Author: James Ho, Source: Author Twitter @jamesjho_; Compiler: Tao Zhu, Golden Finance

Layer 2 on Ethereum has made significant progress in the past few years.

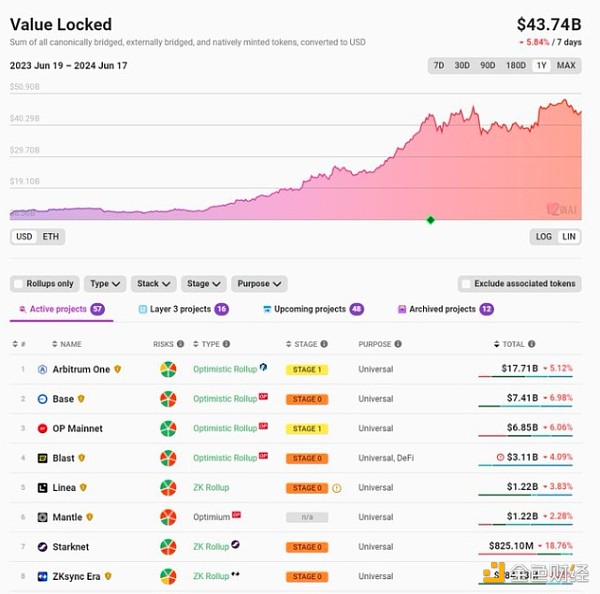

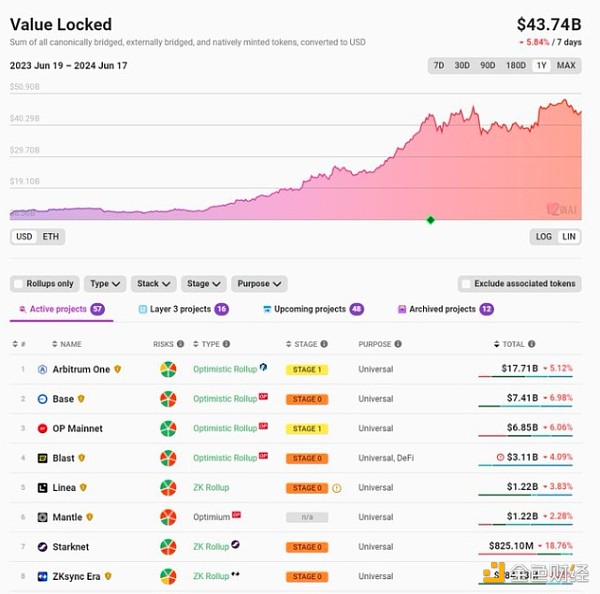

Today, ETH L2's TVL exceeds $40 billion, up from $10 billion a year ago.

On @l2beat, you'll find a list of more than 50 L2s, although the top 5-10 L2s account for more than 90% of TVL.

After EIP-4844, Txns fees are very cheap, with fees for Base, arbitrum, etc. below $0.01.

Despite this, L2 tokens have generally performed quite poorly as liquidity investments compared to ETH (they are clearly excellent venture investments).

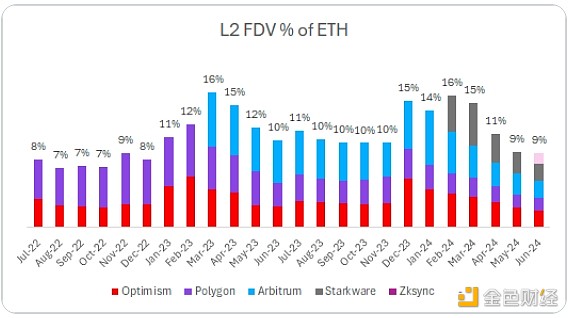

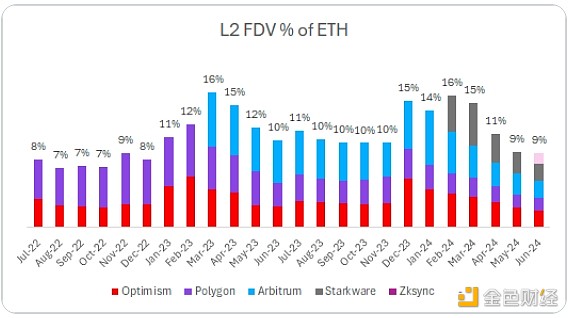

Let’s go back and plot the valuations of the major L2s versus ETH. One notable observation:

Even though the number of listed L2s has increased, their percentage of total FDV of ETH has remained the same.

Two years ago, the only L2s listed were Optimism and Polygon. They accounted for 8% of ETH.

Today, we have Arbitrum, Starkware, zkSync all joining the L2 ranks. They now account for 9% of ETH.

Every new L2 token that enters the market actually dilutes the valuation of previously listed tokens.

