Author: Lawyer Shao Shiwei

On February 9, 2025, the People's Court Daily published a case: "Overseas virtual currency investment is not protected by Chinese law", which is one of the typical cases of foreign-related commercial trials released by the Higher People's Court of Jiangsu Province.

However, in sharp contrast to this legal warning are the myths of getting rich quickly that are not uncommon in the currency circle. A few days ago, Lawyer Shao just heard from a friend that his friend had 100,000 U on Binance, and entrusted others to operate the contract, earning the equivalent of 30 million yuan in a month. Although this kind of thing doesn't sound uncommon in the currency circle, I still can't help but sigh that this person's luck is really enviable, tut tut.

The threshold for investing in the cryptocurrency circle is relatively high. For ordinary people, entrusting financial management and investing on behalf of others are almost common ways to participate in investment. As the saying goes, "Professional matters should be left to professionals." So, what does this guiding case issued by the court mean to friends who speculate in cryptocurrencies?

This article will take this case as a starting point for a detailed interpretation and explore whether ordinary people can still invest in virtual currencies? If the investment loses money, can the investment be recovered by suing? At the same time, the article will also provide pre-risk prevention and in-process response strategies for virtual currency investment for your reference.

1

A lawsuit lasted for 4 years

The 5 million investment funds were still not recovered.

【Basic Facts】

Pan (Singaporean citizen) was very tempted by the high returns and high yields of virtual currency investment, but he had not found a suitable investment opportunity. In October 2019, Pan met Tian (Chinese citizen) through a friend's introduction. The two met too late and had a good chat. Tian often introduced blockchain virtual currency projects to Pan. Tian, who was eloquent and knowledgeable, quickly won Pan's trust, so they decided to jointly invest in virtual currency and create a "wealth myth" together.

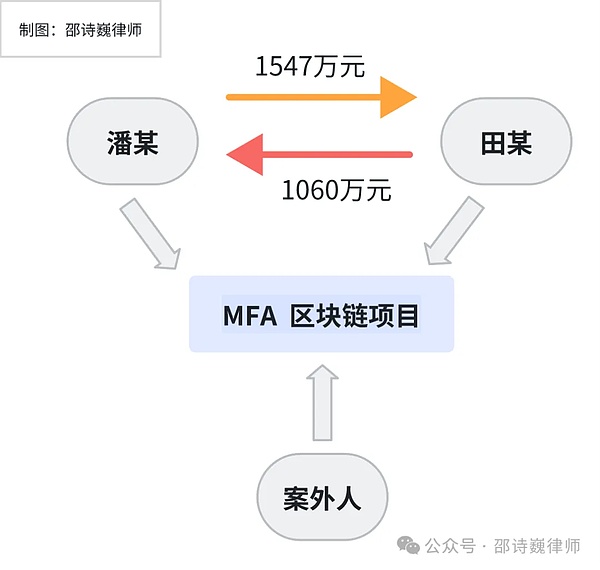

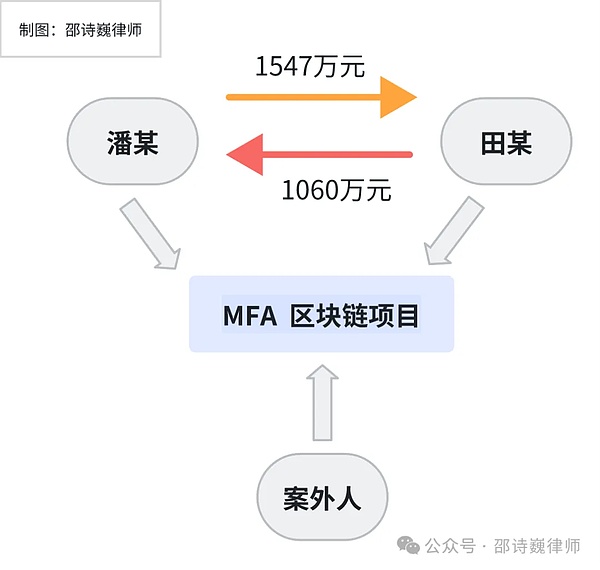

In November of the same year, Pan and Tian signed a cooperation agreement with a third party, agreeing to jointly operate the "MFA Blockchain" project, in which Tian was responsible for technical development and operation, Pan was responsible for pre-development costs and capital operation, and the third party was responsible for market docking and community operation, and clarified their respective shares. Pan transferred 15.74 million yuan to Tian to purchase MFA virtual currency.

