Author: Crypto, Distilled; Compiler: TechFlow

Meme is the fastest Ponzi scheme in the world. Whether you like Dogecoin or Catcoin (or neither), it's hard to deny.

However, after experiencing a few big winners like $WIF and $PEPE, you might be wondering:

Is the carnival coming to an end, or is it just beginning?

What is a Meme?

The word Meme was coined by Richard Dawkins in his book The Selfish Gene in 1976.

It is derived from the Greek word "mimema", which means "imitation".

A Meme is an idea, behavior, or style that spreads through a culture through imitation.

An idea, behavior, style, or usage that spreads from one person to another in a culture

Viral spread of Memes:

From politics and sports to entertainment and finance, Memes are spreading virally.

Due to the speculative nature of altcoins, their synergy with cryptocurrencies is very strong.

The Core of Meme:

Memes have always been an integral part of the blood of cryptocurrency enthusiasts.

They shape the culture of the entire cryptocurrency space.

From "WAGMI" and "Wen Lambo" to "Choose Rich" and "In it for the tech"...

Memes are at the core of Crypto Twitter (CT).

Acceleration point:

Despite its deep historical roots, 2021 is a turning point.

The COVID-19 pandemic, $GME, and massive money printing created a perfect storm for Meme mania.

From joke to giant:

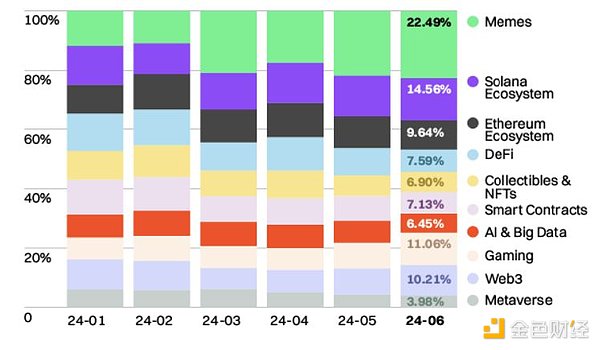

Fast forward to 2024, meme coins continue to explode.

For the first time, meme coins have become the most popular category in cryptocurrency.

Meme accounts for about 23% of page views on @CoinMarketCap, with more than 25 million in June alone.

The fastest Ponzi scheme:

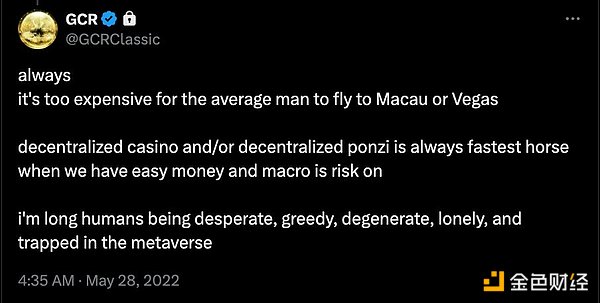

Ironically, in a period when market expectations mature, Meme thrives.

We have $BTC ETFs and new technologies, but investors still choose the dark side.

As GCR said, "Long-term bullish on human desperation, greed, and depravity."

@GCRClassic: "For ordinary people, flying to Macau or Las Vegas is often too expensive. With a lot of spare money and high macro risks, decentralized casinos and decentralized Ponzi schemes are always the fastest choice. I am long-term bullish on human desperation, greed, depravity, loneliness and being trapped in the metaverse."

From Jokes to Fortune:

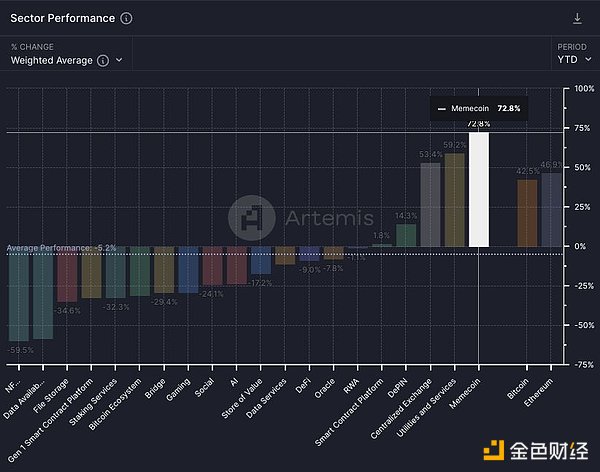

Top Memes not only dominate attention, but also dominate revenue.

Meme coins are the highest gaining sector, up 72% year to date (weighted average by sector).

Dominant Ecosystems:

Most of the leading meme coins are on $SOL or $ETH.

However, the $SOL ecosystem has received more attention than $ETH in this cycle.

For example: $WIF and $BONK.

