Previously, we talked about the overall planning of Trump Tokens, and summarized as follows:

1. Total amount: 1 billion, cannot be changed

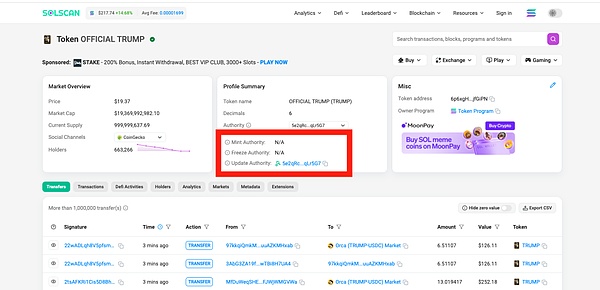

According to the Trump Token contract data query on the solana chain:

mint authority is N/A: means the total amount cannot be changed. If the content is an account address, the address can change the upper limit.

freeze authority is N/A: means no one has the right to freeze the account

update authority is an account address: the controller of this account can change the name, avatar and other non-important content of this token.

2. Release rules:20% of the tokens will be released on January 17, 2025, and the remaining 80% will be distributed to Trump's 6 friends (these 6 do not mean that he will only have 6 friends, but more that there are 6 levels of friends, and friends of different levels have different release rules).

Therefore, from the perspective of the structure, the recipient to whom the contract directly sends the tokens is controlled by two Trump-related entities: CIC Digital LLC and Fight Fight Fight LLC, and then distributed to Trump's friends according to the situation. 3. 80% of Trump's friends' tokens will be released gradually: All Trump tokens will be released within three years, and the earliest release will be on April 17 (3 months later). Of course, this 80% ratio is despised by many crypto investors, because according to general crypto startup projects, the founding team usually gets 20%, early investors account for 15%, and the treasury + community + incentives account for the remaining 65%. So compared with the initial team + early investors' 35%, this 80% ratio is really outrageous. After the introduction, let's take a look at what happened to Trump Coin in the first few hours.

According to Bloomberg research, 90 seconds after Trump’s token announcement on Truthsocial and X platforms, one account directly purchased 5.9 million tokens at a price of around $0.18. This account accounted for 6% of the total available supply of 100 million tokens. This wallet then transferred hundreds of thousands of tokens per minute to multiple other wallets. This group of wallets regularly sold these tokens over the next two days, including the current high of $78 on January 19.

Perhaps you may ask, why do you have to buy your own project?

Yes, this is a common operation in the cryptocurrency circle.

Remember which two methods make up the 20% of Trump’s tokens that are unlocked immediately?

Public allocation + liquidity.

Public distribution is given to Trump's friends, which is given directly.

Liquidity needs to be bought, but buying is also for selling at a higher price.

In decentralized finance (DeFi), the main purpose of project parties buying their own tokens is to provide initial liquidity and manipulate market sentiment. When DEX (such as Uniswap) launches a trading pair, the project party must deposit two assets (such as USDC and tokens), which determines the initial price. If users buy, the USDC in the pool increases, the token decreases, and the price rises, which depends on the constant product formula (x * y = k).

In addition to basic liquidity, project parties may use related transactionsto create market heat, such as using internal wallets to buy their own tokens, increase trading volume, and create an atmosphere of high market sentiment. In addition, they mayambush large investorsin advance, allowing relevant stakeholders to enter the market at a low price in the early stage, and then gradually ship out at a high point. At a high level, the team may also create the illusion of "whale buyback" to induce retail investors to take over. In the end, they cashed out by withdrawing liquidity and smashing the market for arbitrage. This method combinesmarket manipulation, liquidity management, and public opinion guidance, which can not only attract investors, but also may be the core strategy for project parties to make profits.

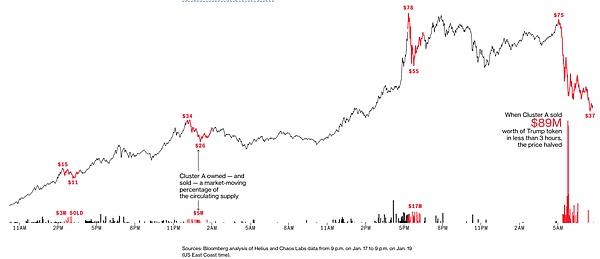

After the project was launched, Bloomberg researchers found that if the wallets that quickly purchased Trump tokens at the beginning and related wallets were grouped into a cluster for analysis, it was found that this was a controller who "knew the inside story and traded at the right time."

The above picture is the researchers' analysis of this wallet cluster. Almost every decline was caused by the selling behavior of these "big players." This does not seem to be surprising.

According to Bloomberg's analysis, these wallets achieved $170 million in revenue within 24 hours of release, and a total of $200 million with related wallets.

When a White House reporter asked Trump: You transferred more than a billion dollars through Trump tokens, what do you think of this matter?

Trump replied: "Compared to these people (Masayoshi Son, Musk), this is small money."

-How do you view your success?

-There are people who are more successful than me, I want to emulate them.

What a great person!

In the earliest days, the exchanges where Trump tokens could be purchased were not centralized exchanges such as Binance and Coinbase, but decentralized exchanges on the chain. In order to attract high-quality projects, this type of exchange will return most of the transaction fees to the liquidity providers, which is the Trump team here. According to Bloomberg data, as of January 31, the Trump team received at least $11.5 million in transaction fees alone.

