AC Capital: Why did we invest in Honeypot Finance?

Honeypot Finance stood out and won the award at the ETH-Beijing hackathon with Batch-A2MM, and then quickly took root in Berachain's unique innovation soil.

JinseFinance

JinseFinance

Source: MIIX Capital

The United States is at or near the forefront of technological advancement and innovation in many areas of the economy, especially artificial intelligence , in the field of encryption, the United States is the center of the world. Ethereum, UniSwap, Binance, Coinbase, DCG, a16z, these leading applications and institutions that we are familiar with, were either born in the United States or headquartered in the United States, and they all have a very close relationship with the United States. .

The United States is at or close to the forefront of technological progress and innovation in many economic fields, especially in the field of artificial intelligence. In the field of encryption, the United States is the center of the world, with Ethereum, UniSwap, Binance, Coinbase, DCG, a16z, these top applications and institutions that we are familiar with, were either born in the United States or headquartered in the United States, and they all have a very close relationship with the United States.

American culture emphasizes individualism, encourages individuals to be self-reliant, and advocates that rewards should be determined by personal abilities rather than wealth or social status. Free market capitalism in the United States emphasizes the profit motive and high risk tolerance, providing ample opportunities, funding, and support for startups, cultivating an ecosystem that is primarily driven by the private sector with minimal public sector intervention, which is critical to the crypto market. It is a natural growth greenhouse.

