Source: C Labs Crypto Observation

The crypto community is talking about AI everywhere, but everyone is holding AI Agent tokens that they rushed into in January and are about to go to zero. I believe many people will ask such a soul-searching question: Is this AI+Crypto reliable?

Reliable, right?

It seems that there are really no serious projects coming out,

Not reliable, right?

The White House in the United States really has an AI and crypto czar, who held a press conference some time ago. It is unlikely that the US government will also organize a group to fool us poor leeks, right?

After a long period of thinking and sorting out,

Today, Da Piaoliang will discuss with you from the perspective of macro to micro, whether this combination of AI and encryption is really something or just another round of narrative of cutting leeks.

Let's get started without further ado~

Macro aspect: Double insurance of dollar hegemony

Dollar hegemony is the core interest of the United States

Speaking of why the United States supports AI and encryption, it has also set up David Sacks, the White House czar, to deal with AI and encryption affairs.

As early as 1965, French General Charles de Gaulle realized that dollar hegemony was an exorbitant privilege of the United States. The major actions of the United States in the 20th century were all carried out around the core interest of the dollar privilege:

First, a large amount of gold reserves were accumulated through World War II.

Then, after the war, the Marshall Plan was promoted to export the dollar to the world;

Then the Bretton Woods system was established;

A large amount of gold was consumed to ensure the hegemony of the dollar

Then oil settlement was controlled to establish the petrodollar system

Until now, the US industrial chain has been transferred to the world, and this globalized trade system has been created for the hegemony of the dollar.

If we understand it from this perspective, it is not difficult to find that the new American AI and encryption czar David Sacks often mentions the word "American Dollar Dominance"

Competitors of the dollar hegemony

The United States wants to maintain the dollar hegemony. They mainly have to guard against competitors from two aspects. On the one hand, it is the competition from other sovereign currencies:

Today, when peaceful competition is the mainstream, the main strategy of the United States in competing with other sovereign currencies is to maintain its leading position in technology.

After the end of World War II, the United States continuously bet on important emerging technologies such as semiconductors/Internet. Now the most important emerging technology in the United States is AI.

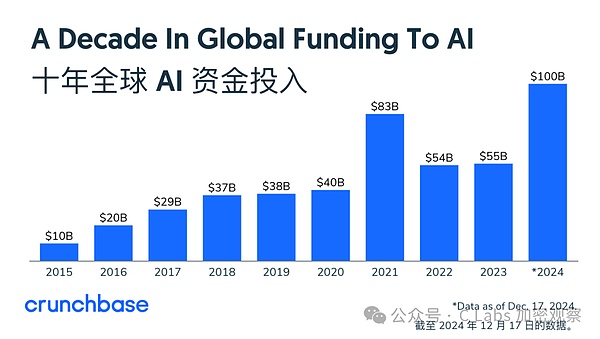

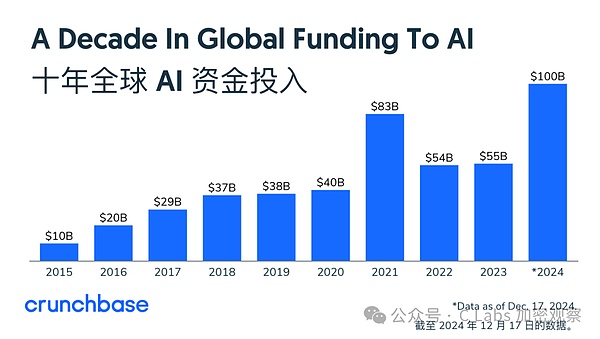

It is for this reason that American VCs have invested heavily in AI over the past decade, with AI investment reaching $100 billion in 2024, a record high.

Another traditional competitor of the US dollar is gold. Before World War II, the world was dominated by gold, with gold reserves accounting for more than 90% of the world.

However, after the disintegration of the Soviet Union, the United States has become unrivaled in the world. The proportion of gold as a global reserve asset has dropped to 10%, while the US dollar has reached 60%:

In recent years, it seems that the status of the US dollar is not as stable as before.

Many central banks have chosen to return to gold, so that the US dollar and gold have been competing for international reserves.

The value of gold as a reserve currency is based on consensus. Speaking of consensus, our friends in the crypto circle can be said to be very familiar with it, right?

The value of Bitcoin is based on consensus.

