Author: Qin Jin

Witness the miraculous moment.

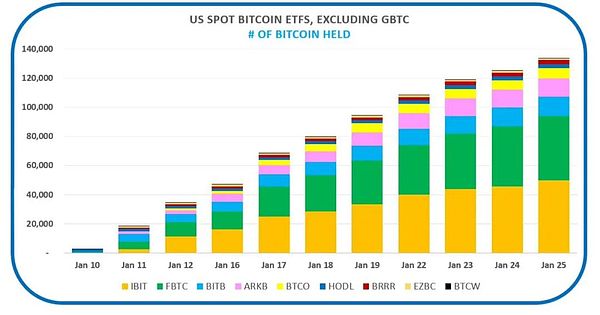

On January 27, within 17 days of the U.S. Securities and Exchange Commission’s approval of the Bitcoin ETF on January 10, the global asset management giant BlackRock’s Bitcoin spot ETF asset management scale had exceeded 2 billion US dollars. The total number of Bitcoins held has reached 49,952. Leading the other 9 Bitcoin ETF institutional participants. Excluding Grayscale GBTC, when GBTC converted from a closed-end fund to a spot ETF after the US Securities Regulatory Commission approved the Bitcoin ETF on January 10, the scale of assets under management was close to US$30 billion.

Some foreign media described BlackRock’s “breakthrough” as a major “milestone.” Larry Fink has become somewhat of a leading global influencer on the Bitcoin market.

Since January 10, after the U.S. Securities and Exchange Commission approved 11 Bitcoin spot ETFs, trading volume has reached a new "milestone", attracting the attention of global investors. For example, on January 20, Bitcoin asset management reached US$13 billion, surpassing silver ETFs and becoming the second largest ETF commodity category in the United States. Some foreign media described it as an important "milestone" for the Bitcoin market.

For another example, when the trading volume of the Bitcoin ETF in the first three days was close to US$10 billion, Bloomberg senior ETF analyst Eric Balchunas described it as a transaction of only BlackRock IBIT (US$1.995 billion at the time) , more than the "entire freshman class" of 2023. It is said that the total trading volume of the 500 ETFs launched in 2023 has only reached $450 million so far. The best one made just $45 million.

According to the latest data from CC15Capital, 10 trading days since the launch of the Bitcoin ETF, 9 Bitcoin spot ETFs have snapped up approximately 134,000 BTC worth US$5.6 billion. "Coindesk" reported that on Thursday, investors increased their capital to BlackRock IBIT by approximately US$170 million, prompting BlackRock to purchase nearly 4,300 Bitcoins again, bringing the total number of Bitcoins in its reserves to 49,952. Leading the other 9 Bitcoin ETFs.

ETF Store President Nate Geraci (Nate Geraci) said that among the more than 600 ETFs launched last year, BlackRock IBIT ranked third in asset management. The next fund to cross the $2 billion mark is likely to be Fidelity’s Wise Origin Bitcoin Fund (FBTC), which held nearly 44,000 Bitcoins as of January 25. Valued at approximately US$1.76 billion.

BlackRock's head of U.S. products Rachel Aguirre has previously said they are very excited to see funds coming from both retail and self-directed investors.

She believes that BlackRock's IBIT brings three benefits to investors. The first is access. Investors now hold IBIT as well as stocks and bonds. This brings a new level of transparency to investors.

The second is convenience. BlackRock removes the burden from investors and provides them with a truly convenient way to invest. Finally, quality. Rachel Aguirre said that as the world's largest ETF provider, BlackRock provides the same institutional-level technology and professional risk management for more than 1,300 ETFs around the world. BlackRock will also bring these technologies and risk management to IBIT .

But Rachel Aguirre also said that Bitcoin is not suitable for everyone. Bitcoin is an emerging asset class with very unique return and risk characteristics. Investors are currently on a journey to understand the benefits of this new asset class in their portfolios.

According to the "Enlightenment of the Development Experience of the World's Three Major Asset Management Companies on my country's Public Fund Industry" released by the China Securities Investment Fund Industry Association in 2020, as of the end of 2019, BlackRock's assets under management A total of 7.43 trillion U.S. dollars, of which the management scale of active funds is 1.95 trillion U.S. dollars, the management scale of index funds (excluding ETFs) is 2.69 trillion U.S. dollars, the management scale of ETFs is 2.24 trillion U.S. dollars, and the management scale of monetary funds is 0.55 trillion U.S. dollars.

According to the latest data this year, BlackRock’s asset management scale currently exceeds US$9 trillion.

Behind the data growth, we see that BlackRock is like a giant squid with ten tentacles. Extend your tentacles to every asset class with huge growth prospects to continuously enrich your body. At present, his tentacles have extended to the Bitcoin market.

Times reporter Heike Buchter once said in the book "The BlackRock Empire" that in the era of large-scale asset management, BlackRock's influence will only increase further. So can the Bitcoin ETF help BlackRock surpass the 10 trillion asset management "milestone"? We have to give time to answer this, let us witness the magical power exerted by Bitcoin on the giant squid. Let’s wait and see.

Xu Lin

Xu Lin

Xu Lin

Xu Lin JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Cheng Yuan

Cheng Yuan