Source: Bitcoin Magazine; Compiled by: Baishui, Golden Finance

A groundbreaking study by the Cambridge Centre for Alternative Finance (CCAF) shows that the United States currently dominates the Bitcoin mining market, controlling a whopping 75.4% of the global hash power. "The United States has consolidated its position as the world's largest mining center (accounting for 75.4% of reported activity)," the CCAF report said. The report is based on a survey of 49 mining companies, which account for nearly half of the Bitcoin network's hash power.

This concentration is equivalent to about 600 of the world's 796 exahashes per second (EH/s) of computing power, which raises a pressing concern: Is Bitcoin mining becoming overly concentrated in the United States? What risks does this bring to the future of this emerging asset?

U.S. Commerce Secretary and former Cantor Fitzgerald CEO Howard Lutnick recently shared his insights on the Trump administration’s vision to position the U.S. as a Bitcoin superpower. “To me, it’s a commodity, just like gold,” Lutnick said in an interview with Bitcoin Magazine’s Frank Kovar, highlighting Bitcoin’s fixed supply of 21 million coins. He outlined plans to “accelerate” U.S. mining through the U.S. Commerce Department’s Investment Accelerator Program, which streamlines the permitting process for miners to build off-grid power plants. “You could build your own power plant right next to [your data center]. I mean, think about it,” he said.

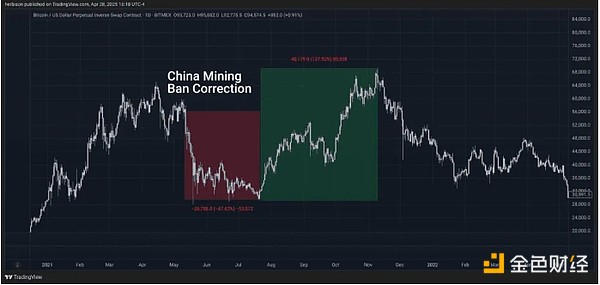

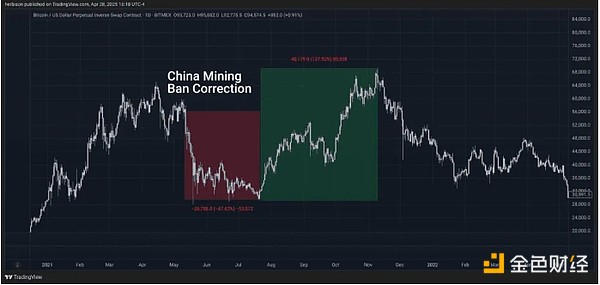

This pro-business stance has fueled the U.S. mining boom, but CCAF’s findings also reveal a downside: centralization. For years, Bitcoin enthusiasts have worried about China’s dominance, which peaked at 65-75% of global hashrate before the mining ban was implemented in June 2021. A 2025 study in Nature Communications noted: “In 2019, China dominated global Bitcoin mining, accounting for 65-75% of the total hash rate of the Bitcoin network.” When China banned mining, hash rate was dispersed globally, and many mines moved to the United States, attracted by states with abundant energy and favorable policies. This shift caused the market to correct by 50%, but also paved the way for a 130% increase at the end of the year, showing the market’s resilience.

While China’s historical concentration of hash rate has never led to network abuse, it has always been a concern. Today, with the United States holding 75% of the hash rate, similar risks are emerging. The Trump administration has been friendly to Bitcoin, but future governments could become hostile and use centralized computing power to control the network. Unlike China’s ban, future U.S. governments could attempt to regulate or manipulate mining, using executive powers such as sanctions to censor transactions—a threat exacerbated by the centralization of mining. The U.S. federal system offers a potential safeguard. The division of power between state and federal governments provides an effective resistance to excessive federal intervention. In states with active mining activity, officials and the public may perceive manipulation of the industry as undermining the value of Bitcoin, which in turn affects investors. This resistance could preserve the integrity of the network. A weakening of the U.S. monetary sanctions regime could work in our favor. Following the seizure of Russian Treasury bonds in 2022, some countries at odds with U.S. policy have reduced their purchases of U.S. bonds, weakening the fiat currency track that is abused in sanctions. The Trump administration’s shift toward controlling the flow of goods rather than money through tariffs could reduce the threat of monetary censorship. This shift buys Bitcoin time, as concentrated hashing power could easily become a soft target for federal intervention.

Nevertheless, American Bitcoiners must remain proactive. Deepening Bitcoin adoption and making it broadly integrated into the economy and the world can deter censorship, as attacks on the network can harm individual wealth and spark backlash. History also shows that miners adapt when displaced—China’s ban proves this—but governments learn their lessons. Rather than banning mining, future U.S. administrations may seek to control it and exploit centralization.

The Bitcoin industry faces a critical juncture. With the U.S. holding a whopping 75.4% of hashing power, even estimates as low as 50% represent significant centralization risks. Should we diversify globally or rely on U.S. mining dominance? As Lutnick’s vision moves toward realization, Bitcoiners must ensure that this sovereign currency remains resilient no matter who is in power.

Kikyo

Kikyo