Author: Peng Xingyun, Deputy Director of the National Financial and Development Laboratory

After the Central Political Bureau meeting held on December 9, 2024 proposed to implement a "moderately loose monetary policy", the Central Economic Work Conference held on December 11-12, 2024 once again emphasized the orientation of monetary policy. This is the first time in more than a decade that my country's statement on the orientation of monetary policy has shifted from "prudent monetary policy" to "moderately loose monetary policy", which has attracted great attention from the market. This article analyzes the orientation of moderately loose monetary policy, involving several important issues: Why should a moderately loose monetary policy be implemented? What policy measures may the central bank take? What impact may a moderately loose monetary policy bring?

Analysis of Monetary Policy - From "Steady" to "Moderately Loose"

01 Why to implement a moderately loose monetary policy

Maintaining currency stability and promoting economic growth is the statutory ultimate goal of my country's monetary policy. As an important tool and means of total demand management, monetary policy is to smooth out the cyclical fluctuations of the economy, and the monetary policy stance depends on the performance of the macroeconomy. When the economy is overheated and inflationary pressure is high, the central bank will adopt a tight monetary policy; on the contrary, when economic growth is weak and employment pressure is high, the central bank will adopt a relatively loose monetary policy. This is the basic principle of the central banks of various economies in monetary policy operations. The socialist market economy with Chinese characteristics is no exception when implementing monetary policy.

In the 24 years since the new millennium, except for the explicit proposal of "moderately loose monetary policy" in 2009 and 2010, China's monetary policy in other years has been defined as "prudent monetary policy". When China first proposed "active fiscal policy" and "prudent monetary policy", it coincided with the impact of the Asian financial crisis, and the government needed to take strong measures to stabilize the macro-economy. Therefore, "prudent monetary policy" actually refers to loose monetary policy. But after entering the new millennium, "prudent monetary policy" has actually become a basic principle of China's monetary policy operations, and it no longer corresponds to loose or contractionary monetary policy. In fact, in the "prudent monetary policy" that has been implemented since the new millennium, in some years, the central bank has been continuously raising the statutory deposit reserve ratio or the benchmark interest rate for deposits and loans, and in some years, it has continuously lowered the deposit reserve ratio and increased the central bank's re-lending to financial institutions. No matter which monetary policy operation direction the central bank adopts, it is all for the purpose of "maintaining a reasonable abundance of liquidity."

The Central Economic Work Conference clearly proposed "implementing a moderately loose monetary policy", conveying a clear monetary policy operation direction to the economic system, that is, through a more abundant liquidity supply, lowering market interest rates, boosting market confidence, and improving expectations. But this does not mean that China's monetary policy has abandoned the principle of "prudence", because "loose monetary policy" must be "moderate", not excessively loose or flooding, and still requires "the scale of social financing and the growth of money supply to match the expected targets of economic growth and the overall price level".

It should be noted that the Central Economic Work Conference proposed "implementing a moderately loose monetary policy", which is not a fundamental change in the monetary policy stance. In fact, in the past few years, the People's Bank of China has been adopting a relatively loose monetary policy to maintain a reasonable abundance of liquidity. First, since 2015, the central bank has lowered the statutory deposit reserve ratio more than 20 times. The statutory deposit reserve ratio of large commercial banks has dropped from the original high of 21.5% to the current 9.5%, and the deposit reserve ratio of small and medium-sized commercial banks has dropped from the original high of 19.5% to the current 6.5%. The reserve ratio has released more than 10 trillion yuan of previously frozen liquidity through the reduction of the reserve ratio alone. Secondly, the central bank provides liquidity to the market through various re-lending tools, which is reflected in the central bank's balance sheet. The central bank's claims on deposit-taking financial institutions have increased from less than 2.5 trillion yuan at the end of 2014 to more than 17.4 trillion yuan at the end of September 2024, an increase of nearly 15 trillion yuan in less than 10 years. Third, although the central bank has not adjusted the benchmark deposit and loan interest rates since 2015, it has directly driven the market interest rate down by continuously lowering the central bank's policy interest rate in monetary policy operations. For example, the loan market benchmark rate (LPR) has dropped from 5.76% in 2014 to the current 3.1%, and the weighted average interest rate of RMB loans of financial institutions has dropped from 6.96% at the end of June 2014 to the current 3.67%, a drop of more than 300 basis points; corresponding to the sharp drop in loan interest rates, the bond market interest rate has also ushered in the longest downward cycle since the reform and opening up, and the 10-year treasury bond yield has dropped from around 3.88% in early December 2017 to less than 1.8% at present. In short, the declining bond market yield reflects the fact that China's liquidity and monetary policy have been relatively loose.

