Author: Sleeping in the Rain Source:Substack

This article is my personal summary of the tokens I am planning to deploy based on Narrative & Catalyst, and hype is hype, but don’t fall in love with the project~

From the overall market situation, I don’t think it’s a rush to Fomo and rush in directly. You can wait for a callback, or make a bottom position now and slowly increase your position.

1/ AI

AI narrative is also the narrative that everyone talked about the most in the past two days. The main reason is that the AI narrative has several clear catalysts:

May 22 NVIDIA Earnings;

June 10 Apple WWDC 2024 also released some additional AI-related content;

ChatGPT 5 may be released this summer, and the GPT version of the search engine is also coming;

May 14 Google I/O Conference

Essentially, this is a science of attention. That is, events generate expectations, expectations generate market attention, and market attention drives prices up.

There are many AI projects in the currency circle, and choosing coins is a science. Generally, I prefer some coins that have been recognized by the market + CEXs List. For example, $FET and $TAO. Although $TAO has a large market value, the pledge rate is still quite high and the circulation is small. And $FET is preparing for a merger with $OCEAN & $AGIX. On May 3, Fetch.ai has minted 1,477,549,566 additional tokens in preparation for the next conversion. Between $TAO and $FET, I chose $FET. In fact, $TAO is also pretty good, hahaha, but my personal funds are limited, so I'll do subtraction first. If you like computing power projects, you can take a look at $RNDR and $AKT. Another track I'm optimistic about is AI agent, which is $OLAS. But $OLAS is my long-term position, so I'll hold it first. I will also add some positions after I make money on other coins. Another AI proxy target is $PRIME, which I cleared out at $24-26. $PRIME is expected to be in the second half of the year or 25 years, so there is no rush to layout.

In addition, some small opportunities can also be paid attention to, such as UpRock of Jupiter's second phase Launchpad.

In addition, there are some interactive scoring projects. I personally think that the profit margin is not high, because where there are many people, there will be a lot of money.

Of course, there are many AI projects, and I have many projects that I have not paid attention to. A simple logic is: whether the market is willing to pay for the corresponding AI project (market attention).

2/ MEME

As for MEME, I won't say much about the chain, looking for gold in the shit. I will probably only do $WIF and $PEPE (I don't deny that $BOME $BONK $FLOKI and other memecoins are also good hype targets). $PEPE is my long-term position, and I like to do swing trading for $WIF. I buy/add positions every time BTC pulls back and market sentiment is low, and sell when sentiment surges back. This type of operation is only applicable to bull markets. I think $WIF and $PEPE both have the opportunity to become $SHIB-level memes in this cycle.

3/ Solana

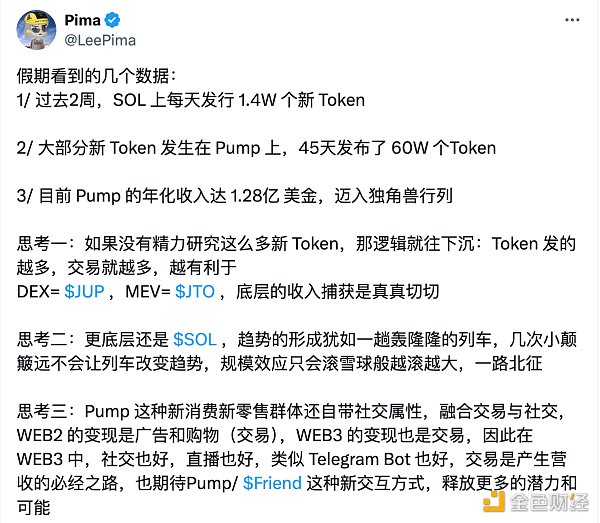

You can take a look at Mr. Pima's views. I would like to add that $JUP is not just doing DEX at the moment, it is working hard to become the front end of the entire Solana ecosystem. Let’s take a look at what Jupiter is doing now:

DEX aggregation: Launched Metropolis Part 1, launched a new T0 API, allowing users to query the market with the largest liquidity on the chain for direct exchange. Also launched

Perp DEX;

Launchpad;

Acquired Ultimate Wallet and its mobile team to promote the Jupiter Mobile plan;

Jito Bundles (tip function, protect users from MEV attacks);

LST jupSOL;

Meme: WEN, WEN is doing things related to NFT and SOL staking;

The Jupiter team has a pretty big picture, so I think $JUP is Solana's biggest Beta. And $WEN will be the Beta of $JUP.

