Author: Alex Felix Source: CoinFund Insights Translation: Shan Ouba, Golden Finance

TON Becomes a Mainstream Ecosystem for Crypto Applications.

The blockchain industry has built extensive web3 infrastructure that promises to bring about a vibrant garden of decentralized applications. Central to this vision is the promise of the “killer app” - that mysterious global product that will achieve cult-like status and magically convert the most skeptical technology users into web 2.0 users. However, while numerous applications have achieved moderate success among thousands or millions of users, that heart-warming breakthrough moment remains elusive year after year. However, a key consumer behavior shift is quietly emerging with The Open Network (TON), which is tightly integrated with Telegram's application and is expected to revolutionize the existing landscape. Telegram is an application that has supported cryptocurrency adoption, education, and coordination around the world since its early days, and is now paving the way for web3 at full speed. It has been with us…We believe that Telegram will now help solve the listing and user experience challenges of cryptocurrencies while driving transparent trading behavior by settling on a public blockchain.

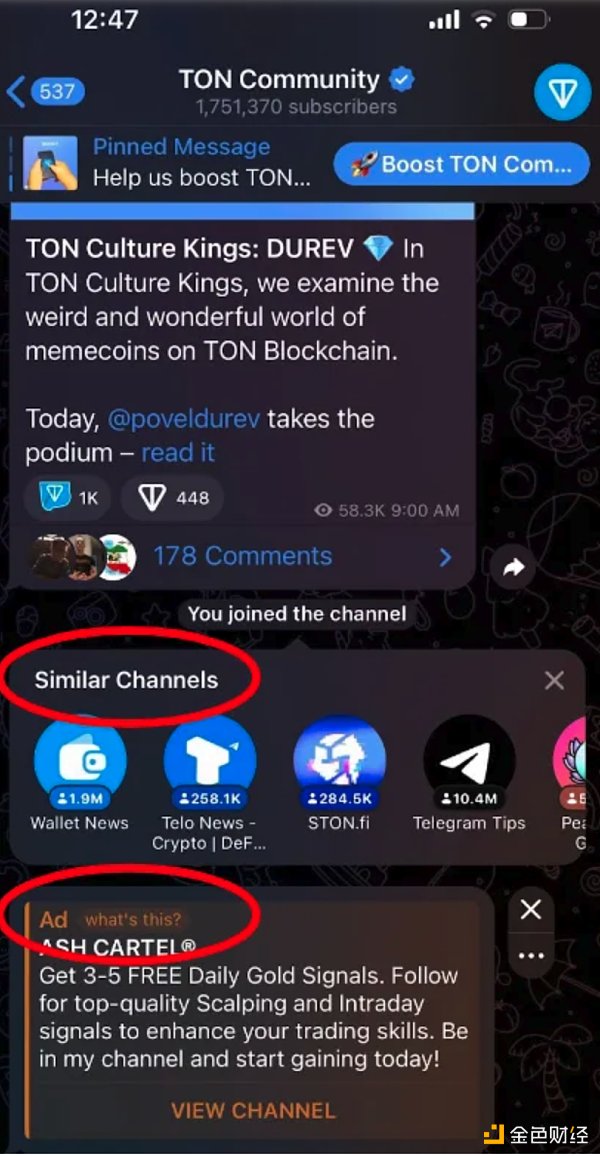

While most investor analysis focuses on the sheer size and potential of Telegram’s 900 million users, people overlook Telegram’s activation mechanism, which is a key link in converting these users into revenue and growth momentum. Our belief comes from Telegram’s elegant and slightly retro way of guiding real users to web3 while providing a more powerful business model for developers and content creators.

The TON ecosystem is addressing some of the key gaps in Web3 today. First, we should not try too hard to convert the next million users who are not related to the ecosystem, we need to connect with the mainstream, which means going to where the users are. Second, consumer services are too fragmented, making them difficult to discover. Finally, consumer cryptocurrencies must ensure secure transactions every time users interact with a new experience or contract. On the back of these corrective measures, Telegram's promotion policy and the release of mini-apps further support this packaging approach. Attempts to merge web3 with scaled applications have often failed due to immature infrastructure or regulatory challenges, as seen with Kik and Facebook; in many ways, this is the first organized technical roadmap for web3 designed by a large tech company with expertise and success in consumer technology.

