Bitcoin vs. Gold: Which Can Beat Inflation?

Both gold and Bitcoin have hit record highs this year, but their sharp rises came long after inflation peaked in June 2022.

JinseFinance

JinseFinance

Source: LD Capital

This week, we focus on the latest developments in the Bitcoin trading market and ETFs because:

Last week, Bitcoin ETF became the exchange product with the largest capital inflow in the world + US$2.27 billion

The total market value reached 69% of GLD

OI in the contract market is close to the all-time high

Cryptocurrency concept stocks have surged, and network difficulty has reached a new high

These phenomena signal the growing prominence of cryptocurrencies, and Bitcoin in particular, on Wall Street.

We will also discuss some hot issues such as:

With the halving imminent, can the price hit another level like last time? new highs?

The proportion of Bitcoin ETFs in total market capitalization has exceeded that of gold. Has the inflow of ETFs come to an end?

Is there still room for ETH ETF speculation?

Do you need to worry about the Genesis sell-off?

What are the hidden worries in Coinbase’s unexpected earnings report?

What are the cryptocurrencies riding the AI boom?

Will inflation and the AI craze, the biggest headwinds in the market at present, test investor confidence again?

Is there room for growth in the valuation of AI leader Nvidia?

Bitcoin futures open interest (OI) exceeds $22B, which is the BTC price in November 2021 It reached the highest level since reaching $65,000. At that time, the contract OI was as high as 23B. New funds entered the market and supported the current price direction, indicating that this trend may continue for some time

Among them CME’s BTC futures Contract positions fell sharply in Europe after the ETF passed (63B-44B) but then quickly hit a record high, which means that more Wall Street investors are entering the market or existing investors are increasing their positions, and OI rises The accompanying rally shows this further confirms the bullish sentiment in the market, as more investors are willing to buy contracts at higher prices:

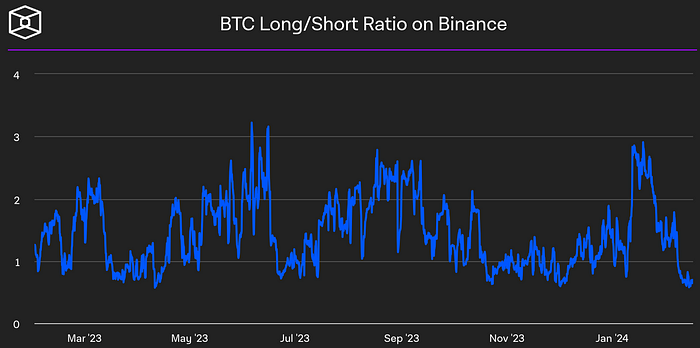

The long-short ratio of Binance futures is at a historical low:

The delivery contract premium remains within the normal range:

BTC 25 Delta option skewness is positively skewed indicating that calls are more expensive (or more in demand) than puts, but positive The degree of bias is not extreme. The 30-day Call implied volatility is 4.8 percentage points higher than the Put. The 90-day and 180-day implied volatility are about 7 percentage points higher:

Recently, Binance’s USDT financing rate exceeded 45%. It is quite rare, which shows that the enthusiasm for long leverage is very high. The financing interest rate has been quite high since November last year, but based on the history of the past year, it seems that there is no obvious reversal relationship between this indicator and the price of BTC:

The Bitcoin Spot ETF has performed strongly over the past week, with net inflows exceeding $2.27 billion (44,865.4 BTC) from February 12 to February 16, nearly half of the total inflows since listing.

At the same time, the net inflow volume of BTC ETFs last week ranked first among all US ETF products (of course this is a group of ETFs versus a single theme ETF). $IBIT alone attracted $5.2B, accounting for 50% of BlackRock’s total net ETF flows of 417 ETFs:

Contract market and spot market ’s positions increased at the same time, adding liquidity and volatility to the crypto market. Generally speaking when price and OI rise sharply at the same time, this may indicate that the market is overheated. This phenomenon is mostly accompanied by speculative buying driving up prices, and as investor sentiment reaches extreme optimism, negative news or events can cause a market stampede to reverse. But the point is that now that BTC has a strong inflow of new ETFs, it is reasonable for the overall holdings to rise to a higher level. We cannot completely compare history horizontally to judge whether it is overheated.

