Background

Currently, the Ethereum Rollup L2 ecosystem has taken shape, with an overall daily TVL of more than $37b, more than three times that of Solana and more than ⅕ of Ethereum. From the user's perspective, the recent average daily number of users of mainstream L2 has reached 158k, exceeding Solana's data of about 100k.

However, the short-term performance of Rollups' currency prices is not as good as expected. In terms of market value, among the mainstream Rollups, Arbitrum has a market value of $7.8b, Optimism has a market value of $7.3b, Starknet has a market value of $6.9b, and zkSync, which has just completed an airdrop, has a FDV of $3.5b, while Solana's FDV reached $74b during the same period. Recently, zkSync was launched, and its poor market performance did not meet the market's expectations for Rollups.

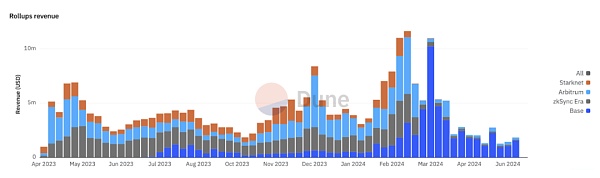

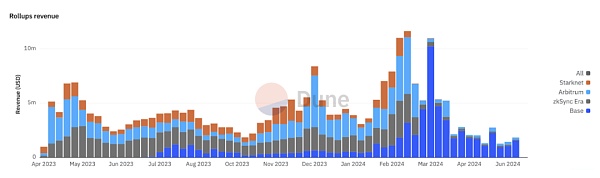

From the perspective of revenue, Ethereum's revenue in 2023 reached $2b, while Arbitrum and Op Mainnet, which performed well in the same year, had annual revenues of $63m and $37m respectively, which is a big gap with Ethereum. Base and zkSync, which entered the market this year and performed well, earned $50m and $23m in revenue in the first half of 2024, respectively, while Ethereum generated $1.39b in revenue during the same period, and the gap has not narrowed. Rollups have not yet achieved a revenue scale comparable to Ethereum.

The current low activity of some Rollups is certainly a reason, which is a problem faced by most public chains. What we want to know more is how well Rollups have fulfilled their mission as mass adoption infra, and whether their value is underestimated due to their current low activity?

Everything still has to go back to the earliest proposition. The birth of Rollups originated from the increasing congestion of Ethereum, and the fees reached a level that users could not accept. Therefore, Rollups were born with the purpose of "reducing transaction costs". In addition to the well-known Ethereum L1-level security, the advantages of Rollups also include its disruptive cost structure, the so-called "the more users, the cheaper Rollups".

If this can be well implemented, we believe that Rollups have irreplaceable value. A more reasonable cost structure can also improve the resilience of Rollups in the face of market changes. The continuous investment brought by healthy cash flow is the source of competitiveness, and protocols with advantages in profit margins will naturally have higher valuations and long-term competitiveness.

This article briefly analyzes the current economic structure of Rollups and looks forward to future possibilities.

1. Rollups' business model

1.1 Overview

The Rollups protocol uses Sequencer as the income and expenditure point, charging users fees for transactions on Rollups to cover the costs incurred on L1 and L2, and to obtain additional profits.

On the revenue side, the fees charged by Rollups to users include:

Potential fees that the protocol can capture by formulating its own strategies include:

On the cost side, it includes the L2 execution costs, which currently account for a small proportion, and the L1 costs, which account for the majority, including:

DA Cost

Verification cost

Communication cost

Rollups differ from other L2 business models in their cost structure. For example, the DA cost, which accounts for the largest proportion, is regarded as a variable cost that varies with the amount of data, while the verification cost and communication cost are more regarded as fixed costs to maintain the operation of Rollups.

From the perspective of the business model, we hope to clarify the marginal cost of Rollups, that is, to what extent the additional cost of an additional transaction can be less than the average cost of each transaction, to verify the specific extent to which "the more users, the cheaper the Rollup" is true.

