Author: Addy, Messari researcher; Translation: Jinse Finance xiaozou

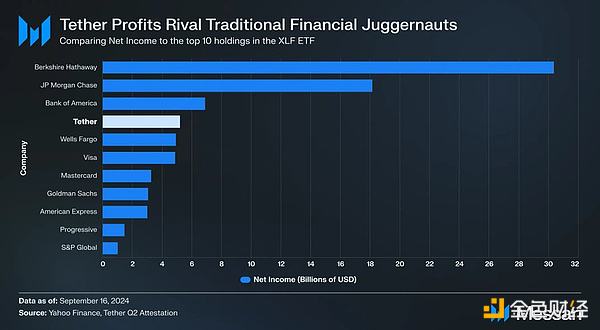

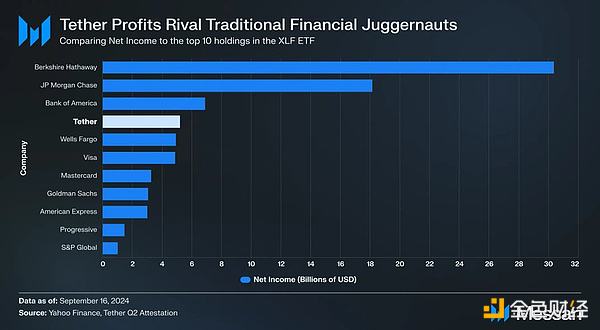

Tether's record-breaking profitability last quarter has made it one of the tradfi giants. But the huge profit of $5.2 billion has also made it a target for new competitors who want to get a piece of the pie.

In this article, we will delve into the rapidly developing world of stablecoins, involving both centralized and decentralized fields.

Overview of Stablecoins

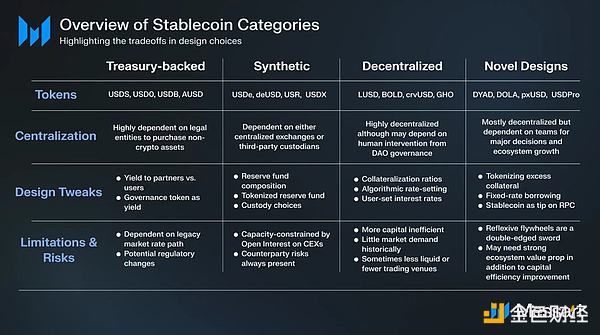

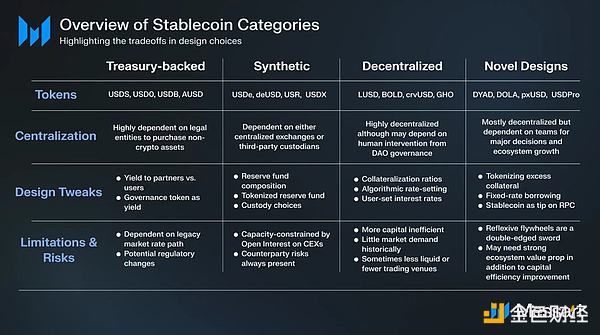

We will make the following vertical subdivisions:

PYUSD

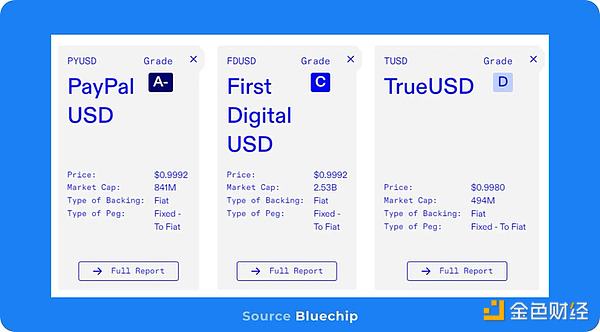

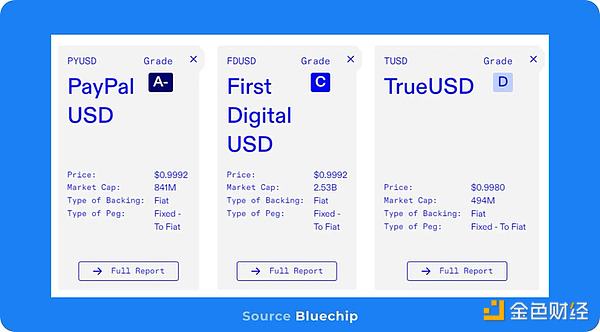

Centralized stablecoins often lack transparency and tend to have high trading volumes only under conditions with clear incentives. PYUSD is one of the few centralized stablecoins with a market value of $1 billion that has gained trust.

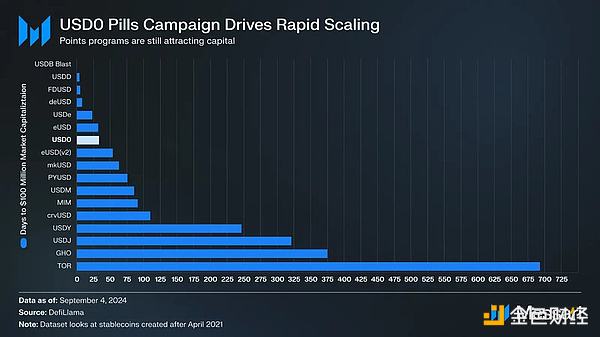

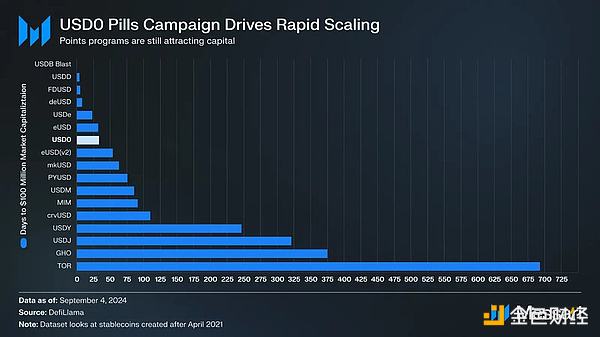

USD0

More decentralized treasury-backed stablecoins like USD0 have grown rapidly through airdrop incentives and cooperative integration with DeFi platforms such as Morpho. With a market cap of about $250 million, USD0 has quickly reached this goal.

Elixir's deUSD

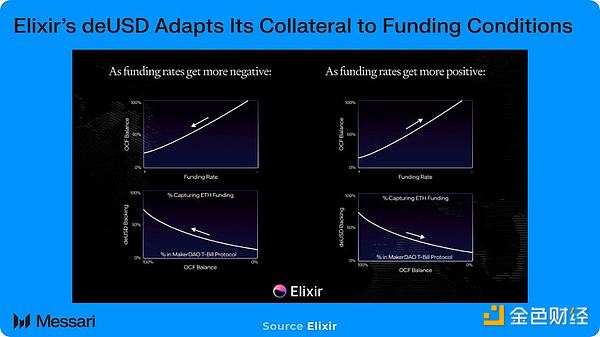

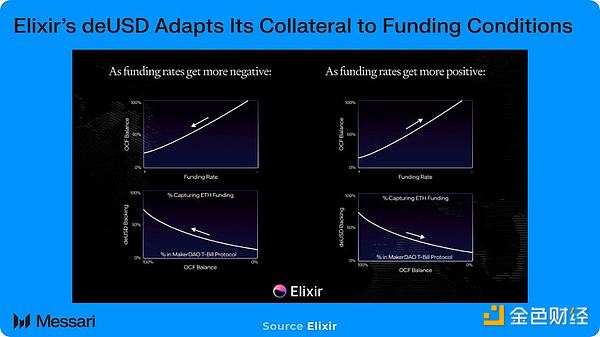

Synthetic stablecoins like USDe use "long spot + short futures positions" to maintain their pegs. USDe lost market share as the basis was compressed. But new protocols like Elixir aim to improve on the Ethena model by adjusting their collateral support.