But the difference is that the output of gold is distributed all over the world. If gold becomes a reserve currency, the United States will have no privileges. Moreover, the United States is known as the world's largest gold reserve country, but it may not really have it.

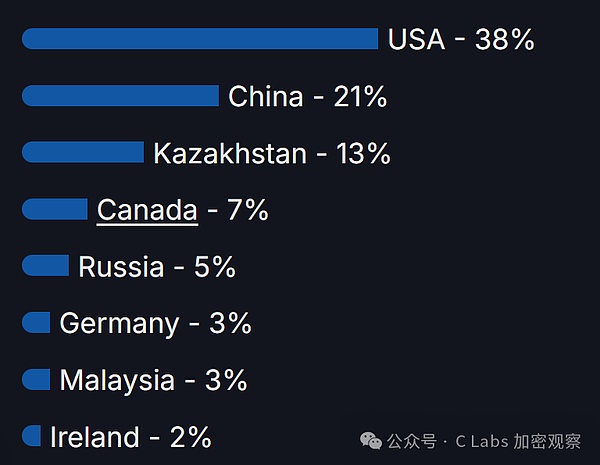

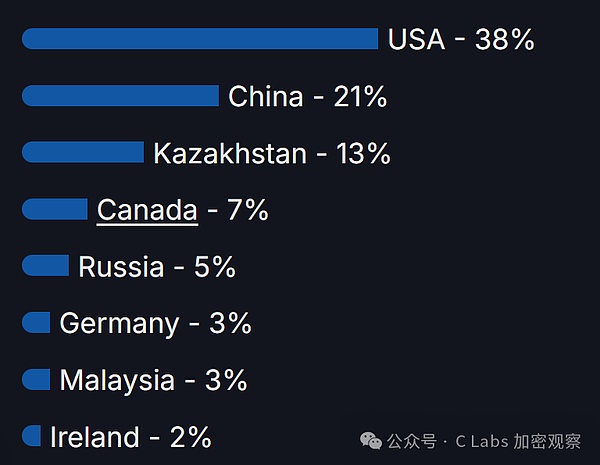

Bitcoin needs to be maintained by the computing power of miners. As long as the computing power is controlled, the United States can control Bitcoin.

Although Trump only expressed his support for Bitcoin in 2024, the battle for computing power has already begun:

Now the Bitcoin computing power in the United States accounts for 38% of the entire network. Together with Canada, which completely listens to the United States, the two of them have already controlled 45% of the computing power of the entire network. There is basically no problem in exceeding 51% in two years.

For the United States, using its own controllable Bitcoin to seize the status of gold as the world's reserve currency is also a means to weaken gold and consolidate the hegemony of the US dollar.

Have you noticed? Now basically all cryptocurrencies are denominated in US dollars! !

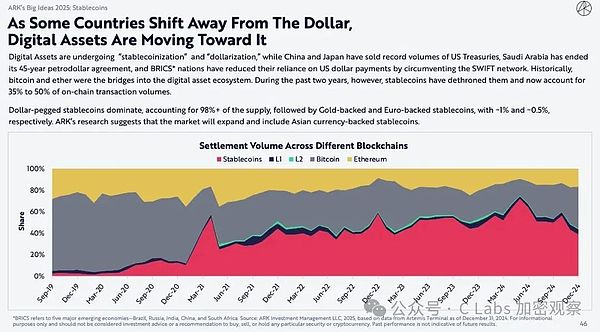

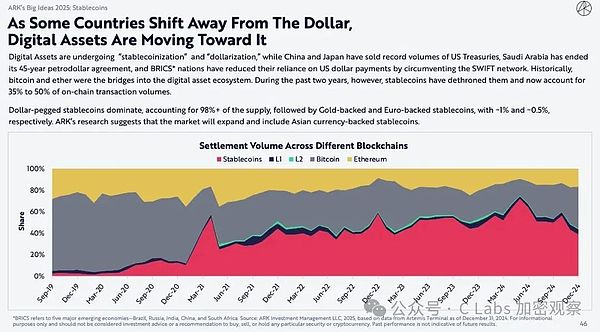

According to Wood Sister's latest research report, many countries are "de-dollarizing". Saudi Arabia has ended the 45-year petrodollar agreement. The BRICS countries have reduced their reliance on US dollar payments by bypassing the SWIFT network. The direct impact is that China and Japan have cumulatively reduced their holdings of US$200 billion in US Treasury bonds since 2021, accounting for almost 10% of the holdings of the two countries.

