Total Supply: 100,000,000 MASK leaf="">From TradingView

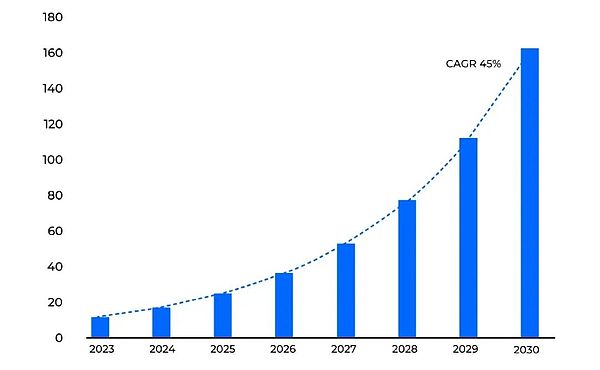

Growth trend

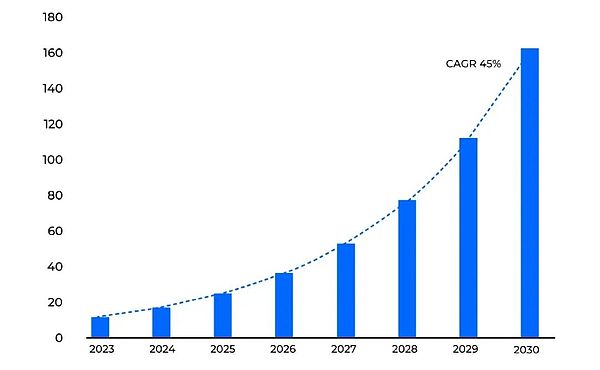

SocialFi global market size forecast:According to a market report by Verified Market Research, the market size of SocialFi will grow from US$1.2 billion to US$12.5 billion, with a CAGR of 45%.

Data source: Verified Market Research

Team introduction

BTX Research arrangement

Project narrative

Track Narrative

SocialFi: SocialFi aims to decentralize social media, enable users to own their own data, monetize content directly, and integrate financial services into social interactions.

Project Narrative

Mask Network is a protocol that embeds Web3 features (privacy tools, token management, decentralized applications) into traditional Web2 social platforms such as Twitter. Doing so lowers the entry barrier for mainstream users and drives widespread adoption of decentralization.

Ecosystem Overview and Horizontal Comparison

Ecosystem Overview

Mask Network has been actively building the Web3 social ecosystem by supporting more than 100 projects covering social protocols, social applications, infrastructure, games, and social intelligence. The network has established itself as a key player in the Web3 field by providing grants, investments, and hackathon activities to promote growth.

Mask's investment in key projects, such asTON, 、Tako These investments further strengthen its decentralized social network ecosystem, promote the broader Web3 ecosystem, and promote the realization of user privacy, autonomy, and financial freedom.

Comparison of similar projects

Compiled by BTX Research

Problems that need to be solved

In the field of social media and Web3:

1. Traditional social platforms fail to truly give users ownership of their data.

2. Content monetization is often controlled by centralized entities (e.g., advertising revenue).

3. The barrier to adoption of Web3 is still high for average users (technical complexity).

Solutions

Products/Services Offered

Mask Wallet (launched in 2021): allows token management and direct interaction with decentralized applications (dApps) on social media.

Tessercube(launched in 2019): A privacy-focused decentralized platform for secure data storage and collaboration.

Next.ID(launched in 2021): An open source protocol for connecting Web2 and Web3 identities with a focus on user privacy.

Firefly(launched in 2022): A decentralized social networking platform that integrates blockchain with traditional content.

Founder's Perspective

Founder Suji Yan envisions a world where social media users can seamlessly leverage Web3 capabilities on their favorite Web2 platforms.

Application Scenarios

On Twitter:Users can encrypt posts, send crypto tips, or interact directly with NFTs via Mask.

DeFi Integration:Access lending protocols through the same social interface.

Token Technology Architecture

Mask Network operates through browser extensions or integrated widgets, overlaying Web3 functions on Web2 social platforms. This architecture simplifies the user onboarding process while retaining the security and decentralization of blockchain technology.

The following figure is an example diagram of the collaborative work of the Mask Network subsystems:

Data Source: Mask Network

System Workflow:

- Users through Content Scripts Initiate actions (such as clicking a button).

- Content Scripts send the request to the Background Service processing.

- After the Background Service completes the processing, it returns the result to the Content Scripts to update the UI.

- Users can modify settings through the Options Page these settings will also interact with the Background Servicethrough messaging.

- Injected Scripts run when the web page is loaded, modify the web page environment, and ensure that the functions of Mask Network can run normally.

