On February 19, 2024, the Financial Services Agency (FSA) of Japan approved the "Report of the Working Group on Fund Settlement System, etc." at the General Meeting of the Financial Services Council (chaired by Chairman Hiroyuki Kamisaku).

The report is the final result of seven rounds of discussions in response to the consultation request of the Minister of Finance in August 2024. The core content of the report involves a new regulatory framework for cryptocurrencies (virtual currencies) and stablecoins, especially specific suggestions on user protection in the event of exchange bankruptcy, the establishment of intermediary business, and asset utilization rules for stablecoins. This policy move marks a further refinement of Japan's regulation in the field of cryptocurrencies and stablecoins, aiming to balance innovation and risk control.

This article will provide an in-depth interpretation of this new regulatory framework from four aspects: policy background, main content, policy impact and future prospects.

1. Policy background: FTX bankruptcy and user protection needs

In November 2022, the bankruptcy of FTX, the world's second largest cryptocurrency exchange, shocked the entire cryptocurrency industry. The collapse of FTX not only resulted in billions of dollars in user asset losses, but also exposed the weak links in the regulation of cryptocurrency exchanges. As an important participant in the global cryptocurrency market, Japan's regulator, the Financial Services Agency, responded quickly and began to re-examine the shortcomings of the existing regulatory framework.

Japan included cryptocurrencies in the scope of regulation through the Funds Settlement Law as early as 2017, and established a relatively complete exchange license system. However, the FTX incident shows that existing regulatory measures alone are still not enough to deal with extreme situations such as exchange bankruptcy. Therefore, the Financial Services Agency launched a new round of regulatory reforms in 2024, aiming to strengthen user protection and improve market transparency.

II. Main contents of the new regulatory framework

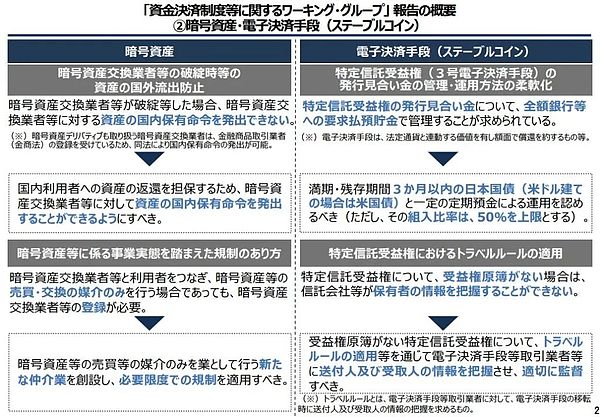

1. Strengthening user protection when an exchange goes bankrupt

The report proposes that new clauses will be introduced in the Funds Settlement Law with reference to the relevant provisions of the Financial Instruments and Exchange Act to strengthen user protection when cryptocurrency exchanges go bankrupt. Specific measures may include:

Asset isolation requirements: require exchanges to strictly separate user assets from their own assets to prevent user assets from being used to repay debts in the event of bankruptcy.

Bankruptcy liquidation priority: clarify the user's priority right to repayment in bankruptcy liquidation to ensure that user assets can be returned first.

Information disclosure obligations: require exchanges to regularly disclose their financial status and asset custody status to enhance transparency.

These measures are intended to prevent the recurrence of similar FTX incidents and provide users with a safer trading environment.

Excerpt from the Financial Review Committee's "Report on the Working Group on Fund Settlement System and Other Related Matters"

2. Establishment of Cryptocurrency Intermediary Business

The report also proposed a new business model - cryptocurrency trading intermediary business. This type of intermediary will adopt the "affiliation system", that is, it must be affiliated with a specific exchange to conduct business. Unlike traditional exchanges, intermediaries do not directly custody user assets, so their regulatory requirements are relatively loose:

No property custody obligations: intermediaries do not directly hold user assets, reducing the risk of misappropriation or loss of funds.

