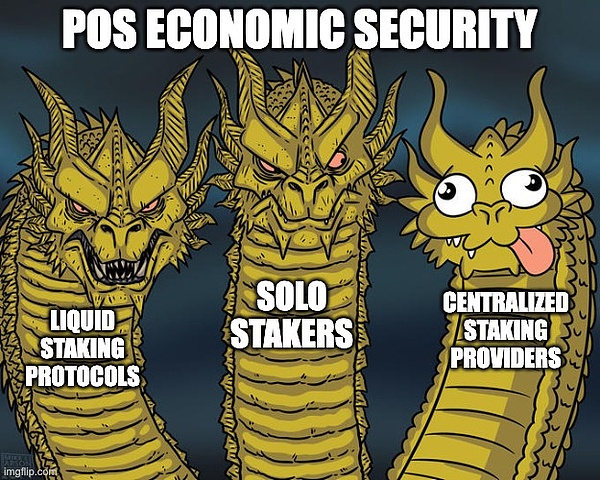

Therefore, we can see that for the same amount of pledge, centralized service providers, liquidity pledge protocols, and individual pledgers have different contributions to economic security. The specific differences are difficult to quantify, but we can draw the following conclusions:

1. As the amount of pledge increases

Centralized pledge service providers have a negative effect on economic security;

Actively governed liquidity pledge protocols play a positive role but with low marginal returns;

Individual validators play a relatively high positive role;

2. With the passage of ETFs, the degree of pledge centralization will increase accordingly

3. As the issuance volume is adjusted, the disadvantages of independent validators will increase

Source: IOSG

Source: IOSG

In addition to economic security, social layer defense and user-initiated forks are the two main defense methods of the POS chain.

Ethereum is always closely watched by thousands of developers and communities. If any attack occurs, the observed nodes will issue a warning, and the social layer will respond quickly to ensure network recovery. When facing attacks outside the system (such as government-level censorship attacks or Ethereum system vulnerabilities, etc.), user-led forks are the ultimate defense, but the disadvantage is that the network activity will be temporarily lost.

So, how do we understand the actual contribution ratio of economic security to security? In fact, this perspective can be used to value ETH through the security expectation demand model provided by Kunal. If the price of Ethereum is regarded as the demand for economic security, then by comparing the total market value of the pledged assets and the economic activity capacity of Ethereum, we can roughly see the market's assessment of the proportion of economic security to the total security capacity. According to calculations, this proportion is currently around 50%.

3. Economic security is a meme to a certain extent. Is it a bad thing?

In Toly's context, meme refers more to "exaggerated propaganda slogans". He believes that the effect of economic security actually exceeds the current demand.

After the utility analysis in the first part, it can be found that this statement is basically correct

Economic security actually plays a smaller role than the pledge value

Centralized pledge service providers do not necessarily promote security; pledges from liquid pledge protocols have very little marginal promotion of security

Social defense and other deterrent measures are currently effective

So what is the motivation for Ethereum to still promote economic security?

First of all, the biggest difference between economic security and non-economic security is the impact on network activity. Ethereum aims to become a world-class asset settlement layer, which means institutional-level trust. Any short-term downtime will affect Ethereum's reputation at this level. But for Solana, the reconstruction after the destruction of the social layer is very effective - people will only think that Solana's restart and reorganization are normal things, because Solana has never advertised itself as a blockchain that does not crash or reorganize.

Secondly, there is certainly a marketing motivation. Toly's denial of economic security as a marketing tool is to use Luna as an example to illustrate that staking economic security may produce incorrect security marketing. The problem with this is that users who need security will not seek security attributes from Luna. And Toly is right that economic security is indeed a better publicity indicator than other attributes.

For users, especially institutions, specific economic security numbers are easier to accept. When users cannot accurately feel the security of the network, a margin number is the best anchor. This number is 33m ETH for ETH and 337m SOL for Solana.

Source: IOSG

4. What is the future of economic security?

So far, we can basically see that economic security has developed to date, as part of Ethereum's long-term strategy, and has indeed experienced a stage of staking saturation, resulting in overflow security.

At the same time, the staking of centralized staking service providers, liquid staking protocols, and independent validators plays very different roles. Let's review again: centralized staking service providers have no positive effect on network security, and with the passage of ETFs, the increase in the proportion of centralized staking service providers is inevitable. Liquidity staking agreements can promote network security through more reasonable governance, but the effect has gradually decreased. The increase in individual validators has contributed the most to the network, but it is currently facing disadvantages in cost structure, which will become more obvious as the issuance of Ethereum and the staking curve are adjusted.

