Author: Bary Rahma, Be In Crypto; Translator: Deng Tong, Golden Finance

Historically, bull markets always start with Bitcoin and Ethereum, followed by altcoins. However, the current situation suggests that this pattern is shifting.

Why it's risky to buy altcoins now

Quinn Thompson, founder of crypto hedge fund Lekker Capital, advises against investing in altcoins at this time. He pointed to several indicators of market instability, including high leverage and open positions, a lack of panic buying, and a stagnant supply of stablecoins.

He believes that the market is facing increasing selling pressure, especially from venture capital funds that need to raise funds, which has led to more selling than buying. This situation, coupled with low trading volumes in the summer, has made it difficult for altcoins to gain traction.

"I think there are serious knock-on risks in cryptocurrencies, especially with the expectation that most altcoins will pull back. The market seems to have lost its ability to rebound, even for the major currencies, while leverage and open interest remain high," Thompson said.

Thompson pointed out that there are two main reasons for his position. First, the impact of Bitcoin and Ethereum exchange-traded funds (ETFs), and the problem of altcoin supply inflation.

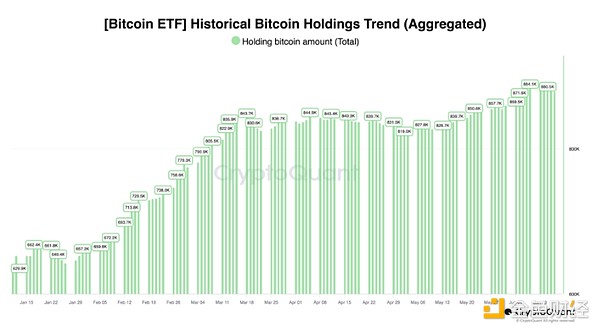

The launch of Bitcoin and Ethereum ETFs has changed the market structure. In the past, during bull markets, capital would flow from major cryptocurrencies such as Bitcoin and Ethereum into altcoins. However, with the current investment amount of Bitcoin ETFs exceeding $50 billion, these funds do not have a similar mechanism to invest in altcoins.

This shift limits the capital available for altcoins, making it harder for them to appreciate. Samara Epstein Cohen, chief investment officer of BlackRock ETFs, said that Traditional market participants are increasingly focusing on Ethereum for tokenization, further marginalizing altcoins.

The rapid launch of new altcoins has also flooded the market, creating huge inflationary pressures. Many projects have aggressively issued large amounts of tokens, resulting in supply far outstripping demand.

Thompson noted that there is a lack of demand to support the estimated monthly inflation of altcoin supply of around $3 billion over the next one to two years. While some altcoins may still perform well, identifying these successful tokens will be more challenging than in previous years.

“Altcoins face relentless selling pressure. As we head into the summer months when trading volumes are inherently low, the combination of large token supply unlocking and selling pressure from venture capitalists could make this an uphill battle for most tokens ,” Thompson concluded.

Meanwhile, Will Clemente, co-founder of Reflexivity Research, reflected on how the market has matured. In 2020, investing in high-beta altcoins was a profitable strategy as these assets outperformed Bitcoin. However, this approach is no longer valid.

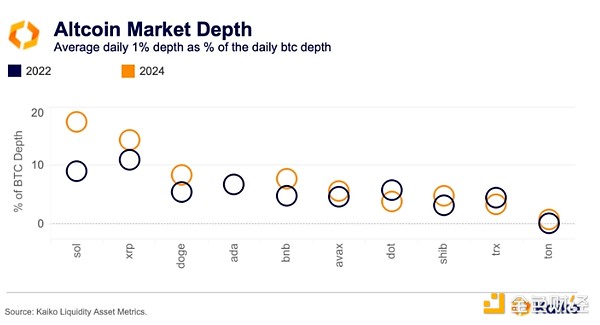

Many altcoins have underperformed Bitcoin in recent months, suggesting that market dynamics have changed.

"In 2020, if you think about risk, these things would have a higher beta than Bitcoin, you just had to go long all the fake news and all these things would go up. We are not seeing that this time. Many altcoins have been falling against Bitcoin for months, and it is not a matter of simply buying any fake altcoin and outperforming Bitcoin," Clemente stressed.

Technical analyst Michaël van de Poppe stressed that Bitcoin is close to or at its all-time high, while most altcoins have yet to reach their previous peaks. This divergence shows a lack of confidence in altcoins, which continue to struggle in the current market environment, suggesting that the days of easy profits in altcoins may be over.

Investors should be aware of the increased risk and consider the new scenario before making decisions in the cryptocurrency market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Beincrypto

Beincrypto Others

Others Cointelegraph

Cointelegraph 链向资讯

链向资讯