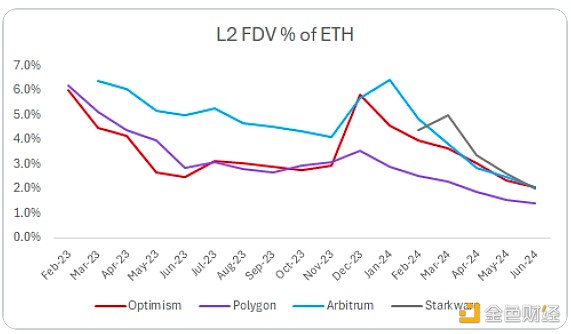

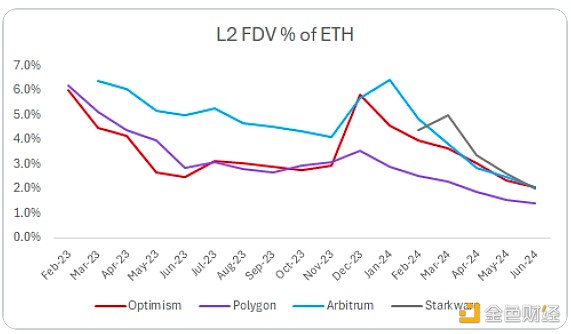

Compared to ETH, the results of investing in L2 tokens are quite significant.

Last 12 month returns (as of today):

ETH +105%;

OP +77%;

MATIC -3%;

ARB -12%.

The leading L2 tokens have long had a FDV of ~$10B. In a sense this is fairly arbitrary and I don’t think there is a good reason from market participants why the valuations are $10B vs $20B vs $3B. Ultimately there is massive supply pressure in the form of vesting, unlocking, etc. - from people who need liquidity and/or surge.

Why isn’t there more liquidity buying these L2s?

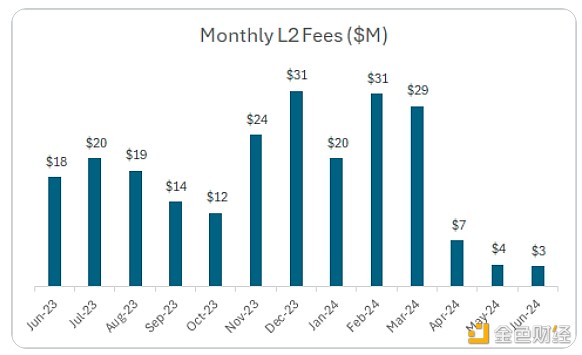

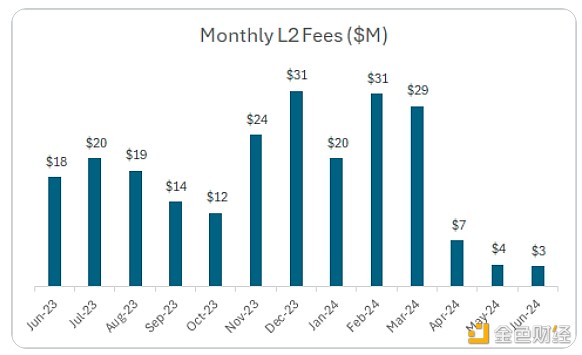

The aforementioned L2s generate $20-30M in fees per month. Fees have dropped since eip-4844 and now total $3-4M per month. That equates to $40-50M in fees per year.

Blobs are dirt cheap right now. Most of the revenue goes to the bottom line.

(including optimism, arbitrum, polygon, starkware, zksync)

These leading L2s are currently valued at a total of ~$40B FDV with annualized fees of $40M. That's about 1000x.

This is in stark contrast to the large DeFi protocols, which are valued at much lower valuations than DeFi protocols (below based on annualized fees in the last 1 month). Typically in the 15-60x range.

DYDX - 60x;

SNX - 50x;

PENDLE - 50x;

LDO - 40x;

AAVE - 20x;

MKR - 15x;

GMX - 15x.

There are many more L2s in the pipeline. As these products come to market, it will likely continue to put pressure and dilute the FDV category of L2s. The supply is simply too large for the liquidity market to easily support.

Final thoughts:

L2s can generate significant fee income in the long run. L2s generate $150M in fees per year (including Base, Blast, Scroll). This can grow meaningfully with L2 activity.

The above comment is not about any specific L2, this is more about the category. It seems hard to buy a basket of L2s with ~$40B FDV for ~$40M in fees (1000x) and expect to outperform ETH in the long term.

It is clear that high throughput chains like L2, Solana, Sui, Aptos, etc. are not short of block space. The limiters are using this block space on applications. I expect to see an increasing focus on applications and liquid markets rewarding the application layer rather than the infrastructure stack in the coming years.

In the last cycle, it was more common for projects to go public earlier. MATIC had less than $50M FDV on liquid markets and is now over 100x higher at over $5B. This appreciation was achieved through liquid markets. However, recently, this has not been the case for $OP $ARB $STRK $ZK and most other L2 tokens that may eventually go public.

Brian

Brian