Author: Lawyer Shao Shiwei

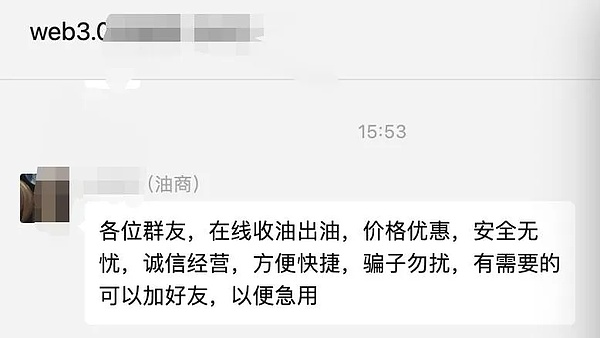

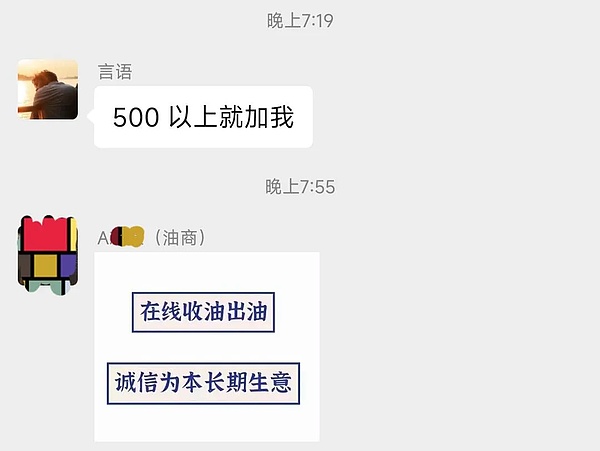

As a criminal defense lawyer in the blockchain industry, I often I saw messages from my potential clients in industry communication groups. What they see is the business of making money, and what I see is the business of criminal defense.

< strong>1. Is it legal to be a U-commerce business in my country?

What is U business? It refers to currency dealers who earn the price difference by buying and selling USDT. USDT (Tether) is a stable currency, directly benchmarked against the U.S. dollar, so doing business with U.S. merchants can be said to be a sure profit but no loss. For example, if you buy u at 6.7 and sell at 6.73, you earn 3 points. If you buy and sell 100,000 u in a day, you can earn 3,000 a day.

So, is it legal to be aU business in my country?

According to the "Notice on Further Preventing and Handling the Risks of Speculation in Virtual Currency Transactions" issued by the central bank and other ten departments on September 24, 2021 (hereinafter referred to as the Notice) In the spirit of , virtual currency-related business activities are illegal financial activities. They are to prevent and deal with the risks of speculation in virtual currency transactions, and to prevent virtual currencies from becoming a tool for illegal and criminal activities such as gambling, illegal fund-raising, fraud, pyramid schemes, money laundering, etc.Any action is prohibited People and organizations provide business activities or services related to virtual currency to the public.

Article 4 of the notice also clearly stipulates that there are legal risks in virtual currency transactions. Personal investment in virtual currencies is not protected by law because it violates public order and good customs.

“(4) There are legal risks involved in participating in virtual currency investment and trading activities. Any legal person, unincorporated organization and natural person investment If virtual currencies and related derivatives violate public order and good customs, the relevant civil legal actions will be invalid, and the resulting losses shall be borne by them themselves; those suspected of disrupting financial order and endangering financial security will be investigated and dealt with by relevant departments in accordance with the law. ”

However, the notice does not restrict virtual currency transactions between individuals, that is: "It is not a crime if there is no express provision in the law." In other words, fiat currency transactions and currency transactions between individuals are currently allowed and are not restricted by law.

Just because this behavior is not encouraged or protected by the state, there are many legal risks in doing U business in practice.

2. What pitfalls will you encounter when doing U business?

U merchants can be divided into on-site U merchants (who trade on the exchange and need to pay exchange margins) and over-the-counter U merchants (who do not trade on the exchange) Through the exchange, the two parties conduct offline transactions, which can be cash transactions or other methods agreed by both parties). Both models have their own advantages and disadvantages.

In short: The biggest risk for on-site Utraders is "getting caught". The biggest risk for foreignUbusinessmen is “getting cheated”.

The following examples are used to explain.

1. Caught

U-merchant in the venue The risk is receiving "black money" and having your bank card frozen. Although conducting KYC audits on users is a basic ability necessary for a qualified U-merchant, the sources of transaction funds for U-merchants are nothing more than currency speculation, online gambling, pyramid schemes, telecommunications fraud and other types. Bank flow can easily trigger anti-fraud measures by banks. The system was judicially frozen by the public security and other departments.

In addition to the high risk of being "frozen", if the source of funds is suspected of gambling, fraud, etc., it may constitute a crime of money laundering, covering up and concealing the crime. offend (crime of concealment), or crime of assisting information network criminal activities (crime of aiding trust), etc.

