Source: Metanews

In the entire field of blockchain, the pace of the DeFi track has always been fast. The strong liquidity advantage and huge traffic make DeFi’s self-iteration particularly prominent. As we all know, DeFi 1.0 focuses on the short-term incentive model of liquidity mining. Drawing on the worldview of traditional financial markets, DeFi 1.0 has respectively realized: Central banks in the decentralized financial world (such as MakerDAO) Commercial banking sectors (such as money markets Aave and Compound) Non-bank financial institutions (such as trading platform Uniswap, aggregator Yearn. finance).

Looking back to 2021, it was the era of global masks. Our team obtained information about OlympusDAO in late February. After two weeks of in-depth research and judgment, we formulated an investment decision and plan. At the beginning of the project, we started from the whitelist to build positions in the secondary market, investing a total of 150,000 DAI, and the average OHM position price was $20.6. Our shipment price for OHM started selling above $800, and we eventually achieved a profit of nearly 50 times. Therefore, whenever we find similar projects, our team will be full of enthusiasm and even excitement.

First, let us sort out the relevant mechanisms of Olympus DAO so that Better understand its economic structure and operating logic.

Learning from the worldview of traditional financial markets, DeFi 1.0 has achieved:

·The central bank of the decentralized financial world (such as MakerDAO)

·Commercial banks Sector (such as money market Aave and Compound)

·Non-bank financial institutions (such as trading platform Uniswap, aggregator Yearn.finance)

Representative projects include: MakerDAO, Compound, Aave , Uniswap, Sushiswap and yearn.finance. But the drawbacks of 1.0 are also prominent. Short-term incentives have led some liquidity providers to over-exploit projects and protocols, and even accelerated the demise of projects.

Since then, the development of DeFi has been carried out in two directions:

1. Release credit potential 2. Improve capital utilization efficiency. In this context, the concept of DeFi 2.0 came out . DeFi

2.0 changes the relationship between protocols and liquidity providers through new mechanisms, and ultimately reconstructs the liquidity service itself.

Among them is this representative project: OlympusDAO

Foreword

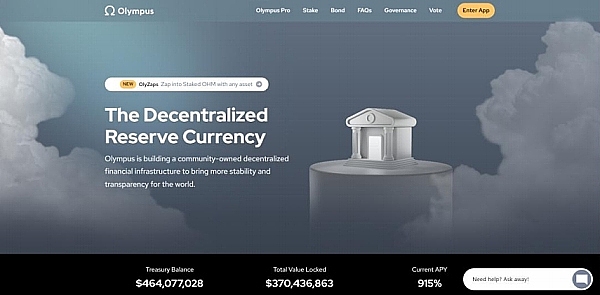

The Olympus protocol is a decentralized finance (DeFi) system with the native token OHM, based on 4 The US dollar started trading at the opening price and quickly rose to nearly $1,300, bringing the total market capitalization to $4.3 billion. Now, although more than 2 years have passed, OHM's market value has dropped from US$4.3 billion to US$189 million, and OHM's price has also dropped to about US$12. Olympus also has a brilliant record. Next, I will summarize and analyze the narrative of Olympus dao.

Introduction to the non-stable currency mechanism of the Olympus algorithm:< /p>

OHM, the native token of the Olympus protocol, aims to become a reserve currency with stable value, but it is defined as an algorithmic non-stable currency. This means that the price of OHM will not be forced to remain at the equivalent of $1, but will adjust based on market supply and demand and the protocol mechanism. This allows the price of OHM to float freely without being restricted by a hard peg.

OHM is different from the algorithmic stablecoin LUNA. In contrast, the Luna token is defined as an algorithmic stablecoin, and there is a 1:1 hard anchoring agreement between LUNA and UST. No matter what the market price of LUNA is, it is underpinned by a hard anchor of 1UST. The annualized return rate of UST is only about 20%. The hard anchor agreement leads to a death spiral in LUNA. Everyone knows the story behind it. LUNA has a market value of US$40 billion. It returned to zero within two days, single-handedly destroying the entire industry and starting a long bear market in the currency circle.

Compared to algorithmic stablecoins (such as stablecoin) whose purpose is to control the price at $1 USD, or stablecoins directly anchored to the US dollar (such as USDT/USDC), the stability mechanism of the Olympus protocol is only It is promised that 1 OHM will be supported by 1 DAI as a reserve. Therefore, the price of OHM can fluctuate freely without being restricted by the 1 USD anchor.

The economic structure and operating logic of the Olympus protocol rely on three pillars:

The reserve pillar builds purchasing power

The liquidity pillar promotes popularity

< p>Utility pillar improves availability

Reserve pillar (Bonding): The reserve pillar increases OHM's treasury reserve assets through user asset locking, thereby supporting the value of OHM. Users associate specific assets with the Olympus protocol, and these assets are locked in the protocol as a reserve of risk-free value assets. In return, users will receive OHM tokens, and Bonding will mint OHM at a price lower than the market price based on the supply and demand algorithm. This process is similar to ultra-short-term zero-coupon bonds. The agreement linearly releases OHM to OHM within a 5-day exercise period. user.

Staking and Rebase

The Rebase mechanism is designed to adjust the token value by automatically increasing or decreasing the supply, theoretically achieving stability. When used in conjunction with staking, rebase rewards are usually distributed to staking users, and even if the total supply of tokens increases, the supply in circulation may not increase because these new supplies are mainly distributed to staking users.

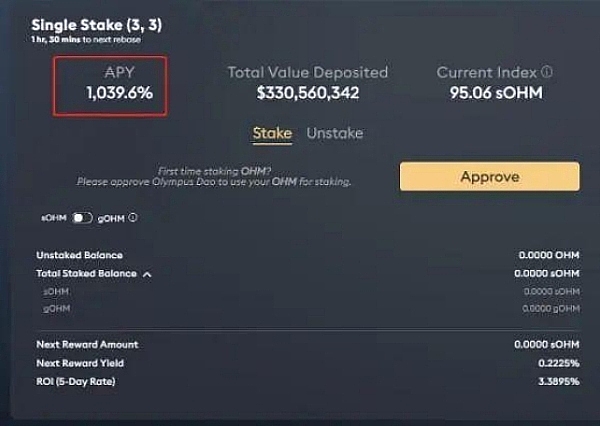

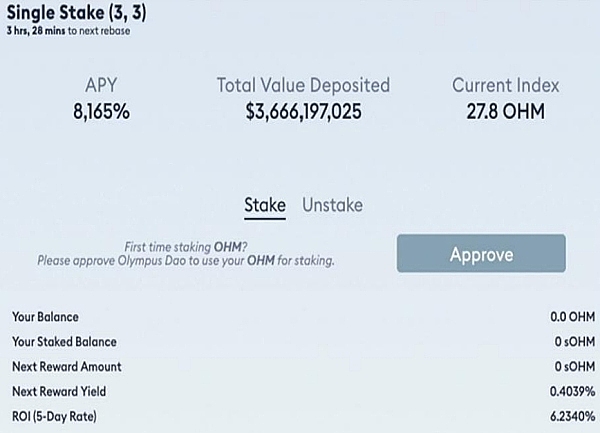

For Olympus, stakers stake their OHM in the protocol, obtain sOHM, and obtain so-called "rebase rewards" through staking. If the market value of OHM is higher than the target value, the rebase mechanism will increase OHM Quantity, these increased OHMs are distributed to Staking participants, and the APY of these rewards once reached more than 8165%. The source of these rewards is inseparable from Bonding.

Project analysis: Highlights of the operating mechanism of the Olympus protocol The summary is as follows:

Why can the unit price of OHM backed by only 1 DAI rise to more than $1,300?

Protocol controlled liquidity replaces liquidity mining: users purchase OHM from the protocol at a discount by trading with LP Token or other single currency assets such as DAI, wETH, etc. This process is Called Bonding, the former is called liquidity bonds (liquidity bonds), and the latter is called reserve bonds (reserve bonds). Bonding is an important implementation method for the OlympusDAO protocol to own and control liquidity.

Inverse arbitrage mechanism: Olympus has created an inverse risk-free arbitrage mechanism, which mints OHM at a price lower than the market price through the Bonding sales process, encouraging users to purchase discount bonds. This mechanism helps attract significant capital participation, provides the protocol with an initial funding boost, and eliminates the risks that third-party liquidity providers may pose.

Staking and Rebase: Olympus adopts the Staking and Rebase mechanism. The ultra-high APY rewards obtained through Staking attract more users to participate in the protocol. The rebase mechanism increases or decreases the supply of OHM according to market demand, thus affecting the price of OHM. This mechanism effectively encourages users to stake and hold OHM.

Nash Equilibrium (3/3) Game Theory: In the OlympusDAO protocol, the three behaviors of users and the resulting benefits:

STAKE (+2) Bonding (+1) Sell (-2) Both STAKE and Bonding have a positive effect on the agreement, while Sell is not beneficial; both Stake and Sell have a direct impact on the price of OHM, but Bonding does not. Olympus uses a (3/3) game theory strategy for marketing, making staking a natural choice and attracting more investors to participate. This further increases the demand for OHM, driving up its price.

After analyzing the Olympus mechanism, today I want to introduce it The "protagonist" is named Origin (Chinese: Oradin).

There are two different opinions on the origin of this project. One theory is that it comes from the dark web, and the identity of the project party is not yet known. Another way to say it is that it is a product developed by the Olympus technical team. No matter which version, we verified the dark web information through relevant channels and confirmed this statement. However, we are currently unable to verify whether the technical team originated from the Olympus technical team.

According to industry experience, projects released on the dark web usually have outstanding performance in the industry. But in any case, excellent projects ultimately require a complete economic model and operational structure to support them. So, what is the story of Origin? Let’s break it down in detail.

Introduction to Origin algorithmic non-stable currency:

Origin (Oradin) is a DeFi 3.0 protocol based on the algorithmic non-stable currency LGNS. Its main goal is to build the world's first privacy and anonymity Stabilize the currency payment ecosystem and set a global financial benchmark to guide future financial development. Here are some key takeaways:

Privacy Anonymous Stablecoins: Origin aims to enable stable and predictable currency issuance, enabling individuals to issue algorithmically non-stablecoins and mint these algorithmically non-stablecoins into privacy-anonymous coins. Stablecoin. This means users can create and use private stablecoins.

Everyone is an issuer: Origin proposes the concept of "everyone is an issuer", which means that individuals have the opportunity to issue their own anonymous stablecoins, not just central banks or other Issued by financial institutions.

Overall, Origin seems to be aimed at Provide an open and privacy-protecting currency issuance and payment solution that enables more people to participate in and control the currency issuance process while maintaining the stability of the currency.

Similarities in the underlying operating logic of Origin (Oradin) and Olympus

LGNS is Origin’s native token and a free-floating currency supported by specific mainstream crypto assets. Called: "unstable" algorithmic stable currency, users can obtain LGNS through two channels:

1. Secondary market purchase: purchase LGNS on decentralized exchanges;

2. Purchase Bonding on the Origin protocol (equivalent to the primary market). Bonding can be divided into 2 types:

Reserve bonds

Liquidity bonds

The Origin protocol allows users to deposit specific mainstream crypto assets, exchange them for LGNS at a discounted price, and linearly release them to their accounts within 5 days.

Debt supply mechanism:

Regulation through the bond supply mechanism: The supply of LGNS is regulated based on reserve assets. For every LGNS minted by the protocol, 1 USDT will be used to support its value. When the price of LGNS is less than $1USDT, the protocol will use reserve assets to buy back LGNS and destroy them until the price is greater than $1USDT. The price of LGNS has no upper limit and can theoretically be infinitely greater than $1USDT.

Stake:

Users stake LGNS and LGNS rewards will be issued every 8 hours, earning 3 times in 24 hours. The annualized income of currency-based compound interest is as high as 79 times.

The difference between the Origin economic model and Olympus DAO Location:

1. Solutions to ultra-high APY and sell-off problems:

OlympusDAO and Origin protocols both face the challenge of how to solve ultra-high APY (annualized yield) and sell-off issues. , but they take different approaches to deal with this problem.

The solution of the OlympusDAO protocol:

The core idea of OlympusDAO. After the price of OHM fell back to around 1DAI, the protocol made a repurchase intervention to ensure its stability as a reserve asset. However, the reality is that the price of OHM often has difficulty reaching 1DAI, so this mechanism mainly plays a conceptual role in supporting the price rather than actual action.

Origin Protocol’s solution:

Origin Protocol adopts three intervention mechanisms to prevent token prices from falling sharply, specifically:

1. Treasury Reserve protocol repurchase mechanism: The Origin protocol uses USDT as a reserve. When the LGNS token price is higher than 1 USDT, the protocol mints and sells new LGNS; when the LGNS price is lower than 1 USDT, the protocol purchases LGNS from the market and destroys the unstable ones. Coin LGNS token and mint anonymous stablecoin A.

