Metis, the first Ethereum rollup to feature a decentralized sorter, leverages its unique value proposition, multiple bullish catalysts, and competitive valuation. It occupies a unique position in the highly competitive Layer 2 field.

In the medium to long term, Metis is expected to experience significant growth due to four major bullish factors: Implementation of the Cancun Upgrade , the introduction of the spot Ethereum ETF, the launch of the sequencer pool, and the ecosystem expansion driven by the Metis Ecosystem Development Fund.

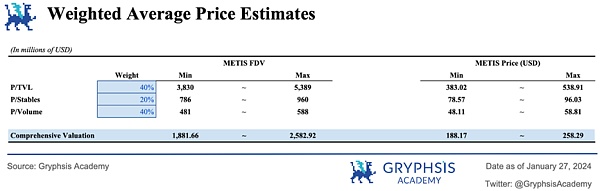

To explore the reasonable valuation of $METIS, we constructed a valuation model based on comparative analysis, taking into account the total locked value , the number of stable coins and DEX trading volume and other factors. The results show a potential price range for $METIS of $188.17 to $258.29, suggesting $METIS has the potential to grow 2 to 2.9x from its current market price.

Looking ahead, Metis demonstrates considerable growth potential. The upcoming launch of its sequencer pool is expected to bring a new narrative of liquid staking and re-staking in its ecosystem, potentially catalyzing new capital inflows. At the same time, Metis EDF is expected to help it close the gap with industry leaders such as Arbitrum and Optimism in terms of ecosystem robustness.

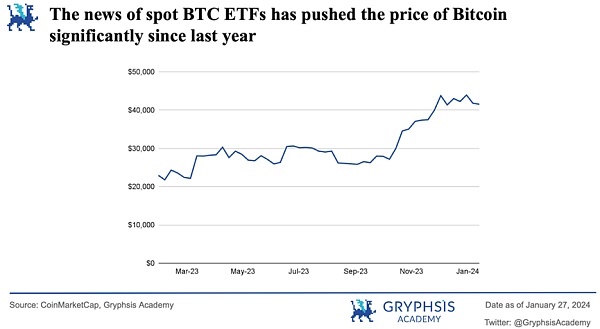

Since the fourth quarter of 2023, the crypto market has experienced a significant recovery, with multiple narratives regaining momentum and related tokens also showing strong performance.

While Bitcoin-related narratives like spot ETFs and BRC-20/Ordinals have been the main drivers of the market in the near term, as Bitcoin Inscription activity has Slowing down and Bitcoin itself entering a period of correction, these narratives appear to be losing steam. This change in market sentiment provides us with an excellent opportunity to identify new narratives that may become trends in the future.

Against this backdrop, Metis stands out for its unique value proposition, multiple bullish factors, and competitiveness against other Layer 2 (L2) tokens. The valuation has attracted our attention.

In our previous report "Metis breaks out of the circle and enters the top five of Layer 2 - revealing the secrets behind its disruptive decentralization strategy", we comprehensively analyzed Metis , discussed its technical characteristics and latest developments from a fundamental perspective.

This report turns to examine Metis from an investment perspective. The report begins with a brief review of Metis and its key bullish factors. Next, we'll explore Metis' valuation through a comparative analysis and assess its potential in the current market. Finally, we will provide insight into the future prospects of Metis and discuss strategies for investing in $METIS.

Metis, launched in May 2021, is an Ethereum Layer 2 (L2) expansion solution designed to optimize decentralized applications (dApps) and user experience. The three core features of Metis include a decentralized sorter, hybrid rollup technology and versatile token applications, making it stand out among many projects.

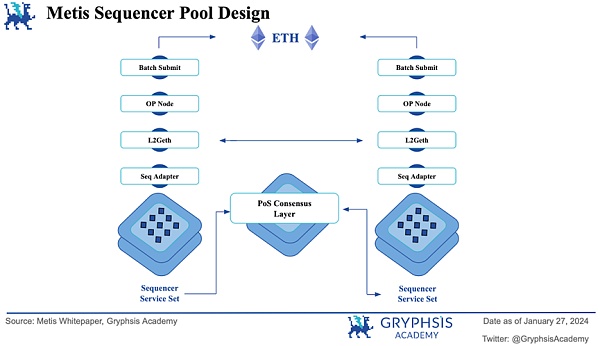

The current challenge facing Ethereum’s main Rollup technology is over-reliance on centralized sequencers, which not only violates the basic concepts of blockchain and cryptocurrency, There is also the risk of a single point of failure. While networks like Arbitrum and Optimism are developing fraud prevention and verification systems to increase decentralization, substantial progress in orderer decentralization has yet to be seen. This is not only related to issues of network control and revenue concentration, but may also pose risks to the entire network and encryption field when the centralized sequencer is attacked.

