As a decentralized computing system based on the Arweave platform, AO can support high-concurrency computing tasks and is particularly suitable for big data and AI applications. Due to the uniqueness of its narrative in the entire network, it has attracted the attention of many players. However, AO's highlight is not only its narrative, but also the following curious highlights, such as:

How does AO create a healthy chip distribution through a clever DeFi economic flywheel and bring about a money-making effect?

DAI mining revenue is more than twice that of stETH. How can users participate in cross-chain mining AO?

Win-win situation between the project party and the user, unique narrative of the entire network, and top-notch innovation in the DeFi track... How many outstanding performances does AO have that are worth noting?

In this article, Biteye will answer the above questions and deeply analyze the AO economic model, revealing the surprises of AO for you step by step!

AO Project Background Introduction

AO is a decentralized computing system based on the Arweave platform, which adopts the Actor-Oriented Paradigm and is designed to support high-concurrency computing tasks.

Its core goal is to provide trustless computing services, allowing an unlimited number of parallel processes to run, and having a high degree of modularity and verifiability. Combining storage and computing, AO provides a solution that is superior to traditional blockchains.

AO announced its token economic model on June 13, 2024, which is a fair issuance mechanism. The mechanism follows the "ancestral system", draws on the economic design of Bitcoin, and innovates the concept of liquidity incentives in DeFi.

Especially the innovation part is very clever, and the performance after the mainnet circulation is very worth looking forward to. It has a brilliant economic model, and its innovation is also one of the best in the DeFi world.

Token issuance rules

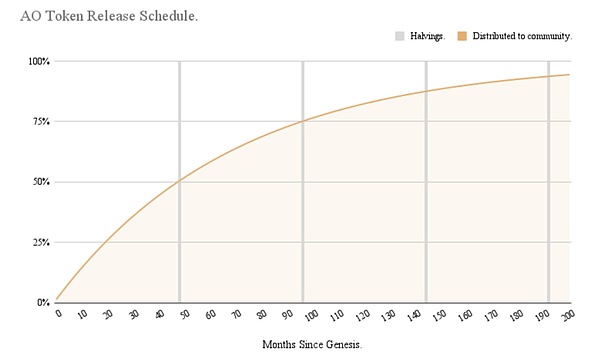

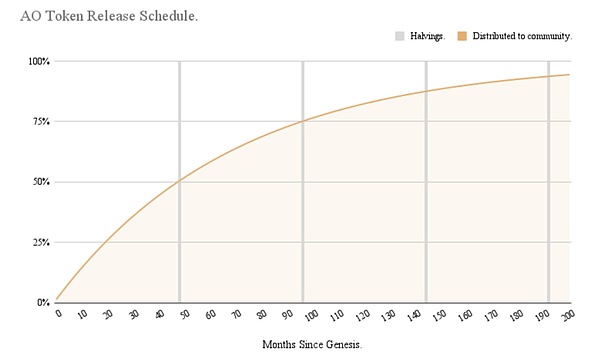

The total token supply of AO is set at 21 million, the same number as Bitcoin, highlighting the scarcity of AO.

The token issuance adopts a halving mechanism every four years, but a smoother issuance curve is achieved by distributing it every five minutes. The current monthly issuance rate is 1.425% of the remaining supply, and this rate will gradually decrease over time.

In the current bull market, VC coins are launched in large quantities. In the industry chaos, AO is very commendable. It adopts a 100% fair issuance model and abandons the common pre-sale or pre-allocation mechanism.

This decision is intended to ensure that all participants have equal access opportunities. There is no original intention of the decentralization and fairness principles pursued in the cryptocurrency field. The pattern is very large.

AO's token distribution rules can be divided into several key stages, each with its own unique characteristics and goals:

Initial stage (February 27 to June 17, 2024): In this stage, it can be understood as airdropping AO to AR holders. AO adopts a retroactive minting mechanism. Starting from February 27, 2024, all newly minted AO tokens are 100% discharged to AR token holders, providing additional incentives for early AR holders. During this stage, one AR can get 0.016 AO tokens as an incentive. If readers hold AR on exchanges or custodians during this period, they can consult about the collection of AO after AO is officially circulated on February 8 next year.

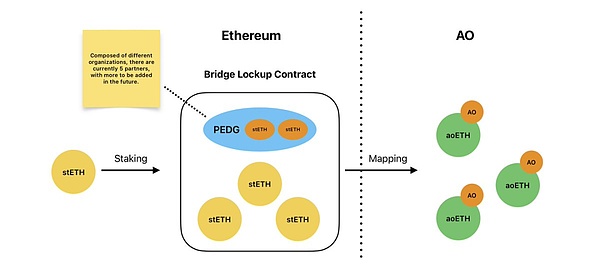

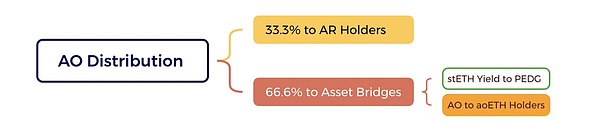

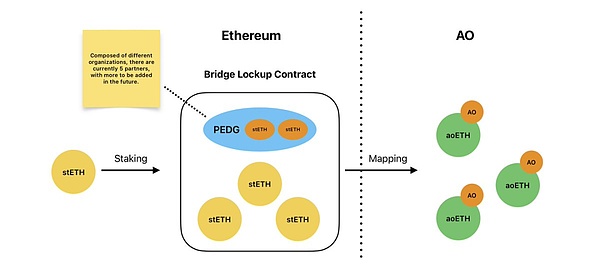

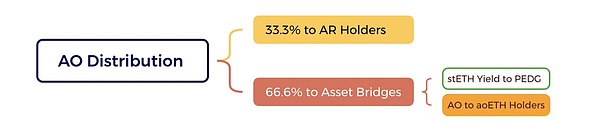

Transition phase (from June 18, 2024): Starting from June 18, AO introduced a cross-chain bridge. In this stage, newly minted AO tokens are divided into two parts: 33.3% continues to be distributed to AR token holders, while 66.6% is used to incentivize asset bridging to the AO ecosystem. Currently, users can participate in the token distribution of this stage by depositing stETH (more asset categories will be added in the future). This part is the highlight of participating in the AO ecosystem, which will be discussed below.

Maturity Phase (estimated around February 8, 2025): This phase marks the maturity of the AO token ecosystem. AO tokens will begin to circulate when approximately 15% of the total supply (approximately 3.15 million AO tokens) have been minted. This time point is set to ensure that the market has sufficient liquidity and participation before the token begins trading. During this phase, the allocation rules remain stable, continuing to follow the model of 33.3% to AR holders and 66.6% for bridging incentives.

In total, approximately 36% of AO tokens will be allocated to Arweave (AR) token holders during the entire emission process (100% before June 18 + 33.3% of the subsequent emission), which strengthens the close connection between AO and the Arweave ecosystem.

The remaining 64% is used to incentivize external income and asset bridging, aiming to promote economic growth and liquidity improvement in the ecosystem.

Economic Flywheel

AO's economic model also includes a very novel ecosystem funding allocation mechanism. Users will continue to receive AO token rewards by using the AO funding bridge to cross-chain qualified assets. It is equivalent to being a cross-chain, and you can continue to get DeFi income, which is very attractive to most people. And this funding bridge is the core of the AO economic flywheel, and it is also the source of project revenue under the fair issuance mechanism.

This is a very new way of playing, which is worth studying in detail. This section will clarify the principle for everyone.

We must first make it clear that there are two requirements for obtaining AO assets through cross-chain:

High-quality assets: These assets must have sufficient liquidity in the market. Usually refers to assets from large public chains. This requirement ensures that the assets that cross-chain to the AO network have wide market recognition and use value.

Have annualized returns: These assets must be tokens that can generate annualized returns. Currently stETH is a typical example. In the future, the team intends to introduce stSOL.

It is precisely the above two requirements that can ensure the fair issuance of AO and are the key to the sustainable development and profitability of the project party.

In simple terms, users pay the interest generated by these interest-bearing assets during the period of staying on the AO chain to the project party, and correspondingly, the project party casts AO for the user.

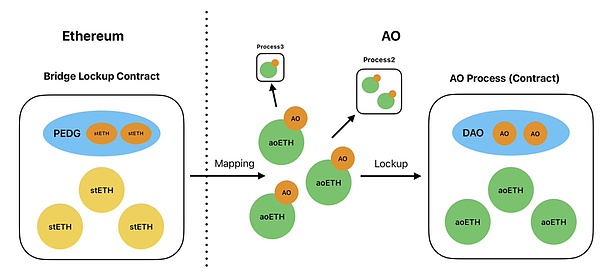

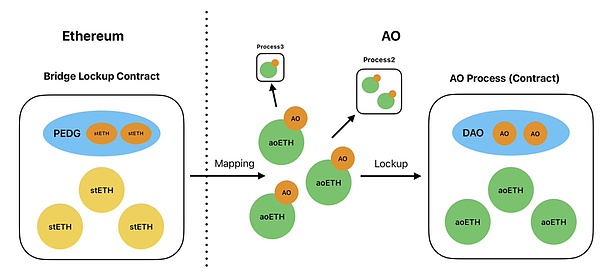

PEDG (Permaweb Ecological Development Guild) in the figure received all the interest on stETH.

