At 23:10 pm on January 31, 2024, Beijing time, the Solana ecological DeFi protocol Jupiter platform currency, $JUP, was simultaneously launched on Binance and OKX.

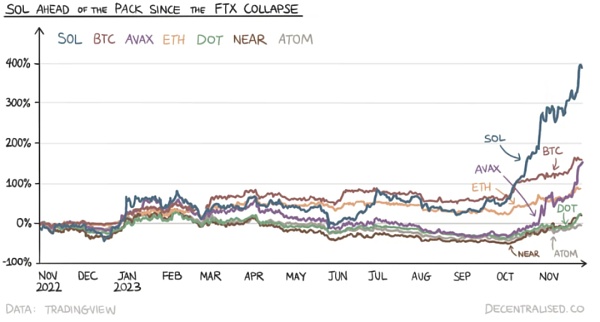

After the FTX incident, Solana's ecological vitality was severely damaged, investment institutions no longer favored it, and well-known projects also fled. Within a few weeks, $SOL plummeted from $236 to $13.

However, in 2023, Solana completed a comeback, with an increase exceeding that of many mainstream public chain assets. Among them, Jupiter, the leader in Defi, has also achieved a tenfold increase in monthly transaction volume, and even brought $JUP, which is known as "the largest airdrop in history."

Why does $JUP win the favor of the two giant exchanges? What kind of future can Solana and Jupiter bring? The article in this issue of Bailu Living Room will be interpreted for you.

Get to know Jupiter

Jupiter is on the Solana public chain The DeFi one-stop service platform was established in October 2021. Its core is to integrate various DeFi applications and optimize user experience. The product was originally positioned as an exchange engine, and has been iterated to support more related functions, such as: cost averaging strategy (DCA, also known as fixed investment method), limit orders, perpetual trading, and the recently launched launchpad.

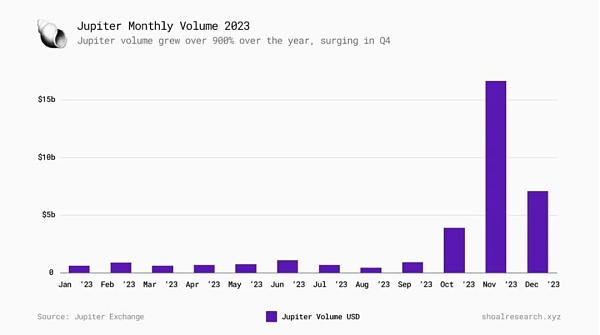

In 2023, Jupiter’s monthly transaction volume will increase approximately tenfold. The trading volume in January was US$650 million, which increased to US$7.1 billion in December. After the platform announced the issuance of $JUP tokens, trading volume hit a new high in November, exceeding $16 billion.

Currently, Jupiter has processed more than $66.5 billion in trading volume and more than 1.2 million transactions, accounting for more than 70% of the organic trading volume among all Solana DEXs, making it the preferred platform for traders on Solana.

On January 26, 2024, Solana’s daily active addresses exceeded 1 million. Regarding active changes, Artemis CEO publicly announced the conclusion of data analysis:Jupiter is the application that drives the most new active addresses.

On January 26, 2024, 37% of the daily active addresses on Solana were new addresses, which were most likely opened by robots to take advantage of Jupiter. new wallet and new address.

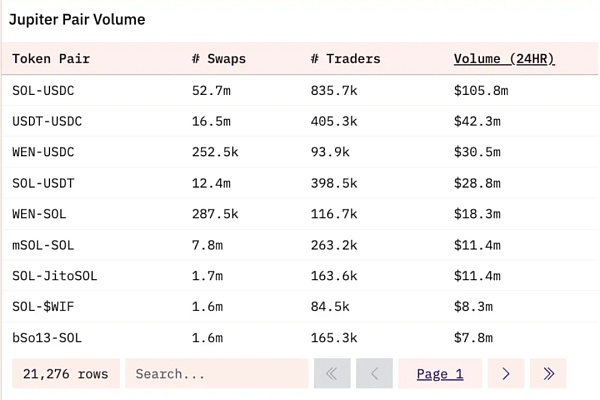

On January 28, 2024, the $SOL-$USDC trading pair on Jupiter had a trading volume of US$52.7 million. In addition, $WEN, $SOL and $USDC The trading volume between them is approximately $48 million.