GHO

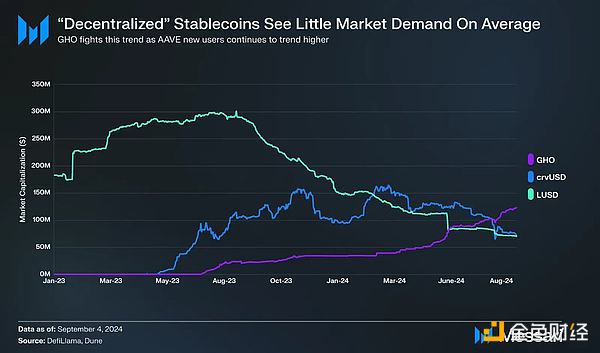

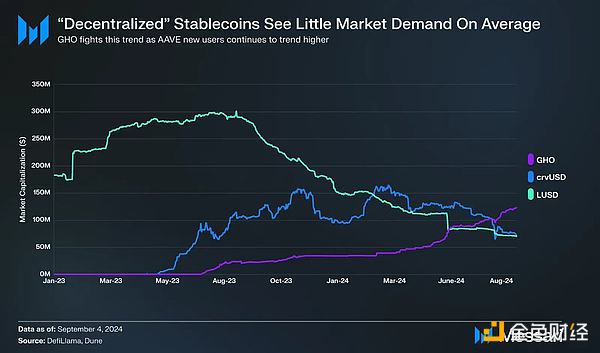

Stablecoins that focus on maximizing decentralization and minimizing human intervention have not shown much demand. GHO may be an exception as it takes advantage of the continued growth of active users on AAVE.

DYAD

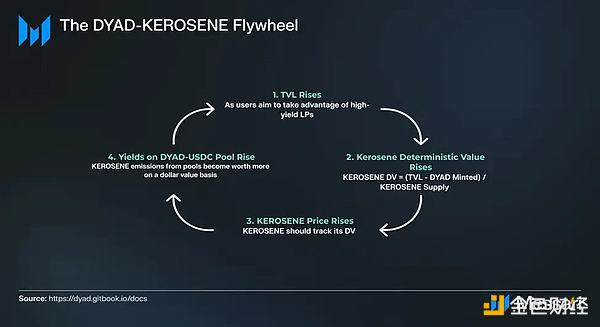

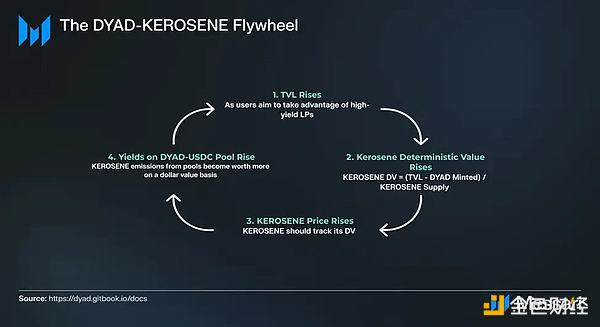

Innovative designs usually try to implement some mechanism to improve typical collateralized debt.

Position model. DYAD is such a stablecoin, and its goal is to utilize excess collateral in the system through another token called KEROSENE. KEROSENE allows users to mint more DYAD by pledging their own exogenous assets. Moreover, the more KEROSENE an NFT (NOTE) holder has, the more they will earn from the liquidity pool.

These categories of new stablecoins all compete with each other in terms of yield, accessibility, liquidity, stability, and capital efficiency. New designs or adjustments to old designs involve various trade-offs:

New stablecoins enter the market every week, and the stablecoin landscape is constantly evolving.

Kikyo

Kikyo