The reason behind this is that Rollups batches data, compresses data, and verifies aggregation, resulting in high efficiency and low marginal cost compared to other public chains. Theoretically, the fixed cost of Rollups can be well amortized to each transaction, so it can even be ignored when the transaction volume is large enough, but this also needs our verification.

1.2 Rollups income

1.2.1 Transaction fee income

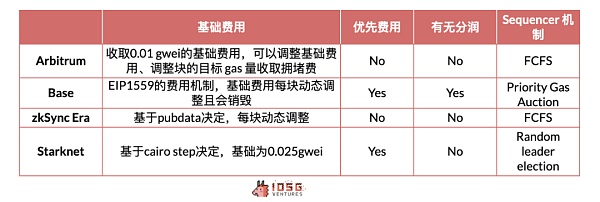

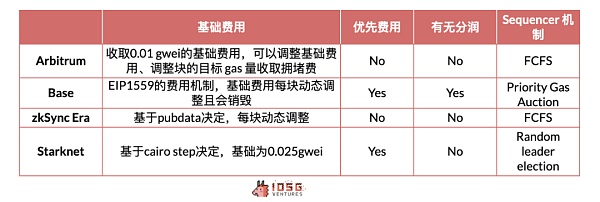

Rollups' main income comes from transaction fees, i.e. gas. The purpose of the fee is to cover the cost of Rollups and obtain part of the profit to hedge the risk of long-term L1 gas changes, as well as to obtain part of the profit. Some L2s will charge transaction priority fees to allow users to execute urgent transactions first.

Aribtrum and zkSync adopt the FCFS mechanism, that is, the order of transaction processing is first come first served, and do not support "queue jumping" requests. OP stack has adopted a flexible approach to such issues, allowing "queue jumping" for transactions paid for priority fees.

Source: IOSG Ventures

For users, the fees of Rollups L2 are determined by the lower limit base fee when the chain is less active. When the chain is busier, each Rollups will charge a congestion fee based on the degree of congestion (often rising exponentially).

Since Rollups' L2 overhead is extremely low (only off-chain engineering and operation and maintenance costs), and the execution costs collected are highly autonomous, almost all users' income for paying L2 fees will become the profit of the protocol. Due to the centralized operation of Sequencer, Rollups have control over the basic fee floor, congestion fees, and priority fees. Therefore, the L2 execution fee will be a "parameter" game of the protocol. Under the premise that the ecosystem is relatively prosperous and the price does not arouse user disgust, the amount of execution fees can be designed at will.

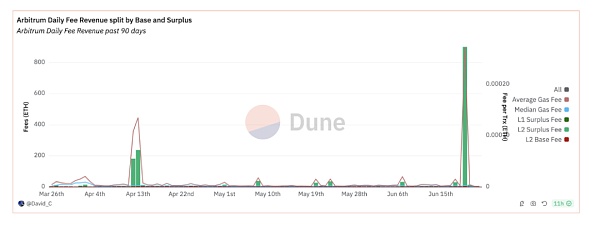

Source: David_c @Dune Analytic

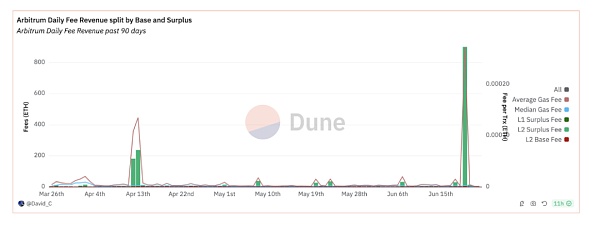

1.2.2 MEV Income

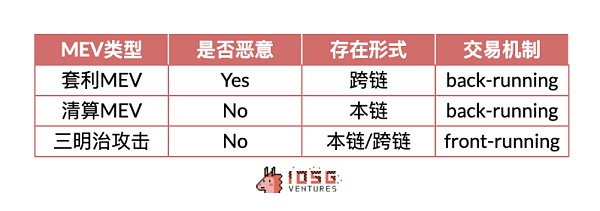

MEV transactions are divided into malicious MEV and non-malicious MEV. Malicious MEV is a front-running transaction similar to a sandwich attack, which is more about robbing the user's transaction value. For example, in a sandwich attack, the attacker will insert his own transaction before the user's transaction, causing the user to buy at a higher price or sell at a lower price, which is the so-called "sandwich".

