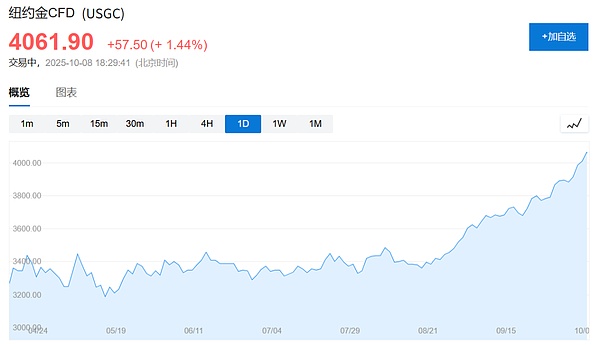

On Tuesday, Bridgewater Associates founder Ray Dalio said that now, like the 1970s, investors should hold more gold than usual. Even as gold prices have soared to record highs above $4,000 an ounce, investors should still allocate up to 15% of their portfolios to gold, which offers a better safe-haven asset than the dollar. Dalio made the remarks while speaking at the Greenwich Economic Forum in Greenwich, Connecticut. Although he believes that speculation around artificial intelligence has typical bubble characteristics, he said that he would not short technology giants. In terms of international investment, Dalio said he is still optimistic about China. From a valuation perspective, China is relatively cheap. 1. Now is like the 1970s. Hold more gold. When asked if he agreed with Citadel founder Ken Griffin that gold's rise reflects market concerns about the dollar, Dalio said: Gold is an excellent diversifier in a portfolio. From a strategic asset allocation perspective, you might want to allocate about 15% of your assets to gold because gold tends to outperform when traditional assets in a portfolio decline. Gold prices have soared more than 50% this year. Since the end of July, gold prices have risen by more than 20% to around $4,000 per ounce. This week, gold futures reached $4,071 per ounce.

Investors have flocked to safe-haven assets due to the growing U.S. fiscal deficit and escalating global tensions, coupled with the U.S. federal government shutdown and market speculation that the Federal Reserve will continue to cut interest rates despite still-high inflation.

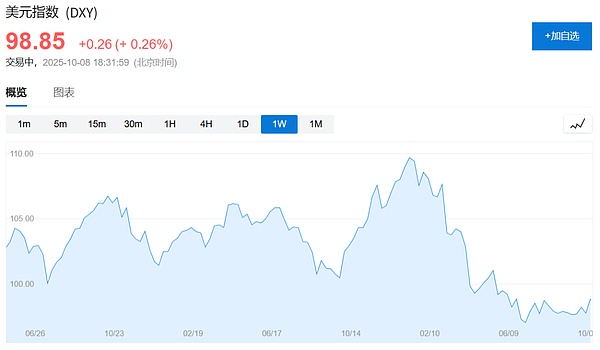

At the same time, the U.S. dollar weakened against all major currencies—under the impact of uncertainty caused by U.S. President Trump, the U.S. dollar experienced its largest devaluation since the 1970s, shortly after the U.S. abandoned the gold standard.

Dalio said that gold is a strong store of value against the backdrop of rising government debt burdens, increasing geopolitical tensions and weakening confidence in the stability of various currencies. Dalio compares the current economic environment to the early 1970s, when high inflation, massive government spending, and a heavy debt burden in the United States shook confidence in paper assets and fiat currencies: The situation now is very similar to the early 1970s. Where should you put your money? When you hold currency and put it into debt instruments like bonds, it is no longer an effective storehold of wealth when the supply of debt and bonds is so huge. Dalio's advice stands in stark contrast to the asset allocation models of traditional financial advisors. Financial advisors typically recommend a 60% stock, 40% bond portfolio, with allocations to alternative assets like gold and other commodities typically limited to a single-digit percentage because they don't generate income. Dalio stated that gold offers a unique hedge during periods of currency devaluation and geopolitical uncertainty. "Gold is the only asset you can hold yourself without relying on others to redeem it." 2. AI speculation exhibits typical characteristics of a bubble. Dalio expressed reservations about the recent rally in the US stock market, arguing that soaring valuations have raised concerns about an artificial intelligence (AI) bubble.

"I think the market right now has a bit of a bubble feel."He pointed out that the speculation around artificial intelligence has typical bubble characteristics and compared it to historical innovation booms - from the patent and technology boom in the late 1920s to the Internet bubble in the late 1990s.

Despite this, Dalio said he still sees opportunities to generate revenue from artificial intelligence - both for companies that use AI to improve efficiency and for companies that provide AI platforms.

At the same time, he also said that although he is cautious about valuations, he will not easily short large technology companies. "I will not short these super-sized technology giants."

3Wall Street is bullish on gold and short-term correction risks

On October 7, Wall Street Journal mentioned thatthe People's Bank of China's gold reserves at the end of September were 74.06 million ounces (about 2,303.523 tons), an increase of 40,000 ounces (about 1.24 tons) from the previous month, marking the 11th consecutive month of increase in gold holdings.

Goldman Sachs said in a report that in view of the continued inflow of ETFs and central bank purchases, they raised their gold price forecast for December 2026 from $4,300 to $4,900.

Jeffrey Gundlach, CEO of DoubleLine Capital, known as the "new bond king", recently put forward a similar view, suggesting that the proportion of gold in the portfolio can be as high as 25%.

He believes that gold will continue to perform well against the backdrop of inflationary pressure and a weakening dollar. David Chao, global market strategist at Invesco Asset Management, recommends "overweighting gold to hedge against the US dollar and prepare for further shocks in the future." Some analysts have also warned of the risk of a short-term correction. Bart Melek, head of commodity strategy at TD Securities, said that given the speed and scale of this rally, speculators may be inclined to take profits. Elon Gu, senior analyst at Ultima Markets, also believes that after such a rapid rise, there may be short-term consolidation.

Weiliang

Weiliang