So, when the monetary policy has already taken an easing stance, why should it be clearly stated that "a moderately loose monetary policy should be implemented"? Fundamentally speaking, this is a need of the macro economy. When diagnosing my country's macroeconomic situation, the Central Economic Work Conference pointed out that "my country's economic operation still faces many difficulties and challenges, mainly due to insufficient domestic demand, difficulties in production and operation of some enterprises, pressure on employment and income growth of the masses, and many risks and hidden dangers."

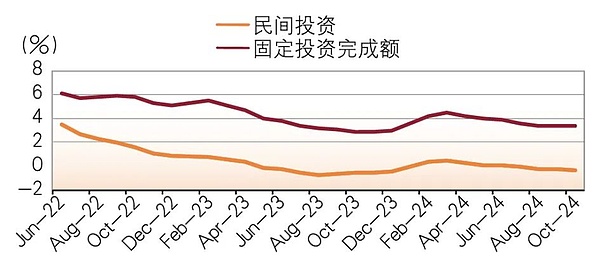

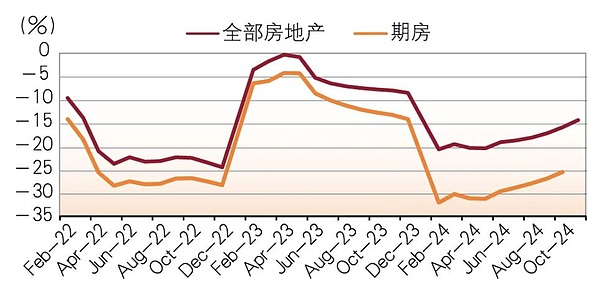

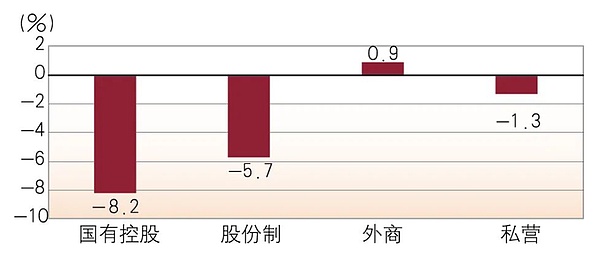

First, investment and consumption demand are weak.Fixed asset investment has been at a low level since the epidemic, and the growth rate of fixed asset investment has been below 5% since 2023. In particular, private fixed asset investment is extremely weak. Since December 2022, the growth rate of private fixed asset investment has been below 1%, and since May 2023, the growth rate of private fixed investment has been negative in most months (see Figure 1). Due to insufficient private investment demand, in order to stabilize growth and investment, it has to rely on government investment, which has increased the fiscal expenditure pressure of governments at all levels and increased the government's debt burden. Final consumption is also very weak. In the early stage after the end of the epidemic, although the total retail sales of consumer goods in China rebounded, it did not last long and showed a relatively weak trend. In December 2022, when the domestic epidemic control was relaxed, the growth rate of total retail sales of consumer goods was -0.2%. It rebounded to 9.3% in May 2023, and then turned to decline all the way, and fell below 4% after June 2024.