Specifically, taking stETH as an example, if a user stakes 1 ETH in Lido, he will get 1 stETH. A key feature of stETH is that its balance will automatically increase over time, and the amount of increase depends on the income generated by the staked ETH. Correspondingly, stETH can also be redeemed for ETH at a 1:1 ratio, or traded back to ETH at a price close to 1:1 through the secondary market.

According to the annualized rate of return of 2.97%, after one year, if this 1 stETH is left on the Ethereum mainnet without any operation, the balance will increase to about 1.0297 stETH, and it can be exchanged back to 1.0297 ETH.

However, when this 1 stETH is cross-chained through the AO asset bridge, the cross-chain bridge contract of the Ethereum mainnet will receive 1 stETH, and the user's AO chain address will receive 1 aoETH. It should be noted that aoETH does not increase its balance over time like stETH.

After one year, since the amount of aoETH itself does not automatically increase over time, the amount of stETH in the Ethereum mainnet cross-chain bridge contract will be more than the total amount of aoETH on AO by one year's interest. Therefore, even if all aoETH on the AO mainnet is transferred back to the Ethereum mainnet (in extreme cases), the stETH in the mainnet contract will still have a surplus, which is the project's income.

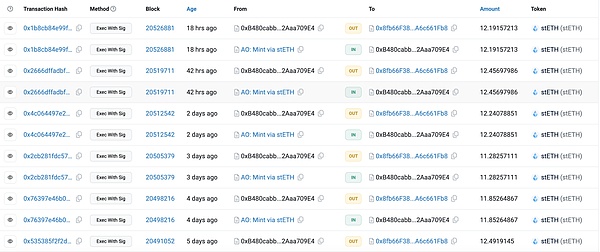

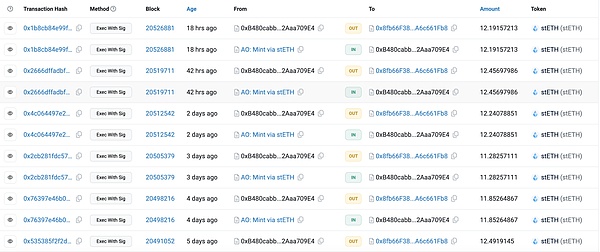

Currently, 151,570 stETH have been deposited in AO's cross-chain bridge. According to on-chain observations, the project uses bots to collect crops regularly every day, with a daily income of about 12 stETH.

This will be a win-win deal, which not only realizes the fair issuance of AO, but also makes the project party profitable without the ugly appearance of high FDV and low circulation VC coins.

According to the 3% stETH interest rate level, the team will profit from the interest generated by all stETH, about 4,500 ETH, and more than 50 million DAI deposited in DSR at 6% interest, totaling about more than 10 million US dollars in income.

This is undoubtedly a very excellent fair distribution mechanism, which is worth learning from subsequent projects.

And the design of the AO economic flywheel is not only that.

In fact, aoETH, whose balance will not increase automatically, is not a supporting role. It is also an indispensable protagonist in the economic flywheel.

You should know that aoETH holders will receive the minted AO, so it is also an interest-bearing asset, and its price is 1:1ETH. In this way, aoETH not only has the advantages of liquidity and price stability of mainstream currencies, but also can generate interest from AO, which many people are optimistic about.

The context of income attribution

Such a high-quality interest-bearing asset naturally requires new gameplay.

The AO network proposes an innovative "developer minting" model, which subverts the traditional project financing and distribution methods. This model not only provides developers with a new source of funds, but also creates a low-risk investment path for investors, while promoting the healthy development of the entire ecosystem.

When developers create DeFi projects on the AO network, they need to lock AO native tokens and cross-chain assets to provide liquidity.

At this time, cross-chain assets such as aoETH become the preferred liquidity targets. Users lock aoETH in the developer's smart contract, which not only increases the total locked value (TVL) of the application, but more importantly, the AO tokens minted by these locked aoETH will be transferred to the developer's contract.

This realizes "developer minting" and provides developers with continuous financial support. It is not difficult to imagine that after stSOL is opened in the future to be eligible to mint AO, AO's DeFi prospects will be brighter.

Because of this, the project party will no longer be too dependent on VC funds, and the chip allocation will be healthier. As the project develops, the locked aoETH increases, and the AO tokens obtained by developers will also increase.

This will create a virtuous circle: high-quality projects attract more funds, and then obtain more resources to improve products, and ultimately promote the development of the entire ecosystem. Thanks to this, the ecology of the entire AO chain will be healthier than the ecology of the chain, and then there will be a money-making effect.

This innovative model not only simplifies the traditional investment process, but also allows the market to determine the flow of funds more directly. Truly valuable applications will naturally attract more aoETH locks, thereby obtaining more AO token support.

This mechanism effectively combines the interests of developers with the development of the ecosystem, motivating them to continuously create valuable applications.

This is undoubtedly a win-win situation. From the perspective of investors, using the annualized income of their holdings (rather than the principal) to support the project greatly reduces the risk, which will increase the investment of investors.

And developers can focus on product development instead of spending a lot of time and energy on financing and chip allocation.

Participation Opportunities

Currently, cross-chain mining through the AO official bridge is the most stable way to obtain AO.

On September 5, DAI officially became the second asset that can mine AO after stETH.

The following will analyze how different risk preferences can participate in cross-chain mining AO from the perspective of cost-effectiveness and security.

Cost-effectiveness

AO has not yet been circulated and has no price, so it is impossible to calculate apr. It is still in the "blind mining" stage. Generally speaking, "blind mining" is more attractive than deterministic DeFi.

Assuming that 1,000 US dollars of stETH and DAI are used to cross-chain mine AO, we compare the cost-effectiveness of the two by predicting the number of AOs that will be obtained in the end.

The result is very unexpected!

September 8, DAI mining AO income forecast table

September 23, DAI mining AO income forecast table

Through September 8 and September 23, we have a jaw-dropping discovery:

September 8 DAI On the third day of mining, which is still in the early stages, the mining income of DAI and other amounts is 10.53579/4.43943=2.373 times that of stETH. As a legit project, the income of stablecoins is not less than that of risky assets, but also multiples, which is very rare in the DeFi market in the past few years.

At that time, the author also noticed this phenomenon. There are two considerations. First, it is too early and the market has not reacted yet. Second, there are implicit risks.

Now, DAI has been mining for nearly 20 days. Logically, the market has almost digested it, but the income of DAI and stETH is still 8.17534/3.33439=2.452 times, which is higher than September 8. Unbelievable!

Excluding the market reaction speed factor, there is only one consideration -

Risk

According to the attributes of financial assets, the risk brought by stETH price fluctuations should be much higher than DAI. Even if you are a complete believer in ETH and firmly hold ETH, you can mortgage ETH and lend DAI for arbitrage, at least to equalize the interest rate difference between the two. But the market did not do so. It is very unreasonable.

Excluding financial risks, there is another one, which is contractual risk.

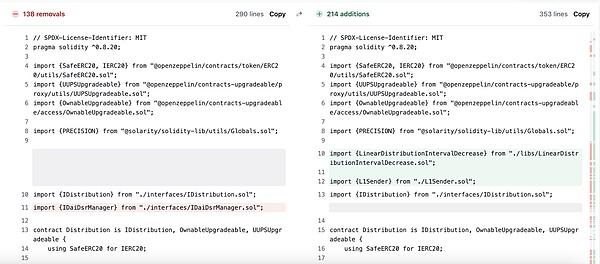

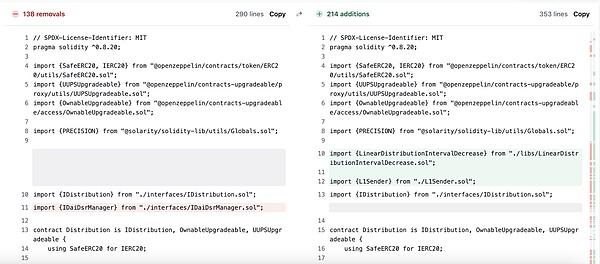

As mentioned above, AO's stETH mining has undergone a complex and sophisticated design, and the team can get all the benefits of stETH. Complex contracts bring risks, but fortunately, the core code of stETH's mining contract uses the code of the MorpheusAIs project Distribution.sol, which has been tested by time. It is relatively safe.

The DAI mining contract is a modification of the AO team based on Distribution.sol, which realizes the deposit of DAI into DSR, which is several orders of magnitude more complicated than the function of collecting stETH.

DAI mining contract comparisonMorpheusAIs contract

Therefore, from the perspective of the contract, stETH's mining contract is much safer than DAI, but this does not fully explain why DAI is more than twice as cost-effective as stETH. This remains to be discussed. (An advertisement, everyone is welcome to join the group discussion!)

Summary

In general, AO is very exciting from the perspective of fair issuance to the "developer coin minting" model: there is no VC dumping, and the clever design from the perspective of DeFi represents a brand new project form to a certain extent.

In terms of participation, Web3 must experience new things. But when faced with incomprehensible situations (DAI's excess returns), we must be cautious and respect the market's choices.

Anais

Anais