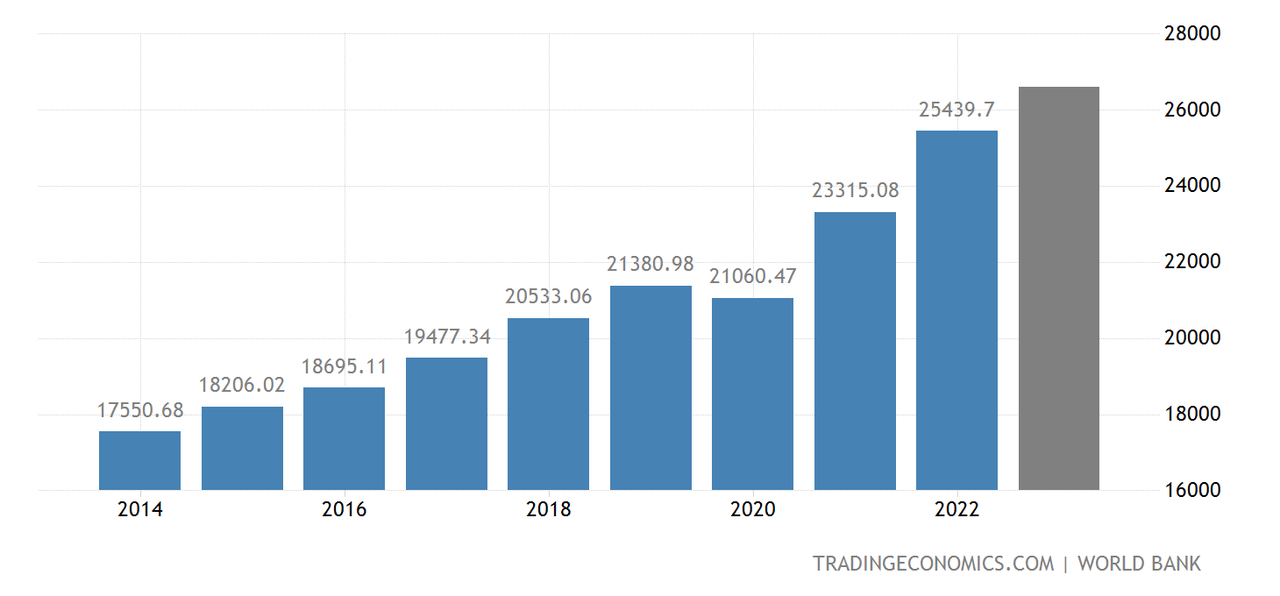

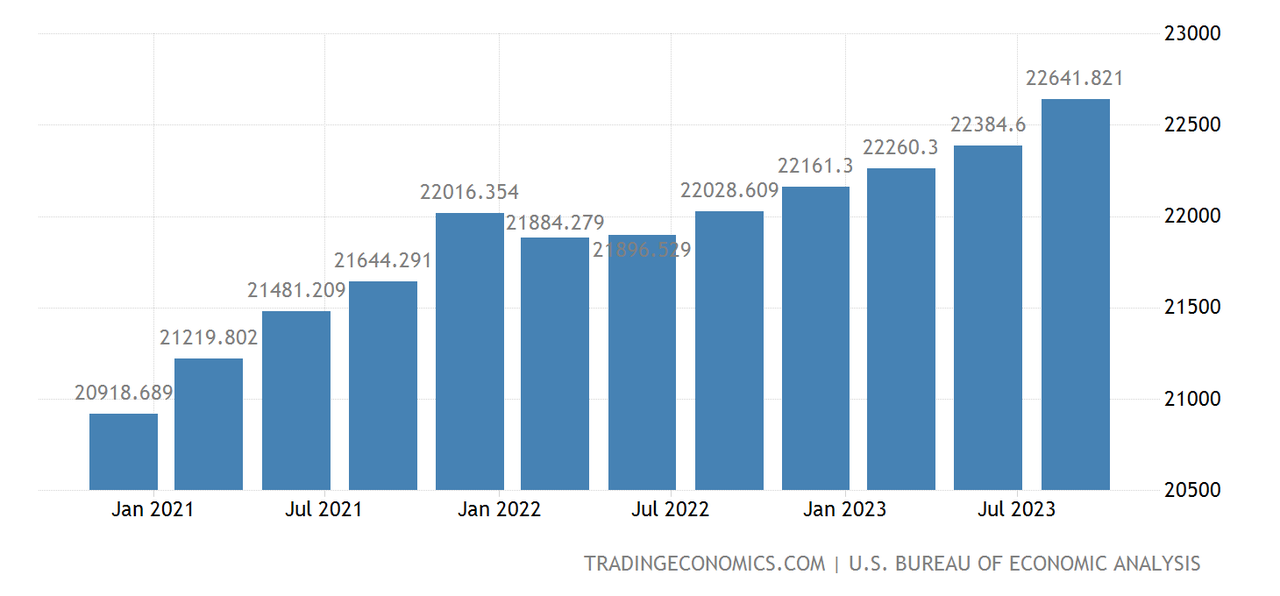

The United States has a highly developed mixed economic system. It is the largest economy in the world based on nominal GDP; and based on purchasing power parity (PPP) ) calculation, it is the second largest economy after China. As of 2022, the United States ranks seventh in the world in nominal GDP per capita and eighth in purchasing power parity.

The United States of America, commonly known as the United States, is a country mainly located in North America. The third largest country in the world by land and total area, the United States consists of 50 states, one federal district, five territories, and several uninhabited island territories. It is the oldest surviving federation in the world and, according to the World Economic Forum, the oldest democracy.

The United States is located in the center of North America. Its territory also includes Alaska in the northwest of North America and the Hawaiian Islands in the central Pacific. It borders Canada to the north, the Gulf of Mexico to the south, the Pacific to the west, and the Atlantic Ocean to the east. The land area is 9.37 million square kilometers. The mainland is 4,500 kilometers long from east to west, 2,700 kilometers wide from north to south, and has a coastline of 22,700 kilometers long. The United States is the third largest country in the world by land area and total area, after Russia and Canada.

As of February 2023, the total population of the United States is approximately 333 million. According to the 2020 U.S. Census data, non-Hispanic whites account for 57.8%, Hispanics account for 18.7%, African Americans account for 12.4%, Asians account for 6%, Indians and Alaska Natives account for 1.1%, Native Hawaiians or other Pacific Islanders make up 0.2% (there is overlap). About 46.5% of the population believes in Christianity, 20.8% believes in Catholicism, 1.9% believes in Judaism, 0.9% believes in Islam, 0.7% believes in Buddhism, 0.5% believes in Orthodox Christianity, 1.2% believes in other religions, and 22.8% has no religious belief (a small number of people belong to Multiple religious beliefs are counted repeatedly).

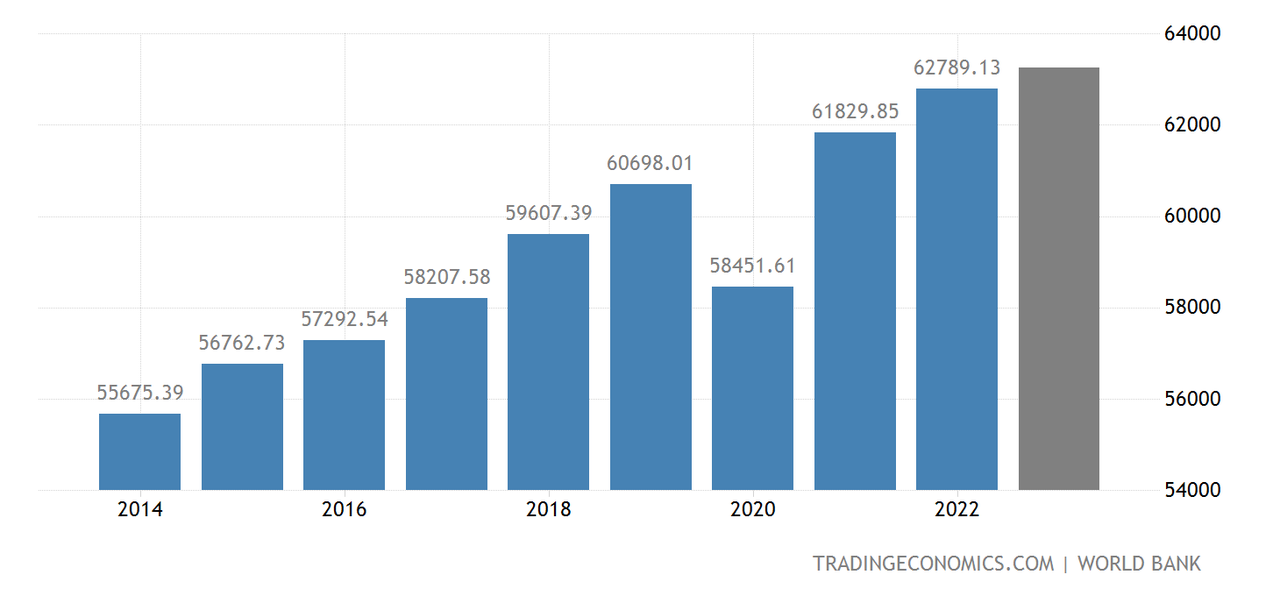

The U.S. economy is highly developed, with huge production scale, leading production technology, complete departmental structure, advanced agricultural and industrial industries, road and aviation technology and transportation volume It ranks first in the world, second in the world in terms of foreign trade volume, and has a very developed financial industry; its economic scale has long ranked first in the world. With a per capita GDP of more than 60,000 US dollars, it ranks first among countries with a population of more than 50 million (inclusive). It is the most important economy in the world and plays the most important role in human economic life.

Wealth in the United States is highly concentrated, with the richest 10% of the adult population owning 72% of the country's household wealth, while the bottom 50% own only 2%. Income inequality in the United States remains at an all-time high, with the top fifth earning more than half of all income, making the United States one of the most widely distributed countries in the OECD.

