Author: Digital Asset Research Source: substack Translation: Shan Ouba, Golden Finance

The first half of this year has been like a roller coaster ride for investors, with the market experiencing a sharp rise and relatively low volatility. Most investors are troubled by the market because it is out of touch with what they experience in the real economy.

Towards the middle of the year, the stock market has risen sharply in the first half of the year, sparking optimism among traders. However, this optimism has also been accompanied by caution this month, as technical indicators and time cycles suggest that there may be turbulence ahead.

At the same time, the cryptocurrency market has also faced a series of challenges,but now seems to have a huge buying opportunity, especially for Ethereum and other altcoins. As the first half of the year comes to an end, it is crucial to understand the signals and patterns that may affect the coming months.

Now let's look at the starting point of the S&P 500 index. I think the stock market may be entering the danger zone for this rally. Zooming out from here to the weekly chart, we can see the balance of time starting to play out. It was 93 weeks from the pandemic crash to the peak. We are now entering week 91 of this move. Additionally, a bearish divergence has formed on the RSI as you can see in the two black lines below. Price is making new highs while the RSI is not. There is still room to move higher in the next week or two, but be aware that we may see a correction to the August window that I have been highlighting since the beginning of the year.

If we zoom in on the daily data, we see warning signs as well.

First, we see two nearly symmetrical moves to bear market lows. Another 200 pip move would not surprise me as that would make this move 150% of the previous move and create a much larger divergence. Also, looking a little closer, we can see a set of signal candles forming a double top. Finally, you can see that the 17th of this month is marked as an anniversary date, which is a very strong top date in an election year.

Therefore, given the macro timing factors that are consistent with price action and current positioning, I believe we may see a more significant correction in the second half of this month.

The last thing I want to tell you is June 7th, which is a natural date that coincides with the end of this week.

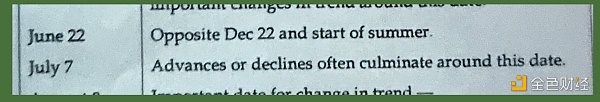

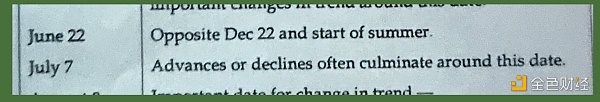

According to Gann's rule, "A move up or down usually peaks on this date." I would say that we have been in a big move up so far. Also note June 22nd, and how SPY put in its first signal candle on the 20th.

Turning our attention to crypto, we have the exact opposite setup.

Again, Gann Natural Dates apply, but unlike the stock market, the cryptocurrency market has been in a downtrend going into this natural date.

BTC has an almost identical setup to SPY but in the opposite direction. It took 42 weeks from macro low to macro low, which was the first phase of the cycle. Now it is 42 weeks from that major low and looks to be another major low and higher than the May low. We are also seeing a bullish divergence on the RSI. The RSI is making lower lows and the price is making higher lows.

This is a clear accumulation range with BTC above the previous ATH level and looks to be the best setup of the year. It took a few weeks longer than expected, but BTC has reached oversold levels not seen since the lows of 42 weeks ago, and before that we hadn’t seen levels like these since the FTX crash. I don’t know about you, but in my opinion this is a major opportunity and we may not see it again in this cycle.

With the upcoming ETF announcement, ETH is on a stronger footing. Starting with the weekly chart, you can see that the green close gives us the signal bottom and holds the 50% level in the purple box. On the daily chart, again focus on the 7th to the 9th. The 7th is the natural date and the 9th will be 120 degrees from the March top.

In the last image you can see the ETH/BTC chart trying to break out of the major weekly downtrend and start to reclaim lost ground for BTC.

All in all, this is nothing new. Stocks surge, crypto gets hammered, and then the tide turns. This has happened in previous cycles and it looks like this is the trend for July. However, I still want to remind everyone that this is not just for stocks, but crypto as well. We are still in a large consolidation range until the market can confidently break out above 72k (BTC) and 4k (ETH). The second half of this month through mid-August will be something to watch. On the surface, the July 7th window will be a key turning point. From a macro perspective, this is a great buying opportunity, especially for beaten-down altcoins.

Bernice

Bernice