Outflows from 14 major gold ETFs have reached $2.4 billion so far in 2024. ARK’s Cathie Wood believes gold’s “replacement” to Bitcoin is underway. But we can’t ignore that FOMO sentiment in U.S. stocks may also be another force sucking money away from gold investments right now.

The current market value of Bitcoin spot ETF is $37B, and gold is $210B, accounting for 17.6%; if you only look at $GLD, which has the largest liquidity and the best liquidity, it is 54B, accounting for 69%. Bitcoin is catching up with gold. The speed is surprising:

BTC ETF accounts for approximately 3.7% of Bitcoin’s market value. By comparison, gold ETFs are equivalent to 2.8% of the total market capitalization of surface gold (excluding jewelry). The BTC ETF has outperformed its biggest rivals on this metric, but is this a sign of overheating? This conclusion alone cannot be drawn.

Because on the other hand, the total number of BTC currently held by enterprises, governments, and funds is close to 2.2 million, with a value of more than 110 billion U.S. dollars, exceeding 10% of the total planned issuance of BTC and exceeding 11% of BTC has been mined. If undisclosed data is included, this proportion should be higher. However, compared with the overall institutional holdings of US stocks, which is as high as 70 to 80%, there is still a lot of room for growth:

< /p>

It is recommended that interested friends make a comparison chart of the daily net flow of ETFs and the daily output of BTC. The current daily output is about 1,000 coins and will be halved in late April. There are only about 500 coins in the end. As long as the net inflow is greater than the output, it can boost market confidence.

So far after the Bitcoin ETF was listed, the net inflow was approximately 96,000 BTC, with an average daily inflow of 3,700 BTC in 26 trading days.

Bitcoin’s current valuation of $1 trillion puts it among the top ten tradable assets in the world, even ahead of Warren Buffett’s Berkshire Hathaway (market cap of $875 billion).

Cryptocurrency concept stocks have surged since February, especially BTC mining companies, whose gains have far exceeded that of Bitcoin itself. Among them, $CLSK announced last week that it has completed the power-on of its first 100-megawatt expansion project at its Sandersville, Georgia, U.S. plant. This achievement has enabled Cleanspark’s computing power to increase by 40%, exceeding 14 EH/s and currently ranking third among U.S. listed companies. Combined with the first quarter financial report that exceeded expectations, $CLSK has become the most eye-catching among crypto stocks:

< /p>

The total computing power of the Bitcoin network has increased by 260% in the past three years:

The most noteworthy thing about crypto concept stocks was last week COINBASE's Q4 financial report, as the only digital currency trading platform stock in the US stock market, achieved quarterly profit for the first time in two years since its listing: Coinbase reported fourth-quarter revenue of US$950 million, exceeding the market consensus of US$820 million. Profit in the fourth quarter was US$273 million, compared with a loss of US$557 million in the same period last year. It unexpectedly achieved quarterly earnings of $1.04 per share, significantly beating analysts' expectations for a loss of 1 cent per share.

While it looks good, as the market rebounds from a bull run, Coinbase’s total trading revenue is still down 44% year-over-year - with 2024 trading volume of $468 billion, compared with $830 billion in 2022 and $830 billion in 2021. US$1,671 billion continued to decline sharply.

But despite the decrease in trading volume, the company's other assets, especially custody of customer crypto assets, increased significantly by +155% to $192.6 billion, and subscription and services revenue increased by 78% to $1.4 billion, It also cut total operating expenses by $2.6 billion, which offset a decline in trading revenue, resulting in net income of $95 million.

However, a closer look at "subscription and service revenue" is a bit misleading. The majority of this revenue (870 million) comes from interest income from stablecoins or deposits, mainly due to rising interest rates in the overall economic environment, which is not the case. What the company can control.

The other is the decline in the number of active traders - MTUs (Monthly Transacting Users): refers to users who have made at least one transaction within a 28-day rolling period. MTUs will average 7 million in 2023, down consecutively from 8.3 million in 2022 and 11.2 million in 2021. This is strange because the activity of the crypto market in terms of transaction volume and OI increased significantly in the third and fourth quarters, but active users even declined.

In addition, according to Coinbase, an estimated 52 million Americans own cryptocurrency.

For 2024, Coinbase Quarterly revenue in the first quarter of this year is expected to exceed $1 billion for the first time, but expenses are also expected to increase.

Coinbase shares later closed up 9% at $180, but are still well below the $381 opening price after their 2021 debut.

