The market remains sluggish, and Hong Kong, which has been neglected for a long time, has also attracted new attention.

On February 8, Hong Kong certified public accountant clementsiu disclosed on social media that the Hong Kong Investment Promotion Agency approved an investment immigration application using Ethereum as proof of assets of HK$30 million. He also stated that in October last year, he had successfully handled the first investment immigration case in Hong Kong using Bitcoin as proof of assets.

It may sound unremarkable at first, but for crypto holders, especially large Chinese holders, the threshold for overseas immigration is significantly lowered. After all, 30 million Hong Kong dollars is not a huge fortune in the crypto circle where the rich are eager to move, and moving to Hong Kong is a natural direction for the Chinese.

But is investment immigration so simple? Is Hong Kong really a crypto utopia? Different people have different answers in their hearts.

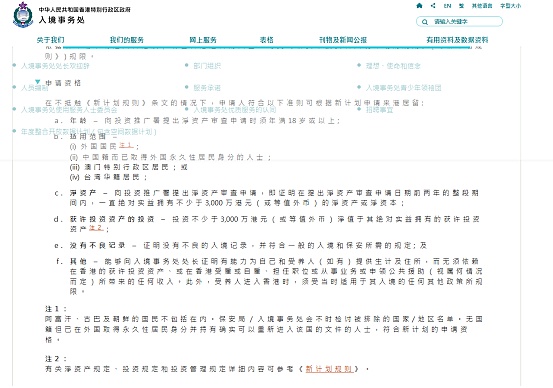

In fact, regardless of whether it includes cryptocurrency, the investment immigration policy belongs to the new Capital Investor Entry Scheme (CIES) proposed by the Hong Kong government in 2023. The scheme is open to qualified investors and will further strengthen Hong Kong's position as an international asset and wealth management centre by introducing external investors and capital.

Under the plan, qualified investors can obtain a stay visa after investing HK$30 million in permitted assets in Hong Kong, and will have the opportunity to apply for Hong Kong permanent resident status after living in Hong Kong for 7 years. The plan is not complicated, but when it comes to actual implementation, there are still many details that need attention.

First, the applicant needs to hire a professional accountant in Hong Kong at his own expense to issue a capital verification certificate proving that he has a net asset of HK$30 million. At this step, the location of the assets is not restricted, and the composition of the assets is not limited. It is only necessary to prove that the applicant has absolutely beneficially owned net assets or net capital with a net value of not less than HK$30 million during the entire period of 6 months before the date of the net asset review application. It is worth noting that the period was originally two years, which was subsequently further optimized to 6 months by the Hong Kong government.

Having assets is certainly not enough. The ultimate goal of the Hong Kong government is to allow assets to flow into mainland Hong Kong. Within 6 months before submitting the application, or within 6 months after approval, the applicant needs to invest no less than HK$30 million in designated permitted investment asset categories. The Hong Kong government has made very clear regulations on investable targets:

Qualified investors must invest HK$27 million in financial assets (all types of transactions are denominated in Hong Kong dollars/RMB), which include stocks of listed companies on the Hong Kong Stock Exchange, debt securities, certificates of deposit, and deferred bonds; qualified collective investment schemes, which include funds, real estate trusts, open-end funds and life insurance plans issued by institutions with a No. 9 license from the Securities and Futures Commission; private limited partnerships registered in Hong Kong; non-residential real estate for commercial or industrial purposes (including pre-sale properties but excluding land), but the upper limit of this type of investment is HK$10 million.

The remaining HK$3 million is equivalent to the mandatory target and must be invested in the "Capital Investor Entrance Scheme Investment Portfolio" established by Hong Kong Investment Management Co., Ltd. The investment portfolio will invest in companies or projects related to Hong Kong to support the innovation and technology industry and other key industries that will contribute to the long-term development of Hong Kong's economy. The specific operation is to deposit 3 million Hong Kong dollars in the designated account of a financial intermediary, which will be managed by four fund management companies and related service agencies, including Betatron Venture Group, Inno Angel Fund, Concept Capital and Huike Science and Technology Investment. To put it bluntly, this 3 million Hong Kong dollars is equivalent to a contribution to Hong Kong angel investment. If it makes a profit, everyone will be happy, and if it loses, there is nothing to say.

