The price keeps falling, and the industry is worried, but there is a group that may be more anxious.

As Bitcoin once fell to $54,000 (now recovered to $57,000), miners, who were already deeply trapped in the sharp drop in profits after the halving, have become more difficult to survive. According to survey agencies, if Bitcoin reaches 54,000, only ASIC mining machines with an efficiency of more than 23W/T can make a profit, and only 5 models of mining machines can support it.

But the culprit behind this decline is undoubtedly part of the miners. In order to cope with the cash flow problem after the halving, the selling of mining companies is still continuing. In just one June, 30,000 bitcoins from miners entered the market.

As BTC approaches the shutdown price, the surrender of miners has also come to an end, but the impact of halving and price changes on them is more far-reaching than imagined.

For the total amount of Bitcoin fixed at 21 million, the importance of miners as direct producers is self-evident. Before institutions poured into BTC, mining companies were the biggest voice controllers in the Bitcoin industry. The business philosophy of mining companies is also very simple. In addition to their own mining and mining machine sales, they provide hosting services for others. The corresponding costs are electricity prices, labor and storage maintenance costs. Since the costs are relatively controllable, the basic price for maintaining the operation of mining machines can be inferred, which is also called the shutdown price of mining machines. Of course, no matter what model, the higher the BTC premium, the higher the profit. Since 2011, the mining industry has made a group of people rich, and the long history of encryption has also left a bitter footnote for mining companies.

In addition to the growing energy costs, mining rewards are the indicators that miners care about most. In order to limit the mining speed and inflation of Bitcoin, the rewards miners receive through mining will be fixed at a block height, that is, every time the Bitcoin blockchain generates 210,000 blocks, the Bitcoin block reward will be halved. This process occurs approximately once every four years. In April of this year, Bitcoin has completed its fourth halving, with mining rewards falling from 6.25 BTC to 3.125.

Every few years, miners' profits will drop by half, and the resulting input-output ratio will drop rapidly. The mechanism forces the refinement, industrialization and scale of the mining industry. After all, the increase in computing power is more likely to obtain deterministic profits, which also makes mining a typical heavy asset industry. And due to the decline in profits, after the halving, the shutdown price will rise, and miners' capitulation will also occur. Simply put, miners' capitulation refers to some miners reducing operations or selling the mined BTC to make a living or hedge risks, which usually leads to a further decline in Bitcoin prices.

This situation undoubtedly also occurred after this year's halving. According to MacroMicro, the average cost of mining a single BTC soared to $83,668 in early June, and fell slightly to about $72,000 as of July 2. Costs have soared, but total miner revenue has plummeted from an average of $107 million per day before the halving to $30 million, reflecting the increased difficulty of mining operations.

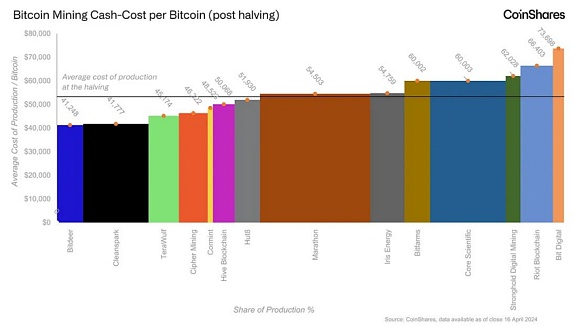

Data from James Butterfill, head of digital research at CoinShares, shows that during the April halving event, the price of Bitcoin hovered around the average production cost of miners. Among the 14 identified mining companies, half of the well-known mining companies, including Bit Digital and Riot Platforms, have overall production costs above average.

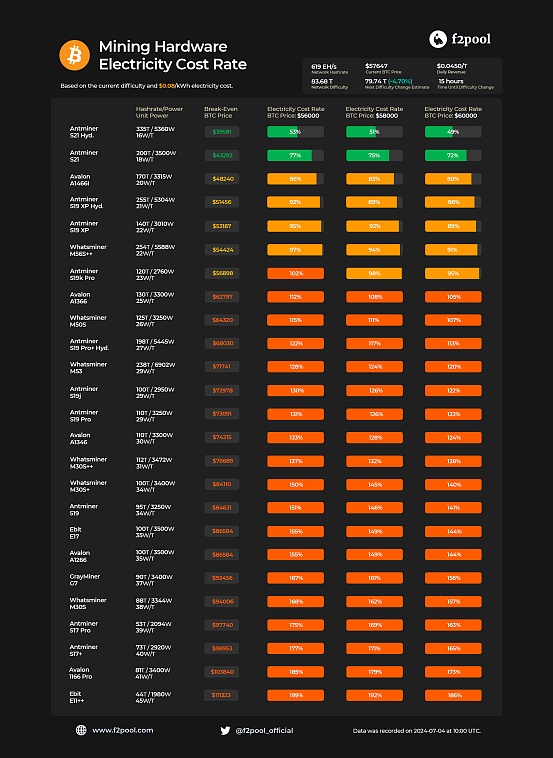

Bitcoin mining pool operator F2Pool also confirmed this conclusion. Based on the estimated energy cost of $0.07 per kilowatt-hour, when the BTC price is $54,000, only ASIC mining machines with a unit power of 26 W/T or less can achieve profitability. In terms of specific models, six Bitcoin mining machines including Antminer S21 Hydro, Antminer S21 and Avalon A1466I achieved Bitcoin break-even at $39,581, $43,292 and $48,240 respectively. Other models such as Antminer S19 XP Hydro, Antminer S19 XP and Whatsminer M56S++ can make a profit when the Bitcoin price exceeds $51,456, $53,187 and $54,424 respectively.

Break-even point of different models of mining machines at different energy prices, source: F2Pool

Against this background, with the ebb of inscriptions, mining companies naturally chose to sell off for survival, whether for cash flow reserves or industry migration and exit. Since June this year, crypto mining companies have sold more than $2 billion worth of Bitcoin, with a total of about 30,000 Bitcoins, and the number of Bitcoins held by miners has dropped to the lowest level in 14 years.

But fortunately, regardless of the good asset-liability ratio given to mining companies by the stress test of the previous bear market, from the market point of view, as the price of Bitcoin drops, small and medium-sized mining farms have also begun to gradually stop working, the difficulty of Bitcoin mining is rapidly decreasing, and the surrender of miners is about to end. On July 9, BTC.com data showed that the difficulty of Bitcoin mining was reduced by 5% to 79.5T, and the average hash rate of the entire network in the past seven days was 586.72EH/s. In line with this data, since May, the number of Bitcoins sent by miners to exchanges for sale has dropped significantly, and the volume of over-the-counter transactions has dropped significantly. Compared with the previous accumulation of selling pressure, the entire volume of mining companies' over-the-counter trading desks on June 29 has been exhausted.

In addition to the surrender after the halving, integration and mergers and acquisitions have also become the main trend of this round of mining cycle. Equipment upgrades to increase production capacity, develop low-cost energy areas, and merge mining pools all require a huge cash base. Therefore, for small mining companies with unoptimistic balance sheets, the best way is financing, or more directly - being acquired.

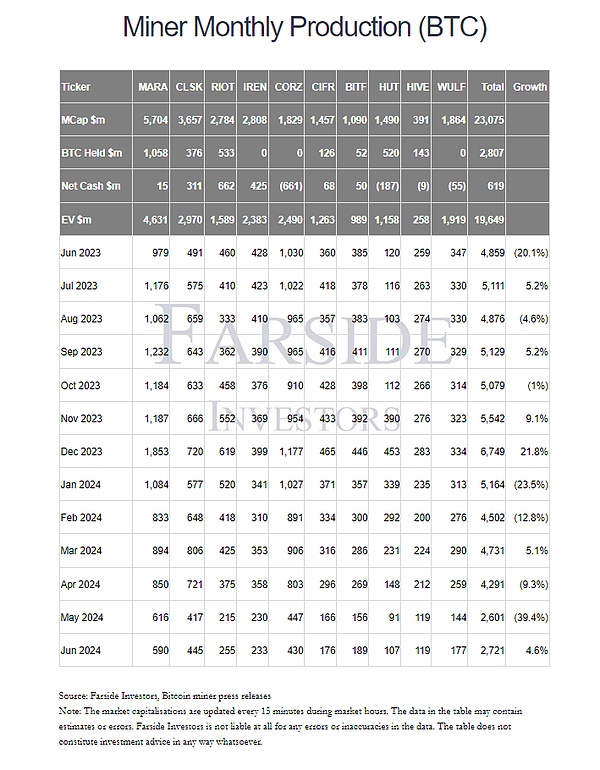

Mining company acquisitions are also a gathering of mining pools from a certain perspective, which has more practicality. As early as before the halving, 10 leading mining companies raised a total of US$2 billion in total proceeds through equity financing activities. Marathon Digital, CleanSpark and Riot Platforms were the companies that raised the most funds in the fourth quarter of 23, accounting for 73% of the funds raised. In April of this year, Bradford predicted that the mining industry would eventually be integrated into four core companies: CleanSpark, Marathon, Riot Platforms and Cipher Mining. It is worth mentioning that these mining companies are also the main force in selling BTC after the halving. Taking Marathon as an example, it sold more than 1,790 BTC in May and June.

Monthly BTC production of the top ten listed mining companies, source: Farside Investors

On the other hand, these four companies have lived up to expectations. In June, CleanSpark acquired micro-miner GRIID Infrastructure for $155 million, and is expected to increase its own power capacity by 400 megawatts. CleanSpark also acquired a total of 60 megawatts (MW) of Bitcoin mining farms in rural Georgia for $25.8 million.

Back in May, a more controversial acquisition was also taking place. Riot Platforms acquired 9.25% of Bitfarms' shares on May 28, becoming the company's largest shareholder. Finally, Riot purchased 1.5 million shares on June 5, raising its shareholding to about 12%. Due to high shareholder holdings and concerns about corporate governance, it requested to add independent directors to Bitfarms' board of directors. Subsequently, Bitfarms opposed it and even announced on June 10 that it had approved the adoption of a shareholder rights plan "poison pill" to prevent acquisitions by peers and competitors.

Cipher Mining purchased 16,700 mining machines as early as January this year, and installed the latest generation of mining machines Avalon A1466 at the Bear and Chief Mountain factories in Texas in the second quarter.

Other mining companies are also working hard to take various measures to improve the efficiency of mining machines and increase their own survival probability in adverse cycles. In the past six months, Iris Energy has reduced its average energy consumption by 15% to 25 J/TH, while TeraWulf's efficiency has increased by 11% to 24.6 J/TH. Core Scientific has also escaped bankruptcy marketing and currently leads with an efficiency of 24.23 J/TH.

But in any case, overall, the head-to-head trend of the mining industry is an inevitable trend. In addition to seeking regional differences or improving efficiency to obtain lower costs, small and medium-sized mining companies have weak competitiveness in the long run. It is normal for the gradual increase in shutdown prices to trigger a wave of withdrawal.

The industry is highly cyclical and the uncertainty of profitability has increased. Against this background, even the leading mining companies are overcoming difficulties through strategic diversification. Among them, it is inevitable that some companies plan to start a new business. The explosive new star AI has become a forced landing place for mining companies eager to transform.

Unlike previous cycles, the stock prices of the world's four largest mining companies have not outperformed the growth of Bitcoin this year, but the growth of medium-sized mining companies is quite obvious. The core reason is the integration of the AI wave. In recent months, many Bitcoin mining companies have begun to replace some mining equipment with equipment for running and training artificial intelligence systems.

It is well known that AI, especially the training of large models, is a high-computing and high-energy consumption scenario, but before the emergence of GPT, data center operators and mining companies were not friendly to this business, believing that the business efficiency was not high enough. But after the emergence of GPT, everything changed quietly. A clear data is that ChatGPT queries consume 10 times more energy than Google searches.

Based on this premise, AI companies began to seek warehouses with cheap energy and large computing power equipment. However, the approval of data centers is strictly regulated in all countries. Taking North America as an example, it may take several years from initial approval to completion of construction. There are very few sites with more than 100 megawatts of electricity and high-voltage substation transformers in place. A few years ago, 80% of data center loads were focused on only 6 to 7 markets. However, Bitcoin mining companies with cheap electricity, suitable physical space and computing power infrastructure naturally meet this demand.

Some mining companies have begun to enter this field by renting space equipment and self-operating computing power. Core Scientific, which had announced that it had entered bankruptcy proceedings, signed a 12-year cooperation agreement with artificial intelligence startup CoreWeave in June to provide more than 200 megawatts of GPUs. CEO Adam Sullivan said in an interview, "There are a lot of invitations from AI. AI companies are actively bidding and starting to subscribe to mining facilities at a higher market price than the crypto field. After announcing AI infrastructure transactions, top private equity firms are also increasing their financing and cooperation intentions."

A typical example of self-operation is Hut 8, which received a $150 million investment from Coatue this year. The purpose of financing is to build artificial intelligence infrastructure. It has previously purchased the first batch of 1,000 Nvidia GPUs and expanded the GPU as a service model. Bit Digital is not to be outdone, saying that it has reached an agreement with a customer to provide it with 2048 Nvidia GPUs within three years.

Of course, even the transformation to AI is not as easy as imagined. Not all mining farms can be converted into compliant data centers. More importantly, the cost of building or repurposing data clusters to accommodate AI computing is not cheap. The capital expenditure required for AI operations is about 20 times that of Bitcoin mining. Therefore, as long as the mining business is profitable, small and medium-sized mining companies will continue.

But the effect of transformation is significant. Taking the above-mentioned companies as an example, Core Scientific expects to increase its estimated cumulative revenue by $1.225 billion within the two-year contract timeline, while Hut 8's sales have already come from artificial intelligence, and Bit Digital's AI revenue has accounted for 27%. The stock price can also see the expected positive. Core Scientific's stock price has risen by 25.33% in the past month, Bit Digital has risen by 31.25%, and Hut 8 has soared by 67.41% in the month.

On the whole, whether it is active change or forced transformation, the defense battle of mining companies has just begun, and the acquisition wave is only in a very early stage. In the long run, given the cyclical nature of mining, diversification and transformation to broaden income sources are the only way for mining companies. In addition, regarding the price impact brought about by the halving, various signals indicate that capitulation has come to an end. The price of the relevant machine is strongly supported, and there is also ETF cooperation absorption. There is no need to worry about short-term adjustments. Obviously, the reason for the sharp decline is the limitation of market liquidity.

From the perspective of the industry, the mining industry, which once occupied the top, has gradually moved away from the power center of encryption. The richest group of people have also ushered in a survival transformation. Where will the layers of historical strokes eventually fall? The context of encryption will continue.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Finbold

Finbold Cointelegraph

Cointelegraph