On January 31, the first phase of the $JUP airdrop officially began to be distributed, and the market attention was unprecedentedly intense. The most watched and potentially largest airdrop in the history of Solana kicked off.

$JUP

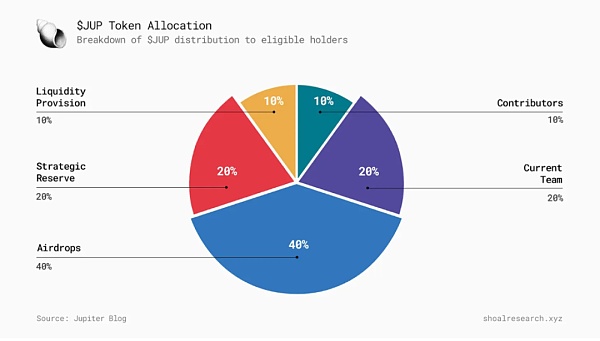

The maximum supply of $JUP is 10 billion, token distribution is evenly distributed into 2 cold wallets: team wallet and community wallet. The team wallet will be used for distribution to the current team, treasury and providing liquidity, while the community wallet will be used for airdrops and various early contributors.

From day one, 15%-17.5% of the tokens are in circulation, 10%-7.5% are in hot wallets, and 75% are in cold wallets.

Jupiter will conduct a retroactive airdrop to 955,000 early users (the deadline is before November 2, 2023), as well as a plan to attract new users and flow sex. The DAO will then vote on the token unlock data and the token will be initially locked with an unlock date set by the DAO. JUP holders will be able to vote on various key aspects of the Jupiter protocol and the role of the token, including the timing of initial liquidity provision, future emission arrangements, where the project will be showcased on Jupiter Start, and more.

$JUP can receive such high attention. In the final analysis,it is Jupiter that can take advantage of Solana and its potential to continuously innovate the future of Defi.

SVM-based construction is more suitable for the development of DEX

A virtual machine can best be described as a single entity maintained by thousands of networked computers running validating clients for a specific chain (such as Ethereum) and is the environment in which all smart contracts and accounts actually exist. To this day, most DeFi and other on-chain activity occurs through the Ethereum Virtual Machine (EVM).

However, despite no longer being in the spotlight, SVM also has a powerful architecture that will certainly continue to attract more consumers looking to build consumer-oriented applications that target speed and performance. Developers of optimized applications.

Smart contract code written in Rust, C, C++ will be compiled into BPF bytecode by SVM. The Sealevel engine is a key component in enabling parallel processing on Solana; with the integration of state access lists into Solana transactions, non-conflicting transactions can run simultaneously, resulting in faster overall performance.

On the other hand, Solana’s average interaction cost is low. Gas costs less than a penny. The cost of obtaining liquidity from multiple sources is almost the same as obtaining it from one source, so DEX aggregators are more practical and beneficial on a chain like Solana than on an EVM chain.

As the leading aggregator on Solana, Jupiter is more likely to achieve significant growth and adoption in the long term, while aggregators on the EVM chain face With higher costs and greater competition.

The same idea applies to other use cases beyond simple A for B, such as providing users with structured dollar cost averaging (DCA) or time Weighted average price (TWAP) products.

A more imaginative DEX development direction

Jupiter It combines a large number of innovative functions of on-chain DEX to create the smoothest trading experience for users and also provides a good example for the future development direction of Defi.

AMMs and aggregators

Automated market makers in is a novel innovation in the digital asset space over the past few years. With the advent of AMMs, traders can deploy digital assets whose markets are made by math and code rather than complex middlemen. Even with extremely low liquidity, traders can enter and exit positions.