Non-malicious MEV is back-running transactions such as arbitrage and liquidation. Arbitrage can balance prices between different exchanges and improve market efficiency; liquidation can remove bad leverage and reduce systemic risk, which is considered a beneficial MEV behavior.

Source: IOSG Ventures

Unlike Ethereum, Rollups does not provide a public mempool. Only the sorter can see the transaction before it is finalized. Therefore, only the sorter has the ability to initiate MEV on the L2 chain. Since most of the L2s are centralized sorters, there is no possibility of malicious MEV for the time being. Therefore, the current MEV income will need to consider arbitrage and liquidation types.

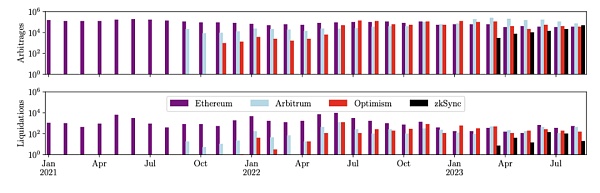

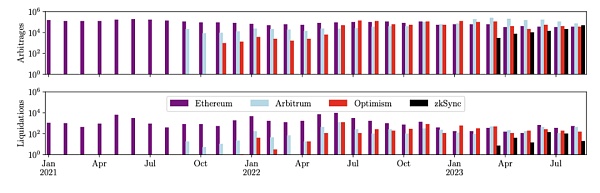

According to the research of Christof Ferreira Torres and others, they replayed the transactions on Rollups and concluded that Arbitrum, Optimism, and Zksync have non-malicious MEV behavior on the chain. The three chains have currently generated a total of $580m in MEV value, which is enough to be a source of income worthy of attention.

Source: Rolling in the Shadows: Analyzing the Extraction of MEV Across Layer-2 Rollup

1.2.3 L1-related costs

This part is the fees charged to users by Rollups to cover L1-related costs. The specific cost structure will be discussed later. Different Rollups charge differently. In addition to the cost of predicting L1 gas to cover L1 data, Rollups will also incur additional fees as a reserve fund to deal with future gas volatility risks, which is essentially an income for Rollups. For example, Arbitrum will add a "Dynamic" fee, and OP stack will multiply the fee by the "Dynamic Overhead" coefficient. This part of the fee was estimated to be about 1/10 of the DA fee before the EIP4844 upgrade.

1.2.4 Profit Sharing

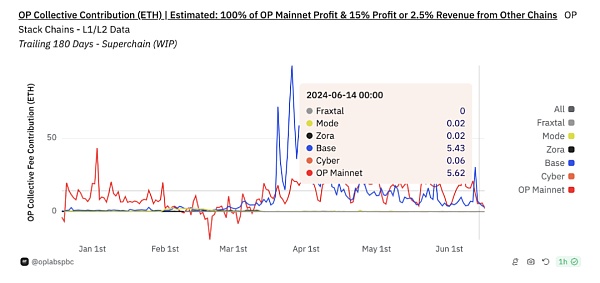

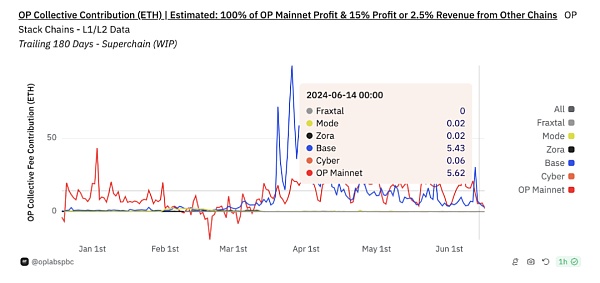

Base will be relatively special due to the use of OP stack. There is a profit sharing. Base promises to contribute 2.5% of total revenue/15% of the profit after deducting the cost of submitting data to L1 in L2 transactions, whichever is higher, to OP stack. In return, Base will participate in the on-chain governance of OP Stack and Superchain and obtain up to 2.75% of the OP token supply. According to recent data, Base contributes 5 ETH/day to Superchain's revenue.