Figure 1 China's fixed asset investment completion and private investment growth rate

Source: According to Wind

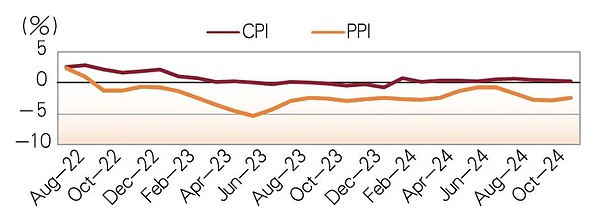

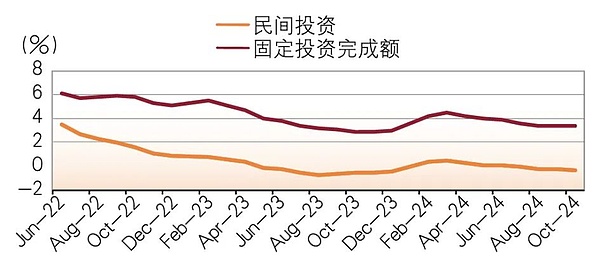

Secondly, prices are sluggish. Since October 2022, China's PPI has continued to grow negatively for 26 months, and the PPI in the last three months (September to November 2024) has been below -2.5%. Although CPI has performed slightly better than PPI, it has been hovering around 0 for 17 consecutive months, which is significantly lower than the 2% inflation target of major countries in the world (see Figure 2). Because of this, Pan Gongsheng, governor of the central bank, said in October 2024 that "promoting a reasonable recovery in prices will be an important consideration". As the price level continues to be sluggish, it has also created more flexible space for further implementation of a moderately loose monetary policy.

Figure 2 China's CPI and PPI

Source: According to Wind

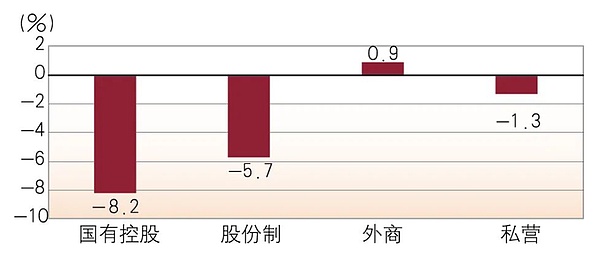

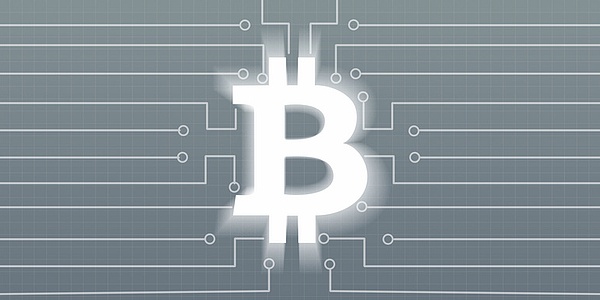

Third, the growth rate of corporate profits continued to decline. According to the data from the National Bureau of Statistics, from January to November 2024, except for the profits of foreign-invested enterprises and Hong Kong, Macao and Taiwan-invested enterprises, which barely maintained positive growth, the total profits of state-owned holding enterprises and joint-stock enterprises fell sharply, among which the profit growth rate of state-owned holding enterprises was -8.2%, and that of joint-stock enterprises was -5.2%. Although the decline in the profit growth rate of private enterprises was not as large as that of the former two, it was also -1.3%. Corresponding to the continuous decline in the profit growth rate of enterprises, the capacity utilization rate of industrial enterprises has also declined significantly (see Figure 3). The capacity utilization rate in the third quarter of 2024 was only 74.6%, which means that more than 25% of the capacity is idle. In fact, the Central Economic Work Conference in 2023 once pointed out that "some industries have overcapacity". The continued decline in profit growth rate and excessive idle capacity will inevitably have a further adverse impact on the confidence of enterprises, which is one of the important factors for the weak private investment.