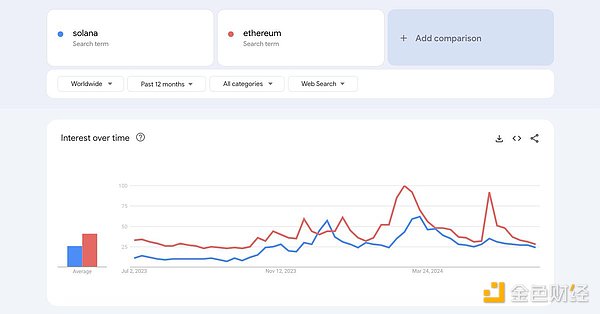

Mindset Dominance:

Since October 2023, $SOL and its Meme coin ecosystem have gained momentum.

While $SOL has not yet surpassed $ETH in market capitalization, it is on par with $ETH in Google search interest.

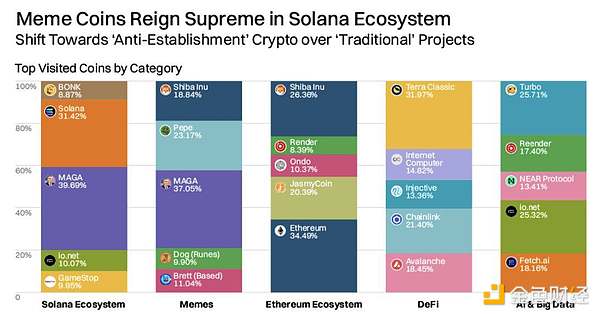

The "Casino" Chain:

In the $SOL ecosystem, Meme coins symbolize the crazy pursuit of speculative assets.

The influx of liquidity has given $SOL a casino-like atmosphere.

Participants seem to prefer high-risk assets over traditional, slower-growing projects. (Courtesy of @CoinMarketCap)

What is driving the Meme craze?

Retail investors value quick returns over high fully diluted valuation (FDV) projects backed by VCs.

Market participants are exhausted due to high project saturation (many projects have high FDV).

Low mainstream adoption and lack of breakthrough consumer applications exacerbate this phenomenon.

Meme Coin Black Hole:

According to CoinMarketCap, new meme coins are gathering momentum faster than any previous cycle.

Even within the AI category, many popular projects are “memeified” AI tokens.

Meme is like a black hole that is swallowing up all those who are “in it for the sake of technology.”

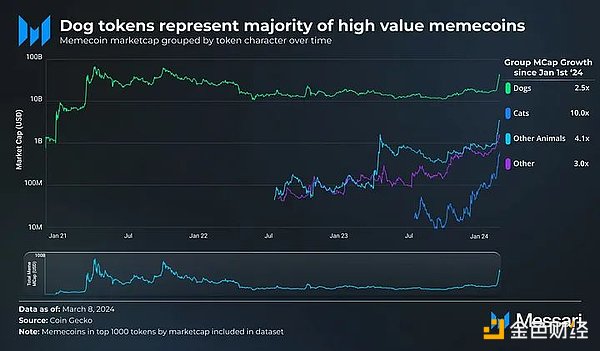

Dog vs. Cat:

An interesting phenomenon in Meme Coin is the competition between Dogecoin and Catcoin.

Catcoin has performed well so far this year, but Dogecoin still has a higher market value.

Yes, this is the current status of cryptocurrency.

Profiting from Meme:

While many people think that Meme is just a lottery, in reality the field is much more complex.

Those who are good at spotting cultural trends early may succeed.

However, without strong trading skills or a solid social network, your odds are not good.

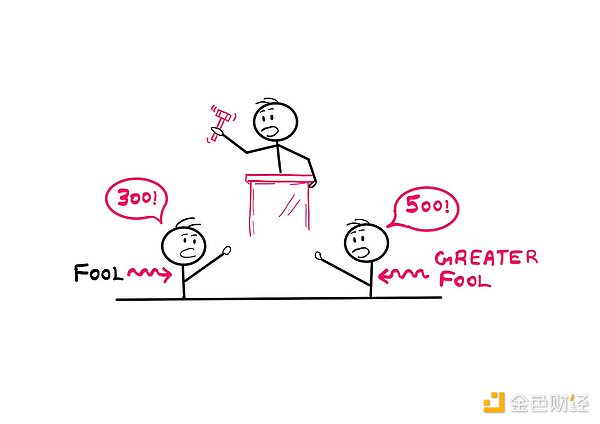

Potential Risks:

Profiting from Meme coins relies on the extremely risky "more stupid theory".

Investment enthusiasm can come and go quickly.

For example: the "1000 Trillionaire" phenomenon.

Final Thoughts:

While currencies may change, the lure of getting rich quick will never go away.

Whether you choose to participate in gambling or not, casinos will always continue to operate.

Even if you don't like Memes, it pays to understand why they succeed.

Dante

Dante

Dante

Dante JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Hui Xin

Hui Xin dailyhodl

dailyhodl Finbold

Finbold Finbold

Finbold Beincrypto

Beincrypto Bitcoinist

Bitcoinist