In contrast, Metis is at the forefront of decentralizing its sorter. This initiative not only improves security, but also demonstrates Metis’s contribution to society. The promise of a group-oriented model. A decentralized sorter not only improves the resiliency of the network, but also promotes a fairer distribution of sorter revenue among users. This represents a major step forward for Metis in aligning the network’s operations with the decentralized principles of the cryptocurrency ecosystem.

Hybrid Rollup technology introduced by Metis in March 2023, integrating the Optimistic Rollup framework and zero-knowledge proof, is the top priority of Metis development. This hybrid approach is designed to combine the scalability benefits of Optimistic Rollup with the inherent security and attestation properties of ZK Rollup.

In the field of Rollup technology, confirmation time and finalization time are two key indicators. Although the current optimistic convolution is confirmed quickly, it takes a long time to finalize due to the challenge window of up to 7 days. Zero-knowledge proof can verify the authenticity of a transaction almost immediately after the prover generates the proof and the verifier confirms it. Therefore, the combination of these two technologies is expected to significantly enhance Ethereum’s scalability.

Once hybrid convolution technology is successfully implemented on Metis, it will bring several major improvements. Among the most significant improvements is the acceleration of transaction finality, reducing wait times from seven days to just four hours. In addition, the introduction of zk proof will greatly enhance transaction security. At the same time, zk's proven efficient data management capabilities ensure that each transaction only contains necessary data, further improving the network's processing capabilities.

Metis' native token $METIS is unique among many second-layer tokens such as $ARB and $OP with its diverse application functions. While $ARB and $OP are primarily used as governance tokens, $METIS goes beyond that and extends to the use of Proof-of-Stake (PoS) staking and network gas fees. $METIS lends itself to fundamental value as a dual-purpose token for staking and gas fees.

As the Metis network continues to expand and its applications increase, the demand for $METIS is also growing, mainly due to its practical application in network operations value. In terms of governance, while the idea of decentralization often emphasizes the importance of governance as a token function, for profit-oriented crypto investors, the opportunity to earn additional income through staking may be more attractive. Therefore, $METIS’s versatility adds significant appeal, making it unique among the many second-tier tokens.

For more details on Metis' technology architecture, check out our previous report.

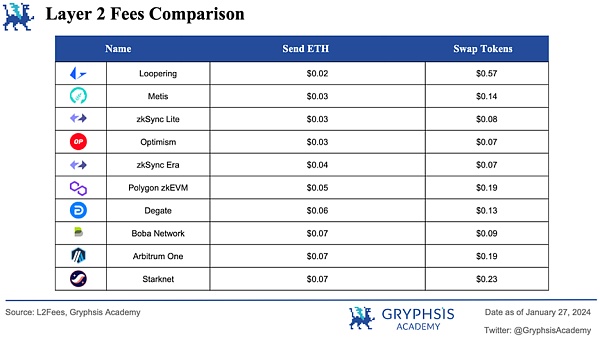

For the Ethereum network, it is expected to be released this year The Ethereum Cancun upgrade will be a major progress, of which EIP-4844 is its most significant feature. The goal of the upgrade is to significantly reduce fees for layer-two (L2) solutions by introducing a new transaction type called “Blobs.” Current estimates suggest Blobs could slash L2 fees by up to 90%. Such significant fee reductions are expected to boost network activity for L2 platforms, including Metis.

Data from L2Fees shows that Metis is already the second-most cost-effective option for transferring $ETH, and the third-lowest cost option for performing token swaps. The implementation of the Cancun upgrade is likely to further enhance Metis's fee advantage and is expected to drive growth in its network activity.

Additionally, major upgrades like Cancun often trigger speculation in the market, especially around $ETH and ETH Beta tokens. Market participants tend to be actively involved in speculation leading up to major updates. As the primary Ethereum L2 token, $METIS is likely to see an inflow of speculative capital as the Cancun upgrade approaches, resulting in heightened trading activity and increased interest in the token.

The discussion surrounding spot Ethereum ETFs is gaining increasing attention. Following the approval of Bitcoin spot ETFs, it is reasonable to expect that Ethereum may be the next asset to receive similar regulatory approval. The potential approval of a spot Ethereum ETF would not only symbolize recognition and reputational boost from the government, but could also trigger massive capital inflows, pushing up its price.

Although Ethereum is different from Bitcoin, which may make its approval process more complicated, the market reacts with each relevant news release and the deadline approaches. Speculative behavior can lead to multiple fluctuations. This phenomenon is already happening with Bitcoin and is likely to happen for Ethereum, especially if there are other narratives surrounding Ethereum such as the Cancun upgrade.

Although the approval of Bitcoin spot ETFs seems to be a "sell news" event because Bitcoin is currently in a correction phase, the launch of spot ETFs is It provides the public with unprecedented ease of access to the Bitcoin market, bringing long-term benefits.

Hence, especially Ethereum layer 2 tokens with strong value propositions like $METIS, will benefit significantly. As Ethereum prices rise, its related second-tier tokens, often referred to as “ETH Beta,” may see larger gains due to their smaller market caps. Metis has the potential to outperform its peers in this market movement due to its unique features and solid value proposition.

Metis' decentralized sorter, as one of its core value propositions, is the main driver of recent market attention. Currently, the sequencer pool is undergoing the first of three phases of community testing. At this stage, users experience Metis’ dApps through the Sepolia test network, while developers stress test and optimize the sequencer pool in preparation for its official launch.

This community testing phase is an important indicator of the development of the sorter pool and heralds its upcoming launch. The successful deployment is expected to have a positive impact on the price of $METIS, as major protocol upgrades often play a catalytic role in the crypto market. Moreover, due to market efficiency issues, prices usually continue to rise for a period of time after such news is announced.

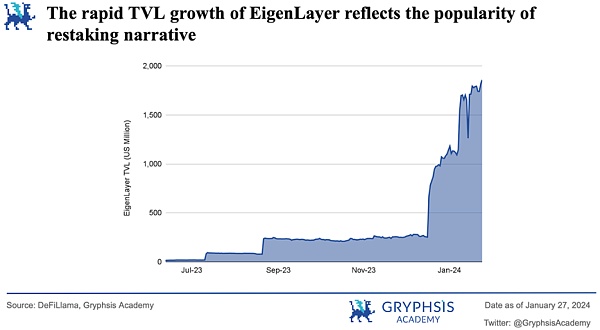

The launch of the sequencer pool also means that liquid staking/re-staking will be introduced into the Metis ecosystem, which has gained significant attention in the DeFi field , which can be seen from the growth of the Ethereum liquid staking ecosystem over the past year. Liquid staking offers many possibilities, such as lending protocols and collateralized debt positions developed on top of $stMETIS, or re-staking protocols utilizing various forms of staking $METIS tokens.

These applications could significantly increase the total value locked (TVL) of the Metis network and increase demand for $METIS, potentially creating a virtuous cycle of growth. Even if Metis’ liquid staking ecosystem doesn’t reach the scale of Ethereum, achieving a fraction of its growth shows huge potential. Once liquidity staking in the Metis ecosystem starts to gain traction, $METIS may experience a supply shock.

When assessing the intrinsic value of L2 tokens, it is critical to consider the scope of economic activity supported by the network, which reflects the usage and adoption of the network itself. Therefore, events that stimulate economic activity within the L2 network ecosystem can be considered bullish factors for its native token.

In December 2023, Metis launched the Metis Ecosystem Development Fund (Metis EDF), an important initiative that allocated $4.6 million METIS to Promote the development, liquidity, activity and wider adoption of the Metis ecosystem. The majority of the fund is used to incentivize sequencer staking, with approximately 35% used for ecosystem development.

Similar initiatives such as Arbitrum’s STIP and Optimism’s RetroPGF have had a positive impact on their ecosystems. Considering that protocols within Metis are generally smaller and small-cap tokens typically offer higher percentage returns, Metis EDF is expected to have a significant impact, attracting yield-seeking users to the Metis ecosystem in search of significant gains.

Developers play a key role in the growth of the web ecosystem. Even a single popular dApp can significantly increase the TVL of a chain, take GMX on Arbitrum as an example. On January 8, WAGMI announced that it would be deployed on Metis.

WAGMI is developed by well-known developer Daniele Setagalli, whose projects have attracted billions of dollars in TVL in ecosystems like Avalanche and Fantom, The transfer of WAGMI to Metis is seen as a positive development.

While it is too early to claim that WAGMI will replicate Daniele's past success, this deployment certainly adds a positive element to Metis' growth trajectory, showing Developers’ recognition of the network’s growth potential.

In addition, the Metis community utilizes a platform called Candidac for project approval to launch new projects. Candidac currently has over 30 projects in its approval queue, highlighting the growing interest in the Metis ecosystem. It also demonstrates the confidence builders have in Metis’ potential and capabilities.

To delve deeper into the reasonable valuation of $METIS, we developed a valuation model based on comparative analysis. This model evaluates the relative position of $METIS in the Layer 2 network (L2) world by selecting specific indicators. The goal of the model is to estimate a potential price range for $METIS, assuming it reaches the industry average or median level. Additionally, the model also incorporates various discounts and premiums into its calculations, taking into account the impact of bullish and bearish factors on the token price.

Our analysis begins by collecting market data for various L2 networks. The data includes key metrics such as price, market cap, fully diluted value, total value locked (TVL), the number of stablecoins on each network, and 30-day decentralized exchange (DEX) trading volume.

Based on this data, we calculated three ratios: FDV/TVL, FDV/stablecoins, and FDV/vol. We chose TVL, stablecoin and DEX trading volume as key indicators because they can reflect the robustness of an L2 network and the economic health and activity of the L2 network.

Our analysis then calculates the range for each metric (FDV/TVL, FDV/Stables, FDV/Volume) based on the mean and median. This is done to reduce the bias that can result from relying solely on extreme values in the data set. By considering both the mean and the median, we aim for a more balanced and representative understanding of $METIS's positioning within the second layer network (L2).

In order to make the analysis more precise and take into account possible market movements, we have introduced a discount and premium range of -10% to +10%. This range applies to the low and high ends of the $METIS price range.

Specifically, the low end of the price range is determined by taking the lower of the mean or median of each indicator and multiplying by 0.9 (representing 10% discount) calculated. Conversely, the high end of the price range is determined by taking the higher of the mean or median of each metric and multiplying by 1.1 (representing a 10% premium).

In determining $METIS's final price range, our valuation model takes a weighted average of price estimates calculated based on three ratios (FDV/TVL, FDV/Stables, FDV/Volume). The weights are distributed as follows: FDV/TVL 40%, FDV/Stables 20%, and FDV/Volume 40%. This allocation is based on the belief that FDV/TVL and FDV/Volume better reflect the economic activity of the network than the number of stablecoins.

This weighting approach results in a final price range for $METIS of $188.17 to $258.29. This suggests that the price of $METIS has the potential to grow 2 to 2.9x from the current market price.

It is important to note that this model and its results are based on current market conditions and assumptions about the importance of different indicators. Actual market performance may vary based on numerous factors, including, but not limited to, changing market dynamics, broader economic conditions, and specific developments within the Metis network or broader Layer 2 (L2) ecosystem.

Therefore, the price range proposed should be regarded as a rough estimate and not an exact prediction of future prices. Readers should consider this model as one of several tools in the decision-making process and conduct their own research and analysis before making investment decisions.

From a fundamental perspective, $METIS looks attractive due to its unique value proposition, multiple bullish factors, and reasonable market cap growth potential. While it is possible to profitably trade these events, it requires precise market timing and expertise in picking entry points, especially when using leverage.

For many retail investors, an effective strategy may be batch allocation (DCA). This method involves investing a fixed amount at regular intervals, helping to gradually build an investment position while mitigating market volatility.

Tranch fixed investment allows investors to continue investing under any market conditions, thereby reducing the emotional stress that often accompanies market timing, which is particularly important when volatility This is especially common in high crypto markets. This strategy also averages purchase costs over time. When bullish factors emerge, investors may consider reducing the risk of some positions. The extent and timing of such actions should be based on one's investment objectives, time perspective and risk tolerance.

But it should be noted that this strategy is based on a positive view of the long-term prospects of the token. Therefore, it is very important to conduct thorough research and due diligence before embarking on any investment. Given the unpredictability and high volatility of the cryptocurrency market, you should also ensure that you only invest money that you can afford to lose.

As the first Ethereum rollup to feature a decentralized orderer, Metis is significantly positioned in the highly competitive second-layer (L2) network space. This step toward a higher degree of decentralization is important and shows Metis’ alignment with the core values of the cryptocurrency community.

It is very exciting to see projects like Metis not only recognizing the importance of decentralization, but also actively innovating in this field.

Looking ahead, Metis presents considerable growth potential. The upcoming launch of its sequencer pool is expected to introduce the concept of liquid staking and re-staking into its ecosystem, potentially attracting a new wave of capital inflows.

In addition, the Metis Ecosystem Development Fund (Metis EDF) plays a key role in accelerating the growth and development of the network ecosystem, helping to bridge the gap with companies like Arbitrum and leading competitors like Optimism.

Given these developments, Metis will be a focus of our attention and we will continue to monitor its progress and future developments closely.

Reference materials

[1]https:// drive.google.com/file/d/1-hGL4mj8hLtWV8jlt6zRz63yKY14cvyr/view

[2]https://www.metis.io/blog/metis-edf -a-new-chapter-for-metis

[3]https://www.metis.io/blog/introducing-hybrid-rollups

[4]https://www.metis.io/blog/metis-community-testing

[5]https://coinmarketcap.com/

[6]https://defillama.com/

[7]https://l2beat.com/scaling/summary

Statement

This report is an original work completed by @GryphsisAcademy student @BC082559 under the guidance of @CryptoScott_ETH. The authors are solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy, nor the views of the organization that commissioned the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be relied upon for investment decisions. It is strongly recommended that you conduct your own research and consult with an unbiased financial, tax or legal advisor before making any investment decisions. Remember, the past performance of any asset does not guarantee future returns.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin The Crypto Illuminati

The Crypto Illuminati 链向资讯

链向资讯