Figure 3 Profit growth rate of industrial enterprises of different ownership from January to November 2024

Source: National Bureau of Statistics

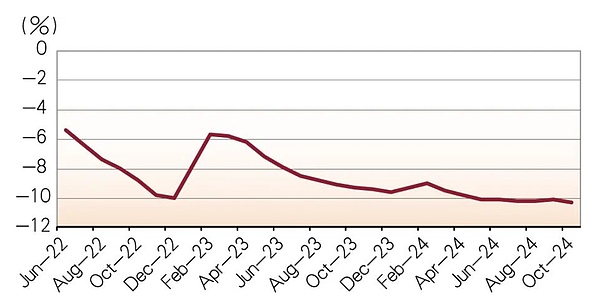

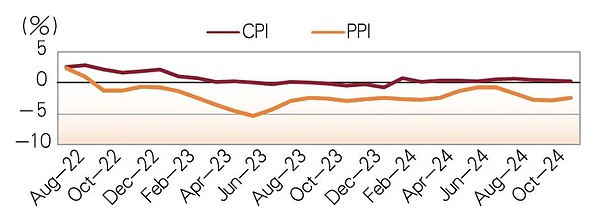

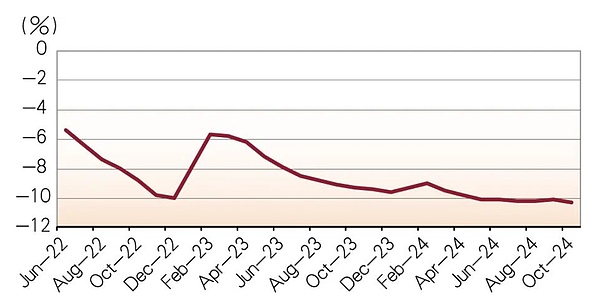

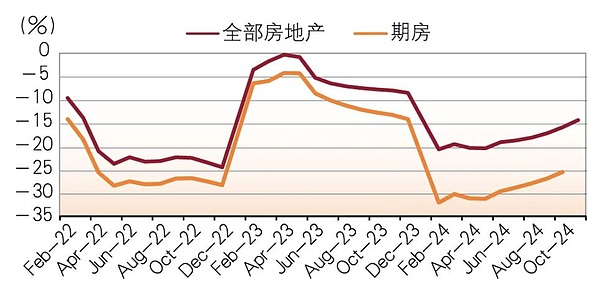

Fourth, the real estate industry is still in deep adjustment. In the past few years, although the government has introduced a number of policies to support the development of the real estate industry, the decline of the real estate industry has not been fundamentally reversed, and the real estate industry is still in deep adjustment. From April 2022 to November 2024, China's real estate development investment has been in negative growth for 30 consecutive months, and the negative growth trend has not only not converged, but has slightly worsened. From May to November 2024, the growth rate of completed real estate development investment exceeded -10%, and from September 2023 to April 2024, it was between -9% and -9.8% (see Figure 4). The decline in real estate construction area and real estate sales area was greater than the decline in the growth of completed real estate development investment. Since 2024, the growth rate of real estate construction area has been below -10%, and the decline in sales area growth rate has narrowed, but it is still in the range of -15% to -20%. In particular, the growth rate of real estate pre-sale area is in the range of -25% to -32%, which puts real estate developers under great pressure on capital turnover (see Figure 5).

Figure 4 China's real estate development investment growth rate

Source: According to Wind

Figure 5 China's real estate sales area growth rate

Source: According to Wind

Fifth, young people are under great employment pressure. Although the statistical urban unemployment rate has remained stable overall and has not increased significantly, a large number of rural migrant workers who were originally concentrated in industries such as construction and real estate have had to return to their hometowns due to adjustments in the real estate industry, which has reduced the statistical unemployment rate. In June 2022, the unemployment rate for young people aged 16-24 was 16.7%, and at the end of March 2023, the youth unemployment rate reached 19.6%. According to the press spokesperson of the National Bureau of Statistics' answer to reporters' questions about the operation of the national economy in the first half of 2023, the youth unemployment rate at the end of June 2023 further rose to 21.3%. The Bureau of Statistics no longer publishes data on youth unemployment rates, but with investment and capacity utilization rates declining, at least one thing can be roughly judged - the youth unemployment rate has not been fundamentally reversed. This is exactly what the Central Economic Work Conference pointed out that "the masses are facing pressure to increase employment and income."

