Author: Brayden Lindrea, CoinTelegraph; Compiler: Wuzhu, Golden Finance

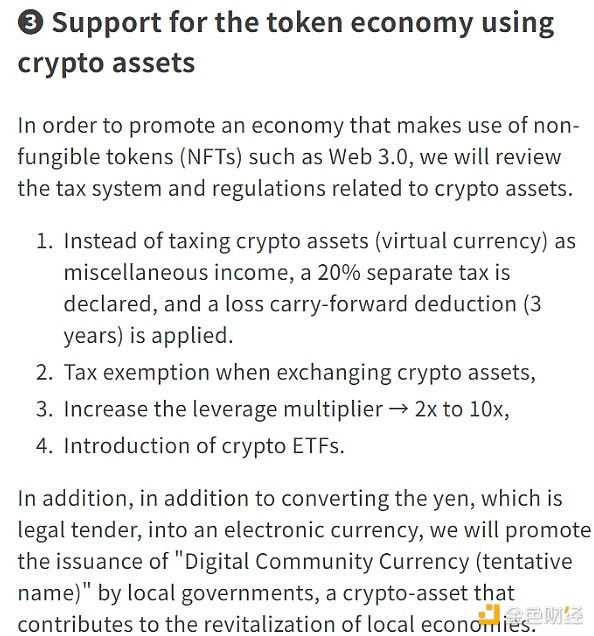

Yuichiro Tamaki, leader of the Democratic Party of Japan (DPP), has proposed a cryptocurrency taxation plan that would reduce the tax on cryptocurrency gains to 20% if he is elected.

“If you think crypto assets should be taxed at a separate 20% instead of being treated as miscellaneous income, vote for the Democratic Party,” Tamaki said in a translated X post on October 20.

But the plan may be far from being realized, as the DPP led by Tamaki currently holds only 7 seats out of the 465 seats in the House of Representatives of Japan, also known as the lower house of the National Diet of Japan.

A 20% tax on cryptocurrency gains would bring them in line with the taxes paid on stock market profits.

Under Tamaki’s plan, no tax event would be triggered when trading one crypto asset for another.

“I would be grateful if you could promote these promises that the Democratic Party has made for the people,” Tamaki stressed.

DPP policy statement. Source: Democratic Party of Japan

Responding to X user Shonai Dog, Tamaki said the DPP will consider implementing tax cuts on other financial income in the future — but for now, it’s focused on making Japan a leader in the Web3 space:

“We want to make Japan a strong country for Web3 business.”

Japan’s general election will be held on October 27.

The DPP’s main pitch to voters is to increase take-home pay to fight inflation.

Earlier this year, on August 30, Japan’s Financial Services Agency published plans for an overhaul of the country’s tax code for fiscal 2025, which included provisions to reduce taxes on crypto assets.

Crypto profits in Japan are currently taxed as miscellaneous income at a rate of 15% to 55%, depending on individual income.

According to crypto tax firm KoinX, crypto taxes can be as high as 55% for individuals earning more than 40 million yen ($268,000).

In comparison, profits earned from stock trading are taxed at a maximum rate of just 20%.

Meanwhile, corporate cryptocurrency holders must pay a flat rate of 30% on their holdings at the end of the fiscal year — even if they didn’t make a profit from selling them.

A recent poll by local news outlet Mainichi Shimbun gave Tamaki’s Democratic Party a slim chance of winning Japan’s election.

The LDP and its coalition partner Komeito are expected to retain their 465-seat majority, while the DPP could see its representation increase from seven to as many as 20 seats.

Kikyo

Kikyo