Token Economics

Token Type

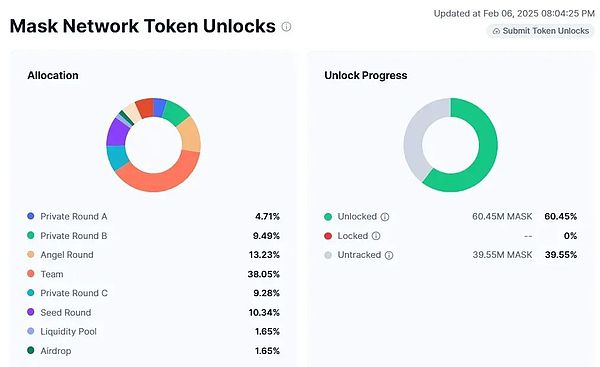

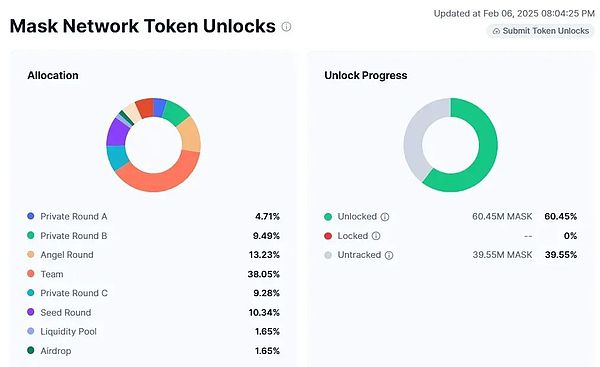

Token distribution

Data source: CoinMarketCap

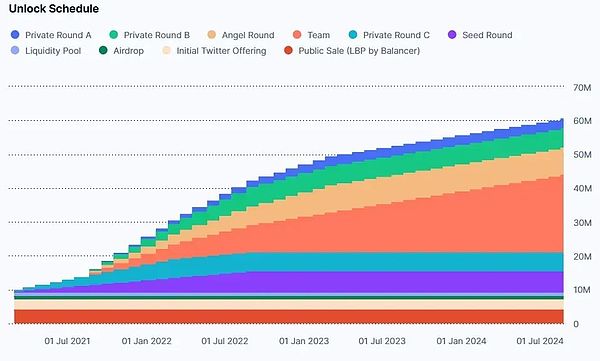

Token unlocking progress

By January 2024, MASK tokens will be fully unlocked.

Data source: CoinMarketCap

Project Development

Cooperation and business development:

DeFi (Decentralized Finance): Mask Network has integrated with well-known platforms such as Aave, MakerDAO, and Compound.

Decentralized Data Management: Mask partners with Codatta to enhance data verification, identity management, and personalization services.

Digital Identity Solutions: Acquired decentralized identity platform Nametag to provide users with greater control over their digital identity.

Recent Collaborations and School Donations: Mask Network has donated funds to top schools such as UC Berkeley and Hong Kong University of Science and Technology (HKUST). This move will increase its brand awareness.

Airdrop Events: Mask Network has benefited from airdrop events such as Arbitrum DAO. There are also rumors of potential future airdrops, which may further incentivize community participation.

Funding Program:Mask Network has provided funding and investment for more than 100 Web3 projects, helping to promote the development of the decentralized ecosystem in various fields (such as social protocols, DeFi, etc.).

Revenue Mechanism:Mask Network provides a staking mechanism with an annualized rate of return (APR) of approximately 25.76%, which encourages users to stake MASK tokens and participate in network governance.

On-chain Data and Insights

On-chain data shows that MASK token ecosystem activity is steady and sustained.

Major Holders:If foundation and exchange holders are excluded, the top 10 holders account for

5.22%

of the total supply. Token Distribution:The total supply of MASK tokens is100 million, and100%are already in circulation.

Staking

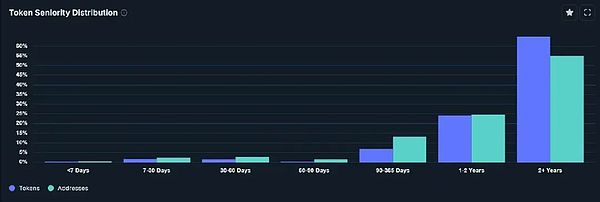

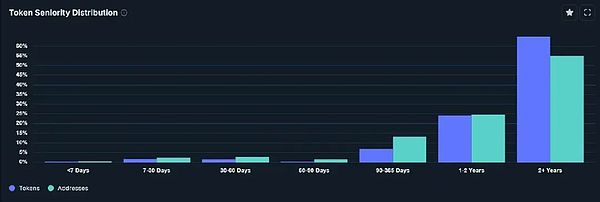

Token Holding Period

Data shows that most MASK token holders have held them for more thantwo years, which indicates strong market confidence and long-term commitment.

