Among the projects we've incubated over the past six months, many include cross-chain bridges. Beyond listing and shipping, project teams often prioritize the sustainable profitability of the cross-chain bridge itself. How can we provide better cross-chain services? How can we expand into new market space amidst the monopoly of giants like Pyth and Layer0? And, besides gas fee revenue, what other potential revenue opportunities are there? We'll use Ronin Bridge as an example to analyze the overall approach, hoping to provide relevant teams with some insights on entering and transitioning into the cross-chain bridge market. 1. Identifying the Right Entry Strategies by Segmenting the Ecosystem Niche Forged for Game Developers: This is Ronin's slogan. Ronin Bridge is the official cross-chain bridge application for the Ronin network. As an EVM-compatible blockchain designed specifically for game developers, it primarily serves Web3 gaming ecosystems like Axie Infinity. It facilitates the rapid transfer of assets between the Ronin chain and other blockchains like Ethereum, allowing users to seamlessly move tokens and NFTs from one chain to another, supporting in-game economies, trading, and staking. Compared to the comprehensive offerings of Python, Layer0, and others, Ronin's core focus is on game optimization, unlike general-purpose bridges like Wormhole, which focus on liquidity aggregation. By 2025, Ronin will emphasize "zero friction" through sponsored transactions, with gas fees waived for users' first transactions and seamless cross-chain support for games like Axie Infinity.

The white paper highlights the "zero friction" feature: Ronin's document update mentions the migration of the bridge to CCIP to further achieve "zero friction". CCIP significantly simplifies traditional cross-chain bridges, with arbitrary message passing, token transfers, multi-network verification, and a single interface, making the process of transferring assets, data, or instructions across chains seamless and easy, with almost no operational barriers or additional complexity.

Spread the word through social media and a series of blog posts: Collaborating with Axie Infinity, a demonstration video was released showing cross-chain speeds of <5 seconds; and by providing RON rewards to top content contributors, a creator program was held to increase social presence, including attracting interactions from official channels.

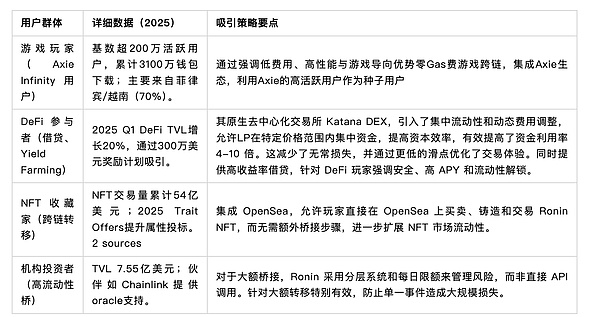

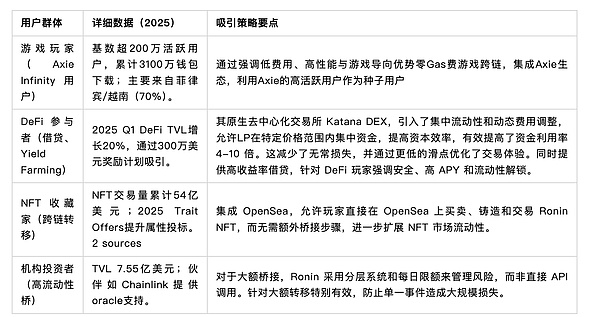

Second, use niche segments to identify target users

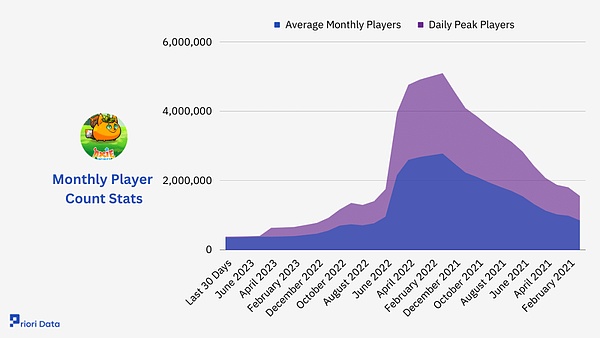

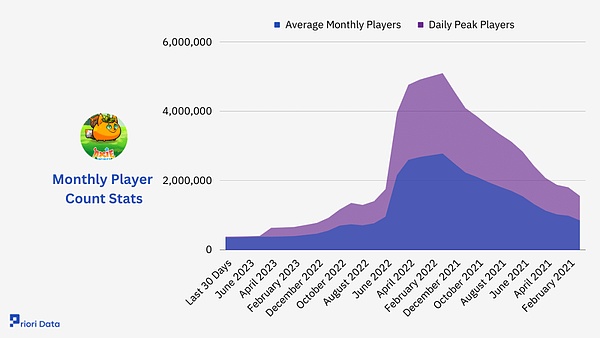

Early target users are gamers, with Axie Infinity having approximately 2-3 million active users.

Then, DeFi Rewards Blitz will be used to attract DeFi players. Furthermore, integration with OpenSea will be used to further expand the NFT market.

Marketing activities:

Monthly user feedback surveys to adjust positioning.

Third, Targeting Segmented Markets with Segmented Traffic Attraction

Ronin Bridge has achieved relative success in attracting users (e.g., doubling bridging volume and increasing TVL) by reducing bridging fees, expanding across multiple chains, optimizing liquidity pools, and emphasizing security. However, this isn't due to a unique price differential in its traffic attraction strategy. Rather, it stems from its uniquely differentiated positioning and comprehensive ecosystem support, rather than simply competing on fees. Other cross-chain bridges have attempted similar strategies, but the results have often fallen short of expectations, primarily due to a lack of Ronin's dedicated ecosystem anchoring and closed-loop user incentive mechanism. Dedicated Ecosystem Anchoring: Ronin Bridge utilizes its bridging functionality as a dedicated entry point to a specific ecosystem, rather than pursuing universality like other cross-chain bridges. This anchoring creates a highly sticky user base and network effects, transforming its low-fee strategy into long-term growth rather than short-term traffic. This distinguishes Ronin from general-purpose bridges like Wormhole, LayerZero, and Stargate. While these bridges support multiple chains (for example, Wormhole supports asset transfers across 30+ chains), they lack dedicated community ties, making it easy for users to churn out to competitors. Ronin's strategy is "low fees + value-added." The announcement of permanent fee reductions in H1 2026 will further stimulate expectations and, building on the experience of the 2025 DeFi Blitz, drive TVL growth. Other bridges' fee reductions are mostly a response to competition, but without a closed ecosystem, their effects are easily diluted. This closed loop uses low fees as an entry point, combined with a $4.5M RON buyback program to reduce supply and increase token value. After connecting to the bridge, users can immediately stake RON to earn APY (20-50%) or participate in liquidity mining for additional rewards. This creates a self-reinforcing incentive: RON's appreciation attracts more bridges, and increased bridging volume in turn benefits the ecosystem (e.g., increased TVL). The announcement of permanent fee reductions in H1 2026 further builds anticipation and encourages long-term holding. Compared to LayerZero's variable fee incentives, Ronin's closed loop is more engaging, allowing users to start with zero fees and gradually become immersed in the ecosystem. Summary: Using the Long Tail Effect to Attack Saturated Markets In fact, a similar strategy is effective not only for cross-chain bridges but for any saturated market: Identify long-tail market demand, capture a small niche, and then gradually erode upstream and downstream markets, ultimately dominating the market.

Ronin does this, Solana does this, and Yuanqi Forest in the traditional market also does this.

After finding the right ecological niche, don't let your execution strategy become distorted, and I believe you will definitely gain something.

Catherine

Catherine