A few days ago, Microstrategy, a US-listed company known for its accumulation of Bitcoin (BTC), released its fourth quarter financial report for 2023. After reading this financial report, I discovered that before the spot ETF was passed in early 2024, the source of power for the violent market that started in October 2023 had a considerable contribution from micro-strategy.

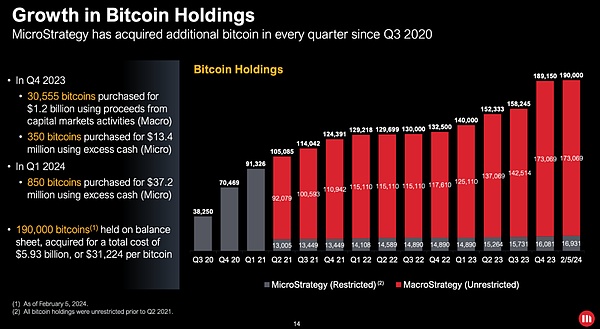

From the position growth chart given in the micro-strategy report, we can see that in the third quarter of 2023, positions are still slowly increasing step by step to 158,000 BTC positions. Micro-strategy suddenly bought more than 30,000 BTC in the fourth quarter, and the position suddenly increased to 189,000 BTC!

In the first quarter of 2024, MicroStrategy slightly replenished its position by 850 BTC, bringing its position to the integer mark of 190,000 BTC as of February 5.

According to the financial report disclosure, there are 190,000 BTC positions, and the total amount of funds used to establish the position is US$5.93 billion, which translates into an average position cost of US$31,224 per BTC. Judging from the current price of around 44.5k, the floating profit is more than 40%.

The 30,905 BTCs purchased in the fourth quarter of 2023 had a total cost of US$1.213 billion, and the average cost of adding a position was US$39,262. In the first quarter of 2024, 850 BTC will be replenished, with a total cost of US$37.2 million and an average replenishment cost of US$43,764. Both are currently worth buying.

You know, how many BTC can miners produce in total in the fourth quarter? Calculated based on the fixed output of 6.25 BTC per block, there are 6 blocks an hour, 24 hours a day, and 90 days a quarter, then the quarterly output is 6.25 x 6 x 24 x 90 = 81,000 BTC.

In other words, MicroStrategy alone took away more than 30% of the quarterly output!

No wonder Bitcoin surged from 27k at the opening in October to 42.5k at the end of December, a quarterly increase of 57%!

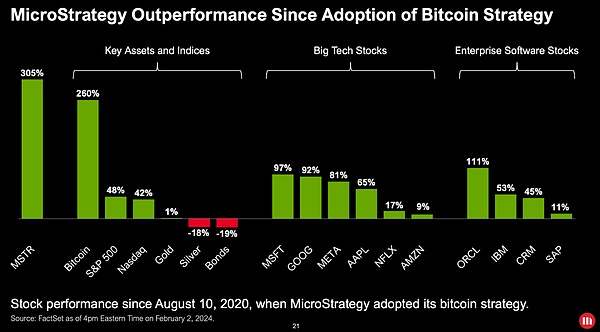

Since hoarding Bitcoin, MicroStrategy’s stock price has also been flying high. The picture below is a U.S. stock growth comparison chart that the boss of MicroStrategy is proud of.

The figure shows that since MicroStrategy started hoarding pie in August 2020, as of early February 2024, its US stock market has increased by as high as 305%, far exceeding the stock price performance of several leading companies in the US stock market.

That’s it, it also didn’t forget to bring along its competitors on the “same track”. But in fact, it is difficult to say that MicroStrategy is still an "enterprise software development company".

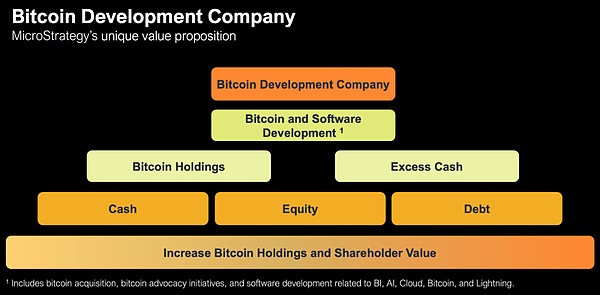

Even MicroStrategy itself has begun to boast that it has become "the world's first Bitcoin development company."

In the report, it wrote: ""MicroStrategy is the world's first Bitcoin development company"

"MicroStrategy (Nas (Daq: MSTR) considers itself to be the world’s first Bitcoin development company.

"We are a publicly traded company dedicated to Our activities in financial markets, advocacy and technological innovation continue to develop the Bitcoin network. As an operating business, we are able to use cash flow and proceeds from equity and debt financing to accumulate Bitcoin as our primary financial reserve asset .

"We also develop and deliver industry-leading AI-powered enterprise analytics software to advance our "Intelligence Everywhere" vision and leverage our software development capabilities to develop Bitcoin applications.

"We believe that the combination of our operating structure, Bitcoin strategy and focus on technological innovation will create a Value provides a unique opportunity.”

Some people say that micro-strategy is a pie-hoarding agent with its own off-site cash flow and flexible use of leverage. This is how micro-strategy itself is promoted.

However, if you look closely at the financial report, you will find that this off-site cash flow is still slightly embarrassing. For two consecutive years in 2022 and 2023, Non-GAAP operating income will be negative! Among them, the loss will be US$1.2 billion in 2022 and US$45 million in 2023. In 2024, they are expected to turn a profit.

So, at least for now, its negative off-site cash flow has damaged the book value of its accumulated BTC assets. This means that under the current accounting standards, the book value of the micro-strategy position is not the market value of US$8.1 billion, but the cost of US$5.9 billion. Subtracting the loss of US$2.3 billion, the result is only US$3.7 billion.

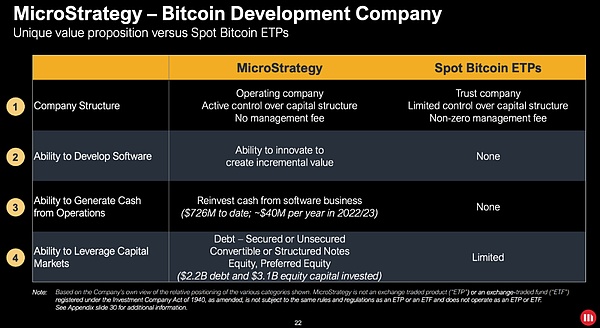

This greatly limits the ability of micro-strategy to increase leverage. But the main strategy that still does not hinder the micro-strategy’s explosive buying is actually leveraging, commonly known as borrowing money!

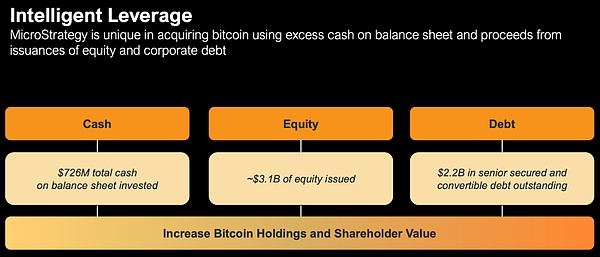

In MicroStrategy’s financial report, it said that it used “clever leverage”.

MicroStrategy currently has $726 million in cash and approximately $3.1 billion in assets on its balance sheet (note the accounting standards issues discussed above). Liabilities are $2.2 billion. In other words, the net assets are only about 7.26 + 31 - 22 = 1.626 billion US dollars.

Planet members who often read the internal reference of the teaching chain know that MicroStrategy and its boss Michael Salyor are actually taking advantage of MicroStrategy's stocks to outperform and seize the opportunity. To reduce holdings and cash out, it is time to stock up on cakes and cakes, and when it is time to reserve ammunition and ammunition. (Refer to reading the internal reference of the teaching chain 11.30 "Micro Strategy for Selling Stocks and Hoarding Pies", the internal reference of the teaching chain 1.3 "How to Plan to Reduce Holdings")

Although they say it Micro-strategy stocks are good in every way, even better than spot ETFs, and so on. But they know better that if there are flowers, they must be broken off, and if there are no flowers, they must be broken off. After all, positions supported by debt are not as stable and practical as spot BTC. It's easy to be debt-free.

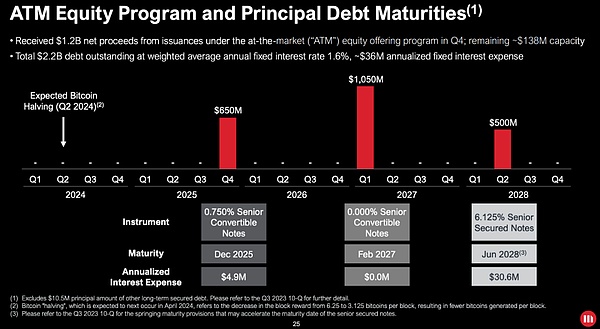

There are three main debts of micro-strategy. Objectively speaking, it is much more beautiful than the leverage that most individuals can obtain. The largest sum is US$1.05 billion, interest-free! Expiration date, February 2027.

The other two deals, one is US$650 million, the interest is 7.5% per thousand (super low), and the maturity date is earlier, in December 2025; the other A sum of US$500 million, with an interest rate of 6.125% (relatively high), but the maturity date is very late, until June 2028.

From the time setting of this debt maturity date, you can see the micro-strategy's calculation at a glance: it must be calculating that the end of 2025 is likely to be the peak of the next round of bull market, and then sell at a high level and pay off this A debt, the rest is yours, feel good about it.

As for the largest debt, the expected bear market in 2026 will be skipped. When the bear market ends and the rebound begins, debt repayment will begin in the first quarter of 2027. . I don’t know whether MicroStrategy is planning to sell off the debt service costs of these two debts at one go at the bull market high at the end of 2025, or to wait until the bear market low at the end of 2026 or early 2027 before selling off the pie to repay the debt. However, according to common sense, it is likely that it will want to maximize its profits, so it will most likely choose to make the most of the bull market at the end of 2025.

If the nearly 200,000 BTC currently accumulated by MicroStrategy are poured out at the high point of the bull market in 2025, will it become the next bull market? What are the important triggers for ending the transformation into a bear?

(Disclaimer: None of the content in this article constitutes any investment advice. Cryptocurrency is an extremely high-risk species and has the risk of returning to zero at any time. Please participate with caution and exercise caution. Responsible.)

If you like this article, please click to read, like, and forward to support

???

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance decrypt

decrypt Coindesk

Coindesk Others

Others Finbold

Finbold Others

Others