Of course, low liquidity will bring new disadvantages. First, traders will encounter slippage, that is, the difference between the expected transaction value and the realized transaction value; second, traders may also lose value in the transaction through the use of information asymmetry in the public mempool, such as the deployment of MEV robots The complex participants jumped the gun or attacked from a flank. These still require developers to make more breakthroughs.

On-chain aggregators emerged to mitigate the impact of low-liquidity trading, allowing traders to place orders and have them delivered from multiple sources instead of just one. fluidity. Liquidity can be obtained from a variety of sources, including AMMs. Jupiter and other DEX aggregators source liquidity across multiple trading venues to provide traders with better trading prices and a better user experience.

DCA

Average cost method DCA, also known as fixed investment , involves splitting capital allocations into multiple transactions rather than one transaction. DCA averages its entry prices when accumulating assets in bear markets to mitigate volatility and generate greater returns over time and as market conditions change. Likewise, DCA can also help with profits in a bull market, as opposed to selling one's position completely immediately, DCA can help spread out the sales to capture any additional upside that may occur during the unwinding period, rather than selling one's position completely immediately.

Traders can also execute a weighted average price strategy, or TWAP, to buy or sell assets. Similar to DCA, TWAP is typically used for large orders that need to be split into smaller parts to prevent price impact from a one-time purchase.

Thanks to Solana’s high-throughput architecture, Jupiter is one of the few platforms that enables users to execute frequent time-limited strategies on-chain. DCA for low timeframe transactions on Ethereum (e.g. daily) can result in hundreds of dollars in transaction fees, whereas on Solana they are just pennies. Even on L2, if a trader wants to execute 10 trades in 1 hour, the fees can add up quickly.

Perpetual Contract

Jupiter launches LP-Traders Perpetual contract exchange. Although still in beta, traders can trade SOL, ETH, and wBTC perpetual contracts with up to 100x leverage, while LPs can provide capital to earn fees.

On Jupiter, traders can open long or short positions on SOL, ETH, and wBTC using virtually any supported Solana token as collateral. Long positions require the corresponding underlying, while short positions require stablecoins as collateral. Traders can take on leverage by borrowing assets from the liquidity pool - by borrowing 1x SOL from the JLP pool, a SOL-USD position can be leveraged up to 2x.

Jupiter Perps utilizes the JLP pool, which includes SOL, ETH, WBTC, USDC, and USDT. Providing liquidity simply deposits any supported Solana tokens into the JLP pool in exchange for an equivalent value of $JLP tokens. The JLP pool receives 70% of the fees generated by the Jupiter perpetual contract, and the price of $JLP grows in tandem with the value of the underlying pool.

The JLP pool also benefits the larger Solana ecosystem because Jupiter Swap is natively integrated into the perpetual contract exchange, meaning not only can it be used with any Tokens serve as JLP collateral, and Solana traders can benefit from the increased liquidity of the JLP pool and obtain better trading prices.

Different from the aforementioned features, Jupiter’s perpetual contract exchange charges more fees for both traders and LPs. Traders pay the pool an hourly borrowing fee or funding rate, which is based on the hourly borrowing rate, position size, and token utilization, and can be expressed as:

Funding rate = (borrowed tokens/tokens in the pool)*0.01%*position size

LP also needs to pay a portion of its own fees , used to open/close positions and exchange different assets within the JLP pool.

Jupiter is a viable bet for Solana to adopt in the near and long term. As network activity on Solana continues to increase, Jupiter is likely to capture significant amounts of liquidity through its established ecosystem, various product suites, and sustainable revenue model, theoretically benefiting $JUP holders in the long term. In today's context where mainstream financial giants are paying more and more attention to asset tokenization, Jupiter's leadership in functional innovation is likely to seize the opportunity of the new generation Defi market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin Cheng Yuan

Cheng Yuan Miyuki

Miyuki JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo Edmund

Edmund Huang Bo

Huang Bo Alex

Alex