Source: Zhou Ziheng

The stock market crash in major economies started in the United States at the beginning of the month and reversed a week later. But the decline of the S&P 500 index (the stock price index of the top 500 companies in the United States) is still below the peak in mid-July and the level at the end of July when the "crash" began. Therefore, the big rise in the US stock market this year, especially since May, seems to have ended.

What caused this downward trend? Does it indicate that the US economy will face more serious problems? Well, this is what I said in April - word for word.

“In the first quarter of 2024, global stocks posted their best first quarter performance in five years, driven by hopes of a soft landing for the U.S. economy and enthusiasm for artificial intelligence. The MSCI World Equity Index is up 7.7% this year, the biggest gain since 2019, and stocks have outperformed bonds by the most in any quarter since 2020.

“The surge in global stocks has been driven primarily by the U.S. stock index S&P 500, which hit a record high 22 times last quarter. The hype around artificial intelligence has driven the market’s gains, with major AI chip designer Nvidia adding more than $1 trillion to its market value, equivalent to about a fifth of the total gain in global stocks this year! According to HSBC, Nvidia’s market value has increased by about $277 billion — roughly equivalent to the market value of all listed companies in the Philippines.”

“The frenzy in the US stock market continues because investors are convinced that there will be no recession in the US economy, and that, on the contrary, US economic growth will accelerate this year and drive up corporate profits around the world. Are they right?

“Financial capitalists usually measure the value of a company by dividing its share price by its annual profits. If you add up all the shares issued by a company and multiply that by the share price, you get the company's "market value" - in other words, the market's value of the company. This "market value" can be 10 times, 20 times, 30 times or even more than its annual earnings. Another way to look at it is that if a company's market value is 20 times its earnings and you buy its shares, you'll have to wait 20 years of profits to double your investment. We can use the share prices of a basket of companies to calculate the average price of all the company stocks on the stock market and then index it. This gives us a stock market index, such as the S&P 500, which covers the 500 largest US companies by market value.

"Because company share prices are based on the subjective judgments of financial investors, they can be far from the actual profits of the company and the value of the assets (machines, plants, technology, etc.) it owns. This is the current situation."

As a result, US and other stock markets are in mid-air, far above their actual value. Tobin's Q, measured as the ratio of the value of the stock prices of companies in the S&P 500 index to the book (monetary) value of the assets of the 500 companies, is close to its historical high. But: “No matter how the stock price fluctuates, ultimately the value of a company must be judged by investors based on its profitability. A company’s stock price may deviate far from the cumulative value of its actual asset stock or earnings, but eventually the stock price will be pulled back on track.” In April, I said: “Fundamentally, if US corporate profit growth slows (which it has) and borrowing rates remain high, the squeeze on stock prices will eventually lead to a reversal of the current market boom.” At that time, the fault line of the boom period (called the “bull market”) had already appeared. The S&P 500 stock index (the top 500 companies in the United States) is almost entirely driven by seven major social media, technology and chip companies - the so-called Big Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla). The market prices of the other 493 companies in the S&P index barely moved relative to earnings. The entire market index therefore relies on the Big Seven to keep growing profits. The trigger for the crash was the Fed’s decision not to cut its policy rate at its late July meeting because it viewed inflation as still “firm.” A few days later, U.S. jobs data for July were released, which showed very weak growth, with net payrolls increasing by just 114,000, just half the average gain over the previous 12 months. The official unemployment rate rose to 4.3%, triggering the so-called Sahm rule for predicting recessions; well above the post-pandemic low of 3.4% in April 2023. The Sahm recession indicator (named after former Fed economist Claudia Sahm) is a fairly accurate signal for the start of a recession. It is "when the three-month moving average of the national unemployment rate (U3) rises 0.50 percentage points or more relative to its low in the previous 12 months." And that rule was violated.

Meanwhile, the U.S. manufacturing sector remains in deep contraction territory, according to the latest ISM survey of manufacturing activity, with the index falling to 46.6 in July from 48.5 in June. (Any score below 50 means contraction.) The July data was the worst contraction in U.S. factory activity since November 2023 and the 20th decline in activity in the past 21 periods,

Then, as the quarterly corporate earnings results came out at the end of July, investors began to sell off despite the claims of good performance, as they worried that the huge capital investments that the Big Seven planned to make in artificial intelligence and semiconductors would not bring better returns in the future. These companies have invested billions of dollars in artificial intelligence infrastructure, but investors are now beginning to doubt the returns on these investments. Equity firm Elliot Management says AI is overhyped, with many applications not ready for prime time, and that the uses will never be cost-effective, will never really work, will consume too much energy, or will prove unreliable. In fact, surveys show that only 5% of companies use AI in their operations so far, suggesting limited, or at least slow, growth.

The situation was further exacerbated by the Bank of Japan’s decision to raise its policy rate, aimed at boosting the yen against the dollar and controlling rising inflation. This weakened the so-called “carry trade” in currency speculation. The carry trade is when speculators borrow large amounts of yen at previously zero interest rates and then buy dollar assets, such as tech stocks. But the Bank of Japan’s actions meant that yen borrowing costs suddenly rose, so speculation in dollar assets fell back.