We can see that Base provides a considerable proportion of Optimism's revenue. In addition to cash flow, the healthy network effect also makes the OP Stack ecosystem more attractive to users and the market. Although some performances of Arbitrum, such as TVL or stablecoin market value, are higher than Base + Optimism, it is currently unable to exceed the latter's trading volume and revenue. This can also be seen from the P/S ratio of the two - after considering Base's revenue, $OP's PS ratios are 16% higher than $ARB, reflecting the additional value that the ecosystem brings to $OP.

Source: OP Lab

1.3 Rollups cost

1.3.1 Ethereum L1 data cost

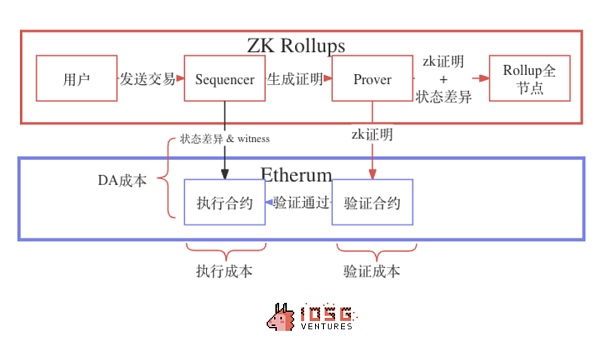

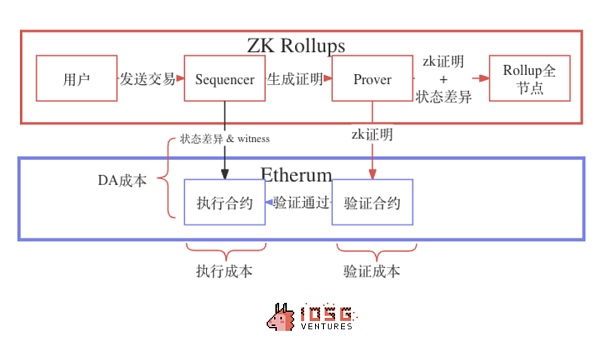

The specific cost structure of each chain is different, but the major categories can be basically divided into communication cost, DA cost, and verification cost unique to ZK Rollups

Communication cost: mainly includes state updates between L1 and L2, cross-chain interactions, etc.

DA cost: includes publishing compressed transaction data, state roots, ZK proofs, etc. to the DA layer.

Before EIP4844, the main cost of L1 came from DA cost (more than 95% for Arbitrum and Base, more than 75% for zkSync, and more than 80% for Starknet)

After EIP4844, DA cost dropped significantly, and due to different L2 mechanisms, the degree of DA cost reduction is also different, with a cost reduction of about 50%-99%.

1.3.2 Verification cost

Mainly used by ZK Rollup to verify the reliability of Rollups transactions through ZK means.

1.3.3 Other costs

Mainly include off-chain engineering and operation and maintenance costs. Due to the current operation mode of Rollups, the operating cost of the node is close to the cost of the cloud server, which is relatively small (close to the cost of the enterprise AWS server)

1.4 Comparison of L2 profit and other L1 data

At this point, we have a general understanding of the overall income-expenditure structure of Rollup L2, and we can make a comparison with Alt L1. Here, Rollups chooses Arbitrum, Base, zkSync, and Stakrnet weekly average data as the data source.

Source: Dune Analytic, Growthepie

It can be seen that the overall profit margin of Rollups is close to that of Solana, and it has obvious advantages over BSC, reflecting the excellent performance of Rollups' business model in profitability and cost management.

2. Rollup Horizontal Comparison

2.1 Overview

The fundamentals of Rollups vary significantly at different stages of development. For example, when there is an expectation of issuing coins in a transaction, Rollups will see a significant increase in transaction volume, and the resulting fee income and expense expenditure will also increase significantly.

Source: IOSG Ventures

Most Rollups are still in their early stages, and absolute profitability is not that important to them. It is more about ensuring a balance between income and expenditure and long-term development. This is also the concept that Starknet has always declared not to charge users additional fees and make profits from this.

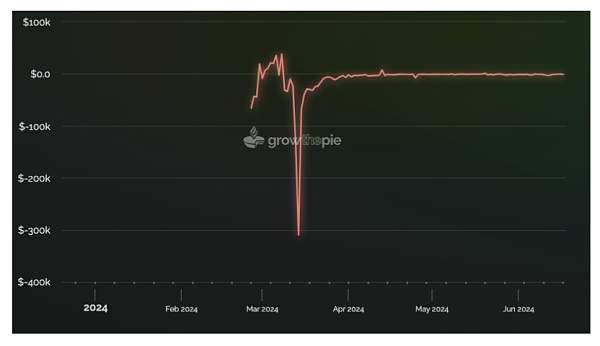

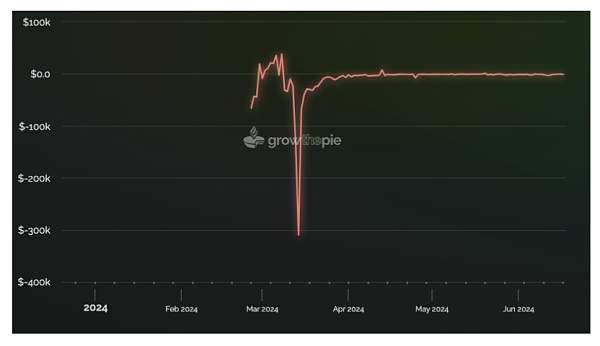

However, since mid-March, Starknet has continued to operate in a state of negative returns. Its on-chain activity performance is indeed poor, but what is the root cause of the negative returns, and will it continue for a long time?

Let us continue to delve deeper into this question. In fact, the revenue structure of Rollups is relatively similar, but the marginal cost structure brought by the Rollup mechanism of each chain is different, and the different calculation mechanisms such as data compression methods also bring about differences in costs.

Source: IOSG Ventures

We hope to compare costs in Rollups to help us compare the characteristics of different Rollups horizontally.

2.2 Cost structure of different types of L2

ZK Rollup

ZK Rollups differ mainly in verification costs, which can often be regarded as their fixed costs and are difficult to collect through amortized handling fees. This is also the root cause of Rollups’ inability to make ends meet.

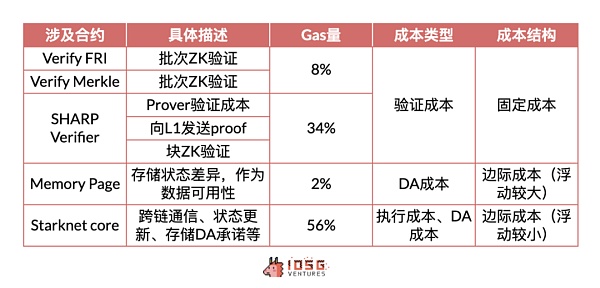

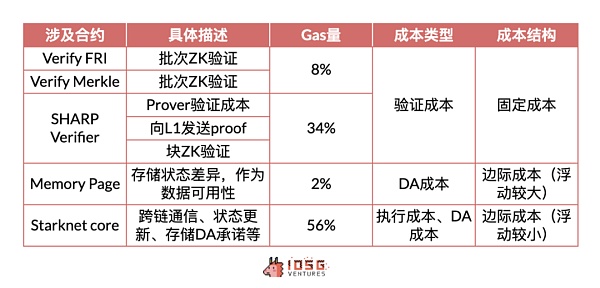

Source: David Barreto@Starknet, Quarkslab, Eli Barabieri, IOSGVentures

This article mainly discusses two relatively mature ZK Rollups with transaction volume.

Starknet

Starknet uses its own verification service SHARP. After transaction sorting, confirmation, and block generation, the batches are constructed through SHARP to build transaction proofs, which are sent to the L1 contract for verification. After passing, the proofs are sent to the Core contract.