Chart source: Nansen

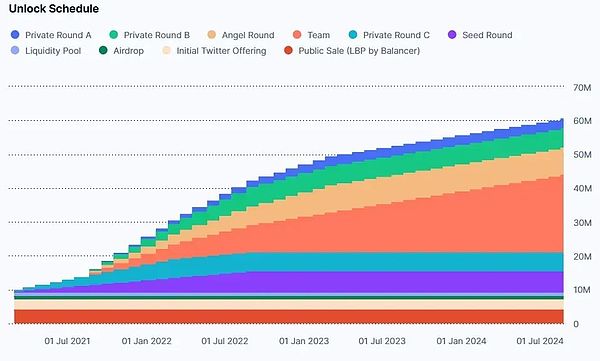

Token unlocking plan

As ofJanuary 2024, all MASK Network tokens have been unlocked. Token release follows a gradual increase in circulating supply from 10.91 million in February 2021 to 100 million in January 2024, optimizing liquidity to support long-term development.

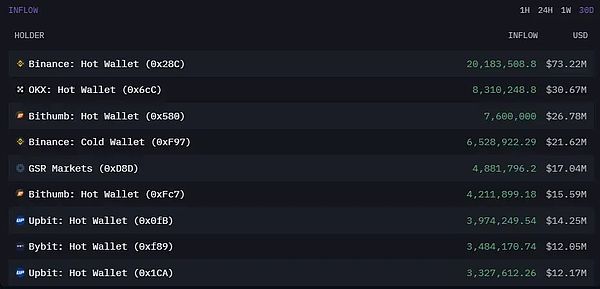

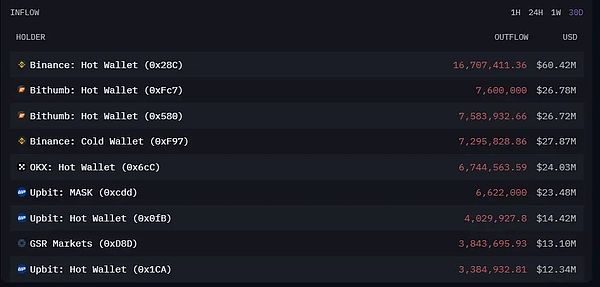

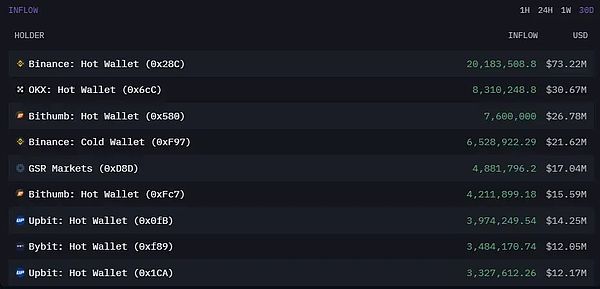

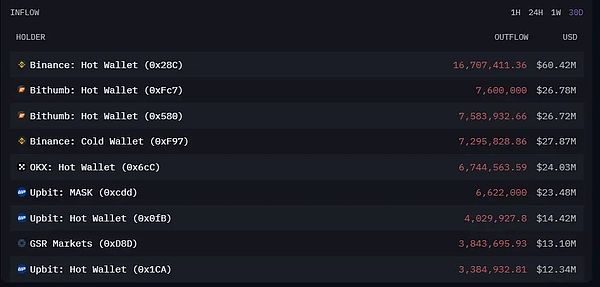

Inflows and Outflows

Analysis of 30-day inflows and outflows of MASK tokens at the beginning of 2025 shows that capital flows are close to equilibrium:

Inflows:$223.7 million

Outflow: US$227.93 million

Difference: US$4.23 million The small difference indicates that capital flows are stable, with no significant capital flight or accumulation.

(1)Mask exchange inflows and outflows and price performance

Data source: Cryptoquant

(2)MASK 30-day inflow

Data source: Arkham

(3) MASK 30-day outflow

Transactions and holder activity Daily Token Transfers: An average of 550 token transfers per day , reflecting the continuity of network activity and user engagement.

Number of Coin Holders: The number of MASK token holders is approximately 32,000, showing the growing and diverse community.

(Data source: Etherscan, Bscscan, Polygonscan)

Investment Risk Warning

There are significant risks in investing in MASK Network and its related digital assets due to the inherent volatility of the cryptocurrency market. Although MASK Network is positioned as a leader in the Web3 social ecosystem, please be aware of the following key risks associated with your investment:

Market Volatility Risk: Cryptocurrency prices are extremely volatile, which can result in large gains or losses in a very short period of time. The value of MASK tokens may experience significant fluctuations, especially after market events or changes in investor sentiment.

Liquidity Risk: MASK tokens may experience periods of illiquidity, especially during market downturns or when large holders choose to close their positions. This may make it difficult to execute trades at the desired price, resulting in potential slippage.

Regulatory Risk: The regulatory environment surrounding cryptocurrencies remains uncertain. Regulatory actions in major markets could affect the legal status of MASK tokens, impose restrictions on transactions, or create obstacles to the operations of MASK Network.

Brian

Brian