After completing the above investment, the Hong Kong Immigration Department will issue a 2-year stay visa, which needs to be renewed later. The renewal is generally in the form of 3+3, but each year the applicant needs to hire a professional accountant to verify the capital report to prove that the total investment amount is still not less than 30 million Hong Kong dollars and that the assets have not been transferred or used for other purposes. However, the total investment amount has nothing to do with previous investment losses. Even if there is an investment loss and the current investment amount does not reach 30 million Hong Kong dollars, it is only necessary to prove that the scale of investment at the time of application has reached 30 million Hong Kong dollars. No additional investment is required, and the interest or other profits from the investment can be freely disposed of. After living there for 7 years, you can become a permanent resident of Hong Kong. At that time, the investment amount will no longer be restricted and the applicant can dispose of it freely.

The overall process is as above, and the participation of cryptocurrency this time is concentrated in the initial capital verification stage, that is, cryptocurrencies such as Bitcoin and Ethereum can also be used for asset identification, and encrypted assets can be placed in cold wallets or certified by head exchanges such as Binance. It is worth noting that although the existing Bitcoin and Ethereum have been recognized, whether other cryptocurrencies can be used for the proof cannot be generalized. Based on the current situation, only currencies with relatively stable value, large circulation and legal in Hong Kong can be applied. In addition, whether the subsequent investment of 30 million Hong Kong dollars can be invested in virtual currency ETFs remains to be discussed. According to Xiao Yaohe, deputy managing partner of Hongyuan Accounting Firm Co., Ltd., the possibility is relatively small, but it can be tried to purchase by opening a limited partnership fund. Whether it can be invested directly still needs subsequent verification.

In fact, from the perspective of asset proof alone, there have long been precedents of using cryptocurrency as asset proof in the United States, Singapore and other places.But for cryptocurrency holders, the most difficult thing is never to take out the money, but where does the money come from? When using cryptocurrency as proof of assets, relevant institutions and accountants will require customers to submit proof of source of funds.

Proof usually involves the original source of funds for purchasing cryptocurrency and the place and low point of purchasing crypto assets. Obviously, for a field like encryption with great ups and downs and unclear anonymity, the above questions are undoubtedly extremely difficult to answer. This is the real difficulty of crypto asset immigration. The historical burden is heavy, and the holders must leave traces of everything in order to resolve it.

In any case, the first use of cryptocurrency by Hong Kong investment immigrants not only reflects Hong Kong’s high degree of openness, but also once again confirms the Hong Kong government’s inclusive attitude towards cryptocurrency. It still has a certain appeal to the Chinese cryptocurrency circle, and the increase in cryptocurrency usage scenarios can further enhance Hong Kong’s position in the encryption field. In the long run, agglomeration effects will be formed from the two major directions of talent and capital, promoting the vigorous development of Hong Kong’s Web3 industry.

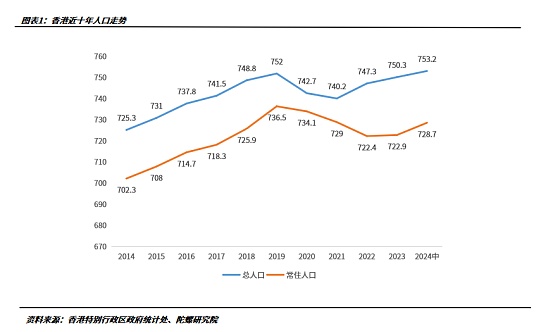

Looking at Hong Kong's planning in recent years, in addition to new capital immigrants, since the end of 2022, the Hong Kong Special Administrative Region Government has successively issued a number of measures to attract foreign talents to Hong Kong, including optimizing the existing talent admission program policies such as the Quality Talent Scheme, the newly launched High Talent Scheme and other initiatives to diversify talent recruitment and enrich Hong Kong's talent pool. The reason for the launch is very simple: there are too many people running around in Hong Kong. Before 2022, Hong Kong's permanent population declined for five consecutive years, from 7.365 million in 2019 to 7.224 million in 2022, while the departure data was even more obvious. From July 2020 to June 2023, 6.33 million Hong Kong residents left Hong Kong through the airport, of which only 5.8 million returned to Hong Kong. In other words, the net number of people leaving Hong Kong in three years was as high as 530,000, which is almost 7% of the permanent population.