The fixed costs of verification and DA in Starknet come from blocks and batches respectively.

Source: Starknet community - Starknet Costs and Fees

The variable costs in Starknet increase with the number of transactions, mainly DA costs, which theoretically do not generate additional expenses. In fact, it is even the opposite - Starknet's transaction fees are charged per write, but its DA cost depends only on the number of memory cells updated, not the number of updates per cell. Therefore, Starknet previously charged too high DA fees.

There is a time difference between the collection of transaction fees and the payment of operating costs, which may lead to partial losses or profits.

Therefore, as long as transactions are still being generated, Starknet needs to continue to produce blocks and pay the fixed costs of blocks and batches. At the same time, the more transactions there are, the more variable costs need to be paid. Fixed costs do not significantly increase marginal costs

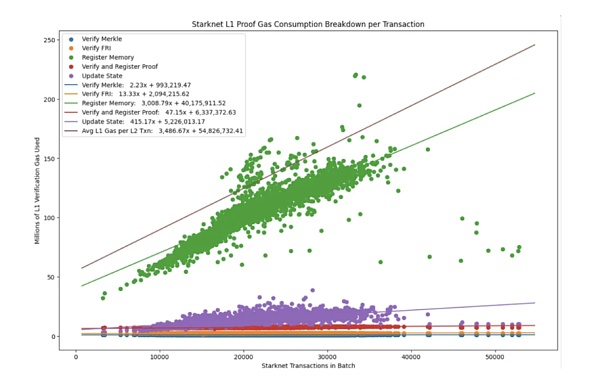

Source: Eli Barabieri - Starknet User Operation Compression

Since Starknet has a computing resource limit for each block (Cairo Steps), its gas fee calculation method is based on computing resources and data size, covering fixed costs and variable costs respectively. Since the cost of block/batch is difficult to amortize to each transaction, but since each block is closed after reaching a certain computing resource (fixed cost is triggered), part of the fixed cost can be calculated and charged through the dimension of computing resources.

However, due to the limitation of block time, if the transaction volume is insufficient (the amount of computing in a single block is insufficient), the computing resources cannot measure the price that needs to be amortized well, so the fixed cost still cannot be fully covered. At the same time, the "limitation of computing resources" will be affected by the upgrade of Starknet network parameters. This is reflected in the huge losses in short-term operations after EIP4844, which were not alleviated until the computing resource parameters in the fees charged were adjusted.

Source: Growthepie

Starknet's charging model cannot effectively cover fixed costs in every transaction, so when the Starknet mainnet is updated and the transaction volume is extremely low, negative income will occur.

zkSync (zkSync Era)

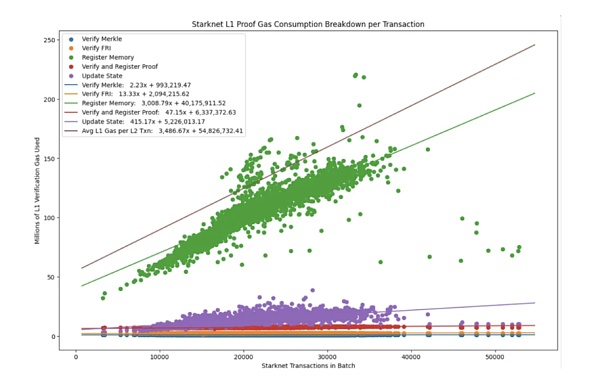

The zkSync era switched from block verification to batch verification and storage state differences after the Boojum upgrade, effectively reducing verification and DA costs. The process is basically similar to Starknet, the Sequencer submits the batch to the Executor contract (state difference and DA commitment), the proof node submits the verification (ZK proof and DA commitment), and the batch is executed after the verification is passed (executed once every 45 batches); the difference is that Starknet has verification costs for both blocks and batches, while zkSync only has verification costs for batches.

Cost Comparison between zkSync and Starknet

Starknet batch size is much larger than zkSync Era, which has a transaction limit of 750 or 1,000 per batch, while Starknet has no transaction limit.