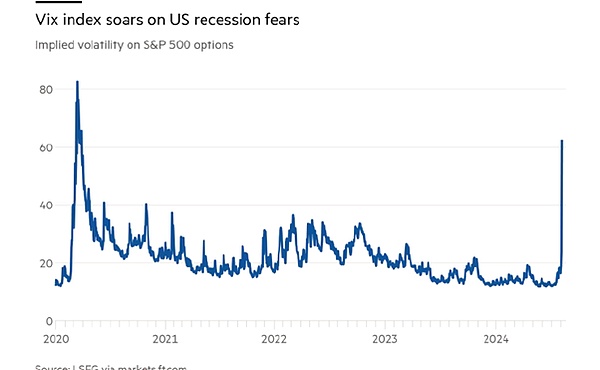

All of these factors came to a head last Friday and on “Black Monday” that followed. Investors panicked – as reflected in the so-called Vix index, which measures investor “fear”.

But does this crash mean that the US economy is headed for a recession? Since the crash, all mainstream economists have rushed to reassure investors that everything is, in fact, fine. The Financial Times screamed: "Calm down, everybody!" The overwhelming evidence suggests that unemployment remains low, inflation is set to fall further, and the US economy as a whole is still growing.

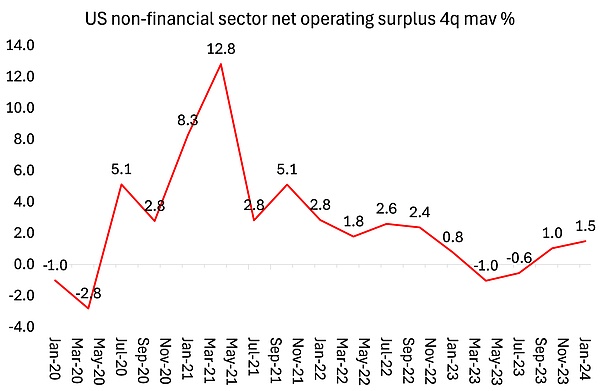

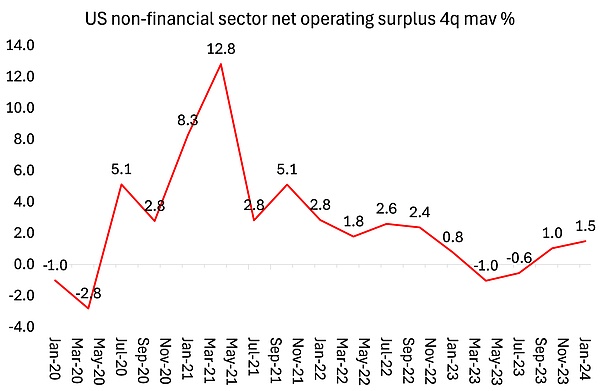

The stock market is indeed not the "real" economy. In essence, stock market prices reflect investors' expectations (rational or irrational) of future profits and profitability. Profits are the ultimate determinant. At this time last year, US corporate profits were beginning to shrink, but have since recovered modestly.

So maybe this crash is just a “correction” that brings stock prices down to levels closer to corporate earnings growth. That’s what happened when the stock market crash was more severe in 1987. Within weeks, stocks recovered to new highs.

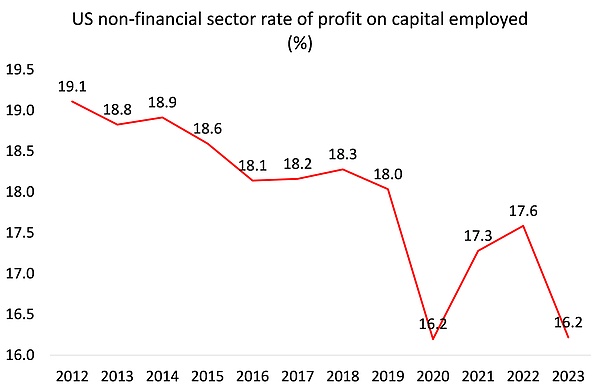

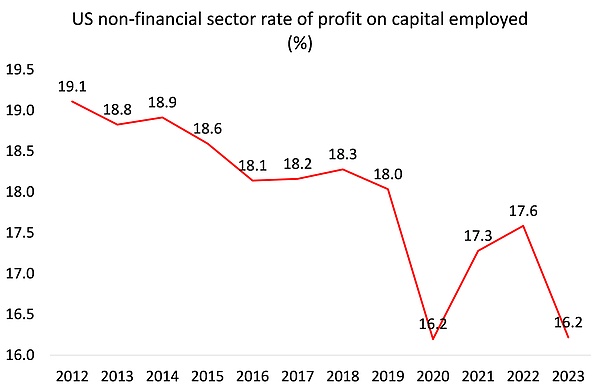

On the other hand, the profitability of non-financial sector capital (not profits per se) is at its lowest level since the end of the Great Recession of 2008-2009. That suggests a recession ahead.

This is not 1929, when the stock market crash heralded the start of the Great Depression. Profitability of US companies is already more than 13% lower than it was in 1924. But even if this stock market crash does not currently portend a recession in real output, investment, and employment, current earnings trends suggest that a recession will eventually occur before the end of this decade.

JinseFinance

JinseFinance