2024 is an exciting year. In addition to Bitcoin, it can be said that it has attracted a lot of attention, from the popularity of spot ETFs at the beginning of the year to Trump's election as president at the end of the year.

In addition to Ethereum, the public chain competition in 2024 is also very exciting. Let's take a brief look at it today:

1. Ethereum

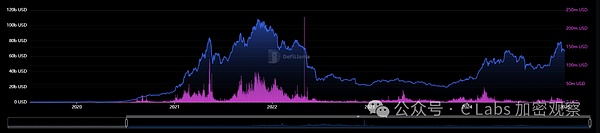

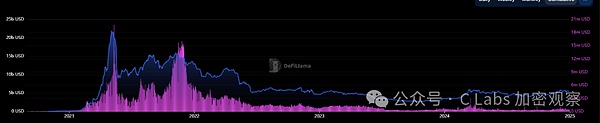

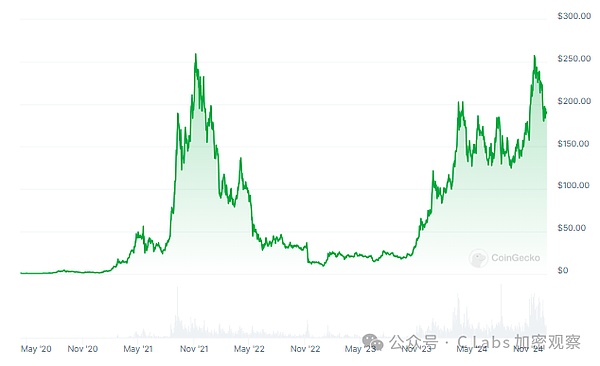

First, let's look at Ethereum. The price of Ethereum has been unable to break a new high:

In fact, Ethereum's performance this year is already worthy of this coin price:

If you look at it from the perspective of revenue, Ethereum is even more hopeless. The gas fee is almost falling, and it has fallen ten times compared to the last bull market!

2. Solana

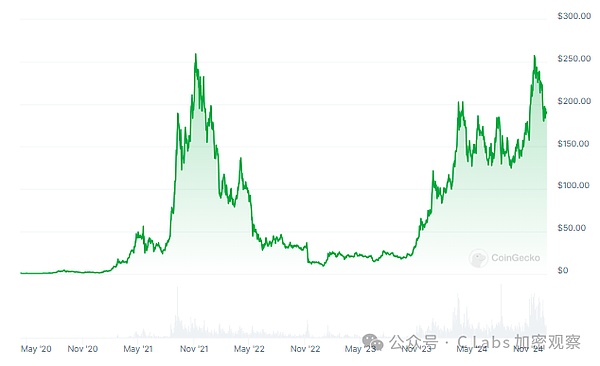

Solana has actually performed well this year, and the currency price is basically the same as the last round of new highs.

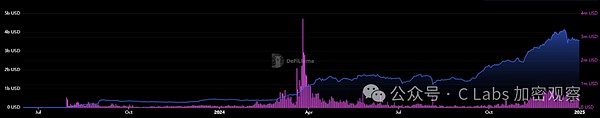

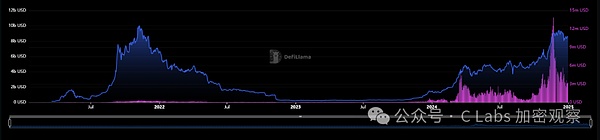

Let's take a look at TVL. Sure enough, this year's high point is basically the same as the high point of the previous bull market:

But this year Solana is different from the previous Solana. This year, Solana's on-chain transactions are extremely active, so the on-chain Gas fee has increased by a thousand times compared to the previous bull market!

Considering Solana's ability to make money, the price of this currency still has a solid foundation for rising~

3. Bitchain

The price of Bitcoin has set new highs:

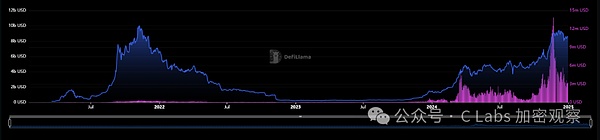

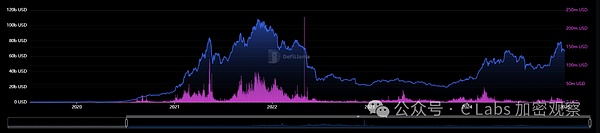

Although the price trend of this currency is not so related to the development of Bitchain, Bitchain has made great progress this year:

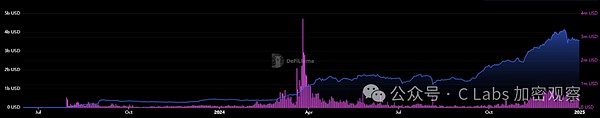

First of all, since 24 years, the assets on the Bitchain have also had TVL, which benefits from the explosion of the Bit ecosystem.

And this TVL scale is second only to ETH and Solana in the mainstream public chains, which can be said to be a very good result.

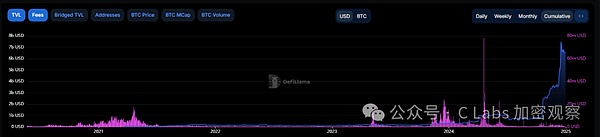

However, the gas fee on the chain has fallen sharply after the inscriptions and runes in the first half of the year. Maybe Bitchain is more suitable for value storage. Maybe the main competitor in the future will be the Ethereum main chain.

Fourth. BinanceChain

Binance Chain's token BNB also hit a new high this year:

However, this coin price performance should mainly benefit from Binance's dominance in the exchange.

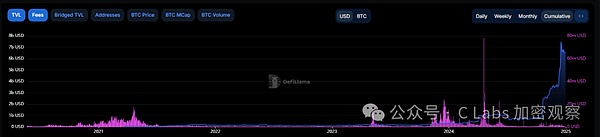

Because Binance Chain's performance this year is actually quite average:

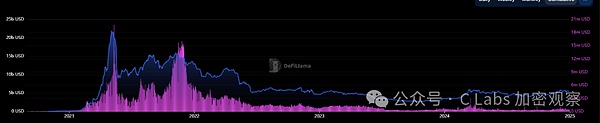

From the perspective of TVL scale, it has maintained a scale of 5 billion US dollars for 24 years, which is mainly a quarter of the peak of the last bull market.

From the perspective of Gas consumption, this round is far worse than the previous round.

Fifth. Base ChainChain

Base Chain is the best performing Ethereum Layer2 this year, but it is a pity that it has not issued any coins.

With the strong support of Coinbase, the TVL of Base chain has been rising to 3 billion US dollars, which is very close to BSC.

The consumption of gas fees is also at a similar level to BSC.

Considering that the transaction volume of Coinbase is ten times that of Binance, the development level of Base chain can be regarded as an excellent representative of exchange chains.

Six. ArbitrumChain

Also as an excellent representative of Ethereum's second-layer chain and the previous leader, Arbitrum can be said to be not only beaten by public chains such as Solana/BSC in 2024, but also overtaken by Base later.

Anyone who has a heavy position in Layer2 this year will miss the entire bull market. By the end of 2024, the price of the token ARB not only did not rise, but was also cut in half.

From the perspective of TVL, Arb remains stable.

However, from the perspective of gas fees, Arb has basically withdrawn from the public chain competition after the Cancun upgrade this year, and is just a bystander in the meme melee.

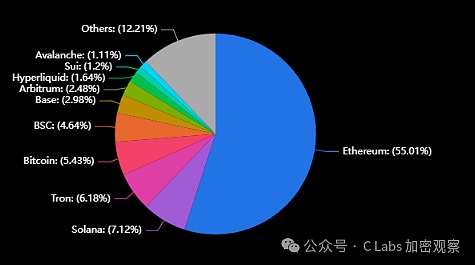

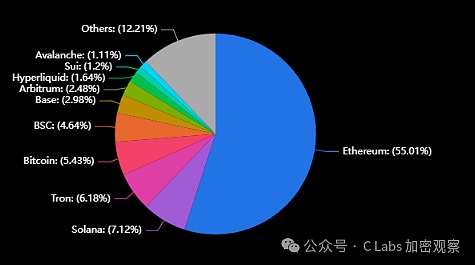

Finally, I put the TVL screenshots of each public chain here for everyone:

The competition among public chains in 2025 will still be very fierce. The leading public chains suggest that everyone pay more attention to the TVL indicator~

Joy

Joy