Source: IOSG Ventures

In this way, Starknet has stronger scale capabilities. Since each block has computing resource limitations, the ability to process more transactions and batches in a single block makes it perform better in high-frequency transactions and scenarios where a large number of simple operations need to be processed, but when the transaction volume is small, there will be a problem of excessive fixed costs. zkSync's compression efficiency and flexible block resources make it more advantageous when it needs to flexibly respond to L1 gas price fluctuations and lack of activity on its own chain, but there will be limitations in terms of block speed.

For users, Starknet's charging model will be more user-friendly, less related to L1, and have a stronger scale effect. zksync's fees are more efficient but will fluctuate more with L1.

For the protocol, in the low-activity stage, Starknet's high fixed costs will bring more losses, and zkSync will be more suitable for this scenario. In the high-activity stage, Starknet is more suitable for a large number of high-frequency transactions and controlling costs. The current mechanism of zkSync may perform slightly worse in high transaction volumes.

2.3 Optimistic rollup

The cost structure of Optimistic Rollup is relatively simple. In the absence of verification costs, users only need to pay the computing cost of L2 and the DA cost of publishing to L1 data. Among them, the publication of the state root is related to block production, which is more of a fixed cost, while the upload of compressed transactions is a variable cost that is easy to estimate and easy to amortize.

Compared with Zk Rollup, it has lower fixed costs and is more suitable for scenarios with appropriate transaction volumes. However, since each transaction needs to include a signature, the variable cost of DA will be higher, and the marginal cost advantage in the large-scale adoption stage will be relatively smaller. Source: IOSG Ventures Based on the current scale of adoption, the fixed costs of ZK Rollup may lead to a higher fee floor for unsubsidized transactions, which brings costs to users compared to OP Rollups, but ZK's advantage lies clearly in scale: High transaction volume and proof aggregation will share the verification costs, and ultimately the marginal cost saved by L1 will exceed Optimism Rollups; running Validiums/Volitions and DAs that only require state differences, faster withdrawal speeds, etc. will be more suitable for scale-based economic needs and RaaS ecology.

2.3 Data Comparison

Revenue

The gas fee charged by Rollups to users shows that Base has higher revenue, Starknet has lower revenue, and Arbitrum and zkSync are on par. The difference in transaction volume leads to horizontal and vertical gaps, so we calculate the revenue per transaction. It can be found that before the EIP4844 upgrade, Arbitrum's revenue per transaction was higher, and after the upgrade, Base's revenue per transaction was higher.

Source: IOSG Ventures

Cost

From the perspective of the cost of each transaction, before EIP4844, Base had too high a transaction cost due to the high DA cost, and was actually in a situation of high marginal cost. The cost advantage due to the scale effect was not reflected. After EIP4844, with the significant reduction in DA costs, Base's transaction cost per transaction plummeted, and it is currently the lowest transaction cost among all Rollups. Compared with OP and ZK, it can be seen that OP Rollups is a greater beneficiary of the upgrade. The actual cost of StarkNet's L1 DA can be reduced by about 4 to 10 times, which is slightly less than an order of magnitude of OP Rollups. This is also consistent with theoretical inferences: in the EIP-4844 upgrade, the benefits of ZK Rollups are not as great as those of OP Rollups. The fee performance of ZK Rollup after the upgrade also reflects the impact of fixed costs on it.