In the early stage of the project, good news came frequently. Tian often sent virtual currency gains to Pan, promising to return all principal and pay high dividends when the time was right.

However, as time went by, Pan began to worry because he had not seen the funds returned, and urged Tian to return the money. At first, Tian evaded the responsibility on the grounds of tight market value. Under Pan's repeated urging, Tian gradually returned 10.6 million yuan to him.

In September 2020, MEXC (Singapore trading platform) offline MFA/USDT spot trading, the virtual account involved in the case was locked and could not be traded, and the principal was completely lost. The dividends were not paid and the principal was seriously damaged. Pan filed a lawsuit with the court, requesting the court to order Tian to return the remaining funds to him according to law.

[Court opinion]

This case was tried by the Yancheng Intermediate Court and the Jiangsu Higher Court.

The Yancheng Intermediate Court held that:

The purpose of the cooperation between the two parties was to invest in the "MFA Blockchain" project. The court held that both parties knew that it was speculation in virtual currency, the contract was invalid, and the losses were borne by themselves, and rejected Pan's request to return the investment.

The Jiangsu Higher Court held that:

Pan is a Singaporean citizen, and this case involves foreign factors. According to my country's Law on the Application of Laws, if it involves my country's financial security and social public interests, the mandatory provisions of my country's laws and regulations should be directly applied. Our country's laws and regulations prohibit virtual currency investment. Therefore, investing in overseas virtual currencies and related derivatives violates the mandatory provisions of our country's laws and regulations and violates public order and good customs. The cooperation agreement should be deemed invalid, and the losses caused by this shall be borne by the parties themselves. The court therefore ruled to dismiss the appeal and uphold the original judgment.

2

Shao Shiwei's Interpretation

People in the currency circle should all know this place, Yancheng, Jiangsu. The famous PlusToken pyramid scheme case, the largest case in the currency circle, was sentenced here. In 2019, Yancheng, Jiangsu, seized 314,200 bitcoins. How much are they worth now?

Oh, the topic has gone too far. Let's come back to this civil case.

Both the courts of first instance did not support the claims of Singaporean citizen Pan. After four years of litigation, the 5 million investment funds were still not recovered.

Looking across the country, there are actually many cases of virtual currency entrusted investment. Lawyer Shao's team has also come into contact with many cases of different judgments of courts in different regions across the country and different trial styles of judges. Regarding whether the funds entrusted for virtual currency investment should be returned, in general, it is nothing more than whether the contract is valid, how to divide the responsibilities of the parties, and how the money should be judged.

But why was this case listed as a typical case? It is probably because of the foreign-related identity of one of the parties, Pan. After all, judging from official reports, there is no doubt that this case is complicated.

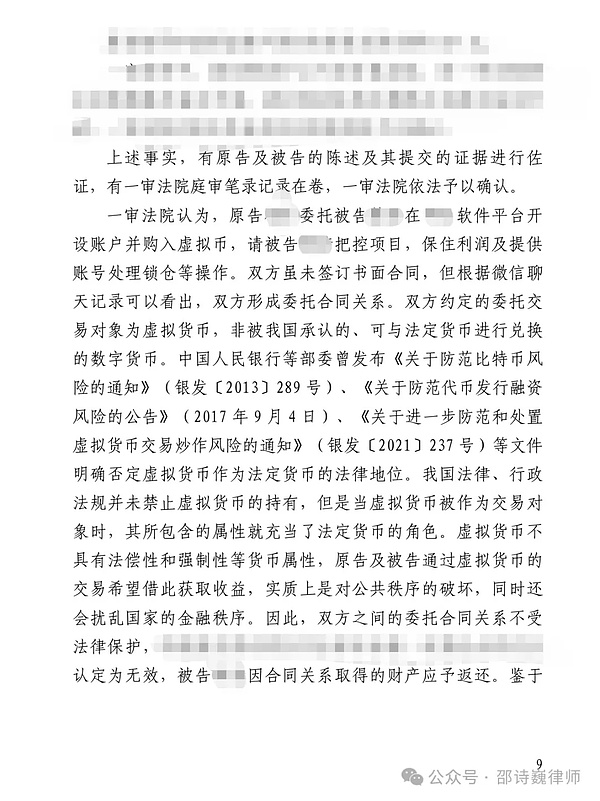

Friends in the currency circle, who have consulted lawyers or have checked relevant legal provisions on their own, should know: According to relevant domestic policies, holding virtual currency is not illegal in my country, but investing and trading in virtual currency is at your own risk. So what are the consequences of bearing the risk yourself? Lawyer Shao combined this case and gave everyone a detailed analysis in the form of questions and answers:

Q: Can virtual currency investment and trading be carried out in China?

A: If an institution is the main body to receive the user's money, it will be identified as illegal financial activities, and the business behavior has a great risk of criminal involvement; if it is an individual retail investor, then the risk is borne by the individual, and the contract will generally be deemed invalid by the court.

Q: Investing in virtual currency in China, at your own risk, is it true that there is no way to protect your rights if you lose money?

Answer: Bearing the risk by yourself does not mean that you cannot get your money back. This involves the issue of responsibility division. If the court finds that the investor is at fault, then the amount of investment to be returned will be relatively small or even zero; but if the court believes that the agent also has a certain degree of fault liability, then when deciding whether the agent should return the investment, the proportion of the amount that the agent should return will naturally be considered.

As for how the court determines the responsibilities of each party in the final judgment, we must combine the facts and evidence of the case itself to explain our views during the trial. In the absence of relevant evidence, as an investor, it is very important to have a reasonable explanation to prove the investor's claim. At this time, professional lawyers who have been deeply involved in the web3 industry need to combine the transaction practices and industry habits of the blockchain industry to "popularize science" to the judge. After all, in most cases, we cannot expect that the judge who hears your case happens to understand you (bi).

Q: If you lose money investing in virtual currency in China, can you sue the court to get your investment back?

A: It should be noted that the current domestic overall attitude towards virtual currency trading and investment is negative. This can be seen not only from the relevant policies such as the 94 Announcement and the 924 Notice, but also from the judicial practice level and various official media reports.

However, from the perspective of such cases handled by our Mankiw Law Firm, investors’ requests for refunds are not necessarily lost, as in the guiding case of the Jiangsu Court in this article. From a practical point of view, there is still room for improvement.

For example, the following are two cases recently represented by Mao Jiehao, a lawyer from our commercial team. One case was judged and the other was mediated, and both achieved ideal results. This is not easy under the current domestic policy background that is not friendly to the regulation of cryptocurrencies as a whole.

Q: Since the domestic policy environment is not friendly to cryptocurrency investment, is “going overseas” a good way to save the country in a roundabout way?

Answer: You can go overseas, but the more critical thing is the prior agreement on the jurisdiction of dispute resolution.

In the case of Yancheng Court, since the investor Pan is a Singaporean citizen, this case has foreign-related factors, but why did the two parties choose to sue in a domestic court? Pan's situation may be like this (there is no public report information on this point, only guessing based on practical experience). First, the agreement did not clearly stipulate the jurisdiction of the court, and the local court in Singapore did not accept this case, so he could only choose to come to the Yancheng Court where the defendant resided, which was easier to file a case. Second, Pan thought that if he sued Tian in Singapore, it would be difficult to execute Tian's property in the future.

For example, Singapore and Hong Kong, China, are indeed more friendly to blockchain and cryptocurrency than mainland China. If the lawsuit can be heard in these places, Pan's investment may have a chance to come back. As for the execution of overseas judgments, you can refer to the following video.

In practice, the procedures for overseas arbitration are certainly more complicated, but no matter how complicated the procedures are, it is better than getting a valid judgment of losing the case.

It is necessary to remind everyone that the jurisdiction of litigation/arbitration cases is not something that the parties can choose at will. This requires a clear agreement between the two parties. Therefore, experienced lawyers will help the parties to foresee all the problems that may occur as much as possible before the two parties decide to cooperate, and reasonably agree on the jurisdiction of future dispute resolution based on the actual situation of the cooperation project between the two parties.

But unfortunately, in general, most people will not think of finding a lawyer until a dispute occurs, which will make them a little passive at this time.

========This is a dividing line========

From the perspective of legal professionals, there are some interesting points in this case. Let's take a look at the views of the Provincial High Court on this case:

The Jiangsu High Court believes that: Pan is a Singaporean citizen, and this case has foreign-related factors. According to my country's Law on the Application of Laws, if it involves my country's financial security and social public interests, the mandatory provisions of my country's laws and regulations should be directly applied. my country's laws and regulations prohibit virtual currency investment. Therefore, investing in overseas virtual currencies and related derivatives violates the mandatory provisions of my country's laws and regulations and violates public order and good customs. The cooperation agreement should be deemed invalid, and the losses caused by this shall be borne by the parties themselves.

This is probably because Pan or his agent proposed in the appeal that "this case has foreign-related factors, so the case should not be judged based on the relevant laws of my country." Therefore, the Jiangsu High Court has the above opinion. However, Lawyer Shao believes that there are still many issues worth pondering about the High Court's point of view. Let's take a look at the "Judge's Interpretation" section: The judge mentioned that according to the "Interpretation of the Law on the Application of Laws I", my country's laws and administrative regulations involving financial security such as foreign exchange control are mandatory provisions that should be directly applied. However, it is immediately stated below that "the cooperation agreement involved in the case involves the act of engaging in overseas virtual currency investment". This ambiguous expression just shows that the investment funds of Singaporean citizen Pan are overseas money and do not involve foreign exchange control. Otherwise, if such a large amount involves disguised foreign exchange trading and is listed as a guiding case, it is impossible not to mention it at all. Therefore, the application of the "Interpretation of the Law on the Application of Laws I" in this case is obviously insufficient.

The judge mentioned that the "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation" (924 Notice) stipulates that virtual currency-related business activities are illegal financial activities, which are strictly prohibited and resolutely banned in accordance with the law; overseas virtual currency exchanges providing services to residents in my country through the Internet are also illegal financial activities. This case violates the mandatory provisions in the field of financial supervision in my country.

——Perhaps considering the application of the "Interpretation of the Law on the Application of Laws I", there is insufficient basis, so the 924 Notice was cited to strengthen the reasoning. However, the dispute in this case occurred in September 20, what does it have to do with the 924 Notice issued in September 2021? Moreover, in terms of the level of effectiveness, the 924 Notice is at most a normative document, and it will not have retroactive effect.

Although according to the 924 Notice, virtual currency-related businesses are illegal financial activities, this restricts the behavior of institutions such as virtual currency exchanges. Although personal cryptocurrency speculation is not encouraged in my country, it is not prohibited either. The personal investment and cryptocurrency speculation of Pan and Tian has not risen to the level of "illegal financial activities".

3

Remember the past and learn from it

That's all I have to say. For friends in the cryptocurrency circle, it is more important to learn from the past cases of others to prevent their own legal risks. So at the end of this article, Lawyer Shao also gives you some suggestions:

1. Before cooperating

If you can agree on foreign jurisdiction in writing, you should give priority to regions with a mature judicial environment and rich precedents, such as Hong Kong and Singapore, to better protect your own rights and interests.

2. When a dispute occurs

If there is no written agreement on the judicial jurisdiction, you need to select an institution that can accept the case based on the actual situation of the case and formulate a reasonable litigation strategy.

If you can only sue domestically, you are not completely without a chance of winning. It is just that the relevant domestic laws and regulations are not yet perfect, the judgment results are uncertain, and different judgments for the same case are more common.

3. Choose a professional lawyer

![]()

Catherine

Catherine