Simplified access conditions: intermediaries do not need to meet strict property-based requirements, nor do they bear direct obligations for anti-money laundering (AML) and combating terrorist financing (CFT).

Business scope restrictions: intermediaries are only responsible for buying and selling, and do not involve complex businesses such as asset custody and liquidation.

The establishment of this new business model aims to lower the market entry threshold and promote market competition, while ensuring the business compliance of intermediaries through the "affiliation system".

3. Adjustment of stablecoin asset utilization rules

The report proposes important adjustments to the stablecoin asset utilization rules. According to current regulations, stablecoin issuers must deposit equivalent assets in banks in the form of "required deposits". The new framework allows issuers to use part of their assets for low-risk financial products such as short-term government bonds and time deposits:

New asset categories: Stablecoin issuers are allowed to invest no more than 50% of their assets in short-term government bonds and time deposits.

Risk control: A 50% cap is set on the proportion of new asset categories to ensure that the asset reserves of stablecoins have sufficient liquidity.

This adjustment aims to improve the asset utilization efficiency of stablecoin issuers while controlling risks through proportion restrictions.

III. Policy impact analysis

1. Impact on users

The biggest beneficiaries of the new regulatory framework are ordinary users. By strengthening user protection measures when an exchange goes bankrupt, the security of users' assets will be significantly improved. In addition, the establishment of intermediary businesses may reduce transaction costs and provide users with more options.

2. Impact on exchanges and intermediaries

For exchanges, the new regulations will increase their compliance costs, especially the requirements for asset isolation and information disclosure. However, these measures will also help enhance the credibility of exchanges and attract more users. For intermediaries, the establishment of new formats provides small and medium-sized enterprises with opportunities to enter the market, but the "affiliation system" also means that their business independence is restricted.

3. Impact on the stablecoin market

The adjustment of the stablecoin asset utilization rules will increase the issuer's asset yield, thereby enhancing its profitability. However, the 50% ratio cap also limits the issuer's risk-bearing capacity and ensures that the stability of stablecoins is not affected.

4. Impact on the Japanese cryptocurrency market

The new regulatory framework further consolidates Japan's position as a global leader in cryptocurrency regulation. By balancing innovation and risk control, Japan is expected to attract more international capital and projects to its market.

Fourth, Future Outlook

With the implementation of the measures proposed by the Financial Services Agency to strengthen user protection, Web3 security compliance companies such as Beosin play a vital role in this process. Beosin focuses on security compliance in the crypto asset industry and provides comprehensive smart contract security audits and compliance services. Through these technical supports, crypto asset service providers can operate within the compliance framework and effectively prevent potential security risks.

This new regulatory framework of the Japanese Financial Services Agency marks a new stage in the regulation of cryptocurrencies and stablecoins. However, with the rapid development of technology and the constant changes in the market, regulators still need to remain flexible and respond to emerging risks in a timely manner.

Possible future development directions include:

Cross-border regulatory cooperation: The global nature of the cryptocurrency market requires regulators in various countries to strengthen cooperation and formulate unified regulatory standards.

Technology-driven regulation: Use tools such as blockchain technology and artificial intelligence to improve regulatory efficiency and transparency.

User education: Strengthen the popularization of cryptocurrency knowledge among ordinary users and improve their risk awareness and self-protection capabilities.

The new regulatory framework approved by the Financial Services Agency of Japan is an important milestone in the field of cryptocurrency and stablecoin regulation. By strengthening user protection, establishing intermediary business and adjusting the rules for the use of stablecoin assets, Japan has not only promoted market innovation, but also provided an important reference for global cryptocurrency regulation. In the future, with the gradual implementation of this framework, Japan is expected to occupy a more important position in the global cryptocurrency market.

Alex

Alex

Alex

Alex Alex

Alex Miyuki

Miyuki Joy

Joy Weiliang

Weiliang Weatherly

Weatherly Anais

Anais Alex

Alex Miyuki

Miyuki Miyuki

Miyuki