In other words, they make a profit by selling the coins to you; if you resell them to others, they will also make a profit.

If a rat runs over, it will lose a layer of skin. So Trump's friends must be making money.

What about most of us?

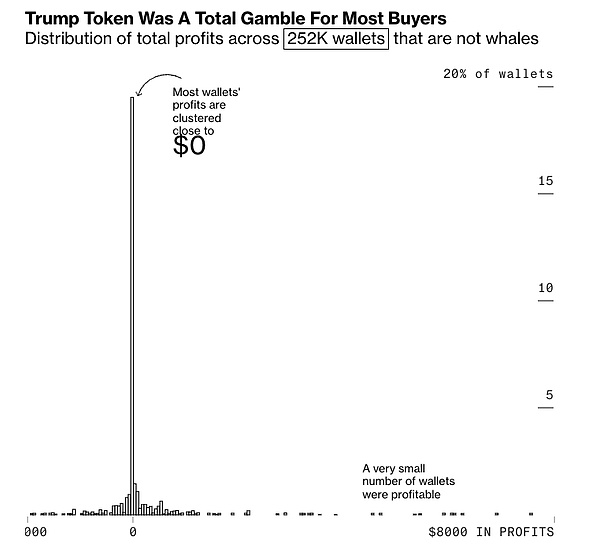

As of January 19, among the 250,000 accounts counted, only a very small number of wallets are making money, and most wallets are neither making money nor losing money. This is entirely considering that Trump Token has been soaring from the issuance on the 18th to the 19th. Now it has dropped to $17, so it can be inferred that most wallets have turned into a state of substantial losses.

Except for insiders, who is making money?

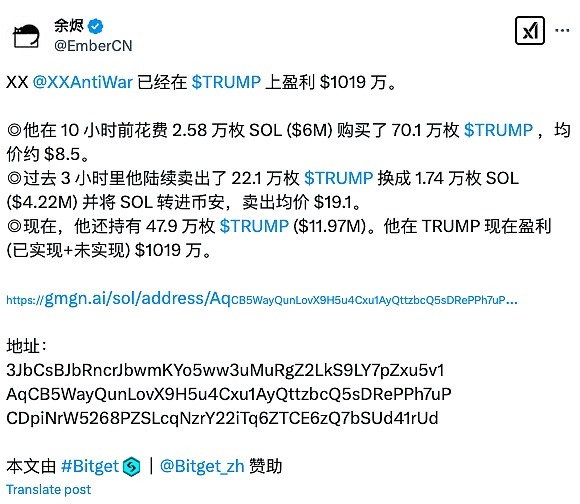

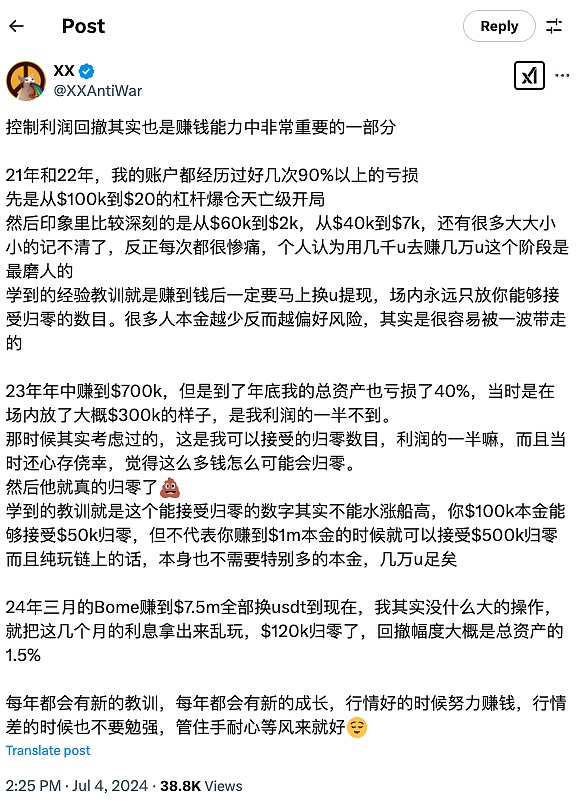

When the Trump Token was launched, a large number of KOLs claimed that they were already financially free. However, according to the information query on the chain, the XXAntiwar netizen on the X platform is truly free, with a total profit (realized + unrealized) of 10.19 million US dollars. His personal signature was also changed to retired status.

If you check the tweets of @XXAntiWar netizen, you will find that she is a person who dares to bet heavily on altcoins. She failed to bet heavily on altcoins again and again, so she got up, dusted off and went after new hot spots, and then she developed a precise sensitivity and vision for altcoins.

If you want to make this money, are you such a person? Are you more professional than him in cottage?

If it is not on the table, it is probably on the menu.

So looking back, if you are not a friend of Trump and want to make money on Trump tokens, you are basically licking blood on the knife edge.

Miyuki

Miyuki

Miyuki

Miyuki Brian

Brian Alex

Alex Joy

Joy Joy

Joy Joy

Joy Joy

Joy Joy

Joy Alex

Alex