The United States is at or near the forefront of technological advancement and innovation in many areas of the economy, especially artificial intelligence; computers, pharmaceuticals, and medical, aerospace, and military equipment. The country's economy is driven by abundant natural resources, developed infrastructure and high productivity. The United States' largest trading partners are the European Union, Mexico, Canada, China, Japan, South Korea, the United Kingdom, Vietnam, India and Taiwan. The United States is the world's largest importer and second-largest exporter after China. It is by far the world's largest exporter of services.

The United States has a diversified, highly developed, private sector-led economy. Since around 1890, the United States has been the largest economy in terms of GDP. It is the largest national economy in the world, characterized by high productivity, high technological innovation and high competitiveness.

The latest record of U.S. per capita GDP was US$62,789.13 in 2022. The per capita GDP of the United States is equivalent to 497% of the world average. Ranking first in the world, followed by Canada and Germany, ranking ninth in the world in terms of purchasing power parity.

As the decline in energy prices slows, the annual US inflation rate in December 2023 increased from 3.1 in November % rose to a five-month low of 3.4%, above market forecasts of 3.2%. Annual core inflation fell back to 3.9%, down from 4% in the previous period but above expectations of 3.8%. Consumer prices rose 0.3% compared with November, the highest gain in three months and above forecasts for a 0.2% increase.

Preliminary estimates indicate that the University of Michigan's U.S. consumer confidence index surged to 78.8 in January 2024, the highest level since July 2021. Meanwhile, a measure of consumer expectations surged to 75.9 from 67.4, and a gauge assessing current economic conditions rose to 83.3 from 73.3. Consumer confidence climbed 29% in January and December combined, the largest two-month gain since the end of the 1991 recession.

The U.S. dollar is the most widely used currency in international transactions and has the country’s dominant economic, military, petrodollar system and financial system support. Since World War II, the U.S. dollar has served as the world's main reserve currency. Some countries use it as their official currency, and in some countries it is the de facto currency. Today, the U.S. dollar accounts for 58% of the value of global foreign exchange reserves. The second most commonly used currency, the euro, accounts for only 21% of foreign exchange reserves.

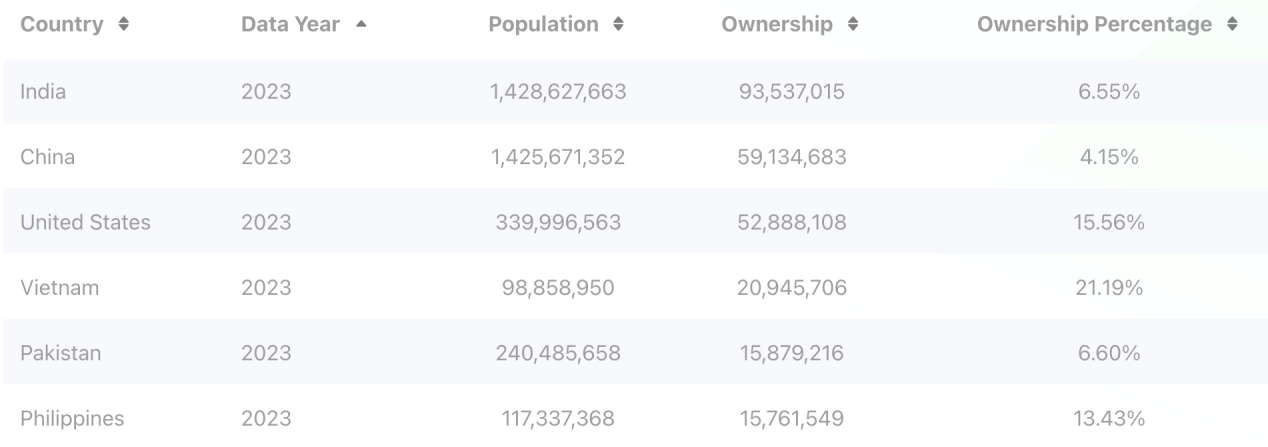

According to TripleA data, the United States has more than 52 million cryptocurrency users and ranks among the top in terms of ownership ratio, accounting for 15.56% of the entire population. There are few samples of U.S. user characteristics data, mainly based on the adoption and trends of U.S. cryptocurrency released by TripleA in 2022.

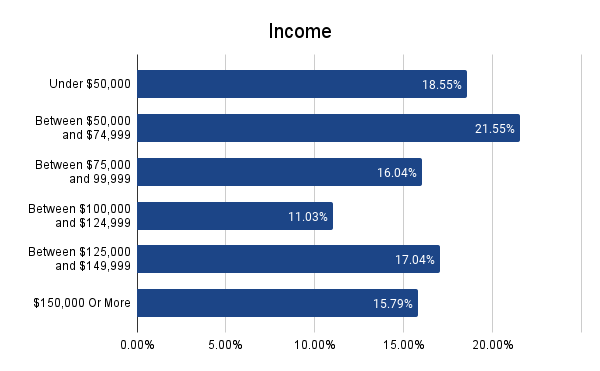

Dividing cryptocurrency ownership by income, 44% of US cryptocurrency owners have an annual income of US$100,000 or more. This suggests that cryptocurrencies are primarily owned by wealthier Americans.

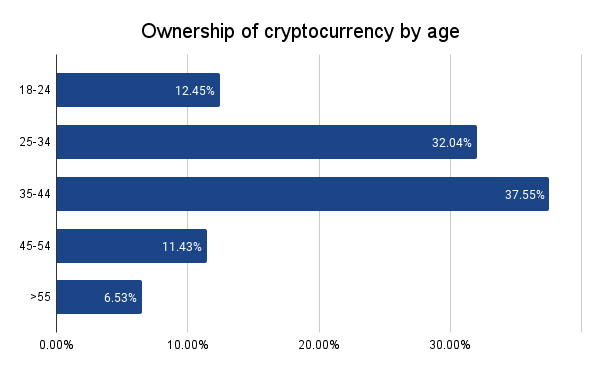

The majority of US cryptocurrency holders are between the ages of 18-44 (82%). Only 7% of them are 55 and older. The takeaway from this is that cryptocurrencies are primarily owned by younger Americans.