For example, in a case in Xi’an Court in 2022 [Case No. (2022) Shaanxi 0104 Xingchu No. 219], the two defendants acted as virtual currency acceptors ( U merchant), made profits by buying low and selling Tether (USDT) high. During this period, the two of them were caught defrauding their bank cards of 50,000 yuan each. The two returned the defrauded funds to the victim and obtained forgiveness, but they were still convicted of the crime of collusion by the court and were sentenced to one year and nine months in prison respectively.

2. Being cheated

Off-site U merchant The profit is much higher than that on the court. For example, it is not surprising to earn 3 points on the court and 30 cents off the court. So why would anyone be willing to sell U at a low price outside the market? We mentioned above that since U-commerce merchants on the market are all trading online, some risks are indeed difficult to guard against when being "monitored" by exchanges, banks, public security anti-fraud centers, etc. The advantage of over-the-counter U-commerce merchants is that the two parties can communicate offline, such as in cash, "paying money with one hand and handing Us with the other", then it can be ensured to the greatest extent that the card will not be "frozen", but if it is "made Game", you can only suffer the loss of being dumb.

For example, as a currency dealer, you saw the information published by Xiao Wang about collecting U at a high price for cash (a reasonable price slightly higher than the market price), so Contact Xiao Wang and the two parties agree on an offline transaction. You will give the U to Xiao Wang on the spot, and Xiao Wang will hand over the cash on the spot. At the appointed time to meet offline, Xiao Wang informs you that he is on a temporary business trip and asks his friend, the little prince, to come to the scene to trade with you. After the meeting, the handover went smoothly. You got the cash the little prince brought, and the little prince also received the U.

After some time, Xiao Wang contacted you again to collect U. The transaction method was the same as above, but the little prince still came to the scene. Based on the trust relationship between the two parties in the previous transaction, you transferred U to Xiao Wang, but this time, the little prince refused to give you the cash. So you immediately contacted Xiao Wang to inquire about the situation, but this time Xiao Wang lost contact...

In this incident, the little prince was actually not related to Xiao Wang. I am an acquaintance of the currency dealer. In the first transaction, you transferred U to Xiao Wang. Xiao Wang (in order to defraud your trust) immediately transferred U to the little prince. Xiao Wang used the method of cheating on both sides, claiming to the little prince that he could sell him U at a low price, and let the little prince come to the scene to trade with you.

At this time, if you take away the money brought by the little prince by force, it may constitute a crime of robbery, because the little prince did not receive u, and if you do this, If you give up, you will lose the hundreds of thousands of dollars you transferred to Xiao Wang. If you go to the public security bureau to report a case and say that you have been defrauded of hundreds of thousands worth of U, the police will ask, what is your basis for claiming that you lost hundreds of thousands worth of money? (After the issuance of the "Notice on Preventing Bitcoin Risks" in 2013 and the "Announcement on Preventing Token Issuance Financing Risks" in 2017, my country has completely banned any entity from engaging in the issuance, exchange, pricing, and information of digital currencies. Intermediary and other services.)

3. Lawyer suggestions

1. The KYC review of users must be professional and rigorous

KYC certification is actually a real-name authentication mechanism. Mainly used to prevent anti-money laundering, identity theft, financial fraud and other crimes. The KYC review of users can be said to be the basic ability necessary for U-business, including but not limited to requiring users to provide proof of identity, bank statements, address and phone number, etc., to review the user's identity, but as the author's previous article " How can a virtual currency OTC merchant who is suspected of a criminal offense plead guilty to a lighter charge? "As mentioned in "The vast majority of U-commerce merchants do not have the ability to identify black money, and if the transaction volume of U-commerce merchants becomes larger and larger, it is inevitable to encounter black money. However, even the most thorough KYC certification cannot verify the user’s source of funds.

2. If you are caught, entrust a defense lawyer to intervene as soon as possible

As mentioned above, the KYC audit of U merchants cannot verify the source of the user's funds. Even U merchants with certain industry qualifications can roughly judge whether a user's transaction funds are suspected of crime through their own social experience, but it is inevitable that When there is a lot of confusion. At this time, if the public security organ determines that the case is suspected of the crime of facilitation or concealment, even if the perpetrator does not admit the confession, it will also be presumed that the U business has "subjective knowledge" of the crime. For example, U-commerce merchants whose cards have been frozen, whose transaction prices are significantly higher or lower than the market price, who use encrypted software for chatting, etc., will all trigger the presumption of subjective knowledge stipulated in the judicial interpretation of the crime of trust. At this time, a professional and responsible criminal lawyer will play a crucial role in the direction of the case.

3. If you are blocked, contact the police to provide materials and actively communicate

In transactions, you can use multiple cards for down payment to spread risks and avoid being frozen by bank supervision or law due to excessive transaction flow on a single card. If your card is unfortunately frozen, but your transactions are indeed normal, you can contact the police officer in charge as soon as possible and ask about the reason for freezing the card. Is it because your transaction itself is suspected of criminal funds, or because the transaction funds of related parties upstream and downstream of your bank card are abnormal? ? How much is the approximate amount involved? After understanding the basic situation, you can provide targeted materials to the police to prove the legality of the funds in the bank card.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Weiliang

Weiliang Zoey

Zoey Aaron

Aaron Brian

Brian Cointelegraph

Cointelegraph