BTC was trading sideways at 84k overnight. Today, the 4.17 Teaching Chain Internal Reference "Optimism and Pessimism Coexist" mentioned that Coinbase Research Institute released a report on the beginning of the bear market. In this report, the Coinbase research team conducted an in-depth analysis of whether the cryptocurrency market has entered a bear market. The original link to the report is in the internal reference. Here are some of the views of this report.

The report pointed out that both Bitcoin and the COIN50 index have recently fallen below the 200-day moving average, a technical indicator that is often seen as a signal of a long-term trend shift. At the same time, the total market value of cryptocurrencies excluding Bitcoin has fallen 41% from a high of $1.6 trillion in December 2024 to $950 billion, and the scale of venture capital funds has also decreased by 50%-60% from the peak in 2021-2022. These data collectively point to the possibility that the market is entering a new round of "cryptocurrency winter."

The report first discusses how to define the bull-bear cycle of the cryptocurrency market.

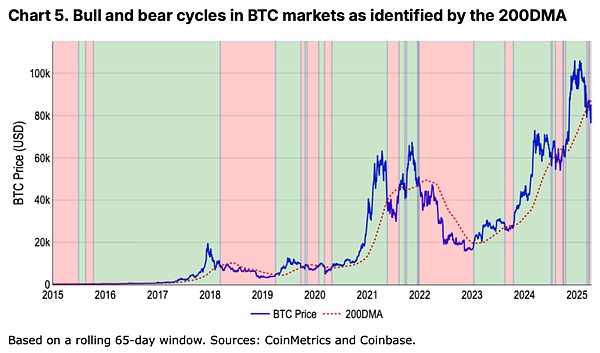

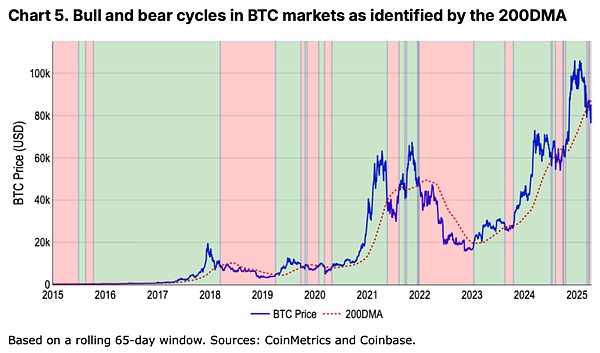

The traditional stock market often uses a 20% rise or fall as a demarcation standard, but this indicator is not applicable in the more volatile crypto market. For example, Bitcoin once fell 20% in a week but remained in a long-term upward trend. In contrast, the 200-day moving average (200DMA) has proven to be a more effective judgment tool - when the price continues to run below the moving average and shows downward momentum, it can be regarded as a bear market feature.

Data shows that Bitcoin has met this standard since late March 2024, and the COIN50 index covering the top 50 tokens entered the bear market zone as early as the end of February.

There are multiple structural pressures behind the market weakness. The implementation and potential escalation of global tariff policies have exacerbated negative sentiment, and traditional risk assets continue to be under pressure in a fiscal tightening environment. This macro uncertainty is directly transmitted to the crypto market. Although venture capital has rebounded in the first quarter of 2025, it is still halved compared to the cycle peak, resulting in a lack of new capital injection in the altcoin sector in particular. It is worth noting that Bitcoin fell less than 20% in this adjustment, but other tokens fell by 41% overall. This differentiation confirms that altcoins have higher risk premium characteristics.

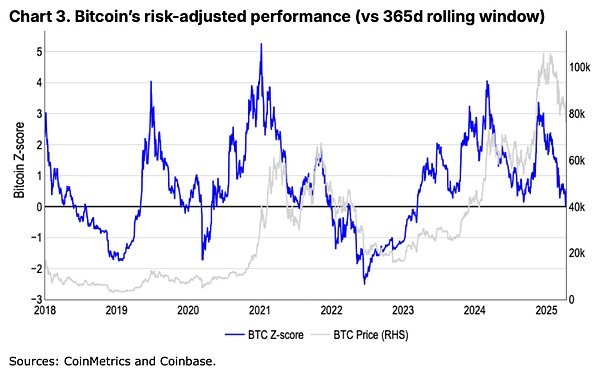

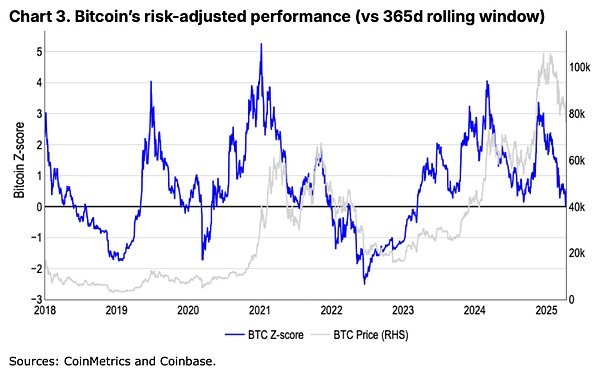

The report verifies the severity of the current trend through risk-adjusted performance indicators (z-scores). Between November 2021 and November 2022, the price of Bitcoin fell 76%, equivalent to a 1.4 standard deviation fluctuation, which is comparable to the risk-adjusted range of the S&P 500's 22% decline (1.3 standard deviations) during the same period. Although this quantitative method can effectively filter market noise, its signals often lag. For example, the model did not confirm the end of the bull market until the end of February, and has maintained a "neutral" rating since then, failing to reflect the sharp drop in March in a timely manner.

Historical data reveals the essential characteristics of a bear market. A true market structural shift is often accompanied by shrinking liquidity and deteriorating fundamentals, rather than a simple percentage change in price. The 200-day moving average model accurately captured trend reversals in historical stages such as the 2018-2019 cryptocurrency winter, the 2020 epidemic shock, and the 2022 Fed rate hike cycle. In the current environment, early warning signals such as narrowing market depth and defensive sector rotation have already appeared, which have predicted larger declines in previous cycles.

The Coinbase research team believes that although a defensive posture is still needed in the short term (next 4-6 weeks), it is expected that the market may find the bottom in the middle and late second quarter of 2025, creating conditions for recovery in the third quarter.

This judgment is based on two key insights: first, the crypto market is extremely sensitive to changes in sentiment, and once a turning point occurs, it often shows rapid reversal characteristics; second, marginal improvements in the current regulatory environment may become a unique catalyst for future rebounds. However, the report also emphasizes that against the backdrop of weak stock market performance, the independent rise of cryptocurrencies faces challenges.

As the cryptocurrency ecosystem continues to expand to new areas such as Memecoin, DeFi, and AI agents, the practice of simply using Bitcoin as a barometer for the entire market has become limited. The report suggests that investors need to establish a more comprehensive evaluation framework, while paying attention to multi-dimensional data such as total market value, risk capital flows, and technical indicators.

The research team's market forecast records since 2022 show that its judgment on cyclical turning points has a high reference value, such as accurately predicting a rebound in the first quarter of 2023 and a rising market in the fourth quarter of 2024.

The report ultimately conveys a core view that is prudent but not pessimistic. Although technical indicators and capital flows clearly show that the market has entered a phase of adjustment, the high volatility unique to crypto assets also means that the recovery may be faster than traditional markets. For investors, the current stage is more suitable for tactical allocation strategies, while controlling the overall risk exposure and preparing for potential reversals in market sentiment.

However, all analyses are based on existing data, and the cryptocurrency market is known for its unpredictability. Any geopolitical changes or regulatory breakthroughs may quickly rewrite the current market narrative.

Weiliang

Weiliang