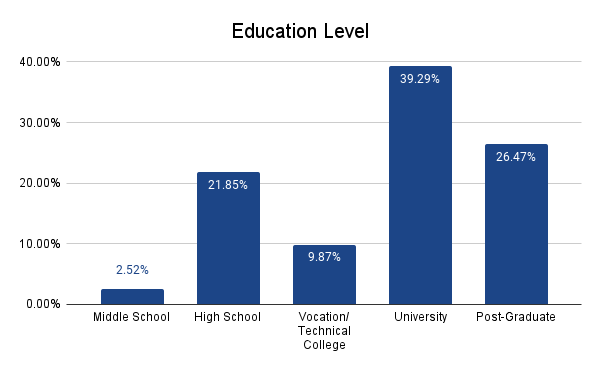

The majority of US cryptocurrency holders are highly educated, with 66% holding a bachelor's degree or higher.

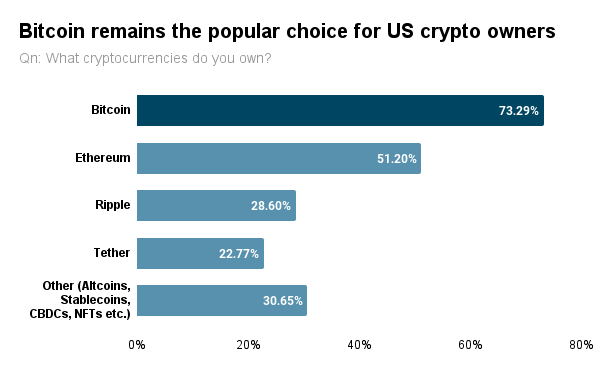

Bitcoin remains a popular choice among US cryptocurrency owners, with more than 73% of cryptocurrency owner respondents owning Bitcoin. Ethereum follows in second place with the cryptocurrency’s broad use cases, followed by Ripple (XRP), Tether (USDT) and others.

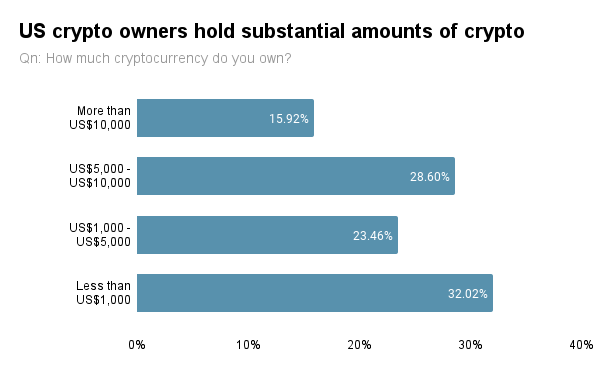

Cryptocurrencies are increasingly viewed as a safe asset and an alternative to national currencies, with more than 15% of cryptocurrency owners owning more than $10,000 in crypto assets.

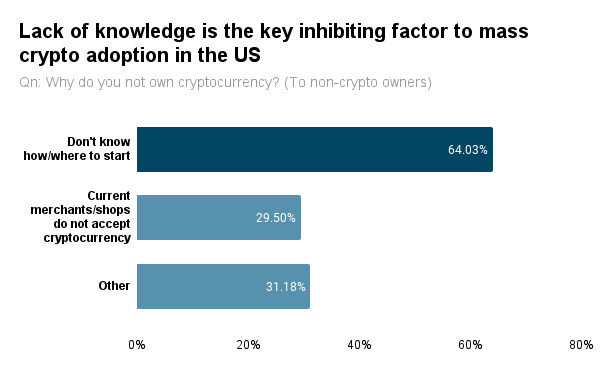

The majority of non-crypto respondents (64%) expressed a lack of knowledge, indicating the huge potential to increase cryptocurrency adoption through proper channel education and awareness.

Coinbase, the largest central exchange in the United States, lists The top 20 states with the highest proportion of the population owning cryptocurrency account for 76% of the market share.

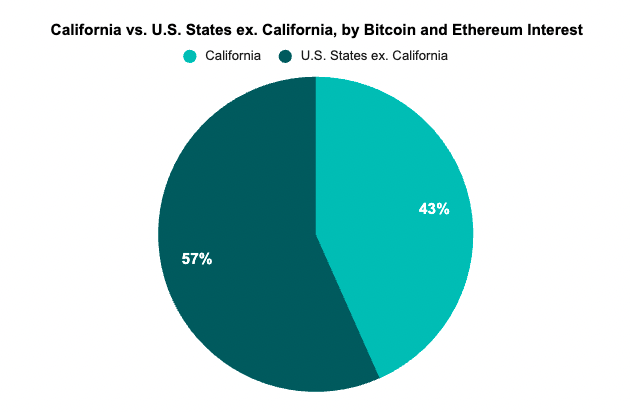

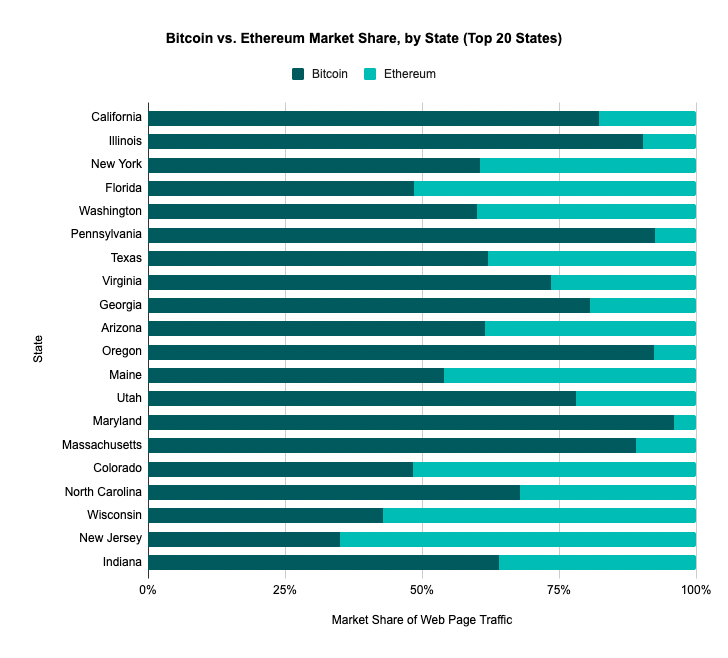

California surpassed all states and accounted for 43% of total US CoinGecko Bitcoin and Ethereum web page traffic, indicating the highest interest in these cryptocurrencies. Other contenders in the top 10 include Illinois, New York, Florida, Washington, Pennsylvania, Texas, Virginia, Georgia and Arizona.

While Bitcoin has a higher market share in most of the top 10 states, Ethereum has a market share of 65.0% in New Jersey, followed by Wisconsin, 57.1%. Colorado and Florida have market shares of Ethereum search interest of 51.7% and 51.5% respectively.

Well-known exchanges in the US, such as Coinbase, Gemini and Kraken, enable users to buy and sell Bitcoin using US dollars and various fiat currencies. These platforms often adhere to strict compliance standards to comply with U.S. regulatory requirements.

Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam as a secure online platform dedicated to acquiring and selling , transfer and store cryptocurrency. Coinbase’s fees are not the most competitive on the market today, with market trader fees ranging from 0.05% to 0.60%, and pending order trader fees ranging from 0% to 0.40%. These fees are offset by the high level of security provided by Coinbase.

Gemini is a cryptocurrency trading and custody platform. It was founded by Cameron and Tyler Winklevoss, who are known for their early involvement in the development of Facebook. Launched in 2015, the exchange focuses on providing a secure and regulated platform for buying, selling, and storing various cryptocurrencies, including Bitcoin and Ethereum. Gemini's fees range from 0.00% to 0.25% for pending traders and from 0.03% to 0.35% for market traders. The more cryptocurrencies you trade, the lower the fees. Gemini is widely recognized for its compliance with regulatory compliance and security measures in the crypto industry.

Kraken is a cryptocurrency trading platform founded by Jesse Powell. Launched in 2011, it has become one of the largest and oldest cryptocurrency exchanges in the world. The platform is known for its advanced trading features, high liquidity, and strong focus on security. Founder and CEO Jesse Powell has played a key role in shaping Kraken into a reputable and historic exchange within the cryptocurrency industry. Kraken’s trading fees range between 0.16% and 0.26% for traders with a monthly trading volume of less than $50,000.

UpholdSecondly ranked as the second largest cryptocurrency exchange in the United States location, showcasing trading and staking services for over 260 digital assets. Under the supervision of FiNCEN, the platform adheres to strict regulations and provides a regulated trading environment for US users. Standout features of the platform include user-friendly marking services and the opportunity for investors to earn up to 21% APR on selected cryptocurrencies.

Uphold’s reputation in the U.S. market is bolstered by its unwavering commitment to transparency and security. Notably, it is one of the few exchanges to offer audited proof of reserves, assuring users of the safety of their funds and confirming that all assets are fully backed 1:1. This focus on clarity and reliability makes Uphold the trusted and relied upon choice in the U.S. cryptocurrency space.

eToro is the fourth largest multi-asset broker in the United States , providing a powerful platform for diversified financial investments. It has a massive portfolio of over 4,500 assets, including multiple cryptocurrencies like Bitcoin and Ethereum, as well as traditional investment options like stocks, commodities, and ETFs. These options cater to investors who want to diversify their portfolios in a single, secure environment, subject to strict regulatory compliance.

Regulatory compliance is a cornerstone of eToro’s operations in the United States. eToro also allows investing in crypto assets and crypto-related stocks, including Microstrategy and Coinbase, positioning it as a comprehensive platform for enthusiasts in the crypto and blockchain space. The focus on regulatory compliance ensures US traders have a safe and secure experience.

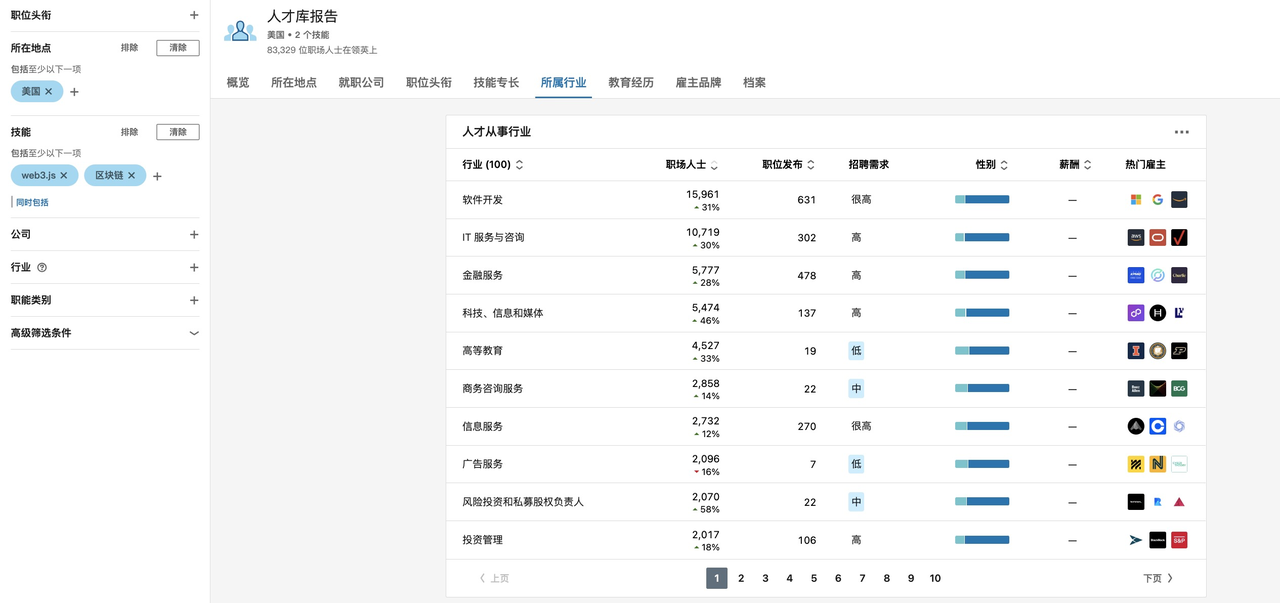

LinkedIn data: There are approximately more than 83,000 encryption practitioners in the United States, mainly located in New York, San Francisco and Los Angeles. , and the overall number of employees is on an upward trend, with Los Angeles having the highest growth rate, reaching 35%.

Among U.S. practitioners, approximately 50% are engaged in technology-related work such as software development and IT services, and approximately 12% are engaged in financial services-related work. You can see It turns out that the encryption industry in the United States is more technology-driven and product-driven, but financial services are strong businesses.

Ethereum was launched by Vitalik Buterin in 2013, Gavin Wood, Charles Hoskinson , Anthony Di Iorio and Joseph Lubin participated in the founding, raised funds through crowdfunding, and was officially launched on July 30, 2015.

Ethereum is a decentralized blockchain platform that establishes a peer-to-peer network for secure execution and verification of application code (smart contracts). Smart contracts allow participants to conduct transactions without a trusted central authority.

Ethereum is best known for its cryptocurrency Ether (ETH), which runs on a blockchain-based platform. The underlying blockchain technology ensures the secure creation and maintenance of public digital ledgers. While Bitcoin and Ethereum have similarities, they differ in their long-term vision and limitations. In September 2022, Ethereum transitioned from a proof-of-work mechanism to a proof-of-stake mechanism. Ethereum provides the foundation for many emerging technological advancements based on blockchain.

Uniswap is a decentralized finance (DeFi) protocol running on Ethereum and other blockchains, and is also the largest decentralized exchange platform (DEX). It allows users to exchange different cryptocurrencies without the need for middlemen.

In Uniswap, anyone can create a liquidity pool or add tokens to an existing pool to provide other users with liquidity for token exchange. Users earn trading fees as rewards by contributing funds to these pools. This approach lowers the barriers to transaction and provides fuel for the growth of the decentralized finance ecosystem.

Uniswap also has its own native token called UNI, which is used to govern and incentivize protocol participants. UNI holders can vote to decide the future direction of the protocol, such as upgrades, fee structure adjustments, etc.

Polygon was founded in 2017 and was originally called Matic Network. It is the work of experienced Ethereum developers Jaynti Kanani, Sandeep Nailwal, Anurag Arjun and Mihailo Bjelic. Polygon is a set of protocol stacks designed to solve Ethereum’s scalability issues.

Polygon is an independent blockchain (sidechain) that runs parallel to the main Ethereum chain. These sidechains can process transactions and smart contracts and then transmit the final results back to the main chain. This approach significantly reduces the strain on the Ethereum network as it offloads most of the processing to sidechains, increasing overall efficiency and speed.

Its goal is to create a multi-chain ecosystem that is compatible with Ethereum and enables developers to easily create scalable and efficient decentralized applications (DApps). Polygon provides a variety of tools and services to support this ecosystem, including development frameworks, APIs, and software development kits (SDKs).

Filecoin is a decentralized storage network designed to allow users to store, retrieve and exchange data. It is built on blockchain technology, making data storage more transparent and reliable. In the Filecoin network, users pay Filecoin tokens to store their data, and storage providers (miners) are rewarded with tokens for storing this data. Filecoin can be seen as a financial layer of IPFS (InterPlanetary File System), which encourages more storage resources to join the network by providing an economic incentive.

IPFS is a distributed system for storing and sharing files, with the goal of creating a faster, more open, and more secure Internet. IPFS allows users to store files on multiple nodes on the network instead of a centralized server. This makes documents more durable and censorship-resistant. Filecoin and IPFS were both founded and released by Juan Benet and his laboratory team.

Tezos began in 2014, when co-founders Arthur Breitman and Kathleen Breitman launched the project with a group of core developers. The company is headquartered in Switzerland. Tezos’ ICO successfully raised $232 million in just 2 weeks, accepting donations in Bitcoin and Ethereum.

Tezos is a decentralized blockchain platform designed to provide a more secure, scalable and durable framework for building distributed applications and smart contracts. is a unique project in the cryptocurrency space, attracting attention primarily for its self-amending blockchain architecture, where stakeholders are responsible for managing upgrades to the core protocol, including to the revision process itself .

The Sandbox is the sequel to the 2D world-building mobile game "The Sandbox" developed by Sandbox in 2012. It is a virtual world based on blockchain that allows users to create, control and currency ize the experiences and assets they create in the game. Its goal is to create a player-driven platform where players can not only participate in the creation process of the game, but also receive real financial rewards for the content they create. This platform utilizes blockchain technology to ensure the transparency and security of asset ownership, providing users with an innovative and interactive virtual environment.

The Sandbox combines decentralized non-fungible tokens (NFTs) and its own cryptocurrency SAND as part of its economic system. Players can use the Voxel editor to create and edit assets. Such as game characters, props and land (called LAND). These assets can become NFTs and be traded within the game or through cryptocurrency markets. LAND is a virtual land in the game on which players can build games, experiences and social spaces.

Digital Currency Group (DCG) was established in 2015 and is led by Barry Silbert. It is a collection of venture capital organizations backed by major entities such as Mastercard, Bain Capital, Transamerica Ventures, CME Ventures, FirstMark Capital and New York Life. DCG plays a key role in promoting cryptocurrency adoption, emphasizing education and advocacy. Grayscale, a subsidiary of DCG, has been influential in introducing mainstream investors to digital assets through innovative products such as Bitcoin Investment Trusts and other cryptocurrency-focused investment products.

Digital Currency Group frequently works with co-investors such as Coinbase Ventures, Pantera Capital, Blockchain Capital, CoinFund and Andreessen Horowitz (a16z).

Its representative investments include: Coinbase, Kraken, Ledger, Etherscan, The Graph, Hubble, Nomics, eToro and Flare Network.

Andreessen Horowitz was founded in 2009 by Marc Andreessen and Ben Horowitz is an investment firm with $35 billion under management and operates in a variety of technology sectors including healthcare, consumer products, cryptocurrency, enterprise, fintech and gaming. Known for its stage-agnostic approach to investing, the firm values and respects entrepreneurs and leverages its deep experience in building companies. The team consists of former founders, CEOs, and CTOs with expertise in different technology areas.

Andreessen Horowitz (a16z)frequently works with co-investors such as Coinbase Ventures, Polychain Capital, Union Square Ventures, SV Angel and Paradigm.

Its representative investments include: Compound, dYdX, Uniswap, Forta and Arweave.

Binance Labs was founded in 2018 with the goal of cultivating and supporting promising blockchain projects that have the ability to redefine the future. The list of projects it supports spans exchanges, blockchain infrastructure, decentralized finance (DeFi) platforms and non-fungible tokens (NFTs), etc., playing a key role in promoting the expansion of different sectors in the cryptocurrency space. effect.

Binance Labs frequently works with co-investors such as Animoca Brands, HashKey Capital, Coinbase Ventures, Hashed Fund, and NGC Ventures.

Its representative investments include: Symbiosis Finance, Polygon, The Sandbox, Melos Studio, Axie Infinity and STEPN.

Coinbase ventures was established in 2018. It is the venture capital arm of the world-renowned exchange Coinbase. With its rich professional knowledge and extensive network, it is committed to supporting and investing in early-stage companies at the forefront. companies that are at the forefront of advancing blockchain technology and digital currencies.

Coinbase ventures often work with partner investors such as Pantera Capital, Polychain Capital, Andreessen Horowitz (a16z) and DragonFly Capital.

Its representative investments include: Compound, Polygon, Rocket Pool, Arweave, Diagonal Finance, Yoz Labs, Credora and Mysten Labs, etc.

Sequoia Capital, a leading venture capital firm, has been identifying and supporting breakthrough companies since its founding in 1972. The company’s significant investments in tech giants such as Apple, Google, WhatsApp, and Airbnb have allowed it to expand its focus on the crypto world. Back in the early 2010s, the company recognized the huge potential of blockchain technology and therefore positioned itself Play a key role in the growing cryptocurrency space across different industries.

Sequoia Capital - They often work with co-investors (crypto only) Andreessen Horowitz (a16z), Coinbase Ventures, Paradigm, Multicoin Capital, and Pantera Capital.

Its representative investments include: (encryption field): Block, Filecoin, Magic Eden and Handshake.

Paradigm is a well-known encryption venture capital firm that plays an important role in promoting innovation and change in the dynamic encryption field. It was founded in 2018 by a strong team of prominent crypto industry veterans, including Fred Ehrsam (co-founder of Coinbase), Matt Huang, and Charles Noyes.

Paradigm frequently works with co-investors such as Coinbase Ventures, Andreessen Horowitz (a16z), Sequoia Capital, Three Arrows Capital and Variant.

Its representative investments include: Uniswap, Cosmos, Yield, dYdX and Tezos.

Cryptocurrency has always been the focus of great attention from the U.S. federal and state governments, but the regulatory environment is currently unclear. , and is constantly evolving. Different federal agencies have taken different approaches to digital assets based on their assessment of the properties of cryptocurrencies. Lawmakers can have their say, and states can set their own rules. Many federal agencies and policymakers have praised blockchain and cryptocurrencies as important components of America’s future infrastructure and acknowledged the need for the United States to maintain a leading role in the development of blockchain and cryptocurrencies.

In the United States, cryptocurrency regulation involves a combination of federal oversight and state laws. Federal agencies such as the U.S. Securities and Exchange Commission (SEC), the U.S. Commodity Futures Trading Commission (CFTC), the U.S. Federal Trade Commission (FTC), the U.S. Internal Revenue Service (IRS), the U.S. Securities and Exchange Commission (OCC) and the U.S. Financial Crimes Enforcement Network (FinCEN) Institutions play an important role in overseeing different aspects of digital assets.

At the state level, the approach is also very different. Some states (Wyoming and Utah) have passed laws to promote and utilize blockchain technology to promote economic growth, including recognizing decentralized autonomous organizations (DAOs) and creating dedicated financial institutions for digital assets. Some states have increased regulatory requirements, such as mandating money transmitter licenses and strict compliance with securities laws, as evidenced by enforcement actions against major players in the blockchain industry.

In addition, the United States has successively introduced legislation such as the Responsible Financial Innovation Act and the Toomey Stablecoin Act to provide clarity and incorporate digital assets into the existing financial framework.

The regulatory environment in the United States continues to evolve, discussions regarding the need for clearer guidance and regulations are ongoing, and legal challenges and controversies remain, particularly regarding the classification of specific tokens and decentralization Regulatory aspects of financial (DeFi) platforms.

Securities and Exchange Commission (SEC)

SEC regulates digital assets that are considered securities Play an important role. Initial coin offerings (ICOs) and certain token offerings will be subject to SEC scrutiny. Compliance with securities laws is critical in projects involving token sales.

Commodity Futures Trading Commission (CFTC)

The CFTC regulates commodities and commodity futures, including Bitcoin and other cryptocurrencies. Bitcoin is considered a commodity, and the CFTC regulates derivatives of the cryptocurrency.

Financial Crimes Enforcement Agency (FinCEN)

FinCEN is part of the U.S. Department of the Treasury and focuses on combating money laundering and financial crime. Cryptocurrency exchanges and certain wallet providers are regulated by anti-money laundering (AML) regulations.

U.S. Internal Revenue Service (IRS)

The IRS treats cryptocurrencies as property for tax purposes. Transactions involving cryptocurrencies are subject to capital gains tax reporting requirements, and individuals must report cryptocurrency-related income.

State-Level Regulation

States take different approaches to cryptocurrency regulation. Some states have introduced specific laws, licenses, or regulatory frameworks for cryptocurrency businesses, while others have adopted a more general regulatory approach.

Bank Secrecy Act (BSA) Compliance

Cryptocurrency exchanges and certain wallet providers must comply with the Bank Secrecy Act, which includes implementing AML and Know Your Customer (KYC) procedures.

The IRS classifies cryptocurrencies as property for tax purposes. As detailed in IRS Notice 2014-21, this means gains from cryptocurrency transactions are subject to tax.

Taxpayers must report gains or losses from the sale or exchange of cryptocurrencies on their tax returns. The tax rate depends on the holding period of the asset. Cryptocurrency gains held for more than one year are subject to capital gains tax. Gains from cryptocurrencies held for less than a year are taxed as ordinary income.

The IRS requires detailed records of all cryptocurrency transactions for accurate tax filing. This includes recording the transaction date, amount, and the fair market value of the cryptocurrency at the time of each transaction. (The 2017 tax reform removed the option to treat the exchange of one cryptocurrency for another as a like-kind exchange, meaning these transactions are now taxable events)

As of January 2024 Starting today, under the Infrastructure Investment and Jobs Act, digital asset brokers must report transactions over $10,000 to the IRS. This reflects regulators’ growing focus on cryptocurrency trading and the importance of the U.S. cryptocurrency market complying with tax reporting requirements.

The free market economy of the United States provides an ideal environment for new technology start-ups, based on the pursuit of profit motives and high Risk tolerance: The United States has the largest economy in the world, technology giants such as Google, Apple, and Microsoft, and global financial centers such as Wall Street. As the global reserve currency, the U.S. dollar has given the U.S. government a strong international influence.

The growing popularity of blockchain technology across various industries is driving the growth of the market, which has led to increased investments in blockchain-related projects and startups, thereby driving the growth of the U.S. cryptocurrency market. The U.S. cryptocurrency market will grow at a compound annual growth rate of 12.0% from 2023 to 2030, reaching $2.9 billion by 2030, according to a new report from Grand View Research, Inc.

Cryptocurrency owners in the United States are widely distributed, but vary by state dynamics, regulations, and wealth levels. 70% of states define crypto assets within their regulatory framework. However, ambiguity remains, especially from the SEC, regarding the classification of digital assets as securities or commodities.

With the approval of BTC spot ETF (the U.S. Securities and Exchange Commission SEC announced that it approved the listing and trading of spot Bitcoin ETF through expedited mode on January 10, 2024, and authorized 11 ETFs to be launched in local time Listed and traded on January 11, 2024), ETH spot ETF is on the agenda, these are further promoting the adoption of cryptocurrency in the United States, and will promote the cryptocurrency market led by BTC and ETH to a wider range of retail investors, while promoting The rapid development and prosperity of the encryption ecosystem.

Honeypot Finance stood out and won the award at the ETH-Beijing hackathon with Batch-A2MM, and then quickly took root in Berachain's unique innovation soil.

JinseFinance

JinseFinanceHong Kong-based digital asset group HashKey's Singapore subsidiary, HashKey Capital Singapore, has secured a significant regulatory milestone, obtaining a full Capital Markets Services (CMS) licence from the Monetary Authority of Singapore (MAS). This licence empowers the firm to deliver regulated fund management services primarily concerning capital markets products within Singapore.

Joy

Joy Coinlive

Coinlive According to the Financial Times, the platform has chosen to shut down and repay investor funds.

Beincrypto

BeincryptoThis comes after the collapse of hedge fund Three Arrows Capital and crypto exchange FTX.

Beincrypto

BeincryptoThe venture firm, which was founded in 2021, is prioritizing decentralized social media, DAOs, DeFi, metaverse, zero-knowledge proofs and layer-1 solutions.

Cointelegraph

CointelegraphSince 2021, Play to Earn (P2E) games have boomed. Following the success of Axie, all kinds of P2E games have ...

Bitcoinist

BitcoinistThe proposal aimed to secure a two-year runway for LidoDAO to carry out its functions in the Lido Finance protocol without worrying about further fundraising.

Cointelegraph

CointelegraphFollowing the UST depeg, the crypto market started to crumble: crypto institutions crashed, exchanges suspended withdrawals, and lending protocols suffered ...

Bitcoinist

BitcoinistA Hacker Targets a Big Name in the DeFi Space, But He May Have Overreached As 'Arthur_0x' Warns, 'You Messed With the Wrong Man.'

Cointelegraph

Cointelegraph