Author: Ignas Source: X, @DefiIgnas Translation: Shan Ouba, Golden Finance

The current general view is that every new L2 added will further exacerbate the problems of deteriorating user experience (UX) and decentralized liquidity, and is therefore bad news for ETH.

However, we have embarked on the "road of no return" of L2 expansion and cannot turn back.

It's time to redefine this narrative and view the launch of new L2s as good news for Ethereum.

Am I too naive to say this?

In fact, the L2 releases of Kraken and Uniswap are indeed good news for the Ethereum ecosystem.

You see, Kraken’s Ink and Unichain have joined the L2 race, but they are not independent L2s, but rather they have joined as members of the OP Superchain.

The first benefit of the OP Superchain Alliance is (eventually) a frictionless user experience between all member L2s.

The Superchain is a unified, interoperable chain network that is able to bring together teams that have traditionally been seen as competitors.

In addition, this also brings economic benefits to the OP Collective.

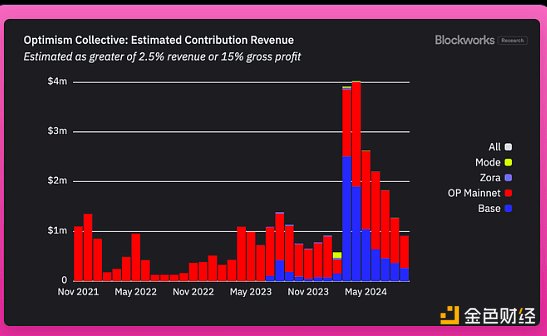

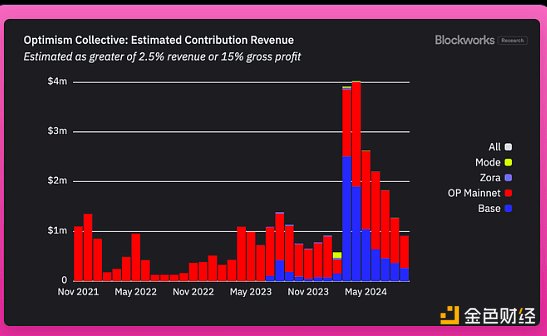

When a new L2 joins the OP Superchain, it commits to contribute the higher of the following two:

15% of its on-chain net profit (total sorter revenue minus fees paid to L1), or

2.5% of its total revenue.

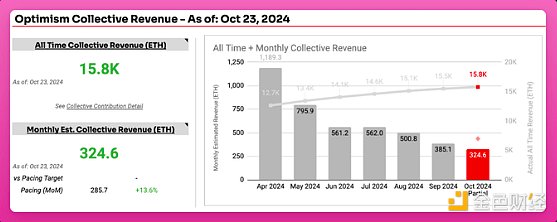

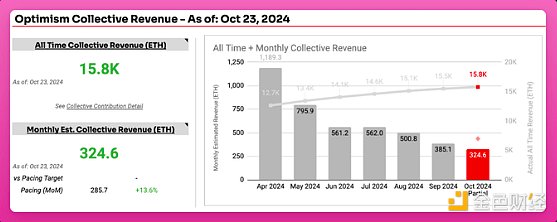

Currently, approximately 30 L2s in the OP Superchain have contributed 15,800 ETH (approximately US$40 million) to the Optimism Collective.

Currently Base and OP Mainnet are the largest contributors.

Revenues are expected to increase further with the addition of Kraken and Uniswap's Unichain.

These funds help drive the future development of Optimism and Ethereum:

Public Goods: Provide financial support for projects in the Ethereum ecosystem, such as infrastructure and development tools.

Network Growth: Supporting the development of OP chains and driving Ethereum adoption.

Innovation: Funding new technological advancements.

$40 million may not be much, but at least the Optimism Collective has a value accumulation mechanism.

Ethereum L1 can learn from Optimism and encourage L2s to at least invest value back into ETH on a social level, even if they can't do it technically.

This is a key factor to be bullish on ETH.

After reading Vitalik's four-part series on "Possible Futures for the Ethereum Protocol", I don't see any new, clear L2 profit models.

He mentioned that Ethereum-based rollups can improve L1 efficiency, ensure higher security, and bring more value to the main chain through tighter integration and seamless interoperability.

However, more and more major players are choosing to join the OP Stack instead of releasing Ethereum-based rollups.

Perhaps L1 can advocate for wider adoption of Ethereum-based rollups.

Vitalik also discussed how L1 can be expanded to apply to specific use cases that should remain on L1 so that value is retained.

As more L2s join the OP superchain under a shared revenue model instead of independently releasing L2s, financial support for the Ethereum ecosystem is increased.

This also provides more incentives to solve user experience and liquidity problems in each L2.

I can’t wait to see the “seamless flow of capital within the super chain” come true soon.

JinseFinance

JinseFinance