02 Possible measures for the central bank to implement moderately loose monetary policy

The Central Economic Work Conference pointed out: "Give full play to the dual functions of monetary policy tools in terms of both total volume and structure, and reduce the reserve requirement ratio and interest rates at an appropriate time...Explore and expand the central bank's macro-prudential and financial stability functions, innovate financial tools, and maintain financial market stability." This points out the general operation mode of moderately loose monetary policy.

First, continue to reduce the statutory reserve ratio. Although the central bank has reduced the statutory reserve ratio for more than 20 times, there is still a lot of room for reduction. In fact, the central banks of many developed economies in the world have abolished the statutory reserve system. Even in countries that still retain the statutory reserve system, their statutory reserve ratios are very low. There are many reasons for this. For example, the capital adequacy supervision implemented for all commercial banks has imposed constraints on the credit of commercial banks. Even in the absence of a statutory deposit reserve ratio, commercial banks cannot expand credit indefinitely. In addition, multiple crises have also shown that the statutory deposit reserve ratio is difficult to ensure that commercial banks in liquidity difficulties can obtain sufficient liquidity and means of repayment in a timely manner. In the end, they have to rely on the central bank's lender of last resort mechanism for assistance. At present, the statutory deposit reserve ratio of China's large commercial banks is 9.5%, and that of small and medium-sized commercial banks is 6.5%. In the future, commercial banks as a whole will have at least 4.5 percentage points of room for reduction in the reserve ratio. This is because the deposit money absorbed and the total amount of credit provided by my country's large commercial banks account for the vast majority of the proportion.

Secondly, the total amount of central bank loans and structural tools are carried out simultaneously. Between the expansion of the total amount of central bank loans and the reduction of the statutory deposit reserve ratio, a moderately loose monetary policy should give priority to continuing to reduce the statutory deposit reserve ratio. Since the interest rate paid by the central bank to financial institutions for statutory deposit reserves is extremely low, the opportunity cost of commercial banks is increased, and commercial banks will inevitably pass on the cost to borrowers. Although reducing the statutory deposit reserve ratio is the preferred policy tool option for moderately loose monetary policy, the role of central bank loans is still very important. The central bank will still increase the total supply of liquidity through re-lending, and guide the credit resource allocation of financial institutions with a variety of structural monetary policy tools. However, it is necessary to prevent some companies from using the preferential interest rates of structural monetary policy for arbitrage.

Third, increase the purchase of treasury bonds in open market operations. Unlike the central banks of other developed economies that hold a large amount of treasury bonds, the proportion of treasury bonds held by the central bank of my country in its total assets is extremely low, which is in fact not conducive to the central bank's guidance of market interest rates and its expectation management through monetary policy operations. In 2024, the central bank of my country began to re-try to conduct spot bond operations on treasury bonds through the open market, but the scale was very small and the impact on the total liquidity was limited. In order to better implement moderately loose monetary policy, the central bank should increase the buyout of treasury bonds in open market operations. Given that the ratio of my country's national debt to GDP is low, if necessary, the central bank may even consider purchasing some provincial government general bonds with low credit risk in the future as a supplement to the central bank's national debt operations in the open market, so as to better manage the total liquidity.

Finally, as a researcher, I have always advocated that the benchmark deposit and loan interest rates should be abolished. China has not adjusted the benchmark deposit and loan interest rates since 2015. In fact, LPR has long replaced the benchmark deposit and loan interest rates set by the central bank and become the new interest rate benchmark for commercial bank loans. In monetary policy operations, the central bank is also guiding the 7-day reverse repurchase rate to become the main policy interest rate, but at the same time, it still retains the benchmark deposit and loan interest rate, a relic of the planned economy, which is inconsistent with the market-oriented reform of China's economy. In the period when market interest rates have experienced an ultra-long downward cycle of nearly 5 years, and both loan interest rates and bond market yields are at the lowest level since the reform and opening up, it is inappropriate to continue to retain the benchmark deposit and loan interest rates of 9 years ago. It neither reflects the changes in the liquidity conditions of the macro economy and financial markets, nor conveys the intention of monetary policy.