Based on this, some obvious development directions will be

4.1 More refined staking amount design

Among them, Stakesure proposed by Sreeram et al. is the first, which aims to transform economic security from a rough measurement of the entire protocol package to a form of calculating each user's expected loss in the event of an attack and providing insurance. This means that once an attack occurs, the funds confiscated by the validator will just cover the losses of all users.

This method of quantifying the staking amount from the user's perspective rather than the attacker's perspective can more effectively measure the demand for economic security and use economic security more efficiently. Naturally, it also has a stronger demand for infrastructure, which is also the direction we are constantly exploring.

4.2 Encouragement for independent validators

The importance of independent validators is self-evident. In essence, the number and distribution of independent validators fully represent the network's anti-censorship ability. For now, the absence of independent validators will not affect the operation of the network (such as Solana). But in the long run, to achieve the vision of "autonomy" and promote the growth of the independent validator network, it is an important but not urgent matter for Ethereum.

The disadvantage of the marginal cost of individual stakers is difficult to change. We have seen attempts by people such as 0xMaki to label independent validators and give them additional incentives similar to Merge mining. We believe in and are also paying attention to the innovations that continue to emerge at this level.

Source: IOSG

4.3 The evolution of POS

The initial doubts about Ethereum's transformation to POS included defining it as a class-based network in which only large households have the right to speak. If we regard independent validators as individual users and centralized staking service providers as large users, we will find that the ETH flowing into the liquidity staking protocol has essentially gradually escaped from the POS binary framework.

The liquidity staking protocol itself is the product of the contradiction between security needs and liquidity needs. This has also led to a discussion within the liquidity staking protocol on how to enhance the decentralization of governance with a very cautious attitude. This has actually sprouted many discussions and exercises on alienated consensus mechanisms based on POS, including dual governance, proof of authority, and proof of governance. This model aims to govern the validator network and select validators through a more efficient mechanism without giving up the security effect of decentralization.

Source: IOSG

Thinking about this actually encourages us to work backwards from the end game. What will Ethereum POS look like in the end? For example, due to the absolute cost structure advantage, 100% of Ethereum is deposited in Lido - dual governance of tokens is essential here; or through some kind of governance supervision method, to ensure that the selected nodes can operate in a reliable manner... In the conception of many industry thinkers, the Proof of Authority & Proof of Governance model that relies on community governance and entity reputation will be the end game of POS.

We believe that the liquidity pledge protocol that actively explores this aspect will go further and even become an indispensable part of the Ethereum consensus mechanism in the future. At the same time, we also see that new attempts at POS are constantly emerging in the Cosmos ecosystem, which will also be a direction we focus on.

4.4 Exploration outside POS

The essence of economic security is to ensure that nodes will not do evil, not the staking behavior itself. All the security solutions we are currently exploring are still centered around a simple game mechanism of POS staking-forfeiture, but in fact, we have seen that some protocols have begun to explore new consensus mechanisms, trying to maintain the security of the network at a lower or even no cost of economic security.

The transition from POW to POS has brought a lot of paradigm innovations, and the opportunity for the next industry may be hidden in another change in the consensus mechanism.

5. Written at the end

In a sense, Toly is right to say that economic security is a meme, because Ethereum's current economic security conversion rate is indeed getting lower and lower, and the security of other levels is also strong enough. But this does not affect Ethereum's demand for economic security. As part of the security component, economic security can protect the activity of the network, and it is the form of security that users can most directly feel, and it can also best protect the core value of Ethereum.

But in any case, this periodic review has indeed made everyone think about how to better move towards the end. These include adjustments to the pledge issuance curve, incentives for individual pledgers, new governance models, new consensus models, and the development of shared security.

It is obvious that we are still in the infrastructure construction stage. Nick Szabo proposed that the value of blockchain lies in social scalability. Kyle Samani explained it as when we enter a building, we will not worry about the safety of the building first, but often start to use the various facilities in the building with peace of mind. Therefore, it seems that the social trust cost of Ethereum is still very high. When the day comes that we no longer need to delve into security and other issues, but assume that Ethereum or other infrastructure can be trusted, it means that we are almost there.

JinseFinance

JinseFinance