On July 13, Nuvve, a Nasdaq-listed clean energy electric vehicle charging technology company, announced the issuance of 5,029,403 shares of common stock at a public offering price of US$0.95 per share, raising a total of approximately US$4.8 million. Lucid Capital Markets served as the bookrunner for this offering. Nuvve stated that it will use the funds to purchase Hyperliquid's native token HYPE to establish a HYPE token reserve. The company has previously disclosed that management has decided to establish a digital financial strategy and plans to use 30% of its idle funds to purchase Bitcoin. On June 20, Everything Blockchain Inc. (EBZT), a publicly listed US company, announced plans to invest $10 million in five major blockchain networks: Solana (SOL), XRP, Sui (SUI), Bittensor (TAO), and Hyperliquid (HYPE), to build a multi-token staking vault geared towards institutional adoption. On June 18, Eyenovia, a clinical-stage ophthalmic biopharmaceutical company, announced a $50 million investment to launch a treasury reserve strategy for Hyperliquid (HYPE). On June 12, Tony G Co-Investment Holdings Ltd., a publicly listed Canadian company, announced that as part of its long-term digital asset strategy, it has completed its acquisition of HYPE tokens, the native asset of the Hyperliquid ecosystem. The company purchased a total of 10,387.685 HYPE tokens at an average price of $42.24 per token, with a total transaction volume of $438,828.46. 4. High-Performance Layer 1 Powers Hyperliquid's Operations. Hyperliquid's Layer 1 is purpose-built for high-performance perpetual contract order book exchanges. It utilizes a custom consensus algorithm called HyperBFT, which brings margin and matching engine state fully on-chain. Hyperliquid offers extremely fast response times, with a median latency of 0.2 seconds (99th percentile of 0.9 seconds). It also boasts high throughput, processing 200,000 transactions per second and capable of handling over $10 billion in daily trading volume. The Hyperliquid platform is highly attractive to high-frequency traders and DeFi developers, and as a result, HYPE, which is deeply tied to Hyperliquid, is bound to rise in value.

II. How high will HYPE rise in the future?

As early as May 23rd, BitMEX co-founder Arthur Hayes expressed optimism about HYPE's performance, posting on social media that HYPE's market capitalization could surpass SOL in this bull market and asking the community: "What do you think, fam?"

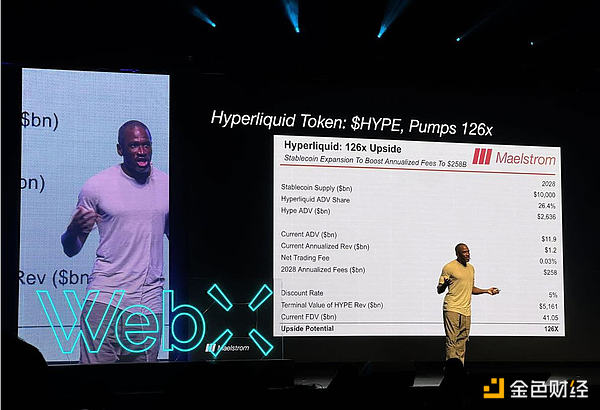

On August 25th, Arthur Hayes reiterated his optimism about HYPE, predicting it will increase 126-fold over the next three years. Hayes believes that Hyperliquid's future is closely tied to the expansion of stablecoins. He described Hyperliquid's strategy of integrating stablecoin liquidity and optimizing cross-chain settlement as the "primary driver" of future growth. Hayes predicts that by 2028, the global stablecoin supply could reach $10 trillion, with Hyperliquid capturing 26.4% of that market. He explains that this level of adoption would completely transform the economics of exchanges. Hyperliquid's current daily trading volume of $11.9 billion could soar to $2.63 trillion, generating $25.8 billion in annual fee revenue at a standard commission rate of 0.03%, which would increase HYPE's value 126-fold over the next three years.

On the daily chart, HYPE is consolidating near the middle Bollinger Band, which suggests some stability in price, but as the Bollinger Bands begin to tighten, the possibility of a bullish breakout appears to be forming.

Moving average analysis shows a clear bullish trend. All key indicators, from the 10-day exponential moving average (EMA) at $44.16 to the 200-day simple moving average (SMA) at $29.32, are currently showing buy signals, confirming the upward trend.

III. Conclusion

Thanks to multiple factors, including market sentiment, whale funds, and technical support, HYPE has reached new highs, dispelling the common belief that "DeFi cannot replace CEX." HYPE has become a focal point of market attention. However, whether HYPE can achieve the 126-fold increase in three years predicted by Hayes remains to be seen. Changes in the macro-financial environment, overall crypto market volatility, regulatory policy development, and competition among exchanges are all factors influencing HYPE's price, and investors should proceed with caution.

Brian

Brian

Brian

Brian Xu Lin

Xu Lin JinseFinance

JinseFinance JinseFinance

JinseFinance Pr0phetMoggy

Pr0phetMoggy Pr0phetMoggy

Pr0phetMoggy Olive

Olive Coinlive

Coinlive  Beincrypto

Beincrypto Coindesk

Coindesk