03 Possible Impact of Moderately Loose Monetary Policy

There is no doubt that moderately loose monetary policy will have some positive effects on the macroeconomy and financial markets. It will first change the reserve structure of commercial banks. The liquidity released and added by the central bank will affect the supply of loanable funds. The abundant liquidity will keep the market interest rate generally low for some time in the future. In short, China has entered an era of ultra-low interest rates, which is both the result of loose monetary policy and the natural result of macroeconomic operation. Given that the bond market interest rates and deposit and loan interest rates are already at extremely low levels, this may lead to a readjustment of the financial asset structure of institutional investors and residents. In this sense, a moderately loose monetary policy will be conducive to the realization of the goal of "stabilizing the stock market" proposed by the Central Economic Work Conference.

In addition, the RMB exchange rate will make necessary responses based on changes in domestic economic fundamentals and the international environment. After Trump re-entered the White House, China's exports are facing tariff pressure again. Hedging tariff risks objectively requires a certain degree of exchange rate depreciation. At the same time, China's continued downward interest rates have further widened the interest rate gap between China and the United States, which will also put pressure on the RMB exchange rate. Of course, exchange rate fluctuations may in turn restrain changes in market interest rate levels, because exchange rate depreciation may certainly promote exports, but it will also weaken the competitiveness of the currency, which is in conflict to a certain extent with the need for a "strong currency" in the construction of a financial power.

However, China's loose monetary policy also faces some challenges. First, China's total money and liquidity are already very abundant. As of the end of November 2024, the balance of China's broad money M2 has reached nearly 312 trillion yuan, and the ratio to GDP has exceeded 200%. China has become the economy with the largest total money supply in the world. This in itself shows that the difficulties and challenges currently facing the Chinese economy are not the result of insufficient money supply. We clearly see that although the broad money M2 has maintained a significant positive growth, the balance of demand deposits of non-financial enterprises has continued to decline, which shows that the demand for money held by enterprises based on business motives is insufficient.

Secondly,at the end of 2023, China's macro leverage ratio has reached about 350%.The debt pressure faced by China today and the debt risks of some local governments are closely related to the past monetary and credit expansion to a certain extent.Therefore, a moderately loose monetary policy must weigh credit expansion against future credit risks.

Third, the difficulties and challenges facing the Chinese economy are the result of the inherent laws of economic development, especially the economic difficulties brought about by the deep adjustment of the real estate industry, which is the result of the change in the supply and demand pattern of the real estate market and the qualitative change of the industrial cycle. It is impossible to expect that the real estate industry will re-enter the era of rapid expansion in the 20 years after the new millennium through a moderately loose monetary policy. At the same time, it seems that it will take a long time for China to digest the adverse impact of changes in global trade and geopolitical environment.

A moderately loose monetary policy is only a stopgap measure. In order to achieve the goals of "stabilizing growth" and "stabilizing investment", while implementing a moderately loose monetary policy, it is necessary to improve the market economic system through deepening reform to enhance confidence, especially the confidence of private entrepreneurs in the future, so that they dare to invest, invest with peace of mind, and invest with confidence. This requires that in practice, we truly "protect the legitimate rights and interests of enterprises of all types of ownership equally in accordance with the law" and ensure that enterprises of all types of ownership can compete fairly without discrimination. To this end, government departments at all levels need to fully understand the laws of operation and competition of the socialist market economy, learn to better deal with the market economy, and "put power in the cage of the system" so that power serves the fair competition of the market, rather than overriding market competition.

In addition, in order to improve the effect of moderately loose monetary policy, China needs to better integrate deeply with the global economy.

Anais

Anais