From the current perspective, the introduction plan has achieved remarkable results. According to the summary of the Hong Kong Immigration Department, in 24 years, a total of nearly 140,000 visas for various talent entry programs were successfully approved, an increase of 4,000 over 23 years. As of January 2, since the launch of the "New Capital Investor Entrance Scheme", Hong Kong has successfully received more than 750 applications, with an estimated total investment of more than HK$22 billion. Unfortunately, at this stage only two applicants are involved in the use of crypto assets. In addition, under the macro-economic background of contraction in recent years, Hong Kong's local economy has also been hit. According to a report by the Hong Kong Economic Journal, Hong Kong's retail sales in December last year were 32.8 billion yuan, a year-on-year decrease of 9.7%, marking the 10th consecutive month of decline. The report also mentioned that cryptocurrency is popular among young people and has become one of the external pillars of Hong Kong's consumer market.

Against various realistic backgrounds, Hong Kong's attention to the Web3 field has not decreased but increased. Looking at the past year alone, Hong Kong's window characteristics have become increasingly prominent. It has taken into account both supervision and inclusiveness in the direction of virtual assets, presenting a situation of perfect policies and ecological support, and has made significant progress in product innovation, platform licensing, and extension of the regulatory framework.

From the product side, in 2024, Hong Kong approved the issuance of 6 Hong Kong virtual asset spot ETFs by three fund companies, namely China Asset Management (Hong Kong), Bosera International and Harvest Global ETFs, which greatly improved the purchase convenience for investors and promoted the compliance and product development of virtual assets. As of now, the three Bitcoin spot ETFs hold a total of 4,330 bitcoins with a total net asset value of US$425 million. The Ethereum spot ETF holds 2,083 Ethereums with a net asset value of US$56 million.

From the perspective of exchanges, the new virtual asset regulations have been implemented for one and a half years. As of now, there are 9 virtual asset trading platforms approved in Hong Kong, more than 31 securities firms have obtained virtual asset Type 1 license upgrades, and more than 36 asset management companies have obtained virtual asset Type 9 license upgrades. In the highly-watched Payfi field, the Hong Kong Monetary Authority has not only launched the Ensemble project to explore RWA and CBDC, but is also continuously extending from platforms to derivative institutions on the regulatory side and constantly improving regulatory regulations. Recently, the relevant bill committee of the Legislative Council of Hong Kong reviewed the "Stablecoin Bill" for the first time. If there are no exceptions, the bill will come into effect this year, successfully realizing the regulation of stablecoin licensees with the same business, the same risks, and the same rules, so that stablecoins have rules to refer to. Last year, Hong Kong launched a stablecoin issuer sandbox to continuously promote the system integration of traditional finance and Web3. The next step of the regulations will be in the OTC and custody directions. It is expected that the second round of public consultation on the supervision of over-the-counter (OTC) transactions of virtual assets will be completed this year, and a consultation plan on the licensing system for virtual asset custody service providers will be launched.

The environment conducive to the development of Web3 is being consolidated, but from the perspective of the market, given the limited market size and high costs, it will be difficult for Hong Kong to become the source of global Web3 development, and its influence on the global encryption market is almost negligible. This can be seen from the virtual asset ETF, which is more than an order of magnitude lower than the net assets of the US Bitcoin ETF of more than US$111.78 billion. Even for this immigration policy, some crypto practitioners said that the price is high and the cost-effectiveness is not high. "It is better to go to Singapore or Australia than to go to Hong Kong with 30 million Hong Kong dollars. Dubai's golden visa is only 4.24 million Hong Kong dollars."

However, as mentioned before, Hong Kong did not plan to grab market share from the crypto market, but tried to build a new decentralized financial system based on traditional finance to fill the gap in virtual assets, that is, to consolidate the positioning of traditional financial centers, and to connect with the future era of digital asset trading from the perspective of innovation. This is also the reason why Hong Kong is currently focusing on the fields of stablecoins and RWA while developing virtual asset trading platforms through licensing regulations.

It’s the same old saying. Although Hong Kong is not the most active region for encryption, "small government, big market" also means security and stability. From the perspective of traditional capital, security is far more important than other factors.

Kikyo

Kikyo

Kikyo

Kikyo Kikyo

Kikyo Alex

Alex Hui Xin

Hui Xin Alex

Alex Kikyo

Kikyo Alex

Alex Brian

Brian Kikyo

Kikyo Alex

Alex