Source: IOSG Ventures

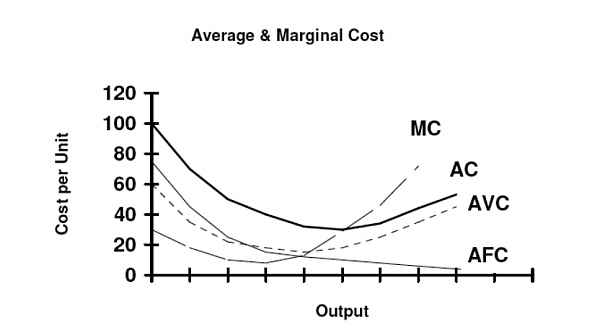

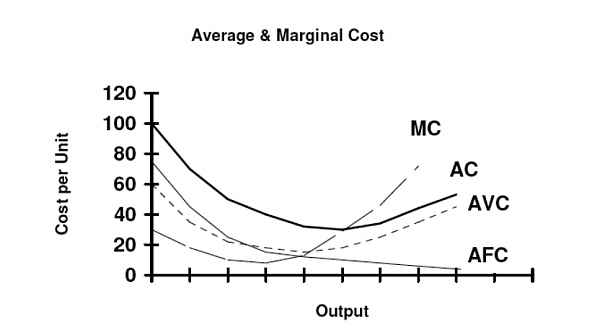

Profit

According to the data, Base has the highest gross profit due to scale effect, far exceeding Arbitrum, which is also Optimistic. Starknet, which is also a ZK Rollup, has a negative transaction gross profit due to its low transaction volume and cannot cover fixed costs. zkSync is positive but is also limited by fixed costs, which is lower than OP Rollup. The upgrade of EIP4844 does not directly help the profit margin - the main beneficiaries will be users, whose fee costs will be greatly reduced. Source: IOSG Ventures 3. Summary 3.1 Cost side 3.1 Cost side At present, most Rollups are still in the first half of their Margin curve. As the transaction volume increases, the marginal cost gradually decreases, and the average fixed cost will also be significantly reduced. However, after the rise of Ethereum L1 or L2 ecological transaction volume in the future, the increase in average transaction costs due to the capacity of the network will cause the marginal cost to gradually increase (as can be seen from the performance of Base3-5 months), which is an issue that cannot be ignored in the long-term development of Rollup. While paying attention to the cost changes caused by short-term adoption, we also need to pay attention to the efforts made by Rollups on the long-term cost curve.

Source: Wikipedia - Cost curve

In the short term, for Rollups, reducing marginal costs more effectively is the best way to establish barriers, among which adjusting the revenue and cost model according to market conditions is a better solution.

3.2 Revenue side

In order to maintain long-term competitiveness, the protocol will not charge users extra fees as much as possible, and even subsidize fees to keep user spending as low and stable as possible, as we can see in the current situation of Starknet. Priority fees will certainly bring more income, but the premise is that the chain must be sufficiently active.

After EIP4844, the income of some Rollups has dropped significantly (such as Arbitrum). This is because the hidden income of DA data fees, which is a part of the profit difference, has been almost wiped out. The revenue model of Rollups will become relatively simple, mainly mining from L2 fees. As the transaction volume grows, the priority fees and congestion fees generated will be important components of revenue. At the same time, in terms of active income, extracting MEV through Sequencer will also be one of the important sources of income for Rollups in the future.

In general, the business model of Rollups does have the advantage of economies of scale, especially ZK Rollups. The current market conditions are not suitable for Rollups to play their advantages, and they need to wait until the Base moment similar to March-May this year. The diversity of business models and the adaptability of different Rollups in different market conditions also allow us to see the far-reaching considerations of the Ethereum L2 Rollups ecosystem.

References

https://community.starknet.io/t/starknet-costs-and-fees/113853

https://medium.com/nethermind-eth/starknet-and-zksync-a-comparative-analysis-d4648786256b

https://blog.quarkslab.com/zksync-transaction-workflow.html

https://www.alexbeckett.xyz/the-economics-for-rollup-fees/

https://davidecrapis.notion.site/Rollup-are-Real-Rollup-Economics-2-0-2516079f62a745b598133a101ba5a3de

https://arxiv.org/pdf/2405.00138

https://blog.kroma.network/l2-scaling-landscape-fees-and-max-tps-fe6087d3f690

https://forum.arbitrum.foundation/t/rfc-arbitrum-gas-fees-sequencer-revenue/24730

https://x.com/ryanberckmans/status/1768290443425366273

https://mirror.xyz/lxdao.eth/CnZFjWYHbR1Vu9Z4UPa7JKDceLtVtNf1EfsQ98Zq7JI

Kikyo

Kikyo