Faced with the launch of Bitcoin ETFs with lower transaction costs, it was previously expected that Coinbase would lower its platform transaction fees. Judging from the sharp decline in the number of active traders, Coinbase should be under some pressure, but so far It seems that they have not seen any corresponding countermeasures. Judging from the CFO Q&A, they still believe that spot ETFs may lead to more investors looking for more cryptocurrency exposure on the Coinbase platform, so they do not intend to take the price competition route. .

At the same time, it is important to note that Coinbase’s newly opened overseas derivatives exchange has attracted a large number of transactions and launched derivatives products for eligible U.S. retail traders in November. This development Very important. Considering that the derivatives market far exceeds the spot market, I believe Coinbase has huge growth potential in this area.

The consensus among Wall Street analysts is leaning toward "Buy," with a median consensus target of $165, with targets ranging from a low of $60 to a high of $250. This high variance target range highlights the highly uncertain and speculative nature of $COIN’s future value.

The halving of BTC production in April will pose a threat to Bitcoin miners. As Bitcoin issuance reduces from 6.25 BTC per block to 3.125 BTC, Bitcoin’s inflation rate drops from 1.7% to 0.85% per year. The marginal impact of deflation is getting smaller and smaller, which theoretically supports the price. The effect will not be as good as before.

Miners’ income from block rewards is effectively cut in half, but payouts must increase.

However, miners are also preparing for reduced block rewards through financial strategies, including raising funds through the issuance of stocks and bonds and selling cryptocurrency reserves, a strategy that is critical to maintaining the Bitcoin network after the halving. Stability and security are crucial. In addition, innovations on the Bitcoin blockchain (such as Inscription and L2) have increased miners' fee income and are not as dependent on block rewards as before, so we expect that the network's computing power can still repeat the previous rebound pattern after a brief decline.

But it is more difficult to predict the price, because the surge after the last halving was accompanied by the global fiscal + monetary policy after the new crown epidemic. This time there is no such background.

Looking back on the 2020 halving, which resulted in the block reward being reduced to 6.25 BTC, followed by a 30% drop in Bitcoin’s hash rate in two weeks and little change in price around $9,000. However, the system quickly adapted, breaking the record just seven weeks later with a new all-time high hash rate. It only took eight months for the price to reach an all-time high of nearly 65,000.

The price of LTC, which was halving in advance in August last year, once rose from around US$80 to US$115 before the halving, but soon fell to US$56 after the halving, and is currently hovering around US$70 in the face of the recent The bull market has also yet to rebound to pre-halving levels.

However, the computing power of the LTC network has hardly been affected by the halving, and has increased by more than 30% since August:

Last week, ETH broke through the $2,800 mark and set a new 21-month high, with an increase of 11.6%, far exceeding BTC's 6.3%. Judging from social media sentiment, the positive effects of BTC spot ETF have made investors refocus on the possibility that ETH spot ETF will soon Possibility of passing. Just last week VanEck and ARK/21Shares submitted updated application documents for their spot Ethereum ETF registration.

Since BlackRock proposed the BTC spot ETF application in June last year, BTC has rebounded by 100%, while ETH has only 70% during the same period. The theoretical market value of ETH is smaller and has more usage scenarios. It should be more flexible, so if an ETH spot ETF can be issued, its bull market price performance should be better than that of BTC. In addition, regulated Ethereum products can also provide up to 5% APY when tokens are pledged, which is more attractive than non-yield BTC ETF products.

The share of closed fund ETHE has shrunk significantly in the past six months. We have repeatedly prompted relevant opportunities in last year’s report"Is buying ETH at 50% an opportunity or a trap? "In-depth analysis of Grayscale Trust", "In-depth explanation of Grayscale Trust|Why you can buy Ethereum at half price ? (2)》. The management fee of Grayscale Ethereum Trust is 2.5% of the net asset value (NAV) per year. If other risks are not considered, today's discount can be understood as the discount of the opportunity cost of holding a position. Therefore, based on the secondary market discount rate /p>

Position opportunity cost + 10-year U.S. Treasury bond yield + 2.5% management fee, then: (1-Y)^T=1+X

Obtained: T=ln( 1 + What resistance does ETH pass? Therefore, if you adopt the strategy of buying ETHE and shorting the ETH perpetual contract, in addition to making money at a reduced discount, you can also charge a certain positive funding rate:

GBTC The discount narrowed to 6.x% in the previous week through ETF:

On February 14, the bankruptcy judge approved Genesis’ liquidation value of approximately $13 billion in GBTC as part of efforts to repay creditors. Since the rules of the bankruptcy plan allow Genesis to convert GBTC shares into underlying Bitcoin assets on behalf of creditors, or sell the shares directly and distribute cash, it is unclear how much of this money will ultimately flow out of the cryptocurrency ecosystem, and if users will still be repaid in cryptocurrency , then after liquidating GBTC into cash, the cryptocurrency spot will be bought back, so the impact on the market will be limited. Otherwise, there will be a certain impact.

After the court news was announced, the market did not panic too much, and BTCUSD still fluctuated above $50,000.

According to a recent report by Stocklytics, the total market value of artificial intelligence (AI)-related cryptocurrencies has exceeded US$12 billion:

The AI-related cryptocurrency with the highest market value is TAO (Bittensor), reaching US$3.88 billion, and its price has increased 11 times in five months. Bittensor (TAO) is a decentralized machine learning protocol that serves as a marketplace for algorithm providers and users in the fields of artificial intelligence and machine learning. Miners provide algorithms by contributing their processing power and machine learning models to the network. Clients who require ML algorithms as input to their own solutions will need to pay TAO, the protocol’s native cryptographic token, to access them.

The market value of second-place RNDR (Render) is only less than half of US$1.87 billion. RNDR can be used to pay for animation and rendering tasks.

The third-placed Akash Network’s AKT has a market value of just over US$800 million.

Among the other six cryptocurrencies, only one, Fetch.ai’s FET, has a market capitalization of more than $500 million, while the other five range from $450 to $280 million. between.

Of the cryptocurrencies in the above list, only RNDR, FET, and AGIX are listed on the Binance exchange. TAO, which has the largest market value, is not even listed on OKX.

However, we believe that AI concept digital currencies should also include WorldCoin ($WLD). Although the project itself is a digital identity concept, because it is a project released by the founder of OpenAI, the leader in the AI industry, Every time there is big news about OpenAI or Sam himself, WLD will follow the fluctuations without exception. For example, last week OpenAI launched a text-to-video AI model called Sora, which amazed the world with its results, and subsequently WLD surged by more than 50%. Sam believes that in a future world with a large amount of artificial intelligence, it will become increasingly important to understand who humans are. This is one of the important missions of WLD.

Main AI concept cryptocurrency trends in 2024:

Due to policy and high leverage risks, most of them were last year It has been cleared of bankruptcies or regulatory lawsuits related to Voyager, Genesis, FTX, Ripple, Binance, etc., so the basis for this round of rebound is relatively healthy. However, the problem is that the last bull market before 2021 was based on low interest rates. At that time, U.S. bond yields were lower than 0.5%, coupled with dual fiscal and monetary stimulus, which led investors to seek risk assets with higher yields. The prices of almost all assets and goods and services in cryptocurrency are rising. The US CPI once rose above 8%. Before that, the Federal Reserve started the process of raising interest rates and proactively burst the price bubble. BTC peaked eight months earlier than inflation.

Figure: US CPI and BTC prices

With the two major inflation data released by the United States last week, CPI and PPI, both fell across the board. More than expected, service inflation rekindled and housing prices rebounded more than expected, indicating continued inflationary pressure in the country. Coupled with more recent upbeat economic data, expectations for the Federal Reserve to cut interest rates have been repeatedly pushed back.

While the interest rate derivatives market has been repricing the weakening of interest rate hikes for more than a month, the stock market and cryptocurrency market have not reacted because they still have The independent theme is enough for investors to ignore the progress of the interest rate market, but this does not mean that one day when the market enthusiasm is exhausted, investors will not see this issue again. This is still the biggest headwind for risk assets to continue upward.

After two price data that exceeded expectations last Friday, the momentum of the US stock market's rapid growth in the beginning of the year finally subsided. However, even so, the decline of the market was still limited, and the S&P 500 index fell by 0.4 for the week. %, closing near a record high. The postponement of the expected interest rate cut from March to June does not seem to make investors too nervous. Currently, market attention has turned to the results that AI leader Nvidia will announce next week, which directly determines whether this hype frenzy can continue.