A Correction to Web3’s Mistakes: Telegram Becomes the First Scaled User Container

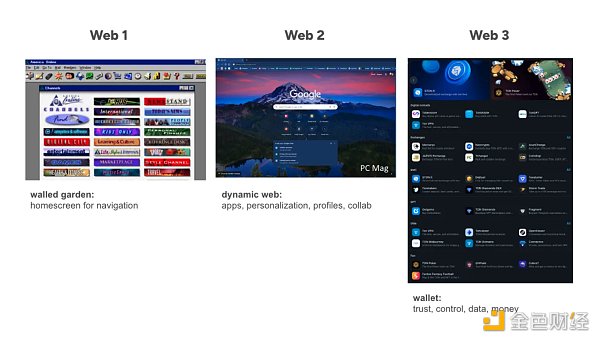

The early internet was a beacon for content discovery that was conservative at first but evolved into an intuitive, controlled landscape dominated by a few large platforms. Similarly, web3 needs a clear roadmap to guide users through its complexity. Telegram’s combination of web3 functionality with a familiar user experience marks a significant shift in the approach to creating user containers. Prior to this, decentralized applications were largely obscure and were mainly discovered by following insiders on non-mainstream platforms. Telegram’s embrace of open source blockchain technology is changing that, demonstrating how user-friendly design and developer freedom can drive innovation and widespread adoption.

The way the crypto industry asks new users to onboard is like navigating an unfamiliar city without road signs. The industry is still fumbling with the simplest questions: "What can I quickly read to get started?" Instead, people learn about crypto through friends and rely on them for a while, or quit altogether when they discover gas fees and transaction failures, or don't know how to use other dapps. 75% of Americans don't have enough confidence in the security or reliability of cryptocurrencies, and we haven't done anything to convince them. In a modern culture that emphasizes exploration and independence and values time as money, consumers hate being told to "figure it out on your own." Think of all the web 2.0 companies focused on online checkout experiences and conversions, not to mention the hundreds of experiences we have every day to make sense of the world’s information: in menus, on mobile screens, in the index of a book, and on an Apple TV. People need a guide.

In web3, wallets serve as a gateway to the decentralized realm. However, the real innovation lies in enabling users to seamlessly traverse the web3 landscape. Imagine a unified portal, reminiscent of the early days of AOL, seamlessly connecting users to preferred NFT marketplaces, DEXs, gaming platforms, and governance forums. We are witnessing the emergence of this new approach at the seed level, with independent company Top Labs building infrastructure to support early applications, including incubating STON.fi, one of our recent investments. As Telegram’s liquidity layer, STON.fi supports in-app swaps and can be easily linked directly from other apps, allowing mini-apps to be populated based on transaction needs. Mini-apps are superior to the bots we have seen so far because they can offer more complex and visually appealing interfaces, similar to fully functional web apps, rather than interacting with the bot primarily through messages and commands on a chat interface. The ecosystem is a work in progress, taking the playbook of other Layer 1 chains. Recently, Notcoin became the first successful web3 consumer application for TONs and has become a focal point for community awareness and adoption. The token went public two weeks ago with a market cap of $920 million, 100% of supply, and 35 million players.

Powerful and customizable business model with web3 safety rails

TON has a significant distribution advantage that will attract developers and content creators. Builders can now generate revenue for their services not only through transaction activity on the blockchain, but also through traditional ad-based revenue. While the former is familiar to web3 builders, the addition of attention-based strategies increases opportunities. Highlights so far:

50% of ad revenue will be shared with channel owners.

95% of sticker revenue will be shared with creators, and as of this month, 730 billion stickers have been shared.

Telegram is generating hundreds of millions in revenue on ads, and its marketplace development is still in its infancy.

Telegram is also monetizing its namespace and selling phone numbers, both of which have generated $350 million in revenue through the front-end service Fragment.

As one of the world’s largest messaging apps, Telegram has deep domain experience in preventing phishing and spam. The growth of its user base and the continued viability of the platform depend on it. Creators will only take advantage of these opportunities and bring their businesses to Telegram if they can ensure direct contact with their customers, unaffected by the overwhelming disruption that often hits popular services on more active networks. In this space, Telegram is a leader — you have to when you need to manage daily communications for 900 million users.

When merging a messaging tool with web3, it’s important to start from a strong position of consumer security. We need Telegram as a citizen of our ecosystem that also helps users avoid losing funds in non-custodial wallets. Mainstream users will not enthusiastically accept a future where one wrong click could empty your wallet. Ensuring safe adoption of cryptocurrencies and blockchain has been a key focus for our ecosystem and regulators around the world. Even basic protections can help accelerate growth. Web3 should eliminate hex addresses and continue its efforts to reduce phishing and spam, improve KYC processes using phone number verification, and increase online account security.

Similarly, regulators will want transparency into trading activity on the platform. By leveraging an open blockchain like TON for trade clearing to gradually reveal the black boxes of traditional platforms, a particularly high level of operational transparency will be established.

Conclusion

As one of the earliest investors in companies building on the platform, we are excited about the potential that Telegram and TON have for the future of web3. Our recent investments, such as STON.fi, which has already attracted $130 million in liquidity, reflect our confidence in the transformational impact of this integration. We have more announcements coming up as we continue to engage with all innovative projects within this ecosystem. The future of cryptocurrency lies in integrated applications, and Telegram is a pioneer.

ZeZheng

ZeZheng

ZeZheng

ZeZheng JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Others

Others Cointelegraph

Cointelegraph 链向资讯

链向资讯 Ftftx

Ftftx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph