Author: Chris Powers, Founder of Does of DeFi, Translated by: Golden Finance xiaozou

The core base layer has shown a good degree of unbundling. Ethereum once had a single solution for execution, settlement, and data availability, but has now switched to a more modular approach, providing specialized solutions for each core element of the blockchain.

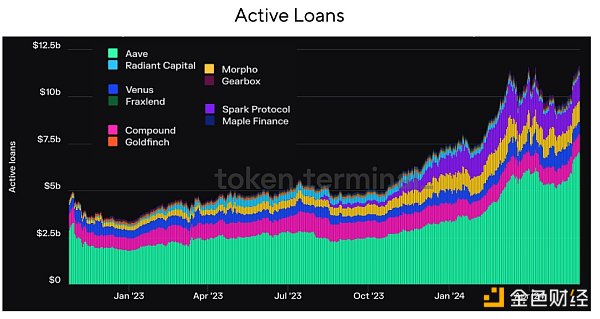

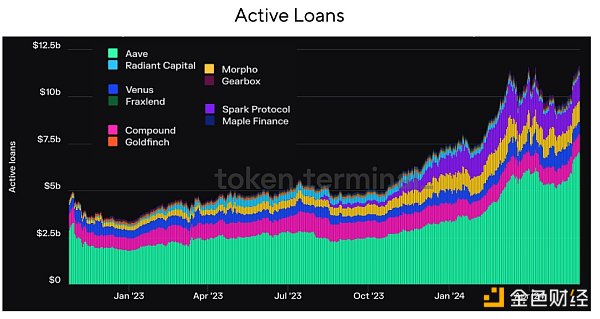

The same pattern is playing out in the DeFi lending space. The first to succeed are those products that can do everything themselves. While the original three DeFi lending platforms—MakerDAO, Aave, and Compound—have a lot of excellence, they all operate within a predefined structure set up by their respective core teams. However, today's growth in DeFi lending comes from a new group of projects that further split the core functions of the lending protocol.

These projects are creating independent markets that focus on minimizing governance, separating risk management, freeing up oracle responsibilities, and removing other single dependencies. Others are developing easy-to-use bundles that combine multiple DeFi “Legos” together to offer more comprehensive lending products.

This new push to unbundle DeFi lending is called “modular lending.” At Dose of DeFi, we’re big fans of memes, but have also seen new projects (and their investors) try to hype new narratives in the market, more for their own pocketbooks than for some underlying innovation.

We think: the hype is real. DeFi lending will go through a similar metamorphosis as the core base layer — new modular protocols emerge (like Celestia) and incumbents change their original roadmaps to move in a more modular direction — just as Ethereum did as it continued to unbundle itself.

In the short term, major competitors are carving out different tracks. Morpho, Euler, Ajna, Credit Guild, and others are pinning their hopes for success on new modular lending projects, while MakerDAO is moving to a less centralized SubDAO model. The recently announced Aave v4 is also moving in the direction of modularity, reflecting the shift in Ethereum's architecture. These current development paths are likely to determine where value accumulation occurs in DeFi lending in the long run.

1. Why modularization?

There are generally two approaches to building complex systems. One approach focuses on the end user experience and ensuring that complexity does not compromise usability. This means controlling the entire stack (as Apple does with hardware and software integration).

The other approach focuses on enabling parties to build parts of the system. In this way, the designers of the complex system focus on creating core standards for interoperability while relying on the market to innovate. The core Internet protocols have not changed, and it is the applications and businesses built on top of TCP/IP that drive innovation on the Internet.

This analogy also applies to economic development, where government is seen as a foundational layer built on top of TCP/IP, ensuring interoperability through the rule of law and social cohesion, and economic development then occurs in the private sector built on top of the management layer. Neither approach will always work, and many companies, protocols, and economies operate as a trade-off between the two approaches.

2. Key components

Proponents of the modular lending theory believe that DeFi innovation will be driven by the specialization of each lending component, rather than just focusing on the end-user experience.

A key reason for this idea is the desire to eliminate single dependencies. Lending protocols require close monitoring of risks, and a small problem can lead to catastrophic losses, so establishing a redundant mechanism is key. Monolithic lending protocols introduce multiple oracles in case a problem occurs with one oracle, but modular lending takes this hedging approach and applies it to every layer in the lending structure.

For every DeFi loan, we can identify five key components - all of which are modifiable:

undefined Loan Asset

undefined Collateral Asset

undefined Oracle

undefined Maximum Loan-to-Value (LTV)

undefined Interest Rate Model

These components must be closely monitored to ensure the platform’s solvency and prevent bad debts from rapidly volatile prices (we can also add a liquidation system to the above five).

For Aave, Maker, and Compound, token governance makes decisions for all assets and users. Initially, all assets were pooled together and shared the risk of the entire system. However, even single lending protocols have quickly shifted to creating independent markets for each asset to differentiate risks.

3. Major Modular Competitors

Independent markets are not the only way to make lending protocols more modular. The real innovation is happening in new protocols that redefine the necessary conditions for lending.

The biggest competitors in the modular field are Morpho, Euler, and Gearbox.

undefined Morpho

Currently, Morpho is the clear leader in the modular lending space, although recently Morpho seems to be getting a little uncomfortable with the meme, trying to transform into "neither modular nor monolithic, but aggregated". With $1.8 billion in TVL, it can be said that Morpho is already at the forefront of the entire DeFi lending industry, but it aims to become the biggest giant. Morpho Blue is its main lending stack, based on which it can create a vault without permission, adjusted to any parameters it wants. Governance only supports the modifiable parts - there are currently five different components - not that these components should be like this. This is configured by the vault owner (usually a DeFi risk manager). Another major layer of Morpho is MetaMorpho, which attempts to be an aggregated liquidity layer for passive lenders. MetaMorpho pays special attention to the end-user experience. This is similar to Uniswap having a DEX on Ethereum, or Uniswap X for efficient trading paths.

undefined Euler

Euler launched its v1 version in 2022, generating more than $200 million in open interest before being hacked and draining almost all of the protocol funds (which were later returned). Now, it is preparing to launch its v2 version and re-enter the mature modular lending ecosystem as a major competitor. Euler v2 has two key components. One is the Euler Vault Kit (EVK), a framework for creating ERC4626-compatible vaults with additional lending functions, enabling these vaults to play the role of passive lending pools, and the other is the Ethereum Vault Connector (EVC), an EVM primitive that mainly supports multi-vault collateralization, that is, multiple vaults can use the collateral provided by a vault. V2 is scheduled to be released in the second or third quarter of this year.

undefined Gearbox

Gearbox offers a more user-centric framework, where users can easily set up their own positions without much oversight, regardless of their skill/knowledge level. Gearbox's main innovation is a "credit account" that acts as a list of non-prohibited actions and whitelisted assets, denominated in borrowed assets. It is basically an independent lending pool, similar to the Euler vault, except that Gearbox's credit account holds both user collateral and borrowed funds. Like MetaMorpho, Gearbox also proves that modular worlds can have a dedicated packaging layer for end-user packaging.

4. Unbundling, then re-bundling

Specialization of some lending components provides opportunities to build alternative systems that may target specific niche markets or bet on future growth drivers. Here are some of the main promoters of this approach:

undefined Credit Guild

Credit Guild wants to catch up with the established aggregator lending market with a trust-minimized governance model. Existing competitors (such as Aave) have very strict governance specifications, which often lead to small token holders losing interest because their votes seem to have little impact. Therefore, the honest minority who control the majority of tokens are responsible for most changes. Credit Guild reverses this dynamic by introducing a veto-based optimistic governance framework that provides for different quorum thresholds and delays for different parameter changes, while integrating a risk-chasing approach to deal with unforeseen consequences.

undefined Starport

Starport's ambition is to bet on the cross-chain theory. It implements a very basic framework for combining different types of EVM-compatible lending protocols. It is designed to handle data availability and enforcement of the terms of the protocol through two core components:

Component 1: Starport Contract. The Starport contract is responsible for loan origination (term definition) and refinancing (term renewal). It stores this data for protocols built on top of the Starport kernel and provides this data when needed.

Component 2: Escrow Contract. The escrow contract mainly holds the collateral of the original protocol borrowers on Starport and ensures that the debt settlement and repayment are carried out according to the terms defined by the original protocol and stored in the Starport contract.

undefined Ajna

Ajna has a truly permissionless and oracle-free aggregated lending model without any level of governance. The capital pool is set up with unique quote/collateral asset trading pairs provided by lenders/borrowers, allowing users to evaluate the demand for any asset and allocate funds accordingly. Ajna’s oracle-free design stems from lenders being able to specify the price they are willing to lend, by specifying the amount of collateral that borrowers should pledge for each quoted token (and vice versa). It is particularly attractive to the long tail of assets (much like Uniswap v2 did for small tokens). 5. If you can’t beat them, join them The lending space has attracted a large number of new entrants, which has also revitalized the largest DeFi protocols, which have launched new lending products: undefined Aave v4 Released last month, Aave v4 is very similar to Euler v2. Previously, Aave enthusiast Marc “Chainsaw” Zeller said that Aave v3 will be the end state of Aave due to its modular nature. Its soft liquidation mechanism was pioneered by Llammalend, and its unified liquidity layer is also similar to Euler v2’s EVC. Most of the upcoming upgrades are not new and have not been tested at scale in highly liquid protocols (Aave has done this). It’s crazy that we’ve managed to gain market share on every chain. Its moat may be shallow, but it’s wide and has a very strong tailwind.