The last report forecast earnings per share (EPS) of $3.39 on revenue of $16.11 billion. The result was earnings in late November that beat expectations by a wide margin, with earnings of $4.02 per share on revenue of $18.12 billion. Despite delivering very strong numbers, the NV share price subsequently experienced a brief downturn, retracing 10% from its highs (500–455).

This time around, market expectations are significantly higher, with earnings per share expected to be $4.57 and revenue of $20.36 billion, and it's uncertain that even if the data beats expectations again by then, the market will take a break. However, this will not affect the long-term optimism. In the past few weeks of earnings season, major customers such as Meta, Google and Microsoft have launched newly defined artificial intelligence strategies. Demand for computing chips is unlikely to decrease. These big technology companies Promised future spending on artificial intelligence is in the tens of billions of dollars.

Just over a month into the new year, NV’s stock price has risen by 50%, and its current market value exceeds US$1.7 trillion. With shares trading at sky-high valuations ahead of the earnings release, it's easy to think that all the good news has been priced in, and even the slightest hiccup could cause the stock to plummet. But in fact, although NV's historical price-to-earnings ratio is as high as 95 times, its 12-month forward price-to-earnings ratio is only 35 times, which is not an exaggeration, because the S&P 500 is 20 times, META is 23 times, AMD is 47 times, Tesla is 65 times, and ARM is 95 times. times.

Goldman Sachs, Bank of America and other institutions have recently raised their Nvidia price targets. If the new target is US$800, it means that the valuation will exceed US$2 trillion:

< /p>

Weekly fund flows: Stock inflows of $16 billion (U.S. $11 billion, China 3 billion), bonds inflows of $11.6 billion, gold outflows of $600 million, cash outflows of $18.4 billion ( Largest outflow in 8 weeks).

It is suspected that the national team’s buying is supporting the market. The Chinese stock funds tracked by EPFR have a net inflow of US$44 billion in the past four weeks. Of course, due to the Spring Festival holiday last week, the data includes February 8-9. Inflows, single-week data may be underestimated:

< /picture>

Bank of America Bull and Bear Indicator Down from 6.8 to 6.6, at neutral level:

The cash level in the portfolios of fund managers surveyed by Bank of America in February dropped to 4.2%, and it will be triggered when cash reaches or falls below 4.0% No "sell" signal from Bank of America:

Goldman Sachs’ institutional sentiment indicator entered overheating for the first time this year:

AAII investor survey long-short gap fell sharply, 87–68 Percentage, mainly due to the increase in the proportion of short positions:

< /picture>

Deutsche Bank’s measure of overall stock positioning has declined, retreating slightly from six-month highs and currently sits in the 84th percentile . Among them, the positions of independent investors have declined (88-87 percentile), and the positions of systematic strategies have continued to increase slightly (78-79 percentile)

Repurchase Statement for the Quarter Earnings season continues to rise:

Both gold and Bitcoin have hit record highs this year, but their sharp rises came long after inflation peaked in June 2022.

JinseFinance

JinseFinanceCurrently, spot BTC ETFs traded in the United States are equivalent to approximately 66% of the total assets managed by gold ETFs.

JinseFinance

JinseFinanceMany people still confuse FHE with ZK and MPC encryption technologies, so this article will compare these three technologies in detail.

JinseFinance

JinseFinanceETF, BTC, gold, Bitcoin ETF's performance 5 months after its launch and comparison with BlackRock's Gold ETF. Golden Finance, analyzing the impact of Bitcoin and gold ETFs on the market.

JinseFinance

JinseFinanceThe passage of a Bitcoin spot ETF opened the door to the cryptocurrency market for many new buyers, allowing them to allocate Bitcoin in their portfolios. However, the passage of an Ethereum spot ETF has a less obvious impact.

JinseFinance

JinseFinanceFor Bitcoin to have and maintain its status as gold, the total amount of fiat money must continue to grow, and at a rate far above normal trends.

JinseFinance

JinseFinance JinseFinance

JinseFinanceThe fate of Genesis Trading, DCG and GBTC continues to hang by a thread.

Bitcoinist

BitcoinistWhen crypto bull market profits dry up, the best way to keep gains coming is by using leverage to open ...

Bitcoinist

BitcoinistLaunched in cooperation with ByteTree, the new BOLD ETP by 21Shares comprises 18.5% of BTC and 81.5% of gold at launch.

Cointelegraph

Cointelegraph