Author: Martin Young, CoinTelegraph; Compiler: Baishui, Golden Finance

Japanese investment company Metaplanet has completed the second largest single Bitcoin acquisition in its history, buying more than 1,000 Bitcoins, with the Bitcoin price just 3% away from its all-time high.

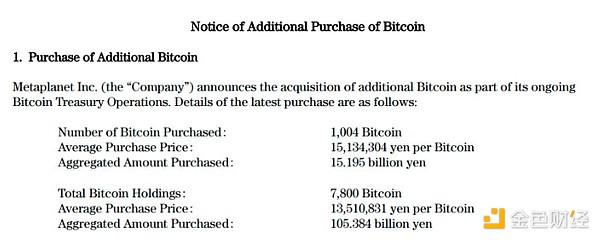

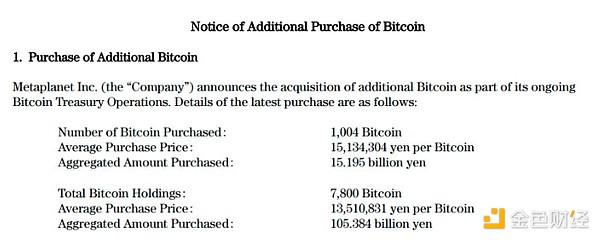

Metaplanet said on May 19 that it purchased 1,004 Bitcoins at a total cost of about 15.2 billion yen ($104.6 million), bringing its total holdings to 7,800 Bitcoins, worth about $807 million at current market prices.

This is the company's second largest single acquisition after the purchase of 1,241 Bitcoins for $129 million on May 12, a move that made its Bitcoin holdings surpass those of El Salvador.

Metaplanet is the largest publicly traded Bitcoin holder in Asia and the 10th largest publicly traded Bitcoin holder in the world, according to BiTBO.

The company reported a 95.6% return on Bitcoin in the first quarter and a 47.8% return so far in the second quarter. The return measures the percentage change in Bitcoin holdings per fully diluted share.

If Metaplanet buys another 301 Bitcoins, it will surpass Galaxy Digital Holdings, which holds 8,100 Bitcoins and ranks ninth.

Metaplanet Bitcoin Purchase Disclosure. Source: Metaplanet

In terms of corporate BTC holdings, Michael Saylor's strategy remains a clear leader, holding 568,840 bitcoins, worth approximately $59 billion.

Metaplanet has been more aggressive in increasing its bitcoin holdings in recent months, buying 2,800 bitcoins so far in May. The firm bought four bitcoins in April for a total of 794, and six in March for a total of 1,655.

Saylor Hints at More Purchases

Meanwhile, Michael Saylor posted a screenshot of the Saylor tracker on X on Monday, which tracks the firm’s bitcoin portfolio, hinting at more purchases.

“Never short someone who buys barrels of orange ink,” Saylor said.

Strategy led the way with a 77% increase in bitcoin holdings so far this year, according to bitcoin investment firm River.

On May 12, River researchers revealed that corporations are the largest net buyers of Bitcoin so far this year, outpacing exchange-traded funds (ETFs), governments, and even retail investors.

Kikyo

Kikyo