However, the crypto industry, because it is all denominated in US dollars, actually makes up for this part of the loss.

In particular, the scale of stablecoins has increased from US$100 billion in 2021 to US$300 billion. The incremental US$200 billion can almost make up for the scale of national debt sold by China and Japan~

Therefore, at the macro level, although there is no high expectation for the integration of AI and encryption, AI and encryption have been regarded as the same strategic height by the United States.

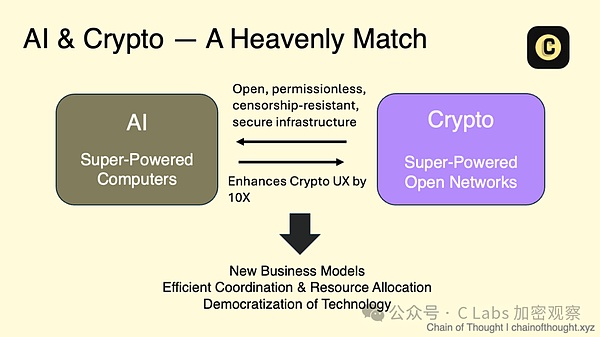

Meso-level: AI and encryption, a natural match

AI needs money

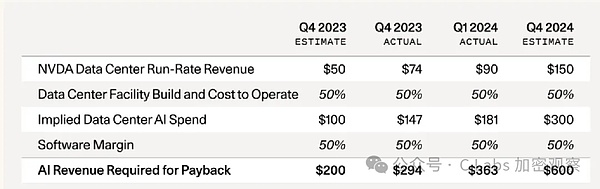

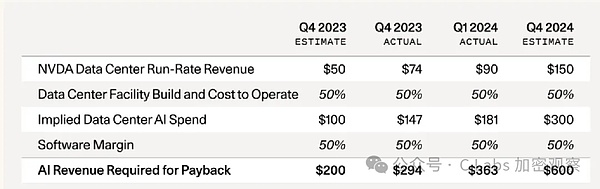

In fact, the development of the AI industry in recent years has not been satisfactory. Although the investment is huge, there are not many projects that can survive on their own.

The AI industry has developed to this point. If the entire industry continues to rely on VC transfusions like this, it may not be enough to suck the blood of the entire VC industry dry in a few years.

Is there any way to face this situation?

At present, it seems that the currency is issued.

The essence of our encryption industry is an industry that issues token assets. Whether these tokens are valuable depends mainly on faith.

The AI industry is the industry with the most faith in the whole society in recent years. Everyone believes that with the development of time, AI will be omnipotent, but it just can't make money for the time being.

Isn't this just like dry wood meeting fire, or meat buns meeting dogs?

AI should be settled with cryptocurrencies

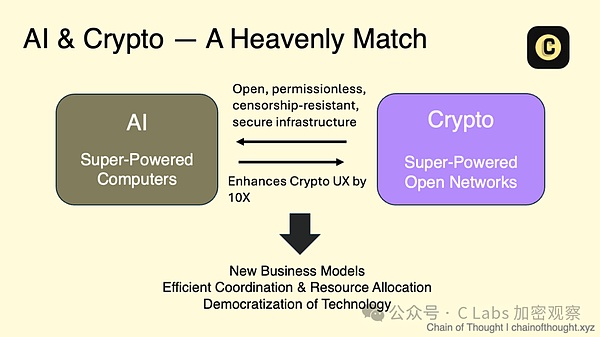

My cousin CZ once said something that I agree with: the currency for AI is crypto.

The development of AI requires massive amounts of data/computing power and energy, and many cryptocurrencies have integrated these AI infrastructures.

Moreover, both AI and cryptocurrencies are online 24 hours a day, which is very suitable for execution through smart contracts.

Whether it is the training or use of AI models, they can be achieved through tokenization, which is called tokenized AI.

In addition, AI Agent became very popular at the beginning of the year, which made many AI developers rich, and I believe it also made many AI project parties jealous.

While encryption brings wealth effects to AI Agent developers, AI Agent can also provide application scenarios for encryption.

Compliance obstacles

So AI not only needs encryption, but is also very suitable for issuing coins.

In this context, why don’t AI giants enter the market?

In fact, AI giants have thought about it. Didn’t OpenAI’s Ultraman issue Worldcoin?

But if you want the current AI giants to issue coins, the most important thing is to clearly define the definition of tokens, whether they belong to securities, commodities, or collectibles.

That is the encryption regulatory framework often mentioned in the industry.

If these AI giants are punished by the SEC due to compliance issues, which in turn affects the stock price of existing shareholders or future listing, it can be said that the gains do not outweigh the losses.

However, according to David Sacks's recent press conference, although this regulatory framework is one of his top priorities at present, it may not be completed until the second half of this year.

Therefore, at the meso level, encryption and AI are a natural match and are very suitable for integrated development.

But before the implementation of compliance, we see more encryption projects trying to take advantage of AI's popularity, and AI giants who are cautious are slow to embrace encryption even if they have the impulse in their hearts.

Micro: Three types of encryption AI projects

Although the regulatory framework for encryption has not yet been clarified, many projects combining encryption and AI have been implemented.

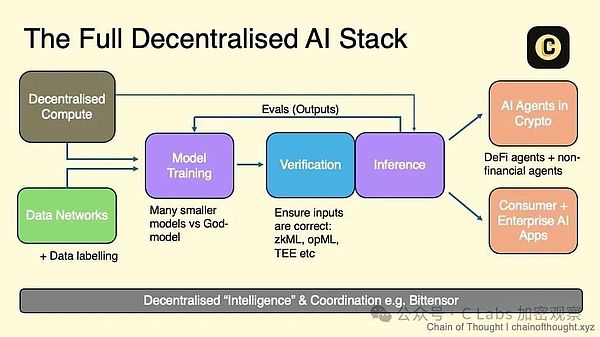

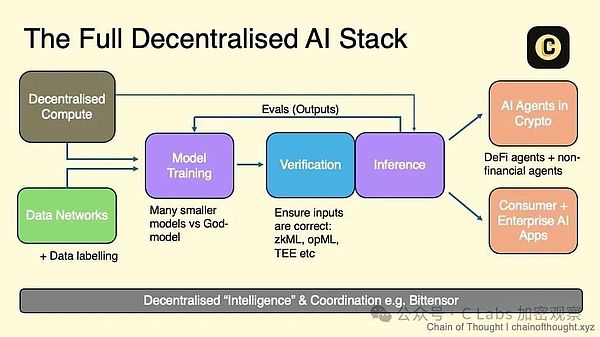

These AI encryption projects are divided into three types: AI infrastructure, tokenized AI, and AI applications:

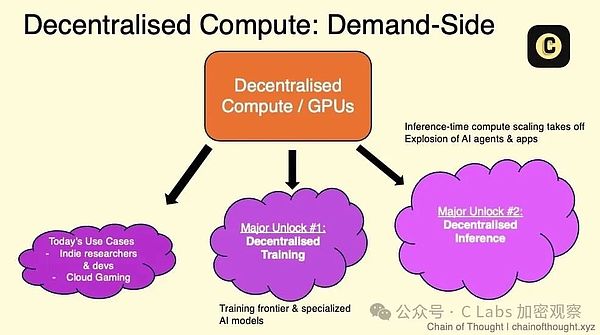

AI infrastructure

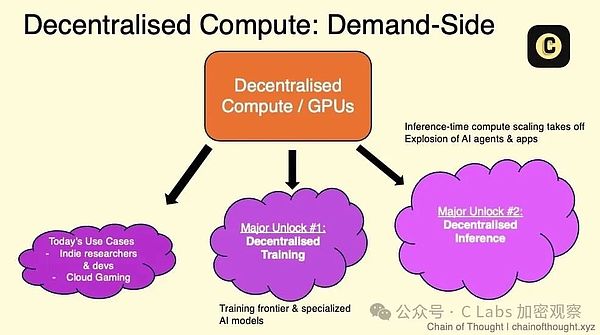

AI infrastructure mainly includes three aspects: computing power/data/electric energy, because the essence of AI is electricity, and data is processed into AI models through computing power equipment.

AI computing power projects were introduced a lot last year, and the current leaders include Aethir/IO, etc.

The main logic of AI computing power projects is to build a platform, access the computing power equipment of each household, and provide computing power for AI projects through the way of everyone contributing to the fire.

Specifically, whether it is an individual or an institution, they can "rent" their idle computing power to users who need to train AI models and get paid through cryptocurrency. (Emphasis) This model breaks the limitations of traditional data centers and greatly improves resource utilization efficiency.

In the past, many people believed that large AI models consumed too much computing power, and distributed computing power could not meet the needs of AI projects at all.

However, with the emergence of projects such as deepseek, people may find in the future that they do not need such exaggerated and large computing power requirements to run good models.

And with the arrival of the future AI application era, if people have higher requirements for the real-time performance of computing power, our distributed computing power also has significant advantages over centralized computing centers!

In addition to distributed computing power, there are also distributed data projects, and the representative project of this type is Grass.

Distributed data focuses on data equality. Now large AI models mainly use data generated by users on the Internet. However, major AI giants have already taken these data for themselves. For example, Google bought out Raddit's data resources, and Twitter also began to restrict and raise the price of its API calls after announcing its XAI.

Although these data are not open to enterprises, ordinary users can still access them, so there are a number of distributed data projects that turn users into data upload nodes to collect data.

In addition to collecting data, the current distributed data track has further developed to downstream industries such as data labeling. In the future, it may become a new flexible employment outlet after driving Uber/delivering food/delivering express.

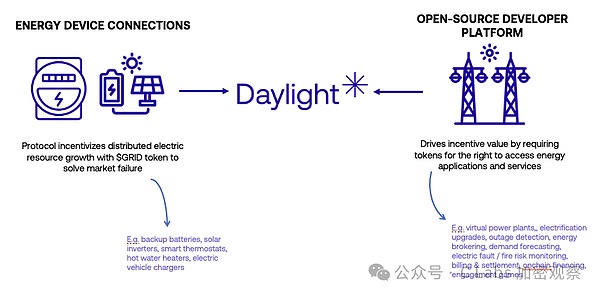

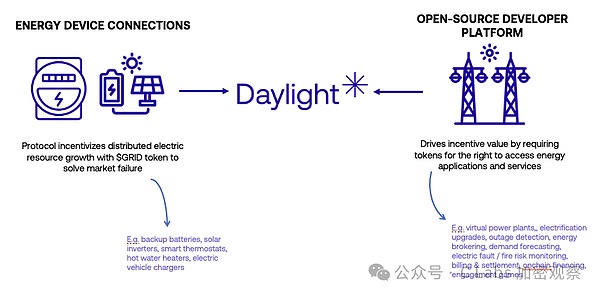

There is one last blue ocean in AI infrastructure, which is distributed energy!

In fact, A16Z has long been eyeing the distributed energy cake. With the development of AI and crypto mining, the power grid's control over power consumption is actually weaker.

However, as a long-term monopoly enterprise, the power grid still needs a lot of game to share its cake, but this part can be focused on in the future~

Tokenized AI

The current AI model actually still has many trust issues.

For example, China does not believe in the US model, and the US does not believe in the Chinese model. Both sides think that the other side will engage in ideological infiltration.

Even Musk thinks that openAI's ChatGPT is left-wing, and of course Bill Gates will think that Musk's Grok is right-wing.

In theory, blockchain can solve all aspects of trust issues, from data sources, sample labeling, to model training.

Even the development/governance of AI models can be solved in a tokenized way. This track is called tokenized artificial intelligence.

The top project in this track is Sentient, which has received an investment of US$85 million. It claims to compete directly with OpenAI and build an open source AI model contributed by the community. Each community contributor is rewarded with tokens.

I am still looking forward to their performance. I hope they can win a reputation for our crypto industry.

AI Agent Applications

After talking about AI infrastructure and tokenized AI, let’s talk about AI Agents, which became popular at the beginning of the year.

So what are AI Agents?

According to the definition of the latest Cathie Wood research report, AI agents must meet these four behaviors:

First, understand intent through natural language

Second, use reasoning and appropriate context for planning.

Third, use tools to take action and realize intent.

Fourth, improve through iteration and continuous learning.

To put it simply, AI tools that can understand human language, then find ways to complete tasks and grow on their own are AI Agents.