undefined Curve

Curve (also known informally as Llammalend) is a series of independent one-way (non-borrowable collateral) lending markets where Curve’s native stablecoin crvUSD (minted) is used as collateral or debt assets. This allows it to combine Curve’s expertise in AMM design to provide unique lending market opportunities. In the DeFi space, Curve’s approach has always been unconventional, but it works for them. As a result, Curve has carved out a significant niche in the DEX market, in addition to the giant Uniswap, and with the success of the veCRV model, everyone is no longer sure about their doubts about token economics. Llamalend appears to be another chapter in the Curve story:

* Its most interesting feature is its risk management and liquidation logic, which is based on the Curve LLAMMA system and supports "soft liquidations".

* LLAMMA is deployed as a market-making contract that encourages arbitrage between isolated lending market assets and external markets.

* Like a pooled liquidity automated market maker (clAMM, i.e. Uniswap v3), LLAMMA evenly distributes borrowers' collateral across a range of user-specified price ranges, called bands, where quotes have large deviations from the oracle price to ensure that arbitrage behavior is incentivized.

* In this way, the system can automatically sell (soft liquidate) part of the collateral assets into crvUSD when the price of the collateral assets falls below the historical bands. This reduces the overall health of the loan, but is certainly better than an outright liquidation, especially given the clear support of long-tail assets.

Since 2019, Curve founder Michael Egorov has disagreed with outside criticism that they are over-engineering.

Both Curve and Aave are very focused on the growth of their respective stablecoins. This is a good long-term fee strategy. Both are following in the footsteps of MakerDAO, which did not give up DeFi lending and spun off Spark as an independent brand, which has had considerable success in the past year even without any native token incentives. But in the long run, stablecoins and crazy money printing capabilities (credit is addictive) are huge opportunities. However, unlike lending, stablecoins do require some kind of on-chain governance or off-chain centralized entities. For Curve and Aave, which have the oldest and most active token governance (certainly later than MakerDAO), this path is feasible.

The question we can't answer is what Compound is doing? It can be said that it was once a member of DeFi royalty, launched the DeFi summer, and truly established the yield farming meme. Clearly, regulatory concerns have limited the activity of its core team and investors, which is why its market share has declined. However, like Aave's wide and shallow moat, Compound still has $1 billion in outstanding loans and a wide distribution of governance. Just recently, someone outside the Compound Labs team picked up the baton to develop Compound. It's not clear which markets it should focus on - perhaps the large blue-chip market, especially if this can bring some regulatory advantages.

6. Value Capture

The original three DeFi lending companies (Maker, Aave, Compound) are all adjusting their development strategies to cope with the shift to a modular lending architecture. The crypto-collateralized lending business used to be a good business, but when your collateral is on-chain, your profit margins will be compressed as the market becomes more efficient.

This doesn't mean that there are no opportunities in an efficient market structure, just that no one can monopolize their positions and extract rents.

The new modular market structure provides more permissionless access to value for risk managers and venture capitalists alike. This provides a more risk-sharing approach to risk management and directly leads to better opportunities for end users, as financial losses will cause great damage to the reputation of the vault manager.

A good example of this is the recent Gaunlet-Morpho farce during the ezETH decoupling event.

Gauntlet is an established risk management company that operated an ezETH vault that suffered losses during the decoupling. However, because the risk was highly targeted and an isolated incident, other metamorpho vault users were mostly unaffected, and Gauntlet had to provide a post-mortem and take responsibility.

Gauntlet initially launched the vault because they felt that Morpho had a brighter future, where it could charge fees directly, rather than providing risk management consulting services to Aave governance (the latter of which tends to focus more on political factors than risk analysis).

Just this week, Morpho founder Paul Frambot revealed that a smaller risk management company, Re7Capital, has an annualized on-chain income of $500,000 as the manager of the Morpho vault. It is worth noting that Re7Capital also has a great research brief. Although small in scale, it does a good job of showing how to create financial companies based on DeFi (not just degen yield farming). This does raise some long-term regulatory issues, but this is not surprising in the crypto industry today. In addition, this does not prevent risk management companies from being at the top of the list of "biggest winners" in the future modular lending track.

JinseFinance

JinseFinance