Solo mining, as the name suggests, is individual miners. Although most of the current BTC mining computing power is concentrated in mining pools, and several large mining pools distribute rewards based on the so-called computing power contribution, there are still many people who choose to use their own computing power for solo mining.

Compared to receiving "work points" from the mining pool steadily, solo mining is tantamount to a "either explode or go to waste" gamble. For today's BTC block rewards, exploding a block means that the solo miner enjoys 3.125 BTC alone, which is about more than 300,000 US dollars. However, the probability of exploding a block is so low that there is little hope.

How low is the probability of Solo exploding a block?

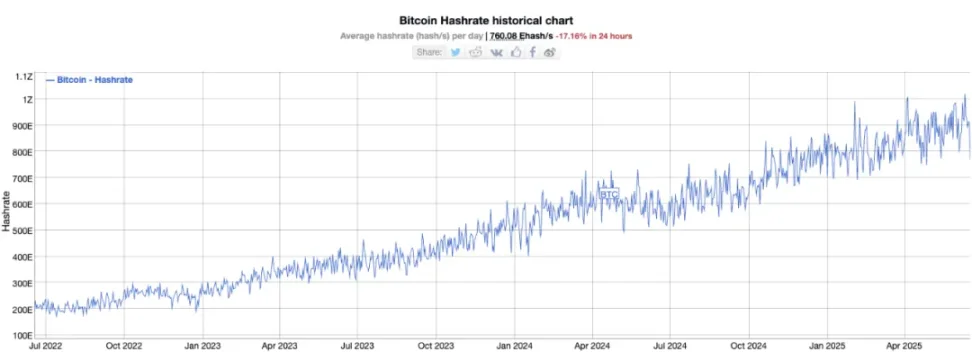

According to the BTC network computing power estimation chart, the current network computing power is about 900E (900EH/s). For the sake of simplicity, 900E is taken. This number means that the BTC network can calculate about 900E hashes per second. An astonishing astronomical figure.

According to the estimation of netizen Matt Cutler, if a desktop mining machine with a computing power of 1T (1TH/s) is used, then according to the independent and identically distributed hypothesis, the probability of a block explosion is 1T/900E = 1/900M, which is one in 900 million.

How low is this probability? According to the average BTC network that explodes a block every 10 minutes, it takes an average of 9 billion minutes, or 17,000 years, to hit a block.

For comparison, he listed the winning probabilities of two typical lottery products:

Powerball Jackpot: 1/292M, or 1 in 292 million.

Mega Millions: 1/303M, or 1 in 303 million.

Obviously, judging from the surface numbers, the probability of a block explosion is much lower than the winning probability of these two lotteries.

Wait a minute. We ignored time. The two comparison lotteries have draws 3 times a week and 2 times a week, which is much lower than BTC's draw every 10 minutes.

If the probability of winning is calculated as 1 in 300 million, 3 times a week, then it takes an average of 100 million weeks, or 1.92 million years, to win a jackpot.

Obviously, it seems that Solo mining still has a higher chance of winning than buying a lottery ticket.

Let's take time into account and align:

Every week:

Powerball (3 draws), winning probability: 1/97M, 1 in 97 million.

Super Millions (2 draws), winning probability: 1/151M, 1 in 150 million.

Solo mining (1T computing power) (1008 draws), winning probability: 1/892K, 1 in 890,000.

Monthly:

Powerball (12 draws), winning probability: 1/22M, 1 in 22 million.

Super Millions (2 draws), winning probability: 1/35M, 1 in 35 million.

Solo mining (1T computing power) (4320 draws), winning probability: 1/208K, 1 in 200,000.

Every year:

Powerball (156 draws), winning probability: 1/1.87M, 1 in 1.87 million.

Super Millions (104 draws), winning probability: 1/2.9M, 1 in 2.9 million.

Solo mining (1T computing power) (more than 52,000 draws), winning probability: 1/17K, 1 in 17,000.

The probability of mining a block is more than 100 times higher than the probability of winning the lottery.

Of course, probability calculation tells us that even if the probability is more than 100 times higher, for most people, the contribution is still greater than the benefit, and the cost is greater than the return. In short, mining loses money.

Because most people's life span is less than 100 years, which is nearly 200th of 17,000.

This is precisely the cleverness of BTC's underlying design.

What kind of investment product (speculative product) in the world has a particularly large number of participants, and most people who invest money lose money, but everyone enjoys it and can't extricate themselves?

Some friends who like to tease may answer. Wrong.

The correct answer is: lottery.

BTC's PoW mining has an incentive mechanism that is very similar to a lottery.

Although miners do not make money, their tireless calculations have voluntarily and spontaneously made outstanding contributions to the world's largest "public welfare" - maintaining the BTC public ledger.

In a trance, there is a spirit of public welfare lottery in it.

BTC was born 16 years ago, and every year there are people who question how the BTC network will be maintained when the rewards are halved and mining is no longer profitable?

This is a dogmatic mistake of looking at the problem from a static perspective rather than a development perspective.

It is only because at this stage, BTC is mostly provided by mining pools and mining companies, so people will question that these companies want profits and make money, otherwise they will not continue to mine and continue to provide computing power.

Perhaps this is exactly what the design wants!

When miners and mining companies that come to mine for money gradually withdraw due to reduced profits, Solo miners and family miners who are not for making money and are not afraid of losing money but for fun will gradually take over their historical position.

At that stage, BTC has also entered a relatively mature stage.

The current situation is just a staged performance of BTC's continued rapid growth (reflected in the rapid rise in prices).

From a financial perspective, BTC is a non-interest-bearing, non-exploitative currency. The fractional reserve system and credit expansion in the traditional financial system are not allowed on the BTC chain. Therefore, according to the financial theory that has been studied in the last century, a financial institution that provides this kind of currency deposits but is not allowed to lend money cannot pay interest to depositors, but must charge them management fees, otherwise it will be economically unsustainable.

The BTC network is like such an institution that provides BTC deposits and cannot lend money. A distributed virtual institution operated and maintained by tens of thousands or hundreds of thousands of miners distributed around the world.

Therefore, the electricity costs and other costs paid by individual miners are actually what economists call management fees paid to this deposit institution.

Unlike today's miners, whose motivation for mining comes from earning block rewards (essentially diluting the value of all holders) and transfer fees (fees that traders are willing to pay), future individual miners are individual users who hoard BTC and treat BTC as savings, or corporate users. Their motivation for paying the cost of running such a mining node is to ensure the safety of their deposits.

Today, the total computing power gathered by several large mining pools in the entire network is about 900E. Assuming that it is broken down into parts and distributed to 9 million users, each user will need to provide an average of 100T computing power.

In the future, with the improvement of computing power efficiency, further reduction of energy consumption, further improvement of silent technology, further reduction of electricity costs (such as thermonuclear fusion power generation), and even the reuse of by-products (such as chip heat dissipation and heating), it is not impossible for each user to provide 100T or more computing power.

We should consider the future from now on, ensure the size of the BTC ledger is streamlined, and strictly control junk data and abuse to avoid the accumulation of problems in the future and the inability to return to a greater degree of decentralization.

Brian

Brian

Brian

Brian Weiliang

Weiliang Joy

Joy Miyuki

Miyuki Weiliang

Weiliang Miyuki

Miyuki Joy

Joy Alex

Alex Brian

Brian Joy

Joy