At 2:00 AM Beijing time on September 18th, the Federal Reserve announced a 25 basis point interest rate cut as expected. Following significant volatility, the crypto market gradually rebounded. Notably, this rebound was not led by Bitcoin and Ethereum, but rather by a number of established altcoins at lower prices, such as DOT, AVAX, and NEAR. The market reaction suggests that investors have captured a more accommodative policy signal from the seemingly in-line interest rate decision. The dot plot predicts a cumulative rate cut of 75 basis points this year, far exceeding the 60 basis points priced in by federal funds rate futures the previous day. This unexpectedly easing signal is rapidly boosting risk appetite and driving capital flows into riskier assets.

In addition to improved liquidity, expectations of potential valuation repair and the simplification of the crypto ETP listing process also provide favorable conditions for the continued fermentation of the altcoin market.

First, according to TradingView data, the current market capitalization share of altcoins (excluding the top ten by market capitalization) has fallen to the lowest level in nearly five years, hovering around 8% for a long time. The most devastating development is that among the top 100 altcoins by market capitalization, over half (considering only the top 100) have market capitalizations below the 85th percentile of their historical levels, and their prices have generally fallen below the 95th percentile. Overall valuations are even more depressed than when Bitcoin was trading at $15,500. Extremely depressed valuations often indicate a significant release of downside risk, making any marginal positive news highly likely to trigger a cash-in. Recently, some altcoins have demonstrated significant resilience at low levels, and futures open interest (IO) has also shown rapid growth, indicating that funds have begun to quietly deploy. Secondly, the U.S. SEC voted on September 17 to approve rule changes allowing spot commodity exchange-traded products, including digital assets, to apply unified universal listing standards. This move means that spot crypto ETFs can be directly listed without case-by-case approval, which greatly shortens the product listing cycle and cost. According to the new regulations, cryptocurrencies must meet one of the following conditions to qualify for spot ETF listing: 1. The cryptocurrency is traded on a member market of the Intermarket Surveillance Group (ISG), such as the NYSE, Nasdaq, CME, etc.

2. Its futures contracts have been traded on a Designated Contract Market (DCM) regulated by the Commodity Futures Trading Commission (CFTC) for at least six months, and a surveillance-sharing agreement is in place.

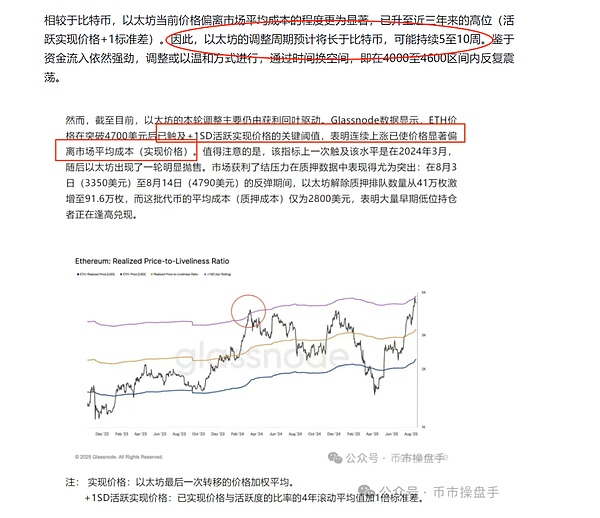

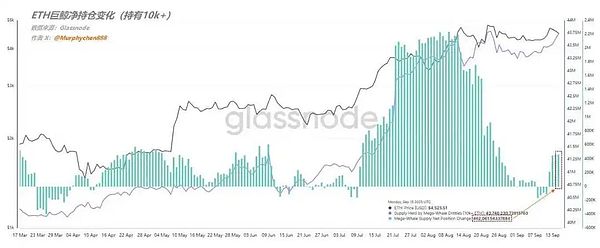

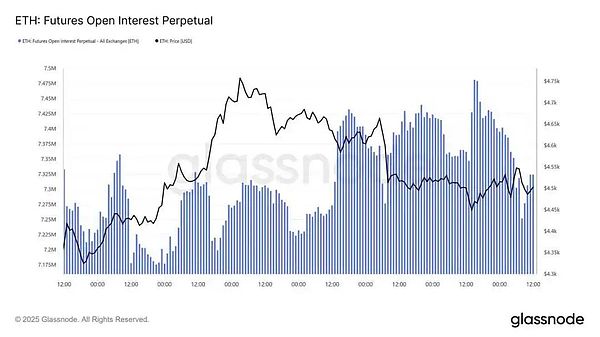

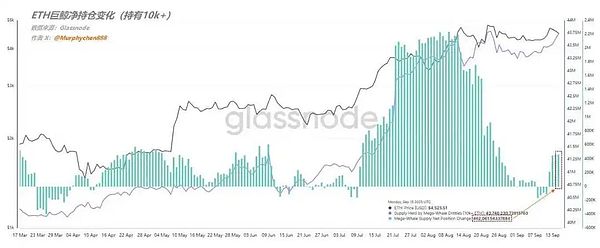

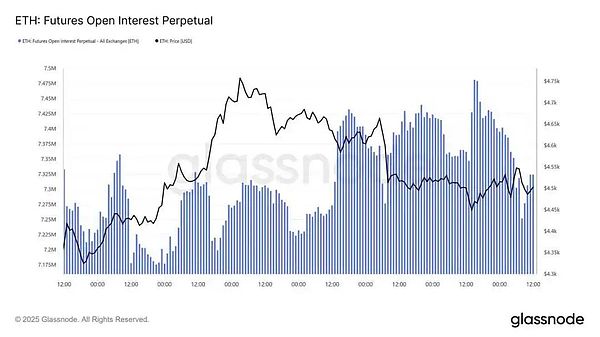

3. There is an ETF listed on a U.S. national securities exchange with at least 40% of its net assets invested in the cryptocurrency. According to Article 2 of the new regulations, any cryptocurrency that has been listed and traded on the Coinbase derivatives exchange for at least six months is eligible to be issued as a crypto exchange-traded product (ETP). Following the implementation of the new regulations, Bloomberg ETF analysts predict that over 100 crypto ETFs are expected to be listed within the next 12 months. This move is expected to bring large-scale institutional capital and significant liquidity to the altcoin market. After three consecutive failed attempts to reach $4,800, Ethereum has formed a typical triple top structure on its technical chart, further exacerbating market concerns that a prolonged rally will inevitably lead to a decline. Despite this, the author still believes that Ethereum's current weekly adjustment is a healthy technical wash-out, the main purpose of which is to digest the huge floating profits generated by the rapid price increase in the short term. The main basis is as follows: First, in the past 30 days, despite the huge profit-taking pressure on Ethereum, whales holding more than 10,000 ETH still maintained a net buying position, and accumulated an additional 460,000 ETH. This means that Ethereum's fluctuations between 4100 and 4600 were more of a healthy turnover of chips than a major player's distribution. Second, during Ethereum's volatile decline from 4750, open interest (IO) grew against the trend, indicating that major long positions continued to increase their positions before and after the rate cut. Given that trends and IO fluctuate in the same direction, a counter-trend increase in open interest often signals the accumulation of momentum for a new round of gains.

Joy

Joy