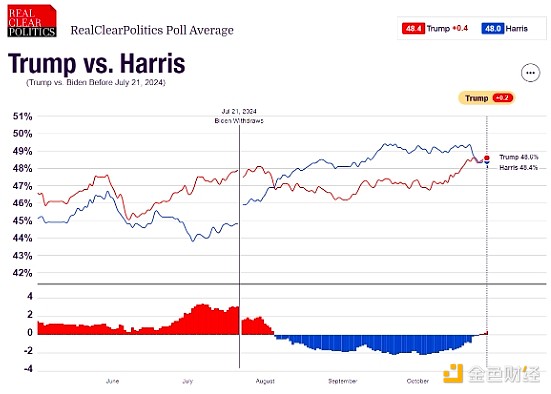

Since October, Trump has come from behind in the polls, global market sentiment has changed rapidly, and the main line of trading has gradually switched to betting on the outcome of the election. As the US election enters the decisive stage, the market seems to be smelling increasingly clear signals, and "smart money" has priced in a sharp tilt towards Trump.

The market is changing for real gold Silver bets on Trump's victory

On Tuesday local time, the share price of Trump Media Group, a well-known "Trump concept stock", continued to rise by 8.76% after a 21.59% surge on Monday. The cumulative increase since then has reached 220.54%. In addition, the KBW Regional Bank Index has gained 10% over the past month, far outperforming the market, showing significant market confidence in Trump-related assets.

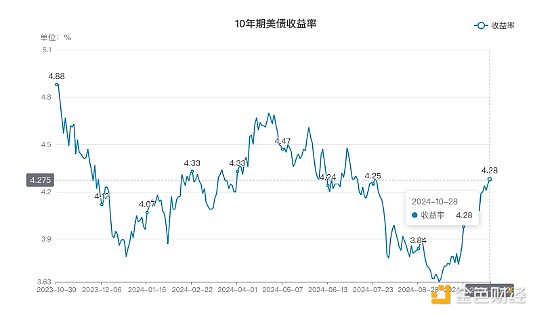

USD and U.S. Treasury Bond Yields Rates also show signs of a “Trump deal.” Currently, the U.S. dollar index has risen sharply to 104-105, rising for the fourth consecutive week, putting non-U.S. currencies under pressure; the 10-year U.S. bond interest rate has risen from the previous low to 4.28%, an increase of 48bp from the end of September.

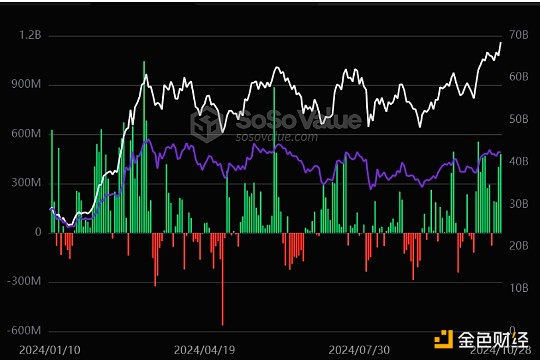

At the same time, Bitcoin has become one of the core assets of the “Trump trade” due to Trump’s support for cryptocurrencies. On October 30, after a lapse of seven months, Bitcoin once again exceeded US$73,000, an increase of only 0.2% from its historical high. Data shows that since October, the U.S. Bitcoin spot ETF has attracted a net inflow of more than $3 billion, with strong institutional buying.

Total net inflows into Bitcoin spot ETFs

In the past few weeks, the U.S. dollar has strengthened, U.S. bond interest rates have risen, The banking and crypto sectors are strong, these most direct "Trump concept stocks" are performing strongly, and the market is betting real money on Trump's victory.

The impact of Trump’s election on the prices of major assets

The U.S. election is in its intensifying stage. Expectations of Trump’s election are increasing day by day, and the market is beginning to bet on his policy policies after his election. Potential impacts across different asset classes. The economic impact of Trump's policies may produce sharp divergences among major assets, and the global economic landscape will also change accordingly.

1. The U.S. dollar may strengthen

Trump’s policy proposals include increasing tariffs and tax cuts, which are expected to push up inflation expectations. The Fed will become more cautious in cutting interest rates, supporting The dollar is strong. Currently, the solid fundamentals of the U.S. economy, especially high employment rates and moderate inflation, provide strong support for the U.S. dollar, which is expected to continue to strengthen in the global foreign exchange market.

2. Procyclical and technology sectors may become the main theme of US stocks

The market is generally optimistic about the boosting effect of Trump’s election on US stocks. The U.S. economy is relatively strong, and Trump advocates tax cuts and deregulation, which will help promote corporate profits and household consumption. In particular, the procyclical and technology sectors will become the focus of investors. With the support of macro factors such as fiscal expansion, strong demand in the AI industry, and global capital reallocation, the mid- to long-term trend of U.S. stocks will be more attractive.

Looking back at history, most U.S. stocks rose in election years. For example, in the 2016 election, Trump’s expansionary policies after his victory promoted the rapid rebound of the S&P index, which also provided guidance for the trend of U.S. stocks this year. Historical reference.

3. Bulk commodities Demand may face adjustments

Compared with the Democratic Party, the Republican energy policy tends to support the traditional energy industry. Trump's election may relax restrictions on fossil fuels, promote the expansion of the oil and gas industry, or suppress oil prices in the medium to long term. The possibility of the current situation in the Middle East weakening, coupled with the expected decline in demand for crude oil due to the global economic slowdown, may cause oil prices to fluctuate and weaken in the short term.

The gold market is currently continuing to strengthen at a high level, which has taken into account more of the hedging and anti-inflation needs under Trump’s policy framework, and deviates from the fundamental support level under the pricing of the US dollar and real interest rates to a certain extent. , if uncertainty decreases after the election, the price of gold may face correction pressure.

4. Bitcoin will usher in a new round of gains

This year’s U.S. election cycle closely matches that of Bitcoin. Trump is friendly to crypto market policies, and he himself is He has been deeply involved in various crypto activities and related products, and his declaration of "making Bitcoin a strategic reserve of the United States" has made the crypto market boil. Trump's victory is a great benefit to the currency circle. Bitcoin will usher in a new round of gains, and the influence of crypto assets in the global market will also reach new heights.

Conclusion

The current "Trump deal" is profoundly affecting global asset pricing. Regardless of the final outcome of the election, global markets will face an unprecedented asset revaluation opportunity.

4E as the country of Argentina As an official partner of the team, it provides trading services covering more than 600 assets such as cryptocurrencies, commodities, stocks, and indices. It also supports financial products with an annualized return rate of up to 5.5%. Users holding USDT can invest with one click at any time. In addition, the 4E platform has a risk protection fund of US$100 million to provide another layer of protection for users’ financial security. With the help of 4E, investors can keep up with the market dynamics of the US election, flexibly adjust strategies, and seize every potential opportunity.

Weiliang

Weiliang

Weiliang

Weiliang Anais

Anais Alex

Alex Weatherly

Weatherly Miyuki

Miyuki Anais

Anais Weatherly

Weatherly Weiliang

Weiliang Weatherly

Weatherly Alex

Alex