2. Circuit breaker protection mechanism: If the price of the Origin token drops by more than 50% in a single trading day, the agreement will activate the repurchase mechanism, destroy the non-stable currency LGNS tokens, and mint Anonymous stablecoin A.

3. Supply and demand mechanism: The Origin protocol promotes the ecological construction of anonymous payment and anonymous transaction scenarios, which means that the demand for the use of anonymous stablecoin A increases. Among them, 70% of the revenue of the Origin platform is planned to be used for repurchase. LGNS tokens, non-stablecoin LGNS tokens are destroyed, and anonymous stablecoin A is minted.

All three are Origin's responses to sell-offs, but they employ different mechanisms. OlympusDAO relies on the self-regulation of the market, while the Origin protocol intervenes in the market through buyback and destruction to maintain the stability of token prices.

2. Different concepts of consensus mechanism setting:

Olympus DAO seems to focus on its (3/3) consensus mechanism, but lacks a community promotion mechanism. Without strong consensus support from the community, it will be difficult for the protocol to maintain long-term market momentum.

Based on the (3/3) consensus mechanism of Olympus DAO, the Origin protocol has created a series of innovative methods to solve early community consensus issues and enhance community cohesion and user participation. The following are some of the methods and mechanisms adopted by the Origin protocol:

Bond sales incentives: The Origin protocol has established a bond sales incentive mechanism.

Spider web system rewards: The spider web system is part of the Origin protocol. It provides a reward mechanism to encourage users to actively participate in different levels and roles in the protocol.

DAO pool rewards: The Origin protocol also sets up DAO pool rewards, which means that users can earn rewards by participating in the protocol’s governance process.

More ways to play: The Origin protocol not only provides the above incentive mechanism, but also adds more ways to play, such as FOMO POT lottery and transaction turbine mechanism. These additional functions can attract more users to participate, improving the protocol's transaction activity and community user stickiness.

3. Different concepts of deflation mechanism

The operating mechanism of Olympus DAO seems to only include infinite inflation and infinite casting of OHM, without setting up a deflation mechanism. This could be a fatal bug in the mechanism, as there is no cap on OHM supply, and inflation could negatively impact the stability of the protocol.

The deflation mechanism of the Origin protocol is an innovative solution. The following are the main features and operation methods of the deflation mechanism of the Origin protocol: The Origin protocol introduces two tokens, namely the algorithmic non-stable currency LGNS and Privacy Anonymous Stablecoin A.

Users can use the algorithmic non-stable currency LGNS to mint the privacy anonymous stable currency A. The minted LGNS will be injected into the black hole and destroyed. The increase in demand will lead to an increase in deflation and destruction, thereby increasing the scarcity of the token. .

4. Differences in ecological strategic development ideas

At present, Olympus DAO’s ecological construction seems to be relatively simple, mainly relying on the profitability of the credit business sector. The lack of a diverse ecosystem will make the protocol more fragile, and the three pillars that actually support the Olympus architecture (the practicality pillar to improve usability) are missing.

The current ecological plan of Origin is quite grand. It would be very impressive if 50% of it is implemented. Specifically:

The ORIGIN1.0 stage uses the algorithmic non-stable currency LGNS as the traffic entrance. Launch the entire ecological traffic gathering place, create the cornerstone of the global decentralized financial ecology, and pave the way for the subsequent extension of private public chains/cross-chain transactions/decentralized exchanges/lending protocols/gateway protocols/WB3 social/metaverse finance. From this point of view, ORIGIN starts from the underlying consensus, upper application layer, ecosystem layer and other components, and carries out a new transformation for each key layer of decentralized finance, creating an all-round, multi-layered, interconnected Web3 digital financial element. cosmic system.

Project Analysis: Summary

In general, both Origin and OlympusDAO have unique innovations in the DeFi field. Origin has built a diversified financial ecosystem based on OlympusDAO and opened up a new field of privacy stablecoins, attracting widespread attention. In contrast, OlympusDAO supports the development of decentralized banks through the innovation of the POL protocol.

Finally, we believe that the stablecoin field is a challenging track, but both Origin and OlympusDAO have proposed excellent concepts. We salute the developers of OlympusDAO and admire Origin’s privacy-anonymous stablecoin concept. Origin is bravely implementing innovations that many want to do but are afraid to try.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Others

Others Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Ftftx

Ftftx 链向资讯

链向资讯