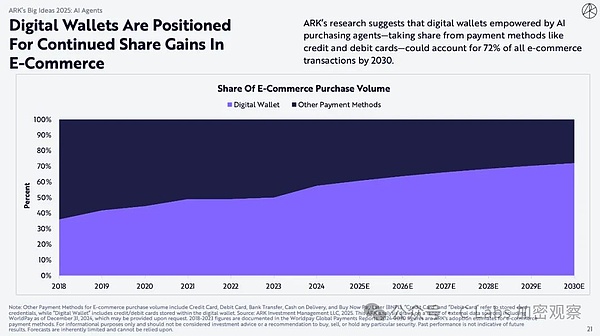

Cathay believes that AI Agents will first make money on advertising. In traditional web2, it is e-commerce that brings goods, while in web3, it is bringing goods for various cryptocurrencies.

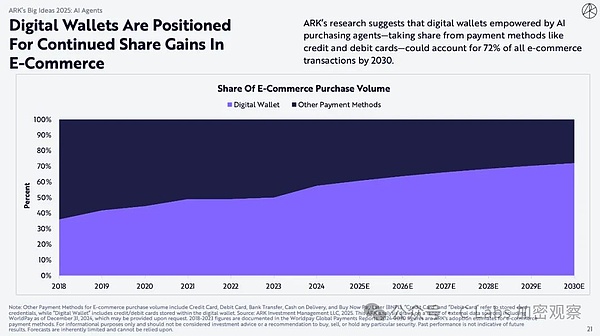

According to Cathay, AI and encryption will be highly integrated in the payment field. By 2030, digital wallets supported by artificial intelligence purchasing agents may account for 72% of all e-commerce transactions, squeezing out the share of traditional network and credit card payments.

By that time, AI+encryption should be able to influence the status of macro dollar hegemony in turn~

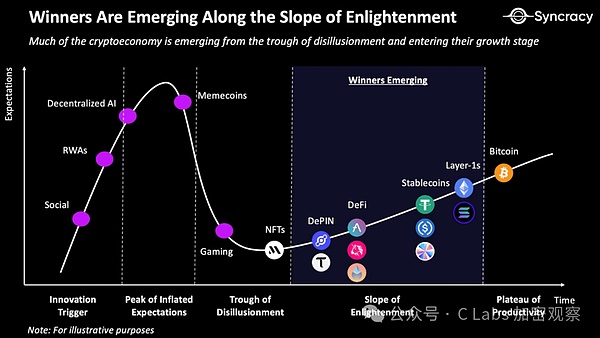

Although the AI track in our encryption industry has a bright future and many projects, there are not many projects that are remarkable in terms of business data.

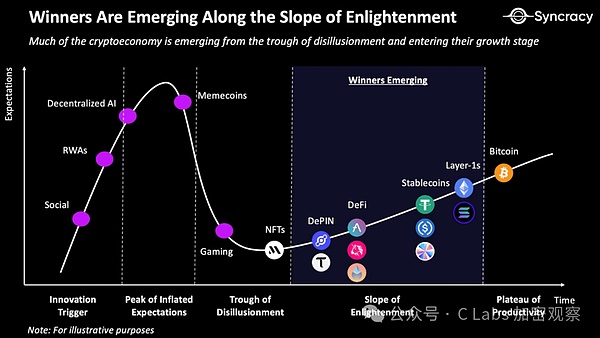

A well-known hedge fund in the encryption industry made a development chart of different encryption projects at the end of 24 years. The three tracks of Bitcoin/Layer1/stable currency have achieved stable development.

The AI track is still at the peak of the bubble, so there are indeed many project parties who are cutting leeks under the banner of AI encryption.

From this year's trend, this chart is still quite accurate. The AI track should have reached its peak in January and is now heading towards a period of collapse.

Be patient and wait for the opportunity

Finally, let's summarize, are we in the AI encryption track here to cut leeks in groups?

First of all, at the macro level, AI and encryption are mainly to deal with the threats of other sovereign currencies and gold respectively, and will not directly promote the integrated development of AI and encryption.

At the meso level, AI needs to issue coins and is also suitable for issuing coins, but the entry of real AI giants will have to wait until the regulatory framework is implemented in the second half of the year. Before that, the space for the integrated development of AI and encryption will be limited by compliance risks.

On a micro level, whether it is AI infrastructure, tokenized AI, or AI applications, many projects have been implemented, but the track is still in a bubble period as a whole~

Therefore, although AI encryption has a bright future, now is not necessarily the best time to participate, because in the future, not only will there be more important players joining, but the track may also experience a low consolidation after the bubble bursts~

When investing, patience is often the key to success.

Catherine

Catherine