$JTO's value lies in LSD and MEV. As Pima mentioned, Solana's ecosystem is booming, which is good for Jito.

In addition, Jupiter's second phase project Sanctum is worth paying attention to. You can save SOL to score points. Welcome to use my link: https://sanc.tm/w?ref=8VZMS1. $PYTH is about to unlock tokens worth 1.19B US dollars, so I am not very optimistic about it. As for $TSNR and $W, I will not look at them. At present, neither of them has much catalyst, and there are many locked-in positions.

Again, do subtraction.

In addition, there are many things on Solana, including Depin (io.net), the cross-chain bridge ($ZEUS) with BTC (BRC20, RUNES), RWA, etc., which are all interesting concepts. I will not update them one by one. If there is a new position, I will update it on Twitter.

4/ Basechain

From my logic (market attention), there are two things that can attract market attention. One thing has already happened: Friend Tech issued a coin. The other thing is on the way: Coinbase Smart Wallet is officially launched.

There are only a few good targets on Base.

My largest position is $DEGEN. The others are basically memecoin.

I think Basechain will definitely be the place where SocialFi will rise. Including Friend Tech (I didn't sell any of Friend Tech's airdrops, and used a small part to do LP. There have been many discussions on Friend Tech's Twitter, so I won't go into details) and Farcaster, these SocialFi will definitely have a very good development on Coinbase and Basechain. I saw in the community that everyone's view on Degen is: no longer regard Degen as a meme, but as a Layer3.

My view is: I think the biggest attribute of $DEGEN is still MEME. My judgment on it is mainly based on the name and birthplace.

5/ ETH

ETH is still optimistic. I think the ETF in May is unlikely to pass, but there is a chance in August. According to GCR's point of view, he thinks the ETH ETF may be at the end of 24 or 25.

$PENDLE I still hold, and I didn't sell any of it during the last FUD. From a more macro perspective, after the end of Eigenlayer, airdrops/points will still be a means for projects to acquire users/TVL or cold start. Therefore, the underlying core value of Pendle still exists. And Pendle v3 is also on the way, and the core word of v3 is "Intent".

Buying in FUD may be a better choice.

$LDO has good fundamentals, but it's a pity that it's not the spring of value coins, so its performance is mediocre, or even poor. But I personally think that $LDO is actually Ethereum's Beta, and $PEPE is Alpha.

$ETC is about to be reduced, which is also worth paying attention to.

In addition, $MODE can be paid more attention.

6/ BlackRock

BlackRock's layout for Crypto is also something that can easily attract market attention. It mainly does ETF and RWA (and some infrastructure). BTC ETF has been approved, and the mainstream target of RWA is $ONDO.

I think we can observe BlackRock's layout more. Following BlackRock's layout to speculate is not a good choice.

7/ European Cup + Summer Olympics

Similar to the previous hype about the World Cup, the Summer Olympics and the European Cup have similar hype expectations. Like AI narratives, this hype is triggered by large-scale external events.

Finally, let me briefly talk about games: I am optimistic, but I don't know when the wind will blow to the game sector. I think we can focus on games with a sufficient number of players.

Overall, "Sell in May and go away" is a very mainstream operation, but I don't think there will be a big drop in May without a major negative event. I prefer the oscillating trend in May (referring to BTC), a cultivation period. Some altcoins in the narrative will have some opportunities.

Beincrypto

Beincrypto

Beincrypto

Beincrypto Coinlive

Coinlive  Crypto Potato

Crypto Potato Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph